Where Do I Send Form 843

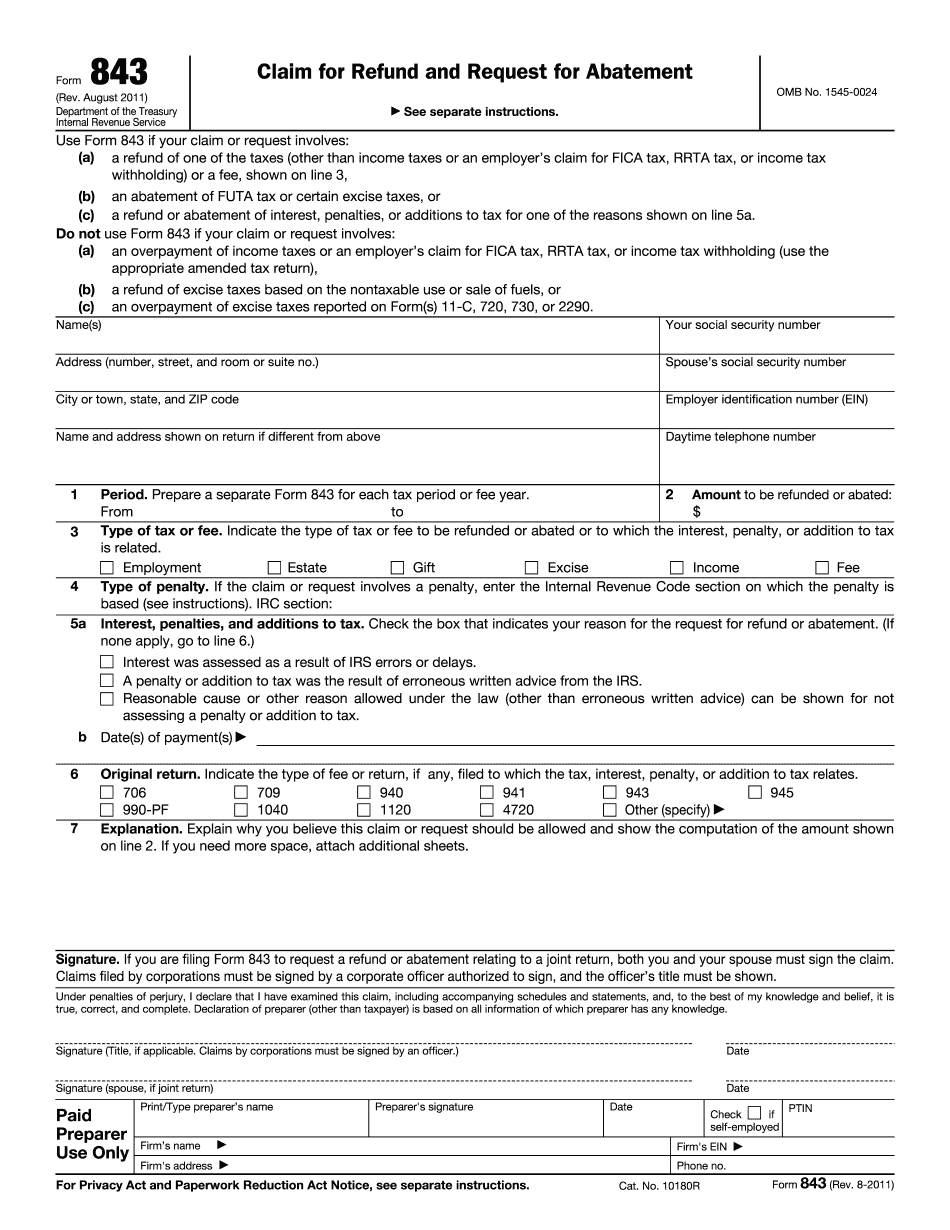

Where Do I Send Form 843 - Use form 843 to claim or request the following. A refund of tax, other than a tax for which a different form must be used. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. This includes most forms 843. Mail the form to the address indicted in the instructions. Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting form 843 According to this irs webpage, california residents should mail returns without payments to:

Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Mail the form to the address indicted in the instructions. Use form 843 to claim or request the following. According to this irs webpage, california residents should mail returns without payments to: Where do i mail form 843? This includes most forms 843. A refund of tax, other than a tax for which a different form must be used. Page provides taxpayers and tax professionals the mailing address for submitting form 843

Where do i mail form 843? A refund of tax, other than a tax for which a different form must be used. Mail the form to the address indicted in the instructions. According to this irs webpage, california residents should mail returns without payments to: Page provides taxpayers and tax professionals the mailing address for submitting form 843 This includes most forms 843. Use form 843 to claim or request the following. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.

Do send in your enquiries and requests via email

Mail the form to the address indicted in the instructions. Use form 843 to claim or request the following. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. A refund of tax, other than a.

Form 843 Request for Penalty Abatement YouTube

Page provides taxpayers and tax professionals the mailing address for submitting form 843 A refund of tax, other than a tax for which a different form must be used. According to this irs webpage, california residents should mail returns without payments to: This includes most forms 843. Information about form 843, claim for refund and request for abatement, including recent.

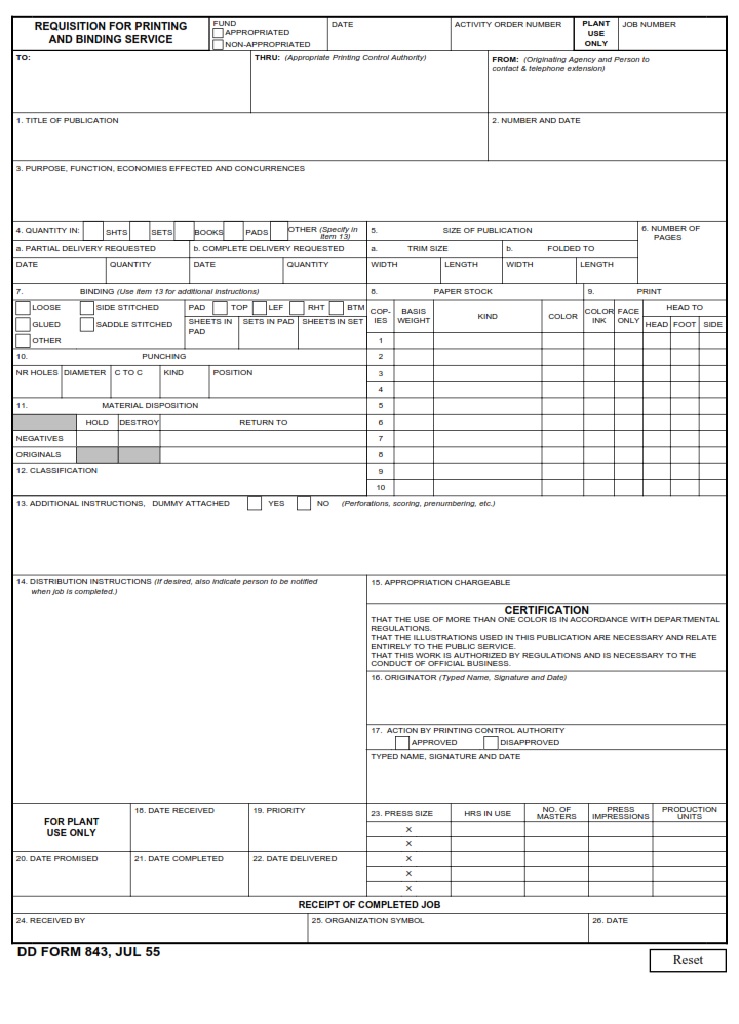

DD Form 843 Requisition For

Use form 843 to claim or request the following. According to this irs webpage, california residents should mail returns without payments to: Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting.

I have “his masters voice gramaphone”since whats its value do you know

A refund of tax, other than a tax for which a different form must be used. Mail the form to the address indicted in the instructions. This includes most forms 843. According to this irs webpage, california residents should mail returns without payments to: Use form 843 to claim or request the following.

Form 843 IRS Penalty Abatement Form Request Wiztax

Where do i mail form 843? According to this irs webpage, california residents should mail returns without payments to: A refund of tax, other than a tax for which a different form must be used. Use form 843 to claim or request the following. Mail the form to the address indicted in the instructions.

IRS Form 843. Claim for Refund and Request for Abatement Forms Docs

This includes most forms 843. Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting form 843 Use form 843 to claim or request the following. A refund of tax, other than a tax for which a different form must be used.

Where To File Form 843?

Mail the form to the address indicted in the instructions. This includes most forms 843. According to this irs webpage, california residents should mail returns without payments to: Page provides taxpayers and tax professionals the mailing address for submitting form 843 A refund of tax, other than a tax for which a different form must be used.

Manage Documents Using Our Editable Form For IRS Form 843

This includes most forms 843. Page provides taxpayers and tax professionals the mailing address for submitting form 843 A refund of tax, other than a tax for which a different form must be used. According to this irs webpage, california residents should mail returns without payments to: Mail the form to the address indicted in the instructions.

Where To Mail Form 843 To The IRS?

Page provides taxpayers and tax professionals the mailing address for submitting form 843 Mail the form to the address indicted in the instructions. Where do i mail form 843? Use form 843 to claim or request the following. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.

IRS Form 843 Instructions

Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Where do i mail form 843? According to this irs webpage, california residents should mail returns without payments to: Page provides taxpayers and tax professionals the mailing address for submitting form 843 Use form 843 to claim or request.

A Refund Of Tax, Other Than A Tax For Which A Different Form Must Be Used.

Page provides taxpayers and tax professionals the mailing address for submitting form 843 According to this irs webpage, california residents should mail returns without payments to: Where do i mail form 843? Mail the form to the address indicted in the instructions.

Use Form 843 To Claim Or Request The Following.

This includes most forms 843. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.