What Is A Tax Refund Recorded As In Quickbooks

What Is A Tax Refund Recorded As In Quickbooks - To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In this article, we will guide you on how to record a tax refund in quickbooks. I have just the steps that'll help you record the liability refund. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Why record a tax refund in quickbooks? In this article, we will. The steps below will guide you through the process: In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds.

In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Why record a tax refund in quickbooks? In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. The steps below will guide you through the process: In this article, we will. I have just the steps that'll help you record the liability refund. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In this article, we will guide you on how to record a tax refund in quickbooks.

I have just the steps that'll help you record the liability refund. Why record a tax refund in quickbooks? In this article, we will. In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will guide you on how to record a tax refund in quickbooks. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. The steps below will guide you through the process:

tax refund complaint Guide)

Why record a tax refund in quickbooks? The steps below will guide you through the process: To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In this article, we will guide you on how to record a tax refund in quickbooks. In this article, we will.

Cannabis Companies Could Be Sitting on Billions of Dollars in Tax

I have just the steps that'll help you record the liability refund. The steps below will guide you through the process: To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Why record a tax refund in quickbooks? In quickbooks online, tax refunds should be categorized under specific income.

Tax Refund Payment How long does it take for tax refund to show in

Why record a tax refund in quickbooks? I have just the steps that'll help you record the liability refund. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. The steps below will guide.

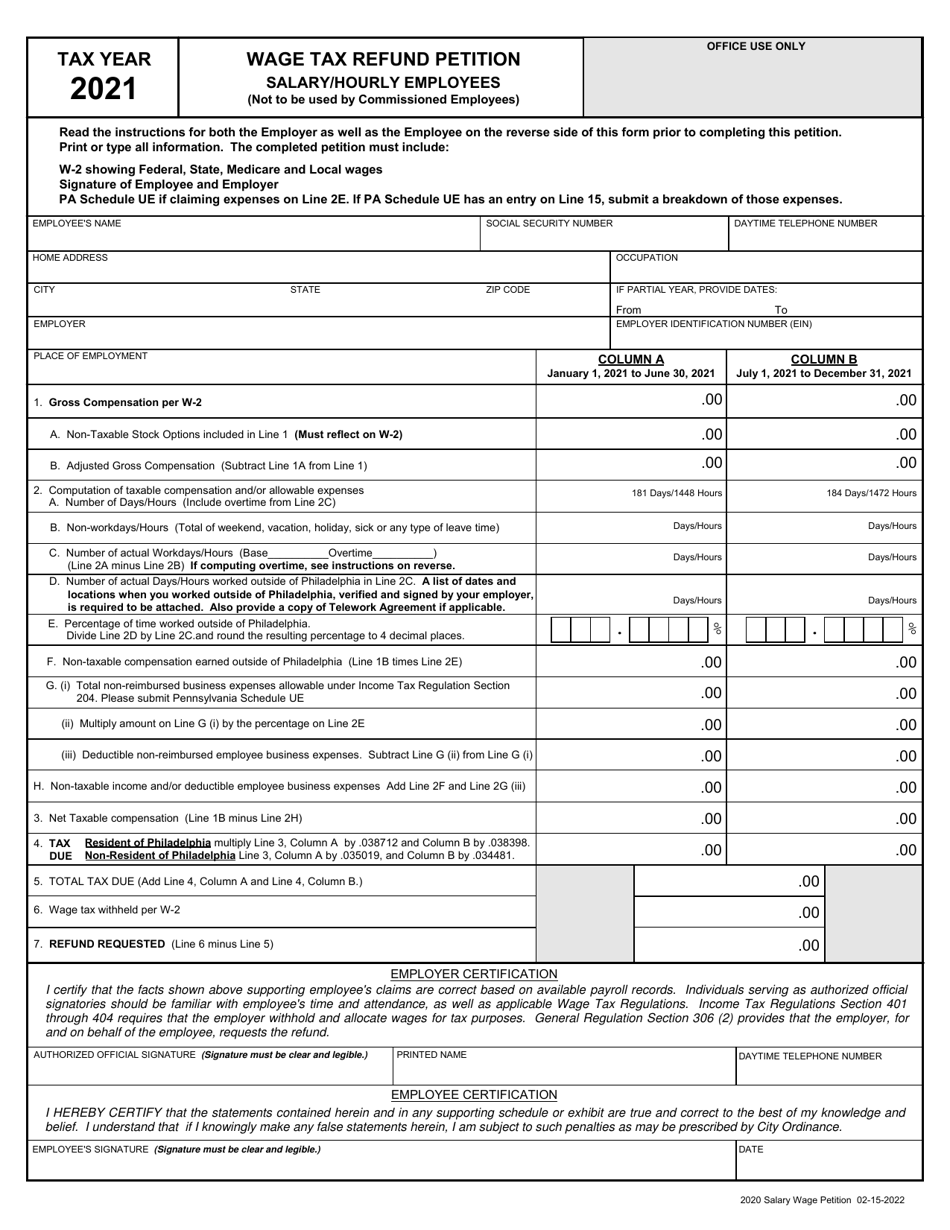

2021 City of Philadelphia, Pennsylvania Wage Tax Refund Petition

I have just the steps that'll help you record the liability refund. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will guide you on how to record a.

How To File A United States Federal Tax Return

In this article, we will guide you on how to record a tax refund in quickbooks. In this article, we will. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Why record a tax refund in quickbooks? In quickbooks online, tax refunds should be categorized under specific income.

Tax Refund How Claim TDS Refund Online

Why record a tax refund in quickbooks? To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. I have just the steps that'll help you record the liability refund. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. The steps below will guide.

How Long Does it Take to Get Your Tax Refund? A Comprehensive Guide

In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. The steps below will guide you through the process: In this article, we will guide you on how to record a.

How to raise your chances of getting a bigger tax refund next year

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. In this article, we will guide you on how to record a tax refund in quickbooks. In this article, we will. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. I have just.

My 8,220 tax refund disappeared I’ve been warned 'free' is rarely

Why record a tax refund in quickbooks? In this article, we will guide you on how to record a tax refund in quickbooks. In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses,.

IRS Cyberattack Highlights Risk of Tax Refund Fraud Recorded Future

I have just the steps that'll help you record the liability refund. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. In this article, we will guide you on how to record a tax refund in quickbooks. In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for.

In This Article, We Will Guide You On How To Record A Tax Refund In Quickbooks.

In quickbooks, the most appropriate category for tax refunds is typically an income account specifically designated for refunds. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Why record a tax refund in quickbooks? In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds.

The Steps Below Will Guide You Through The Process:

In this article, we will. I have just the steps that'll help you record the liability refund.