Vat Invoice Airbnb

Vat Invoice Airbnb - Airbnb charges vat on its service fees for customers. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Access a vat invoice as a host. Airbnb charges vat on its service fees for. Your invoice is finalized and issued when a. Value added tax, or vat, is a tax assessed on the supply of goods and services. Value added tax, or vat, is a tax assessed on the supply of goods and services.

Access a vat invoice as a host. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Airbnb charges vat on its service fees for. Value added tax, or vat, is a tax assessed on the supply of goods and services. Your invoice is finalized and issued when a. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Airbnb charges vat on its service fees for customers. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Value added tax, or vat, is a tax assessed on the supply of goods and services.

A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Airbnb charges vat on its service fees for customers. Airbnb charges vat on its service fees for. Access a vat invoice as a host. Value added tax, or vat, is a tax assessed on the supply of goods and services. Your invoice is finalized and issued when a. Value added tax, or vat, is a tax assessed on the supply of goods and services.

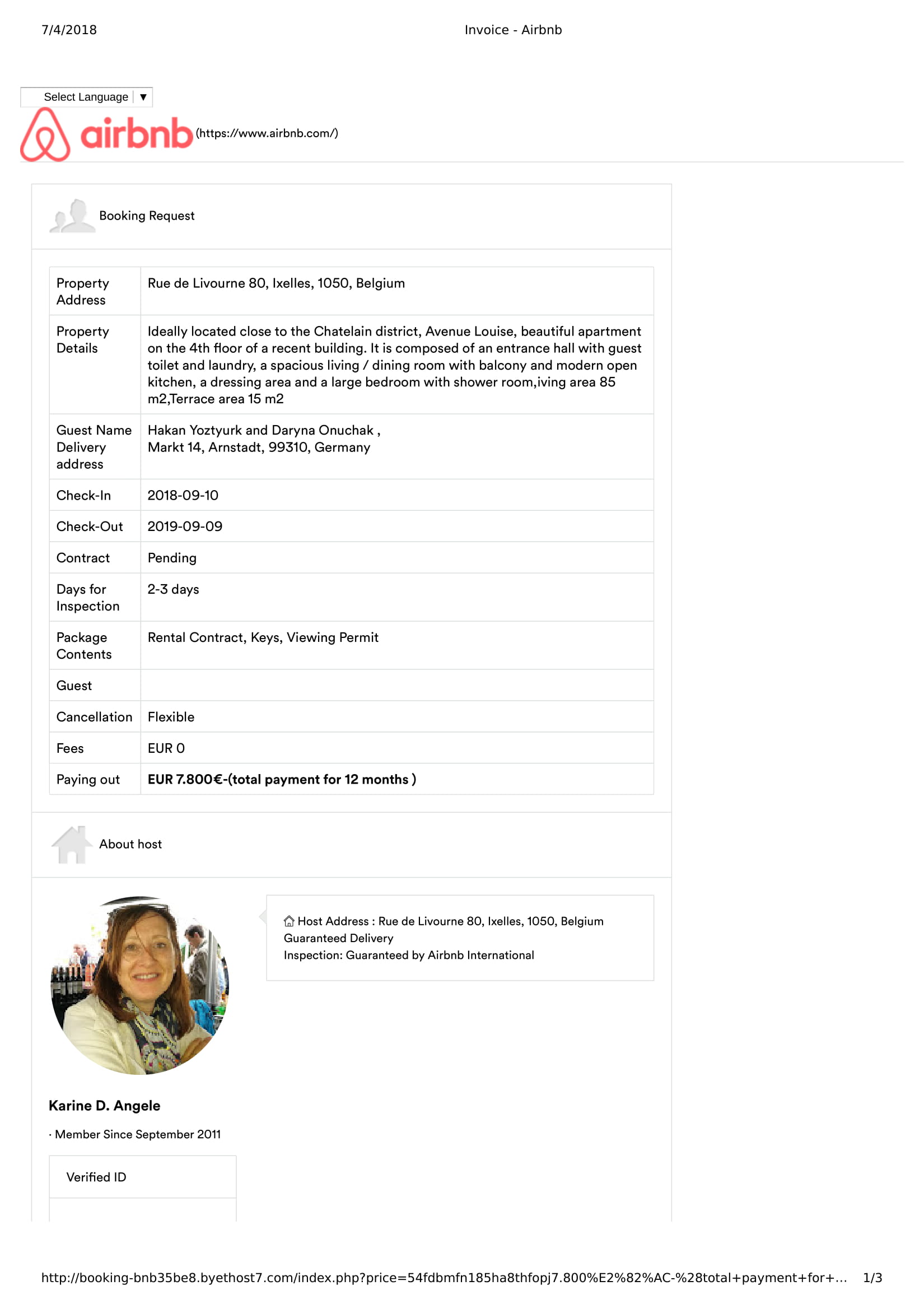

AirBnb invoice Airbnb Community

Access a vat invoice as a host. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Your invoice is finalized and issued when a. Airbnb charges vat on its service fees for. Value added tax, or vat, is a tax assessed on.

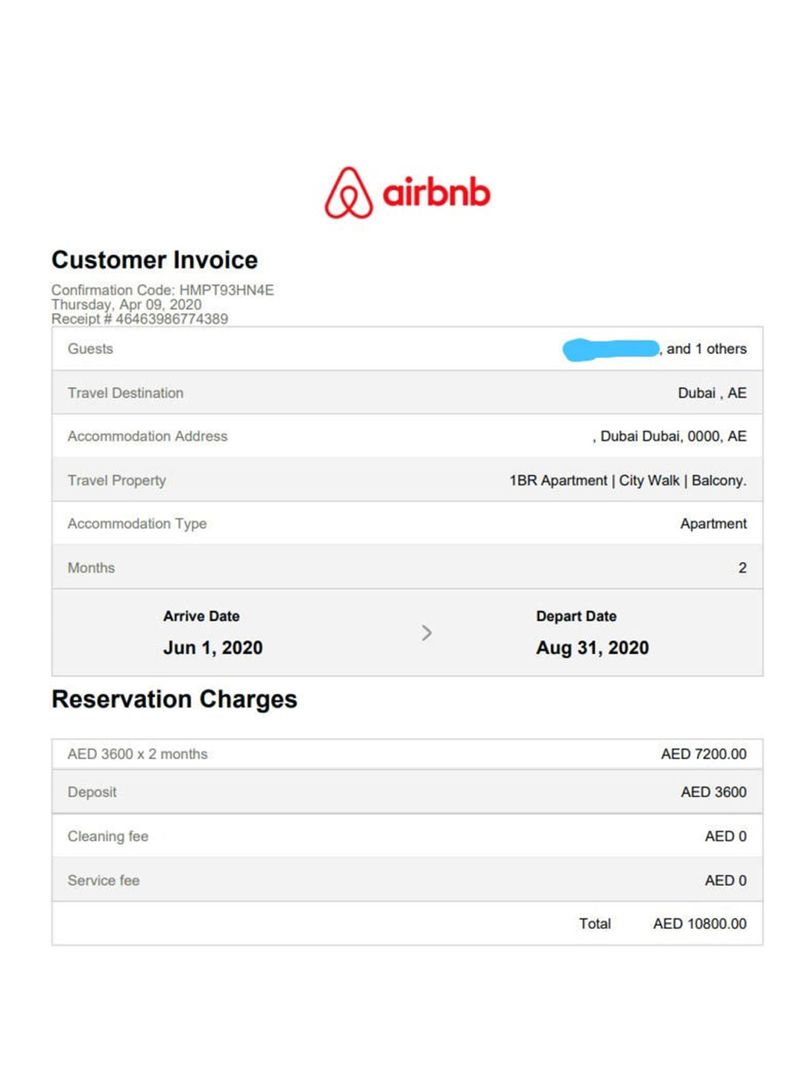

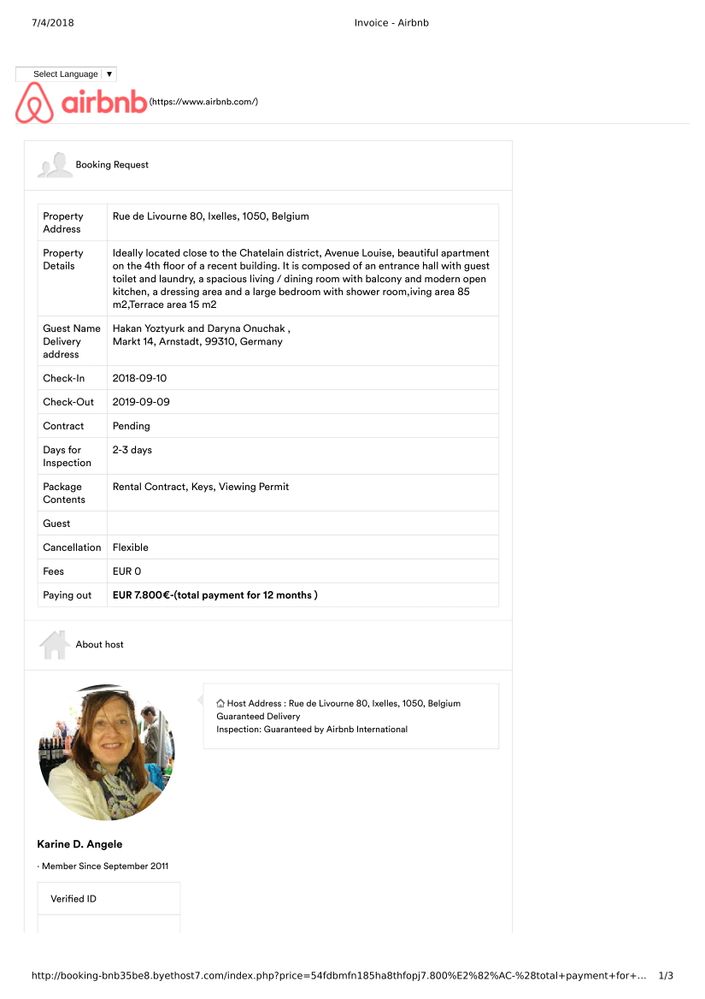

Fake Airbnb website scam snares British pilot in Dubai Uae Gulf News

A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Access a vat invoice as a host. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Airbnb charges vat on its service fees for customers. Value added tax, or vat, is a tax assessed on.

AirBnb invoice Airbnb Community

Value added tax, or vat, is a tax assessed on the supply of goods and services. Airbnb charges vat on its service fees for customers. Value added tax, or vat, is a tax assessed on the supply of goods and services. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Airbnb charges vat.

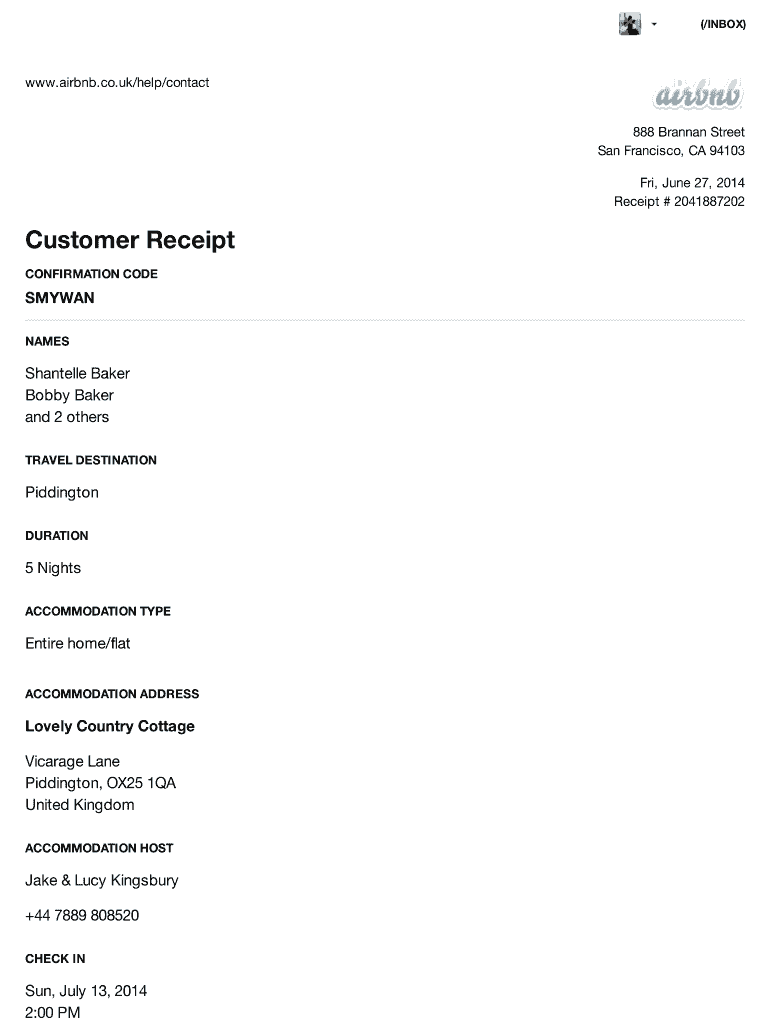

Airbnb Receipt Complete with ease airSlate SignNow

Access a vat invoice as a host. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Airbnb charges vat on its service fees for.

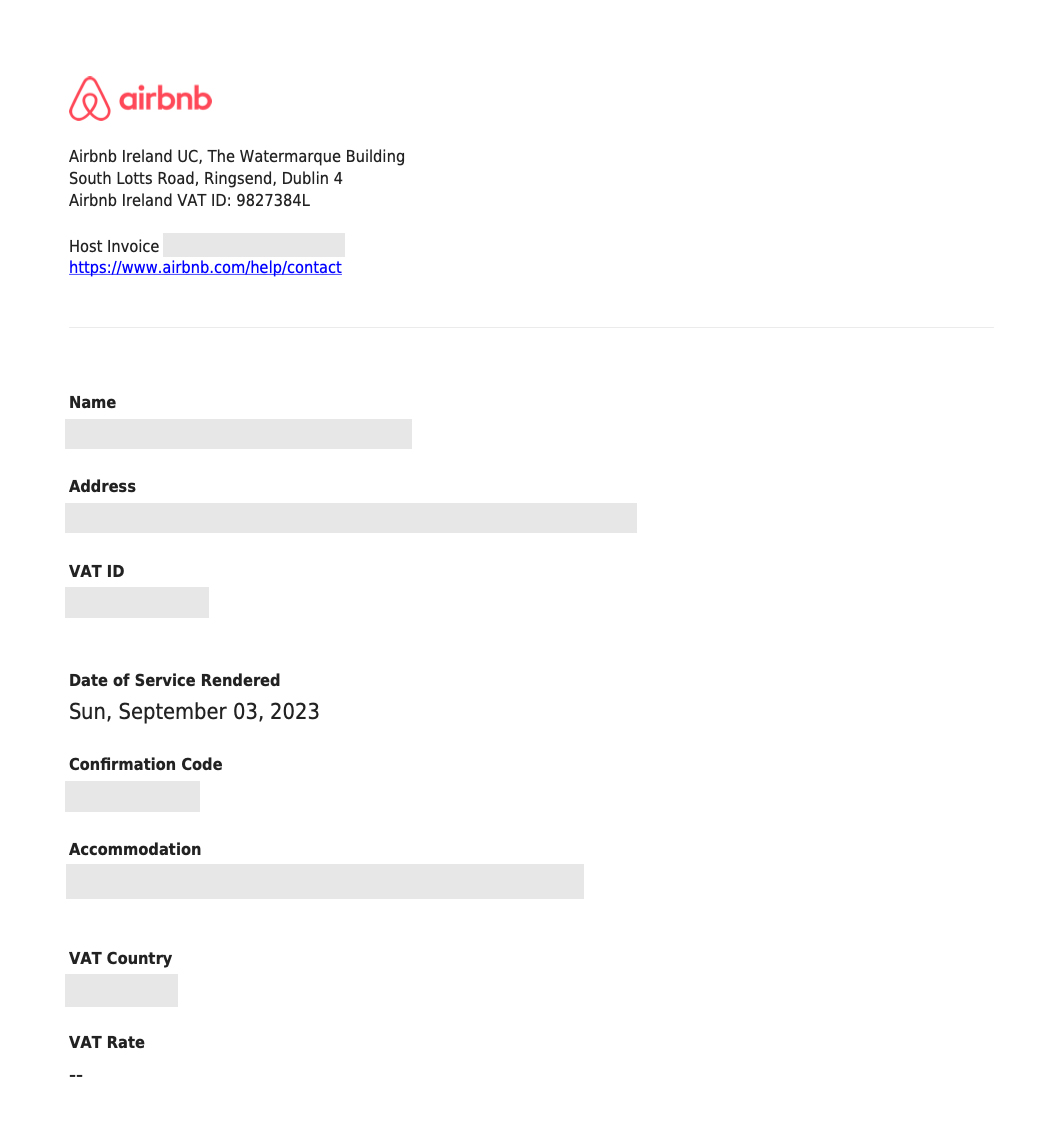

Download Airbnb Host EU VAT Invoices VATinvoicer

Airbnb charges vat on its service fees for. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Your invoice is finalized and issued when a. Value added tax, or vat, is a tax assessed on the supply of goods and services. Airbnb charges vat on its service fees for customers.

Airbnb Invoice Template Airbnb Invoice Modern Airbnb Etsy

Value added tax, or vat, is a tax assessed on the supply of goods and services. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Airbnb charges vat on its service fees for customers. You can access individual vat invoices for each.

Airbnb Invoice ThomasSims Blog

Airbnb charges vat on its service fees for. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Airbnb charges vat on its service fees for customers. Access a vat invoice as a host. You can access individual vat invoices for each reservation.

Customizable AirBnB Invoice Template, Informational Printable for VRBO

Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Value added tax, or vat, is a tax assessed on the supply of goods and services. Value added tax, or vat, is a tax assessed on the supply of goods and services. Airbnb.

AirBnb invoice Airbnb Community

A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Value added tax, or vat, is a tax assessed on the supply of goods and services. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in the. Airbnb.

Airbnb Invoice Generator

Value added tax, or vat, is a tax assessed on the supply of goods and services. You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Any guest requests for vat invoices should be addressed to airbnb (by the guest) as there is both your vat and airbnbs vat to include in.

Any Guest Requests For Vat Invoices Should Be Addressed To Airbnb (By The Guest) As There Is Both Your Vat And Airbnbs Vat To Include In The.

Access a vat invoice as a host. Value added tax, or vat, is a tax assessed on the supply of goods and services. A value added tax (vat) invoice is provided whenever vat is assessed on airbnb service fees. Airbnb charges vat on its service fees for.

Value Added Tax, Or Vat, Is A Tax Assessed On The Supply Of Goods And Services.

You can access individual vat invoices for each reservation or download vat invoices in bulk in the regions. Airbnb charges vat on its service fees for customers. Your invoice is finalized and issued when a.