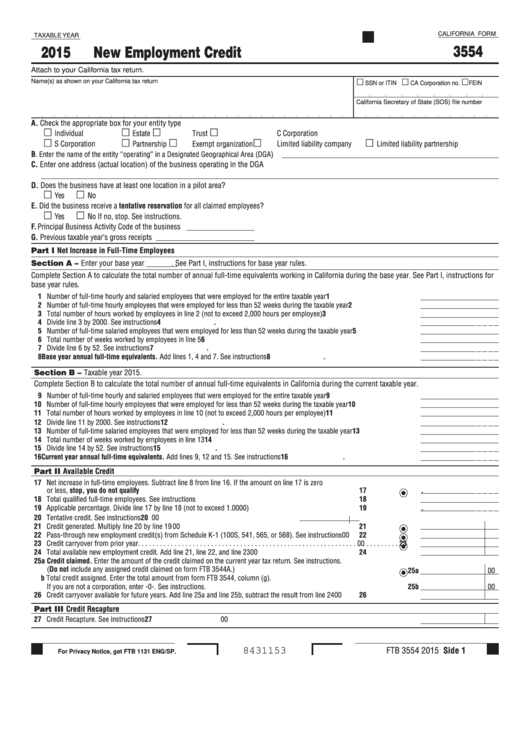

Tax Form 3554

Tax Form 3554 - (do not include any assigned credit claimed on form. Enter the amount of the credit claimed on the current year tax return. For 2020, you could qualify for the credit if you hired. We last updated the new. Form 3554 is used to obtain a credit for new employees acquired during the year.

Form 3554 is used to obtain a credit for new employees acquired during the year. For 2020, you could qualify for the credit if you hired. (do not include any assigned credit claimed on form. Enter the amount of the credit claimed on the current year tax return. We last updated the new.

We last updated the new. Enter the amount of the credit claimed on the current year tax return. For 2020, you could qualify for the credit if you hired. (do not include any assigned credit claimed on form. Form 3554 is used to obtain a credit for new employees acquired during the year.

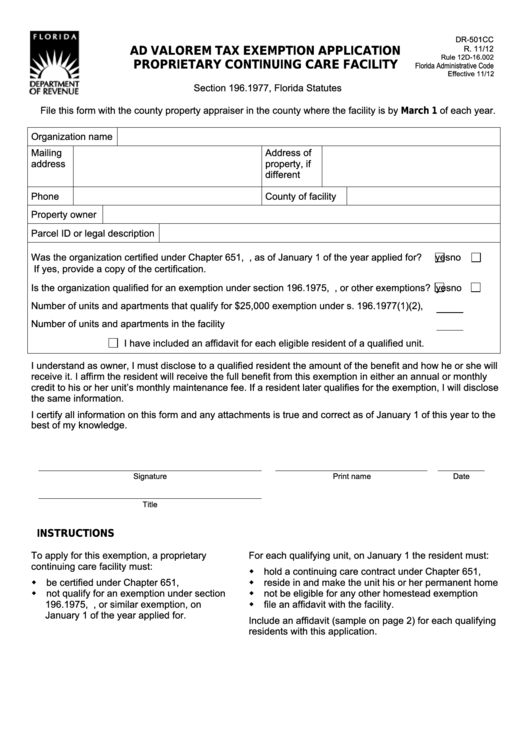

Form Dr501cc Ad Valorem Tax Exemption Application Proprietary

We last updated the new. Form 3554 is used to obtain a credit for new employees acquired during the year. (do not include any assigned credit claimed on form. For 2020, you could qualify for the credit if you hired. Enter the amount of the credit claimed on the current year tax return.

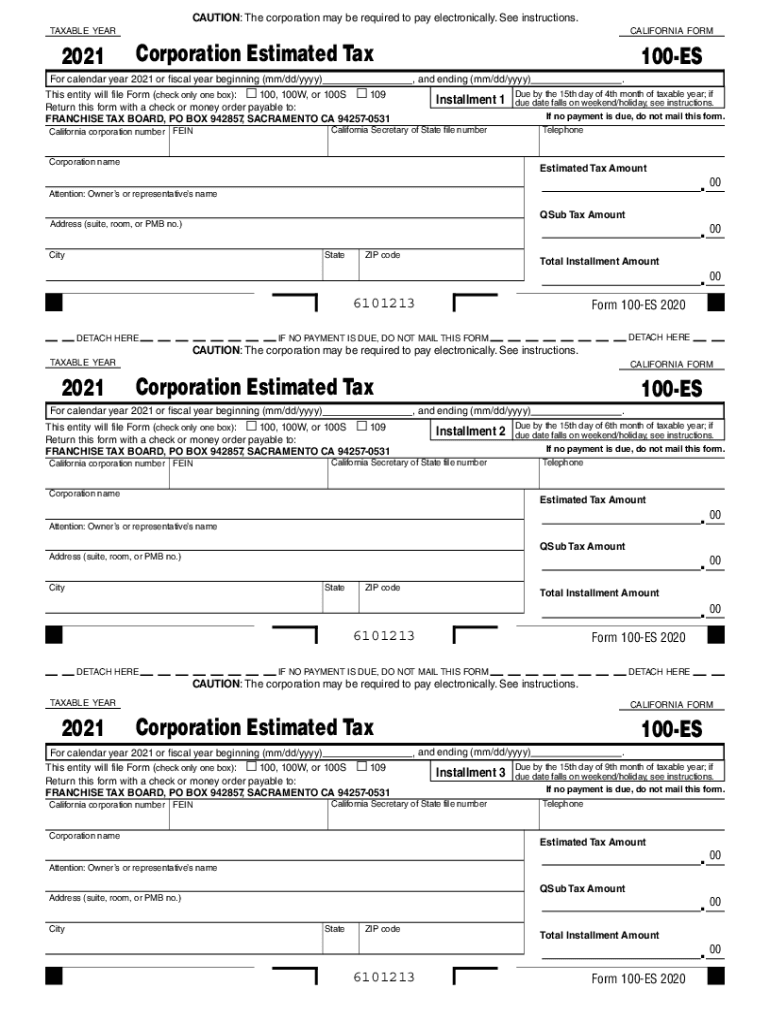

2021 Form CA FTB 100ES Fill Online, Printable, Fillable, Blank pdfFiller

Form 3554 is used to obtain a credit for new employees acquired during the year. For 2020, you could qualify for the credit if you hired. We last updated the new. (do not include any assigned credit claimed on form. Enter the amount of the credit claimed on the current year tax return.

Tax return form icons. Correctly and incorrectly completed Tax form

For 2020, you could qualify for the credit if you hired. (do not include any assigned credit claimed on form. We last updated the new. Form 3554 is used to obtain a credit for new employees acquired during the year. Enter the amount of the credit claimed on the current year tax return.

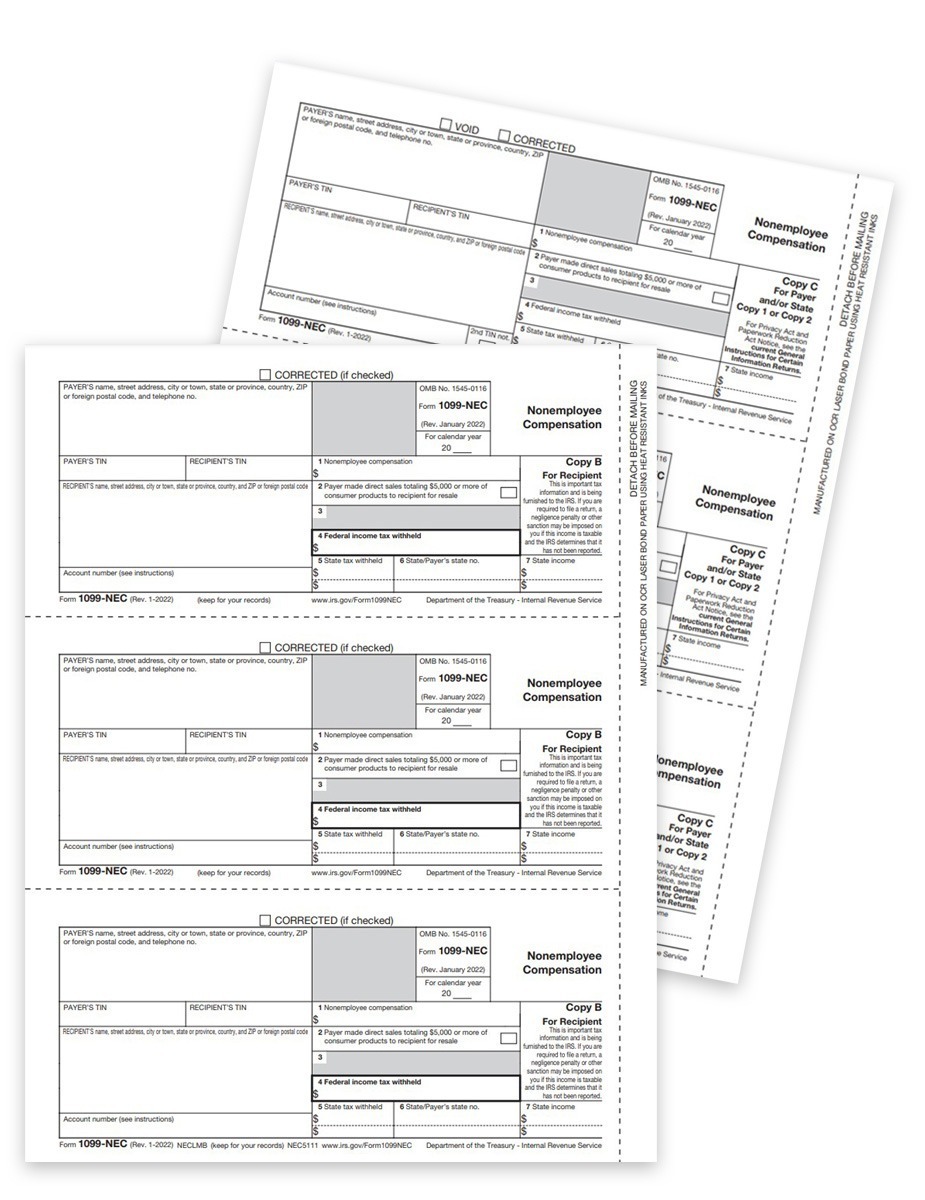

1099NEC Tax Forms Sets for EFilers ZBP Forms

(do not include any assigned credit claimed on form. For 2020, you could qualify for the credit if you hired. We last updated the new. Form 3554 is used to obtain a credit for new employees acquired during the year. Enter the amount of the credit claimed on the current year tax return.

Form 3554 California New Employment Credit 2015 printable pdf download

Form 3554 is used to obtain a credit for new employees acquired during the year. Enter the amount of the credit claimed on the current year tax return. (do not include any assigned credit claimed on form. For 2020, you could qualify for the credit if you hired. We last updated the new.

CA FTB 540 20202022 Fill out Tax Template Online US Legal Forms

For 2020, you could qualify for the credit if you hired. (do not include any assigned credit claimed on form. Form 3554 is used to obtain a credit for new employees acquired during the year. Enter the amount of the credit claimed on the current year tax return. We last updated the new.

EXEMPT is no longer on Tax Form One News Page VIDEO

Form 3554 is used to obtain a credit for new employees acquired during the year. We last updated the new. Enter the amount of the credit claimed on the current year tax return. (do not include any assigned credit claimed on form. For 2020, you could qualify for the credit if you hired.

Tax Form W4 What is a W4 form used for and how you can fill it out

We last updated the new. (do not include any assigned credit claimed on form. For 2020, you could qualify for the credit if you hired. Form 3554 is used to obtain a credit for new employees acquired during the year. Enter the amount of the credit claimed on the current year tax return.

GT FORM HF2.1 HYBRID BRUSHED TITANIUM 20X10.5 5X114.3 WHEEL ONLY

Form 3554 is used to obtain a credit for new employees acquired during the year. We last updated the new. Enter the amount of the credit claimed on the current year tax return. For 2020, you could qualify for the credit if you hired. (do not include any assigned credit claimed on form.

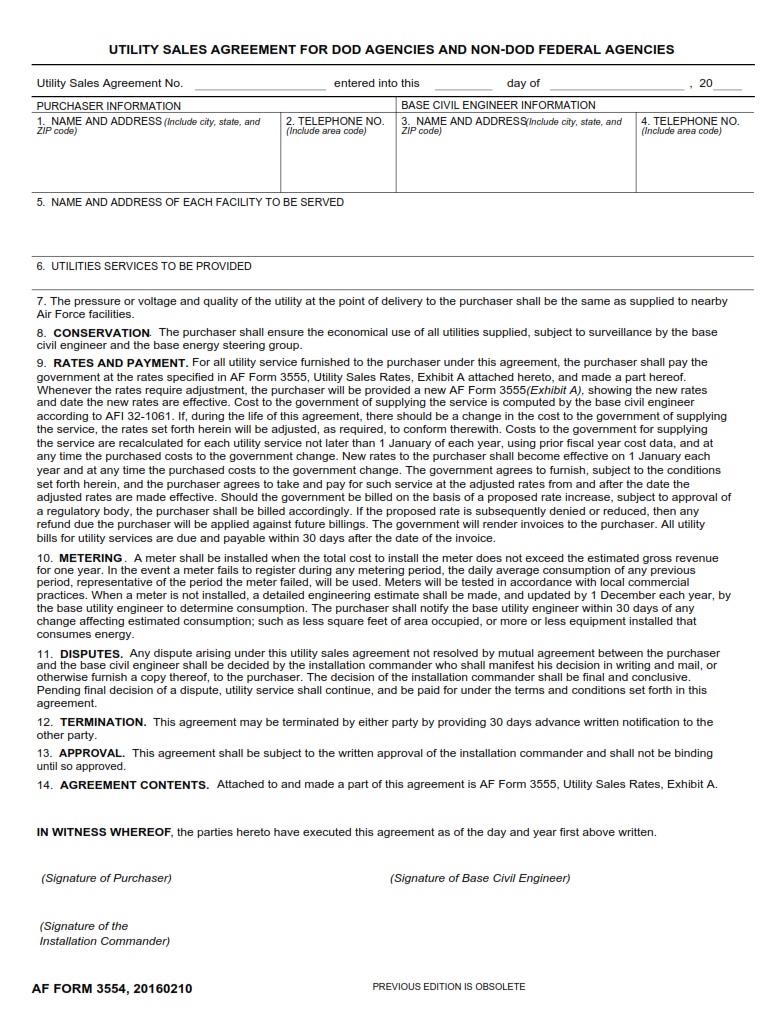

AF Form 3554 Utility Sales Agreement For DoD Agencies And NonFederal

(do not include any assigned credit claimed on form. We last updated the new. Form 3554 is used to obtain a credit for new employees acquired during the year. Enter the amount of the credit claimed on the current year tax return. For 2020, you could qualify for the credit if you hired.

Form 3554 Is Used To Obtain A Credit For New Employees Acquired During The Year.

We last updated the new. (do not include any assigned credit claimed on form. Enter the amount of the credit claimed on the current year tax return. For 2020, you could qualify for the credit if you hired.