Withholding Tax Table

Withholding Tax Table - There are seven income tax rates, ranging from 10% to 37%. Here is a list of our partners. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Which federal income tax brackets are you in?. The first federal tax table from the irs is. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system.

There are seven income tax rates, ranging from 10% to 37%. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Which federal income tax brackets are you in?. The first federal tax table from the irs is. Here is a list of our partners.

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Which federal income tax brackets are you in?. There are seven income tax rates, ranging from 10% to 37%. Here is a list of our partners. The first federal tax table from the irs is.

Reading your pay stub 8 things that could be affecting your takehome

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Which federal income tax brackets are you in?. Here is a list of our partners. The first federal tax.

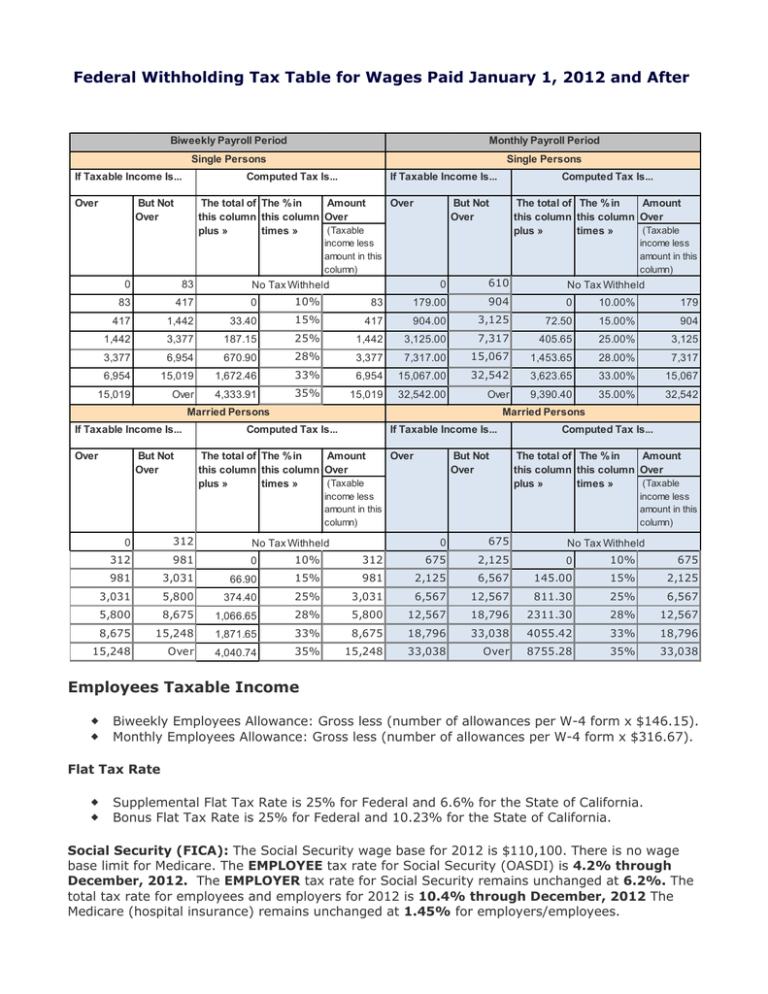

Federal Withholding Tax Table for Wages Paid January 1, 2012...

The first federal tax table from the irs is. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are seven income tax rates, ranging from 10% to 37%. Which federal income tax brackets are you in?. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and.

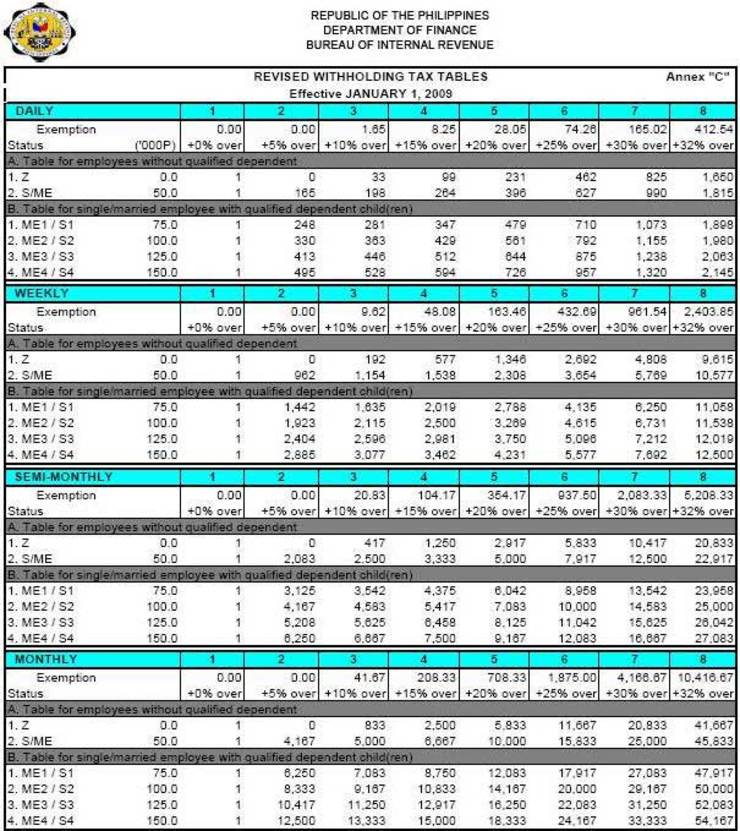

Withholding Tax Table in the Philippines NewstoGov

Here is a list of our partners. Which federal income tax brackets are you in?. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. The first federal tax.

Bir Annual Withholding Tax Table 2017 Matttroy

Which federal income tax brackets are you in?. Here is a list of our partners. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are seven income tax rates, ranging from 10% to 37%. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage.

The 2022 Bir Tax Table Jobstreet Philippines

There are seven income tax rates, ranging from 10% to 37%. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here is a list of our partners. Which federal income tax brackets are you in?. The first federal tax table from the irs is.

AskTheTaxWhiz Is 13th month pay really taxable?

There are seven income tax rates, ranging from 10% to 37%. The first federal tax table from the irs is. Which federal income tax brackets are you in?. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. Here is a list of our partners.

Payg Withholding Tax Table Fortnightly 2023 Image to u

Which federal income tax brackets are you in?. The first federal tax table from the irs is. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. There are seven income tax rates, ranging from 10% to 37%. Here are the irs withholding tax tables for.

WITHHOLDING TAX COMPUTATION UNDER TRAIN LAW USING VERSION 2 TABLE EBV

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are seven income tax rates, ranging from 10% to 37%. The first federal tax table from the irs.

Employer's Federal Withholding Tax Tables Monthly Chart Federal

There are seven income tax rates, ranging from 10% to 37%. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Which federal income tax brackets are you in?..

Revised Withholding Tax Table Bureau of Internal Revenue

If you're a payer making periodic payments of pensions and annuities, use worksheet 1b and the percentage method tables in this section to figure. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are seven income tax rates, ranging from 10% to 37%. Which federal income tax brackets are you in?..

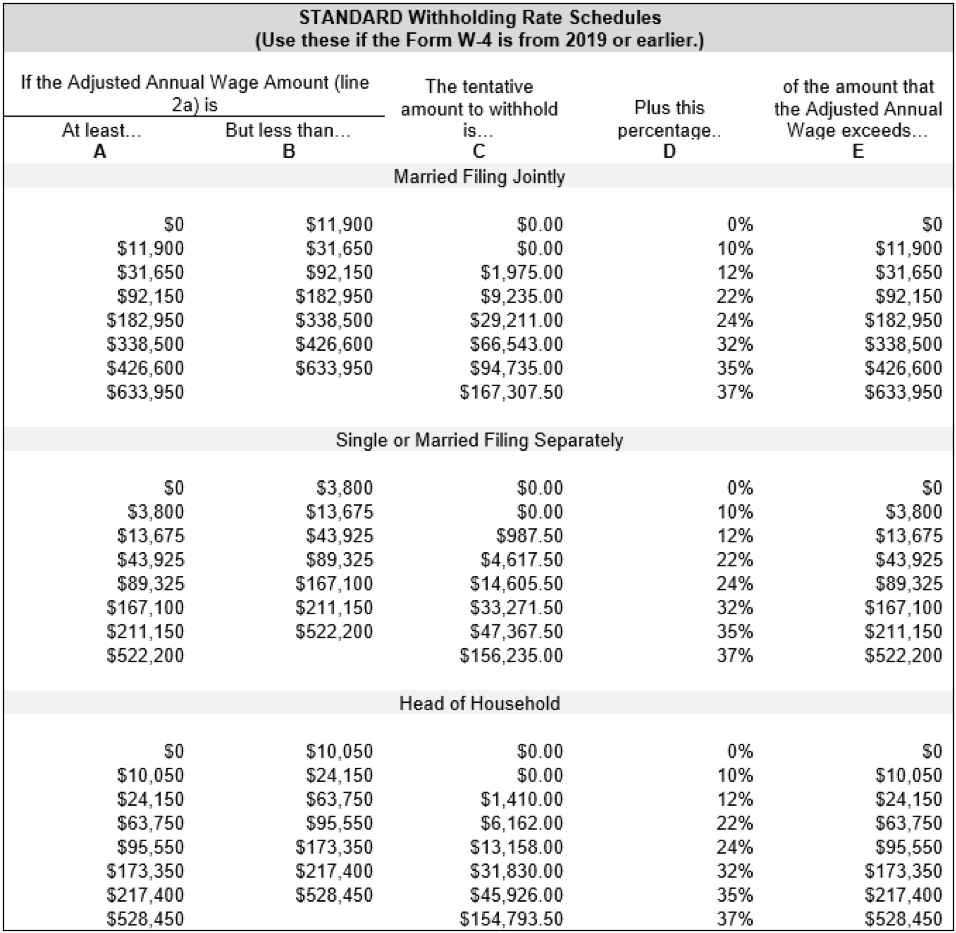

Which Federal Income Tax Brackets Are You In?.

Here is a list of our partners. The first federal tax table from the irs is. There are seven income tax rates, ranging from 10% to 37%. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system.