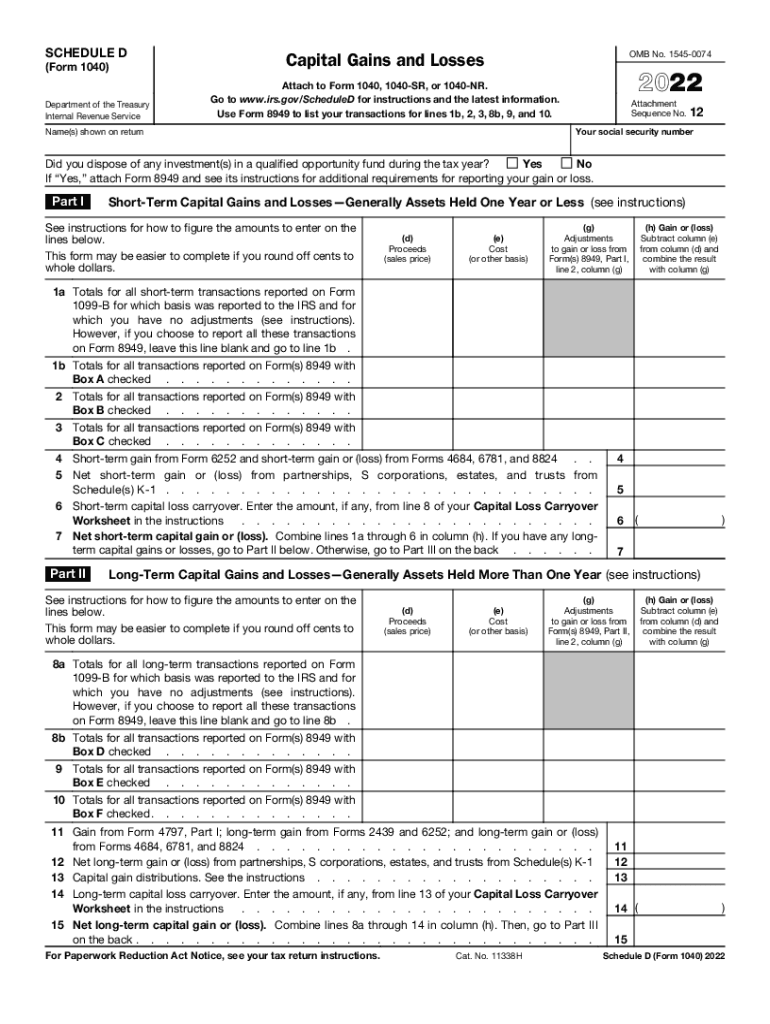

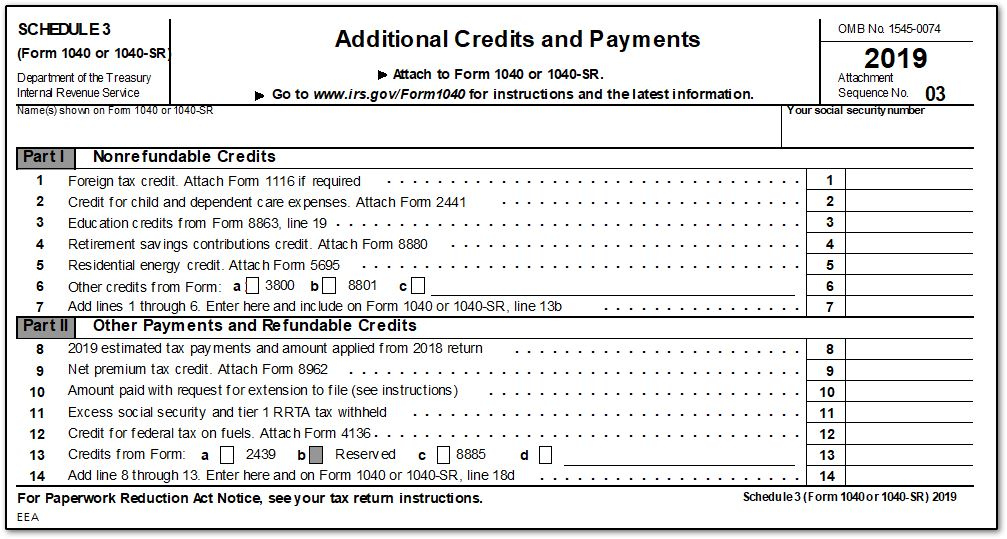

Schedule 3 Tax Form

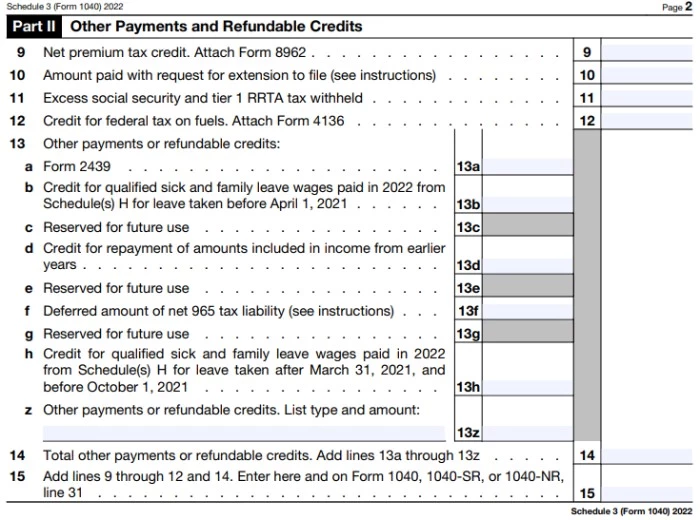

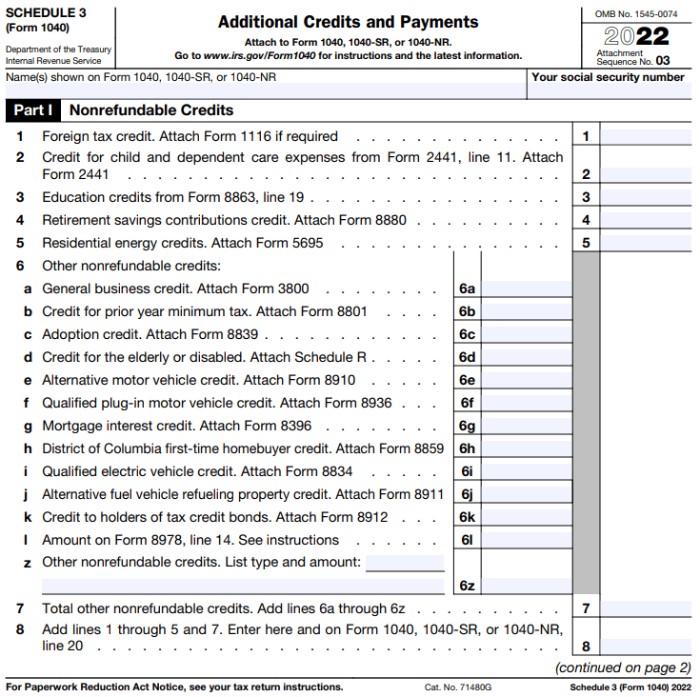

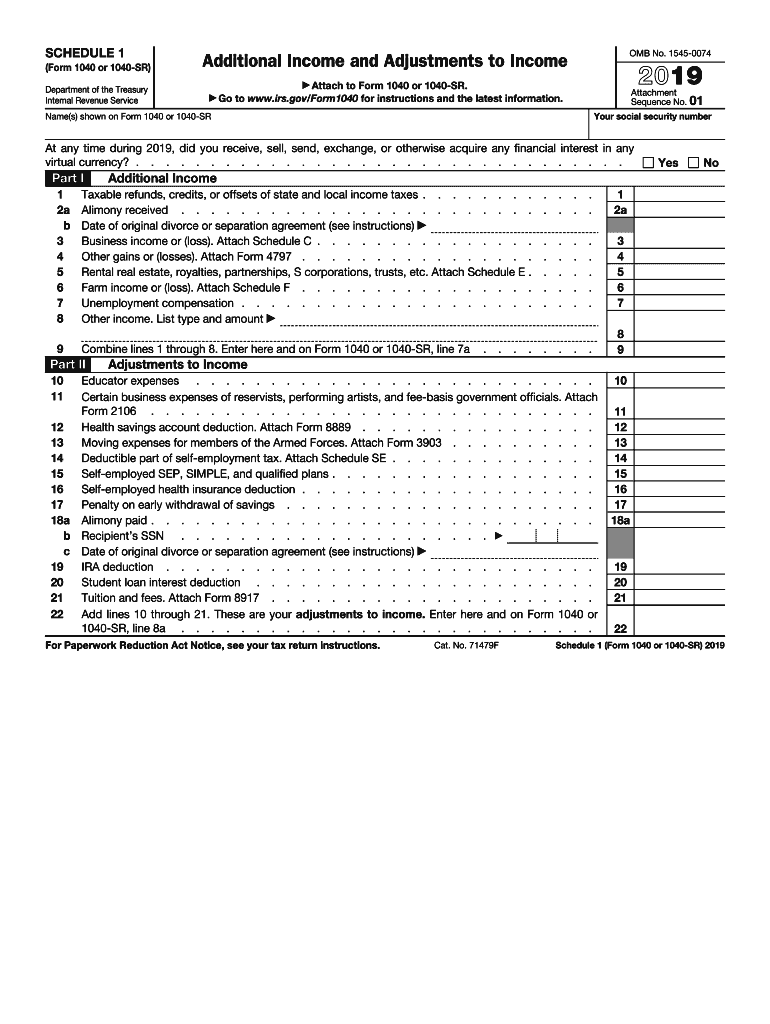

Schedule 3 Tax Form - Let’s start at the top with part. Other payments and refundable credits; Rely on draft forms, instructions, and. There are two parts to this tax form: How do i complete irs schedule 3? One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. This form is titled additional income and. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. Do not file draft forms.

Other payments and refundable credits; Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. Do not file draft forms. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. This form is titled additional income and. Let’s start at the top with part. Rely on draft forms, instructions, and. One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill. How do i complete irs schedule 3? There are two parts to this tax form:

This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. How do i complete irs schedule 3? Let’s start at the top with part. There are two parts to this tax form: Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. Rely on draft forms, instructions, and. Other payments and refundable credits; This form is titled additional income and. Do not file draft forms. One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill.

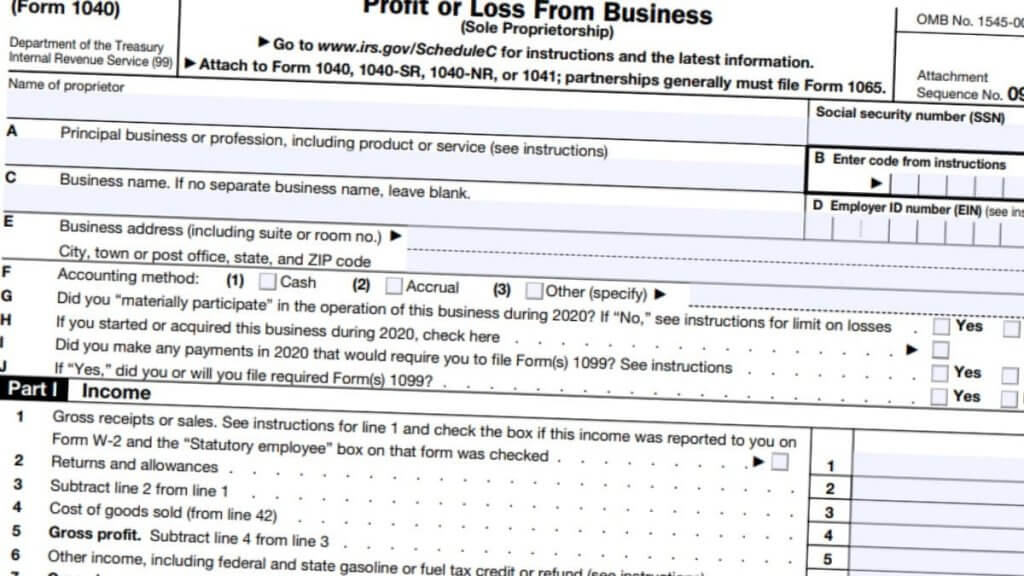

IRS Schedule 2 walkthrough (Additional Taxes) YouTube

This form is titled additional income and. Rely on draft forms, instructions, and. Let’s start at the top with part. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. One of these forms may be form 1040 schedule 3, which lists additional credits you might.

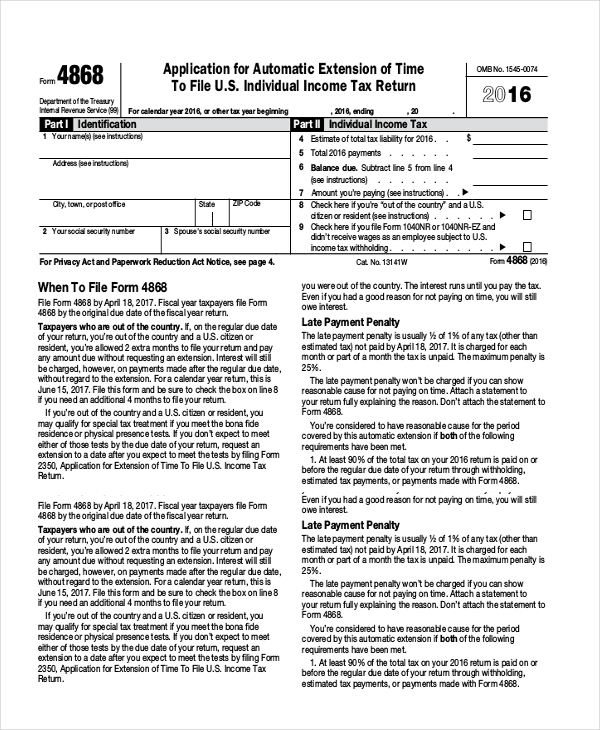

Printable Schedule E Tax Form Printable Forms Free Online

This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Other payments and refundable credits; Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. How do i complete irs schedule 3? One of.

2023 Form Canada TD1 E Fill Online, Printable, Fillable, Blank pdfFiller

How do i complete irs schedule 3? There are two parts to this tax form: Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. Do not file draft forms. Other payments and refundable credits;

How to Quickly Fill Out Form 1040 Schedule 3 XOA TAX

Rely on draft forms, instructions, and. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. Let’s start at the top with part. This form is titled additional income and. Other payments and refundable credits;

How to Quickly Fill Out Form 1040 Schedule 3

This form is titled additional income and. Other payments and refundable credits; One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income.

Schedule 1 tax form Fill out & sign online DocHub

One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill. How do i complete irs schedule 3? Do not file draft forms. Rely on draft forms, instructions, and. There are two parts to this tax form:

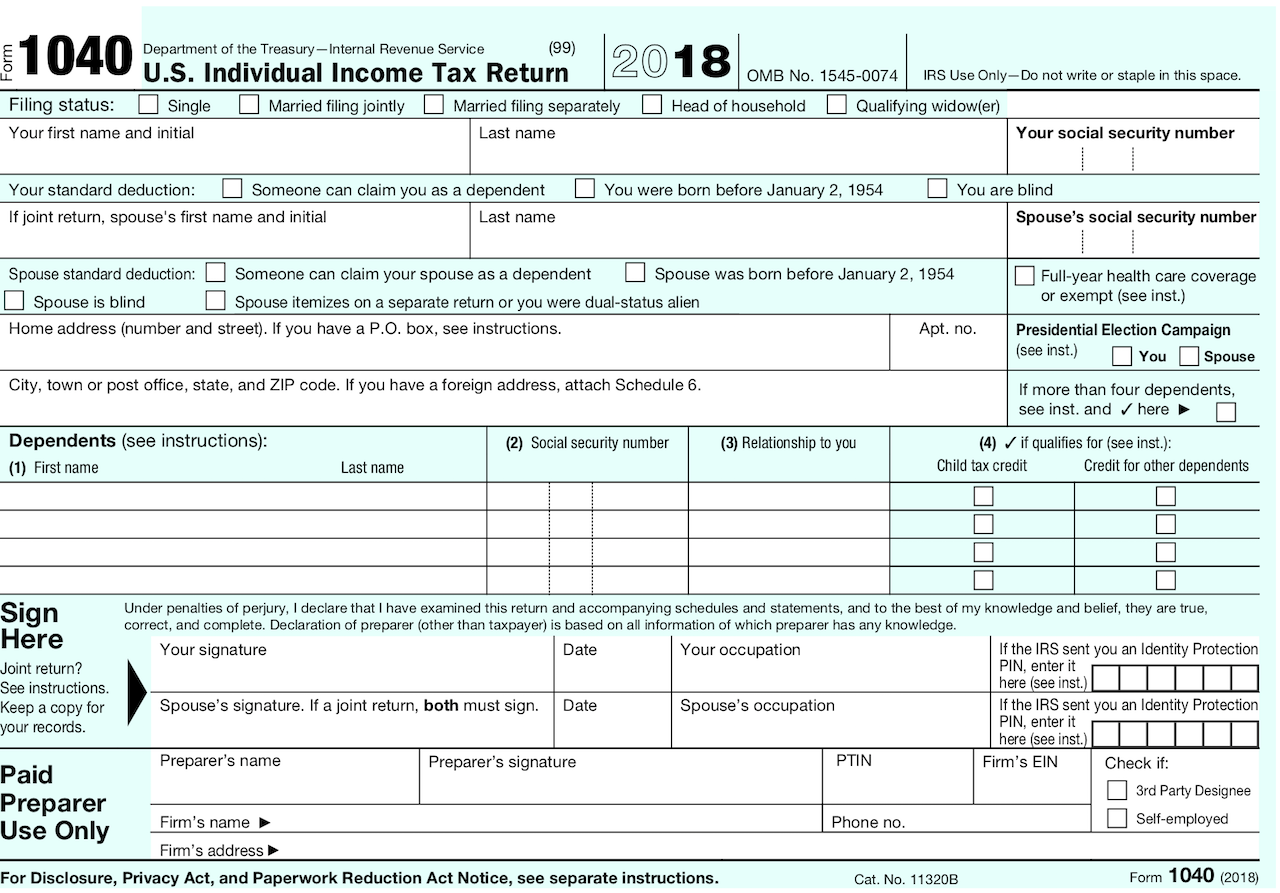

Describes new Form 1040, Schedules & Tax Tables

One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill. Let’s start at the top with part. How do i complete irs schedule 3? Do not file draft forms. Schedules 1, 2, and 3 are supplemental documents.

2023 Schedule 3 2022 Online File PDF Schedules TaxUni

One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. This form is.

Printable Form 1040 Schedule 1

This form is titled additional income and. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied.

2023 Federal Tax Exemption Form

Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. There are two parts to this tax form: Do not file draft forms. How.

How Do I Complete Irs Schedule 3?

Rely on draft forms, instructions, and. This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. This form is titled additional income and. One of these forms may be form 1040 schedule 3, which lists additional credits you might be able to claim as well as some payments that will get applied to your tax bill.

Other Payments And Refundable Credits;

Let’s start at the top with part. There are two parts to this tax form: Do not file draft forms. Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayer’s income tax filing package, even if they aren’t filled out.