What Is Sales Tax In Butler County Ohio

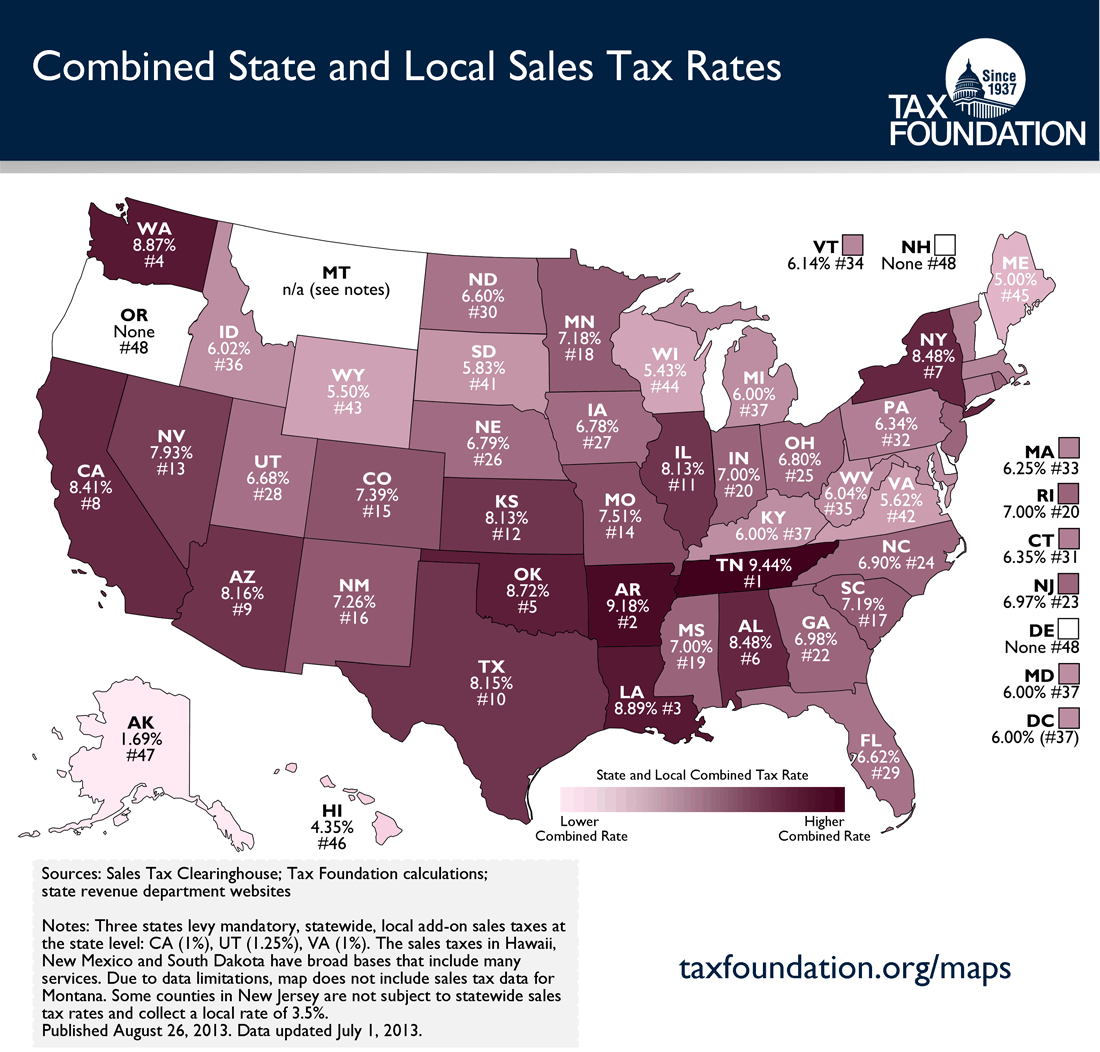

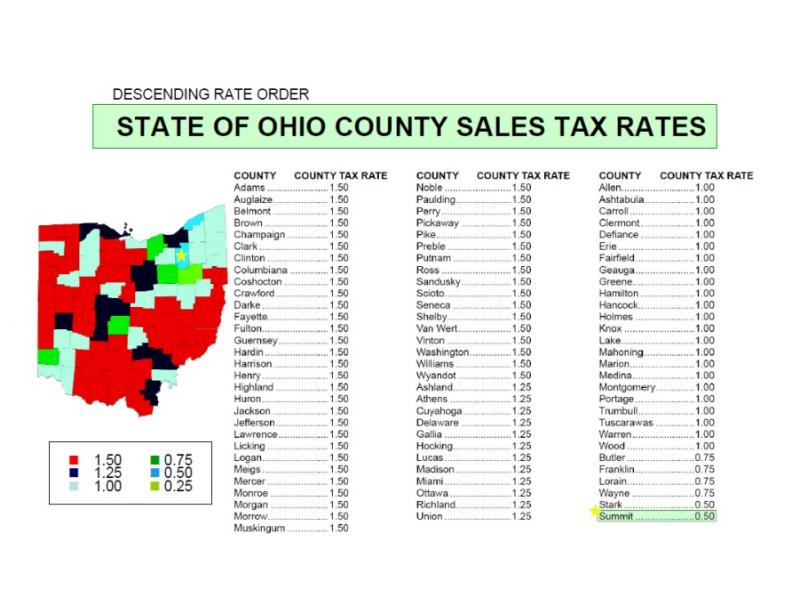

What Is Sales Tax In Butler County Ohio - The calculator will show you the total sales tax. By law, ohio's counties and. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The butler county sales tax rate is 0.75%. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. There are a total of 576. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. Look up the current rate for a specific address using the same geolocation technology that powers the. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code.

This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. There are a total of 576. The calculator will show you the total sales tax. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. By law, ohio's counties and. Look up the current rate for a specific address using the same geolocation technology that powers the. The butler county sales tax rate is 0.75%. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%.

Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. The butler county sales tax rate is 0.75%. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. By law, ohio's counties and. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The calculator will show you the total sales tax. Look up the current rate for a specific address using the same geolocation technology that powers the. There are a total of 576.

Ohio Sales Tax Rate 2024 By County Ranna Jessamyn

1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. Look up the current rate for a specific address.

Butler County Property Tax Map

You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Look up the current rate for a specific address using the same geolocation technology that powers the. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county.

Sales Tax Rates by County in Ohio PDF Ohio The United States

There are a total of 576. The butler county sales tax rate is 0.75%. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. The calculator will show you the total sales tax. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a.

Butler County property taxes likely to rise as rollbacks expire

The calculator will show you the total sales tax. Look up the current rate for a specific address using the same geolocation technology that powers the. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. By law, ohio's counties and. There are.

Butler County Ohio Sales Tax Rate 2024 Belva Cathryn

The butler county sales tax rate is 0.75%. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. By law, ohio's counties and. The.

Ohio Tax By County Map Images and Photos finder

1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. By law, ohio's counties and. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Look up the current rate for a specific address using.

9 graphical things to know about Gov. Kasich's Ohio budget proposal

You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Look up the current rate for a specific address using the same geolocation technology that powers the. There are a total of 576. The butler county sales tax rate is 0.75%. This page offers the latest information on sales.

Projected 42 Butler County property value hike is a ‘crisis’, auditor says

1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The butler county sales tax rate is 0.75%. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. The calculator will show you the.

Butler County Courthouse No. 5 Art of Frozen Time

You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. By law, ohio's counties and. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. There are a total of 576. The calculator will show you the.

Printable Sales Tax Chart

This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. By law, ohio's counties and. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. Look up the current rate for a specific address.

There Are A Total Of 576.

The butler county sales tax rate is 0.75%. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Look up the current rate for a specific address using the same geolocation technology that powers the. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%.

By Law, Ohio's Counties And.

Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. The calculator will show you the total sales tax.