When Is Irs Form 8606 Required

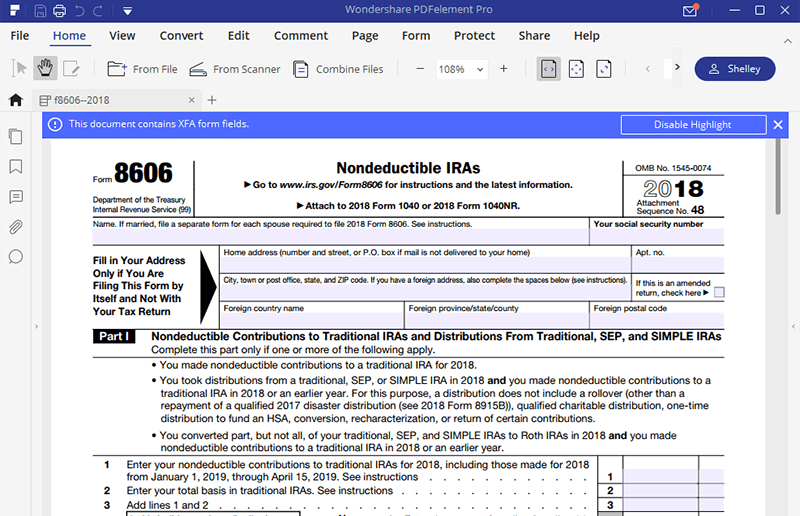

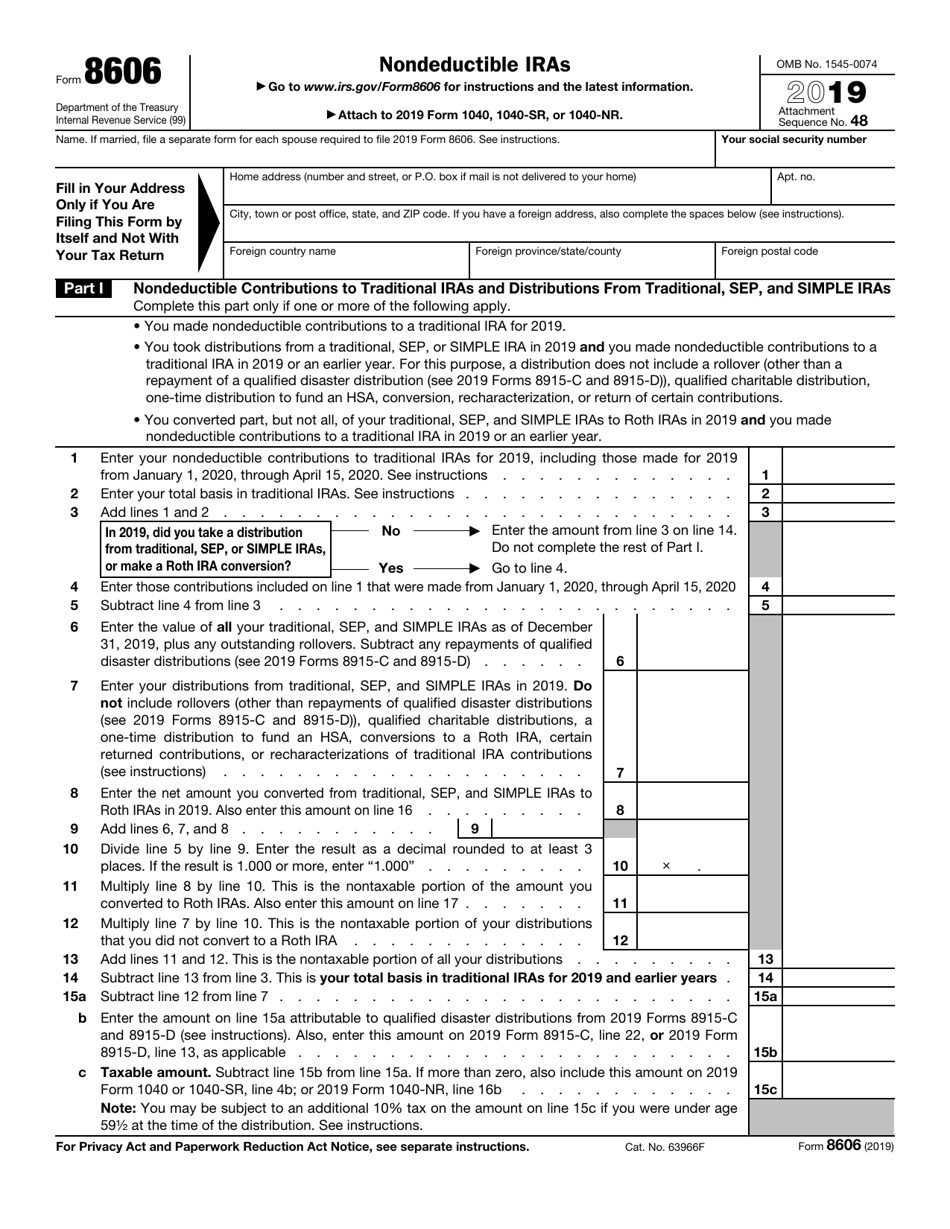

When Is Irs Form 8606 Required - File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras.

File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras.

File form 8606 if any of the following apply. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified.

IRS Form 8606 (Nondeductible IRAs) walkthrough YouTube

You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras. File form 8606 if any of the following apply.

for How to Fill in IRS Form 8606

Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. File form 8606 if any of the following apply.

How to Complete IRS Form 8606 (for a Backdoor Roth IRA) YouTube

You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. File form 8606 if any of the following apply. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras.

Complete Guide to IRS Form 8995 Reconcile Books

Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras. File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified.

IRS Form 8606 When is Form 8606 Required for IRAs? Wolters Kluwer

File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras.

IRS Form 8606 Instructions A Guide to Nondeductible IRAs

File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras.

IRS Form 8606 ≡ Fill Out Printable PDF Forms Online

You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. File form 8606 if any of the following apply. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras.

Individual retirement accounts When is IRS Form 8606 required

You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras. File form 8606 if any of the following apply.

IRS Form 8606 Instructions A Guide to Nondeductible IRAs

File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified. Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras.

Form 8606 Availability Free File Fillable Forms Printable Forms Free

Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras. File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a qualified.

You Made Nondeductible Contributions To A Traditional Ira For 2023, Including A Repayment Of A Qualified.

Form 8606 is used to report nondeductible contributions, distributions, and conversions to/from traditional, sep, or simple iras. File form 8606 if any of the following apply.