Unapplied Cash Bill Payment Expense Quickbooks Online

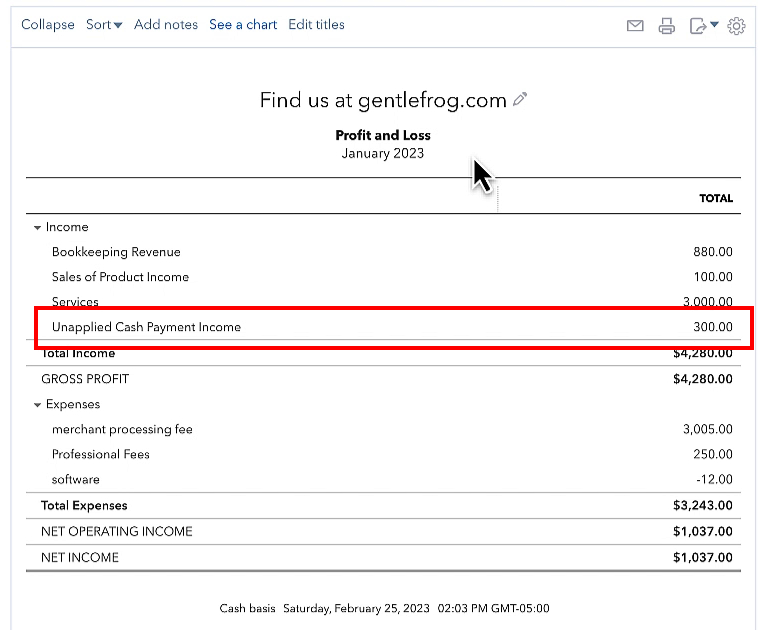

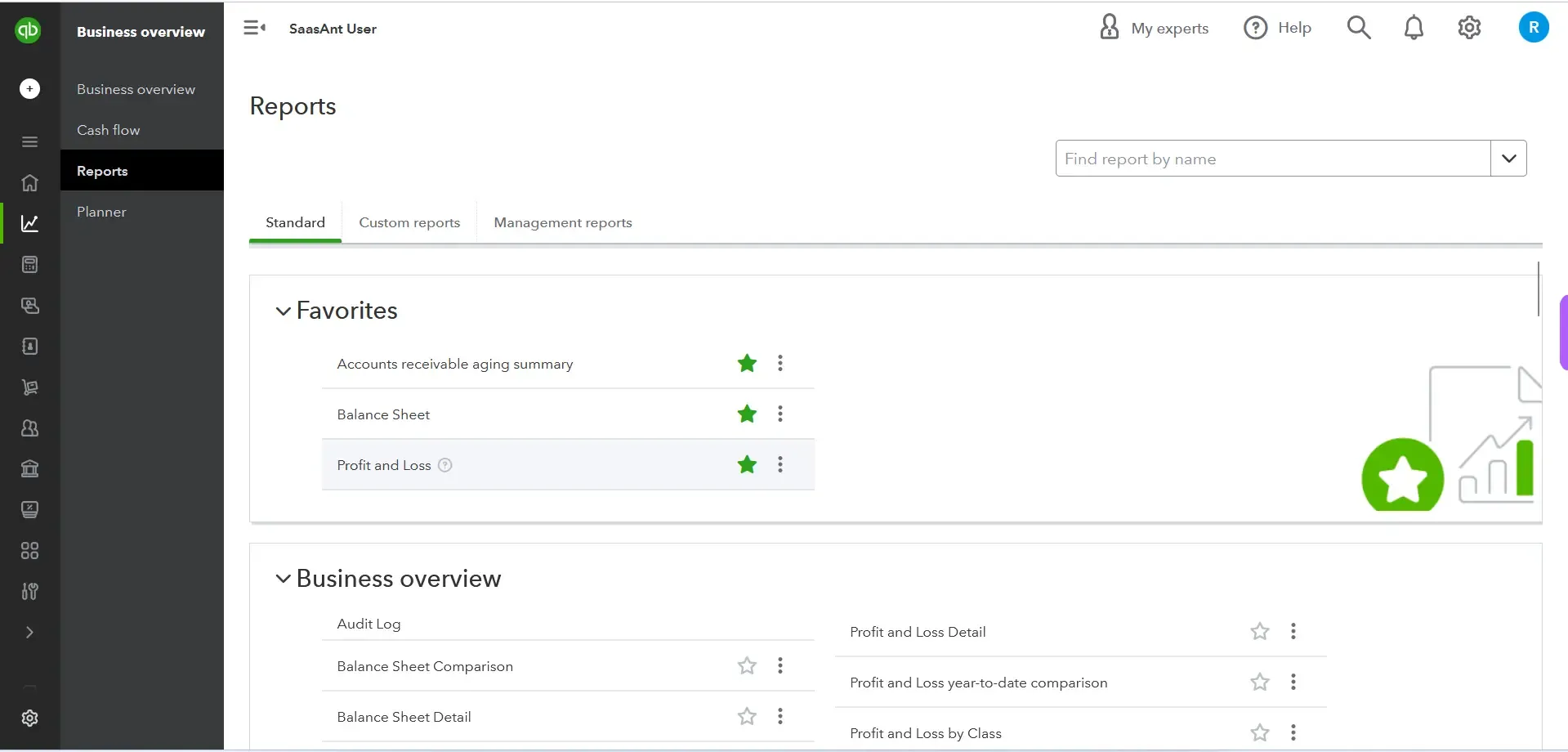

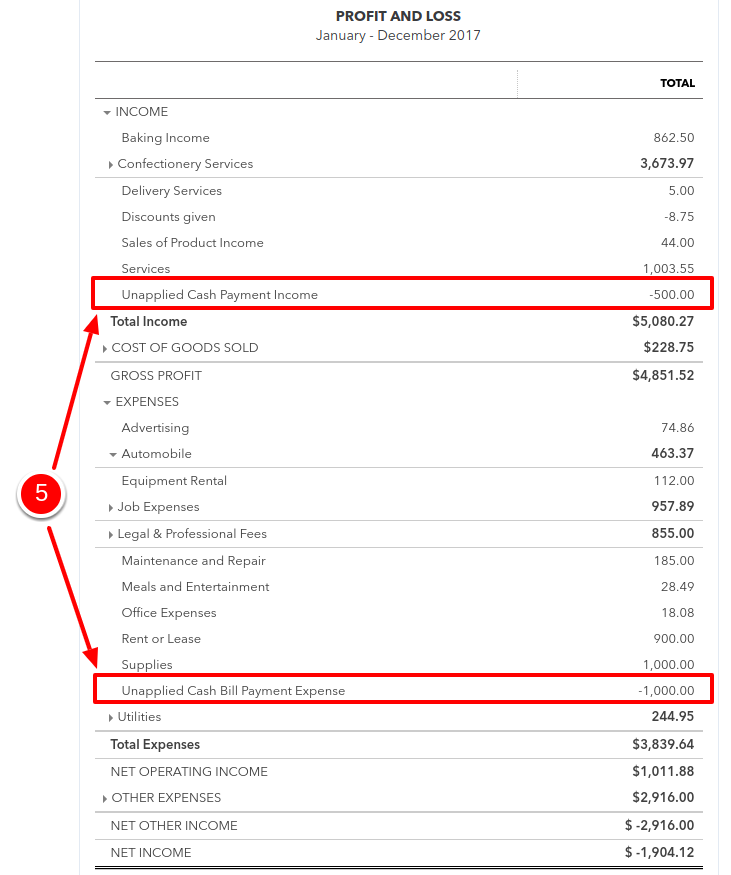

Unapplied Cash Bill Payment Expense Quickbooks Online - When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. With the profit and loss report open, look for the section unapplied cash bill payment. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. To fix this, you can follow the steps below:

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. To fix this, you can follow the steps below: Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. With the profit and loss report open, look for the section unapplied cash bill payment. When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill.

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. To fix this, you can follow the steps below: When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. With the profit and loss report open, look for the section unapplied cash bill payment.

Unapplied Cash Payment and Expenses in QuickBooks Online

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online.

How to clean up Unapplied Cash Payment & Expenses in QuickBooks

Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. With the profit and loss report open, look for the section unapplied cash bill payment. To fix this, you can follow the steps below: When you run a profit and loss report in quickbooks online (using the cash method), an account.

Unapplied Cash Payment in QuickBooks Online Gentle Frog

With the profit and loss report open, look for the section unapplied cash bill payment. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. To fix this, you can follow the steps below: When you run a profit and loss report in quickbooks online (using the cash method), an account.

What to do if you see unapplied cash bill payment expense on your

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. To fix this, you can follow the steps below: When you run a profit and loss report in quickbooks online.

Unapplied cash payment and how to reconcile transactions

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. With the profit and loss report open, look for the section unapplied cash bill payment. When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. Coming across unapplied.

Unapplied Cash Payment in QuickBooks What It Means for Your

With the profit and loss report open, look for the section unapplied cash bill payment. Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. To fix this, you can follow the steps below: When you run a profit and loss report in quickbooks online (using the cash method), an account.

Unapplied Cash Payment in QuickBooks What It Means for Your

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. To fix this, you can follow the steps below: Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. With the profit and loss report open, look for the section.

How to fix unapplied cash payments in QuickBooks Online 5 Minute

To fix this, you can follow the steps below: Coming across unapplied cash payment income and expenses in the profit and loss report during a quickbooks online cleanup. With the profit and loss report open, look for the section unapplied cash bill payment. When you run a profit and loss report in quickbooks online (using the cash method), an account.

Unapplied Cash Payment in QuickBooks Online Gentle Frog

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. With the profit and loss report open, look for the section unapplied cash bill payment. When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. Coming across unapplied.

Cleanup the Unapplied Cash Bill Payment Expense using QuickBooks Online

When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. With the profit and loss report open, look for the section unapplied cash bill payment. To fix this,.

Coming Across Unapplied Cash Payment Income And Expenses In The Profit And Loss Report During A Quickbooks Online Cleanup.

With the profit and loss report open, look for the section unapplied cash bill payment. When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill. To fix this, you can follow the steps below: When you run a profit and loss report in quickbooks online (using the cash method), an account called unapplied cash bill.