Shopify Price To Earnings Ratio

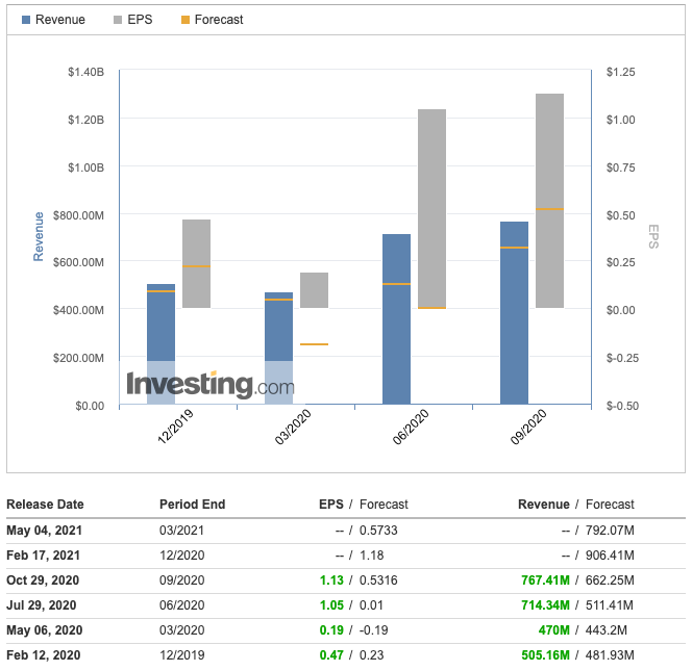

Shopify Price To Earnings Ratio - The enterprise value is $136.03 billion. Current and historical p/e ratio for shopify (shop) from 2013 to 2024. Shopify has a market cap or net worth of $139.78 billion. It is the most commonly used metric for determining a company's value relative to. Price to earnings ratio or p/e is price / earnings. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. This metric is considered a. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). The next estimated earnings date is. Analyzing the last five years, shop's pe ratio reached its highest.

Price to earnings ratio or p/e is price / earnings. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. Current and historical p/e ratio for shopify (shop) from 2013 to 2024. It is the most commonly used metric for determining a company's value relative to. The price to earnings ratio is calculated by taking the latest closing price and. This metric is considered a. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). The next estimated earnings date is. Shopify has a market cap or net worth of $139.78 billion. The current price to earnings ratio for shop is 662.77% higher than the 10 year average.

Price to earnings ratio or p/e is price / earnings. The next estimated earnings date is. The enterprise value is $136.03 billion. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). Current and historical p/e ratio for shopify (shop) from 2013 to 2024. This metric is considered a. It is the most commonly used metric for determining a company's value relative to. The price to earnings ratio is calculated by taking the latest. Shopify has a market cap or net worth of $139.78 billion.

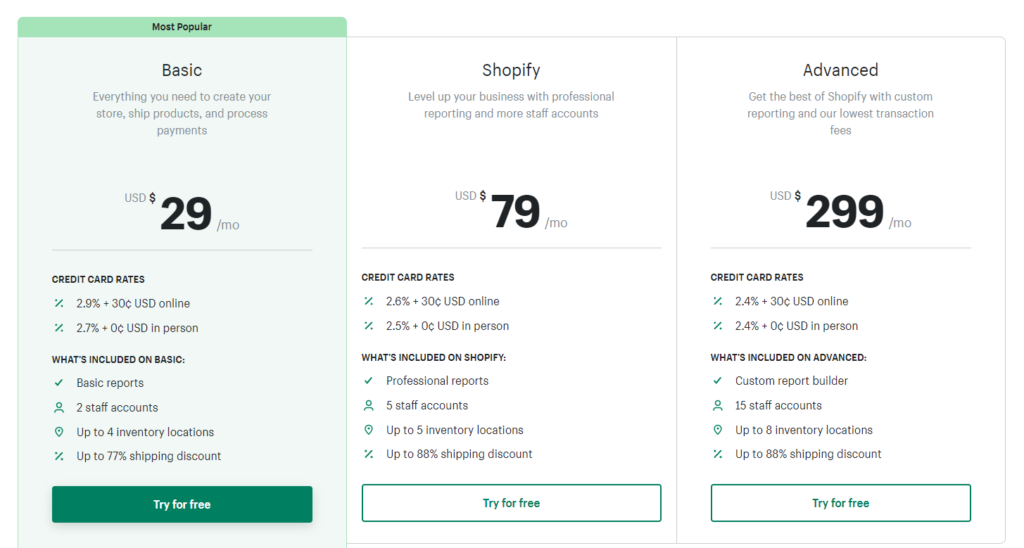

Shopify Pricing and Fees 2024 Which Plan is Right For You?

The price to earnings ratio is calculated by taking the latest. The price to earnings ratio is calculated by taking the latest closing price and. Price to earnings ratio or p/e is price / earnings. The current price to earnings ratio for shop is 662.77% higher than the 10 year average. Current and historical p/e ratio for shopify (shop) from.

Shopify Soars 10 On Earnings Beat

Price to earnings ratio or p/e is price / earnings. The price to earnings ratio is calculated by taking the latest. The next estimated earnings date is. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. The enterprise value is $136.03 billion.

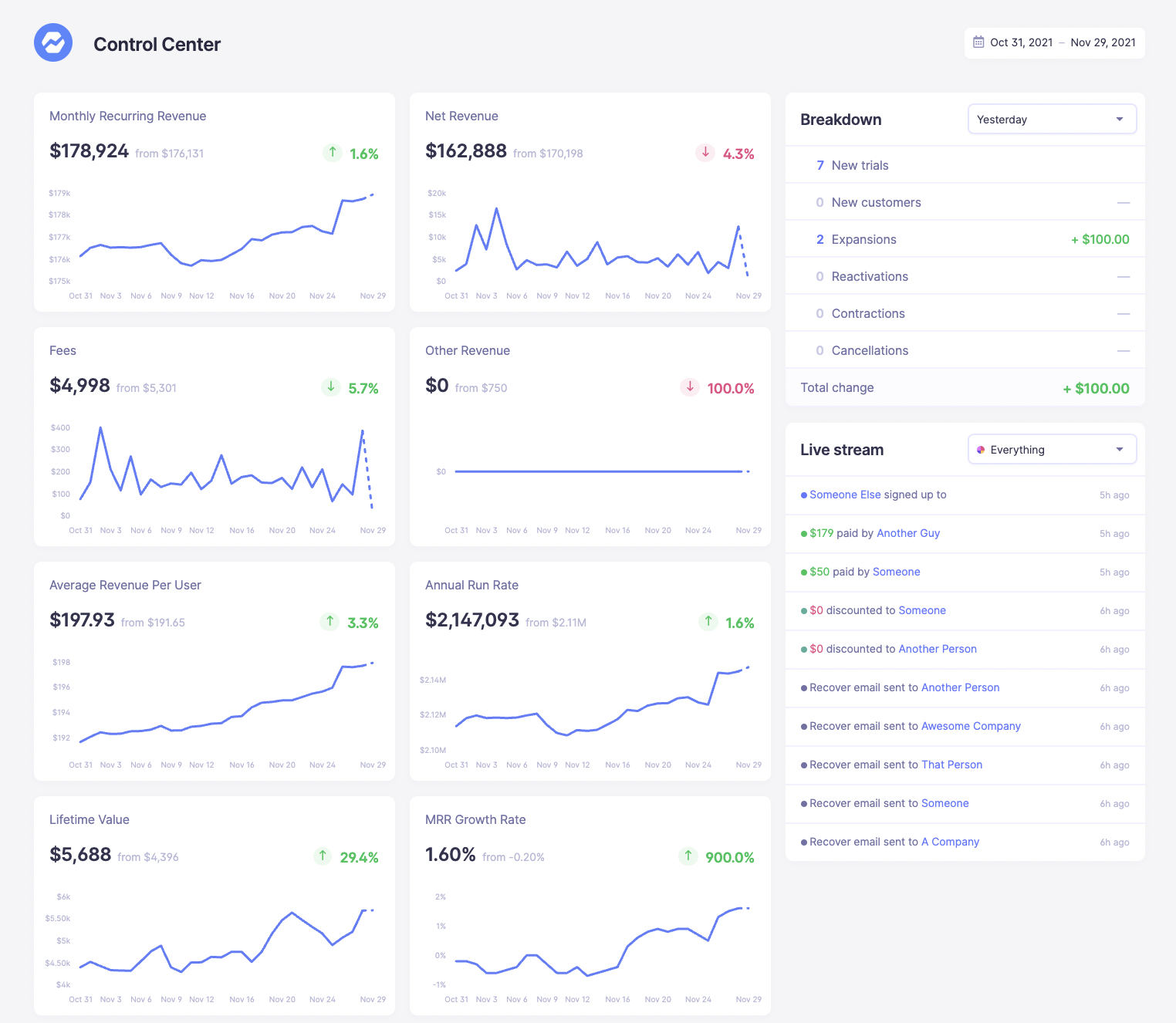

How to Calculate Profit for a Dropshipping Business

The enterprise value is $136.03 billion. This metric is considered a. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. It is the most commonly used metric for determining a company's value relative to. The price to earnings ratio is calculated by taking the latest.

Week Ahead It’s the Year of the IPO + Shopify Earnings

Current and historical p/e ratio for shopify (shop) from 2013 to 2024. The enterprise value is $136.03 billion. It is the most commonly used metric for determining a company's value relative to. The price to earnings ratio is calculated by taking the latest closing price and. The price to earnings ratio (pe ratio) is calculated by taking the stock price.

Shopify Price Automation Tips, Apps & Best Practices WebLime

The price to earnings ratio is calculated by taking the latest. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). This metric is considered a. 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. The next estimated earnings date is.

Shopify Pricing, Plans, Fees And Costs Fastlane

The enterprise value is $136.03 billion. Shopify has a market cap or net worth of $139.78 billion. The price to earnings ratio is calculated by taking the latest. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). 50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024.

Shopify Stock Rockets to AllTime High After Earnings

Shopify has a market cap or net worth of $139.78 billion. The enterprise value is $136.03 billion. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). The price to earnings ratio is calculated by taking the latest. Price to earnings ratio or p/e is price / earnings.

Shopify Revenue Share What Shopify Partners Need to Know (2021

Current and historical p/e ratio for shopify (shop) from 2013 to 2024. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). The price to earnings ratio is calculated by taking the latest closing price and. The current price to earnings ratio for shop is 662.77% higher than the 10 year average..

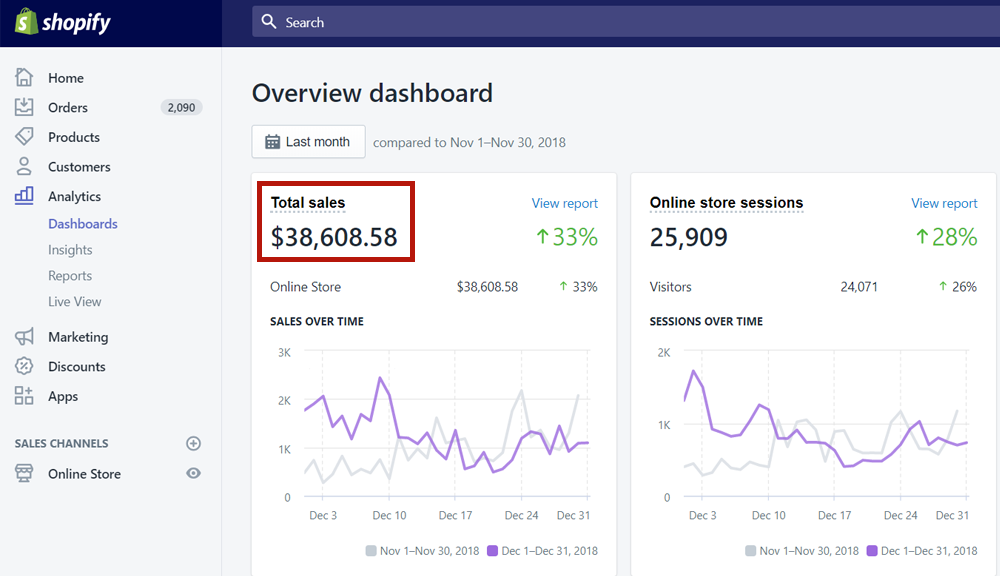

Earnings Shopify Inc. (NYSE SHOP) reports Q3 2020 financial results

It is the most commonly used metric for determining a company's value relative to. This metric is considered a. Analyzing the last five years, shop's pe ratio reached its highest. The price to earnings ratio is calculated by taking the latest closing price and. The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps.

Shopify Review An Platform

The price to earnings ratio (pe ratio) is calculated by taking the stock price / eps diluted (ttm). Shopify has a market cap or net worth of $139.78 billion. This metric is considered a. The price to earnings ratio is calculated by taking the latest closing price and. The next estimated earnings date is.

This Metric Is Considered A.

The enterprise value is $136.03 billion. The next estimated earnings date is. It is the most commonly used metric for determining a company's value relative to. Shopify has a market cap or net worth of $139.78 billion.

The Price To Earnings Ratio (Pe Ratio) Is Calculated By Taking The Stock Price / Eps Diluted (Ttm).

The current price to earnings ratio for shop is 662.77% higher than the 10 year average. Current and historical p/e ratio for shopify (shop) from 2013 to 2024. The price to earnings ratio is calculated by taking the latest. Analyzing the last five years, shop's pe ratio reached its highest.

The Price To Earnings Ratio Is Calculated By Taking The Latest Closing Price And.

50 rows current and historical p/e ratio for shopify (shop) from 2013 to 2024. Price to earnings ratio or p/e is price / earnings.

:max_bytes(150000):strip_icc()/shop2-b93a53047e10465aaed47ff5a1f096cb.jpg)