Ubereats Tax Form

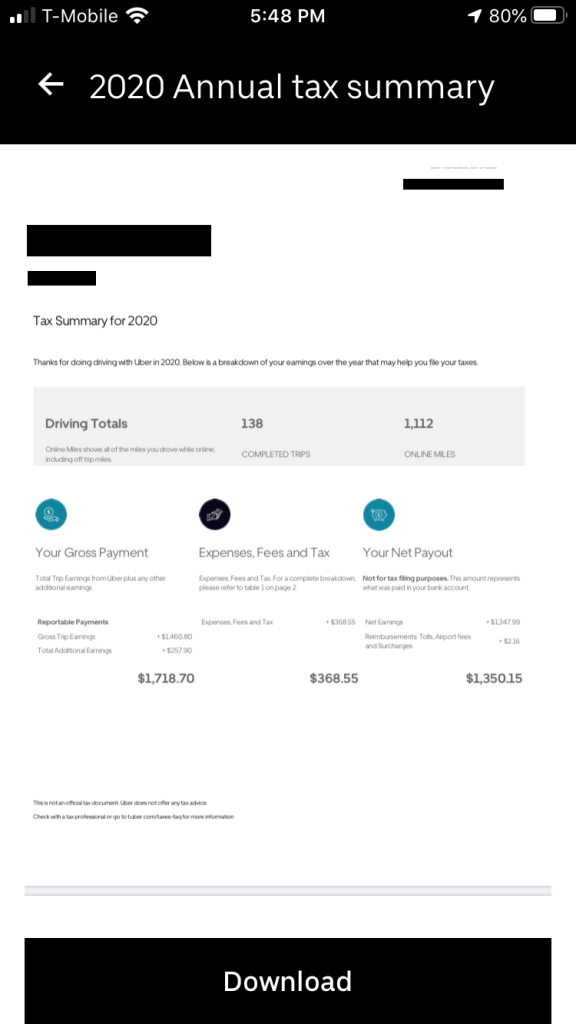

Ubereats Tax Form - As a uber independent contractor, you may receive one or both of the following tax forms: I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. Click “download” next to your tax forms when they are available. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. This form is for drivers who. All annual tax documents listed below. All tax documents will be available electronically via the uber eats manager. If you also opted in to receive your tax forms by mail, tax documents. Log in to drivers.uber.com and click the “tax information” tab.

To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. As a uber independent contractor, you may receive one or both of the following tax forms: If you also opted in to receive your tax forms by mail, tax documents. All tax documents will be available electronically via the uber eats manager. All annual tax documents listed below. This form is for drivers who. Click “download” next to your tax forms when they are available. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. Log in to drivers.uber.com and click the “tax information” tab. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual.

All tax documents will be available electronically via the uber eats manager. This form is for drivers who. Log in to drivers.uber.com and click the “tax information” tab. Click “download” next to your tax forms when they are available. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. As a uber independent contractor, you may receive one or both of the following tax forms: All annual tax documents listed below. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. If you also opted in to receive your tax forms by mail, tax documents.

UberEats Business Model & Revenue Model Guide] by Sarasameera

This form is for drivers who. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. Log in to drivers.uber.com and click the “tax information” tab. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule.

Uber Drivers How To Calculate Your Taxes Using TurboTax

All annual tax documents listed below. As a uber independent contractor, you may receive one or both of the following tax forms: This form is for drivers who. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. I've made well over $600 (the threshold) with uber,.

Ok, since I didn't get a 1099 form, where would I submit this in my tax

All tax documents will be available electronically via the uber eats manager. As a uber independent contractor, you may receive one or both of the following tax forms: All annual tax documents listed below. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will..

A complete guide to taxes for Postmates,Doordash, UberEats drivers

All tax documents will be available electronically via the uber eats manager. This form is for drivers who. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. If you also opted in to receive your tax forms by mail, tax documents. All annual tax documents listed.

Tax Form For Seniors 2023 Printable Forms Free Online

As a uber independent contractor, you may receive one or both of the following tax forms: I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. Log in to drivers.uber.com and click the “tax information” tab. If you also opted in to receive your.

Discover all that there is to know about paying taxes when driving for

This form is for drivers who. Click “download” next to your tax forms when they are available. Log in to drivers.uber.com and click the “tax information” tab. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. Since you are now a subcontractor, all.

how to fill tax form in adsense 2023 us tax form kaise bhare 2023

This form is for drivers who. Click “download” next to your tax forms when they are available. As a uber independent contractor, you may receive one or both of the following tax forms: Log in to drivers.uber.com and click the “tax information” tab. All tax documents will be available electronically via the uber eats manager.

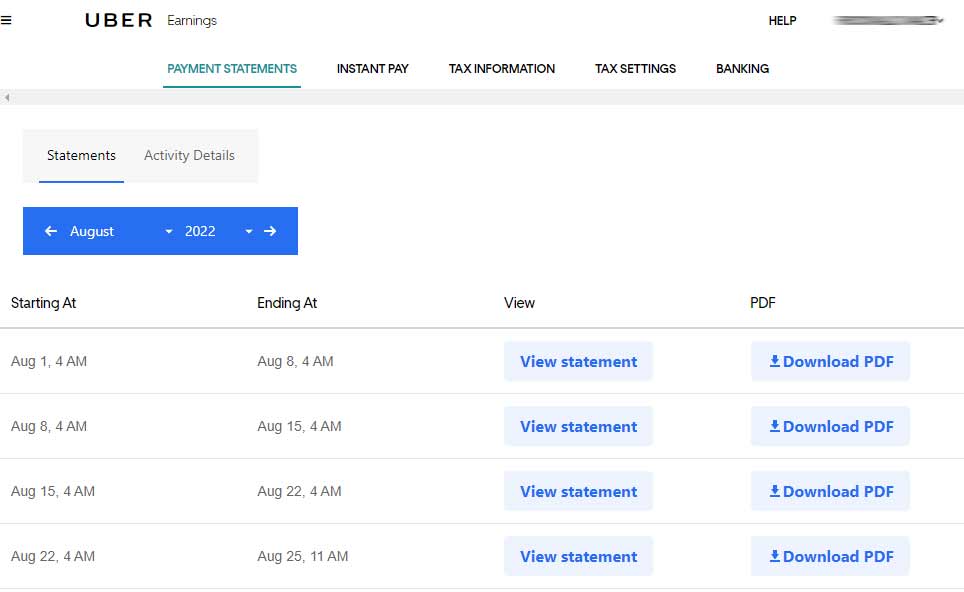

Uber Eats Pay Stubs, Earning Statements, Employment Verification

To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. Click “download” next to your tax forms when they are available. Log in to drivers.uber.com and click the “tax information” tab. All annual tax documents listed below. All tax documents will be available electronically via the uber eats manager.

How Do Food Delivery Couriers Pay Taxes? Get It Back

Log in to drivers.uber.com and click the “tax information” tab. If you also opted in to receive your tax forms by mail, tax documents. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. To file your tax return, you’ll need to use your 1099 forms and.

Tax form hires stock photography and images Alamy

I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. If you also opted in to receive your tax forms by mail, tax documents. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings..

Log In To Drivers.uber.com And Click The “Tax Information” Tab.

If you also opted in to receive your tax forms by mail, tax documents. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. All tax documents will be available electronically via the uber eats manager. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual.

This Form Is For Drivers Who.

Click “download” next to your tax forms when they are available. All annual tax documents listed below. As a uber independent contractor, you may receive one or both of the following tax forms: I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will.

![UberEats Business Model & Revenue Model Guide] by Sarasameera](https://image.isu.pub/221221072641-5bf1d56009da05af3b8ad5d5ce8e0554/jpg/page_1.jpg)