Sales Tax Report In Quickbooks Online

Sales Tax Report In Quickbooks Online - In the sales tax center, you can add and edit tax. Add multiple sales tax rates, including combined. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. To access the report, go to reports > vendors & payables > sales tax liability. This report provides a summary of sales by tax. Learn how to set up, edit, and deactivate your sales tax rate and settings.

In the sales tax center, you can add and edit tax. To access the report, go to reports > vendors & payables > sales tax liability. Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. This report provides a summary of sales by tax.

For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. Add multiple sales tax rates, including combined. In the sales tax center, you can add and edit tax. This report provides a summary of sales by tax. Learn how to set up, edit, and deactivate your sales tax rate and settings. To access the report, go to reports > vendors & payables > sales tax liability.

What QuickBooks Reports Do I Need for Taxes List]

Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. To access the report, go to reports > vendors & payables > sales tax liability. This report.

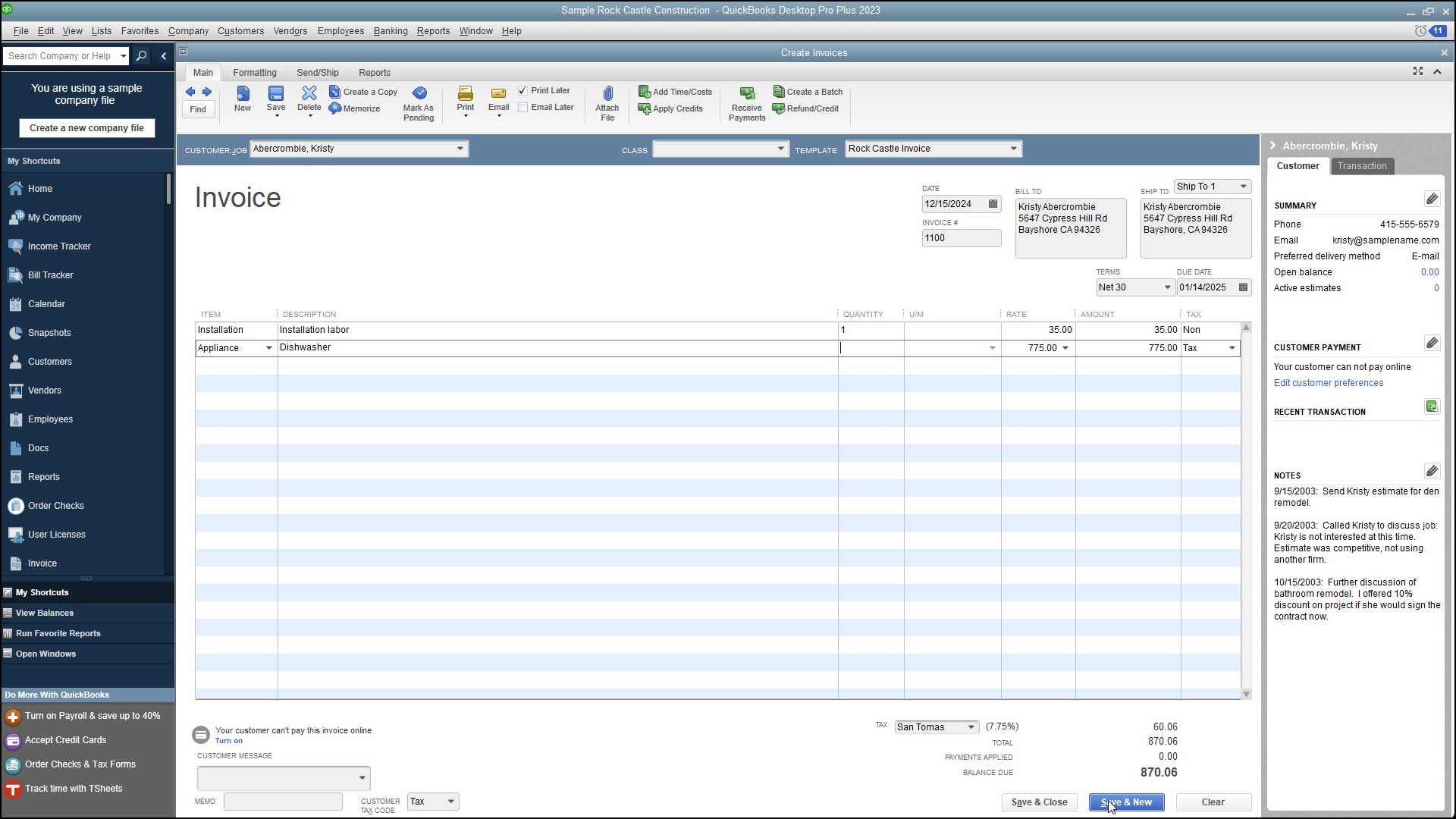

Create an Invoice in QuickBooks Desktop Pro Instructions

This report provides a summary of sales by tax. In the sales tax center, you can add and edit tax. To access the report, go to reports > vendors & payables > sales tax liability. Add multiple sales tax rates, including combined. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and.

Reporting Sales Tax Experts in QuickBooks Consulting & QuickBooks

To access the report, go to reports > vendors & payables > sales tax liability. In the sales tax center, you can add and edit tax. Learn how to set up, edit, and deactivate your sales tax rate and settings. This report provides a summary of sales by tax. Add multiple sales tax rates, including combined.

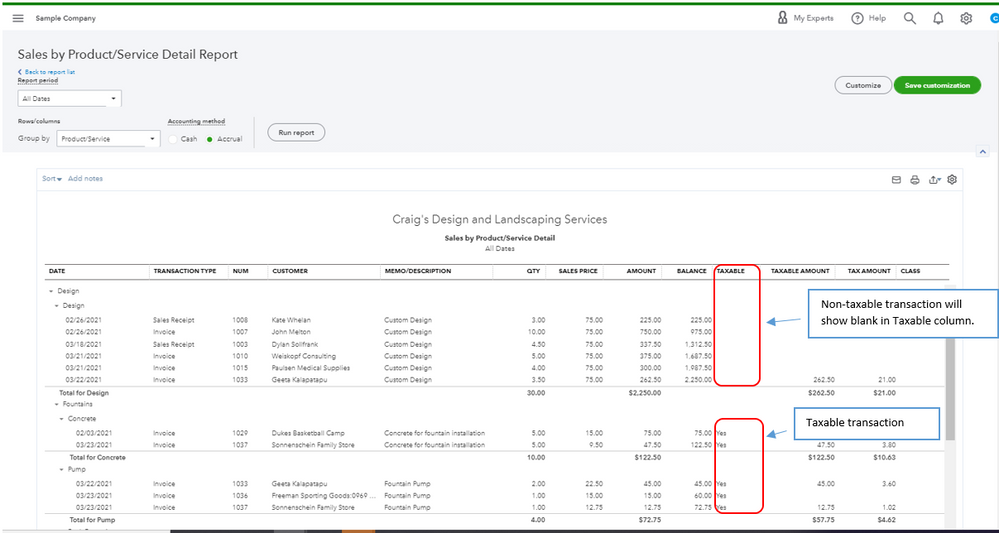

QuickBooks Online Tutorial Sales Tax Reports Intuit Training YouTube

For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. To access the report, go to reports > vendors & payables > sales tax liability. Learn how to set up, edit, and deactivate your sales tax rate and settings. This report provides a summary of sales by tax..

How to use the Sales Tax Report Help Center

In the sales tax center, you can add and edit tax. To access the report, go to reports > vendors & payables > sales tax liability. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. This report provides a summary of sales by tax. Add multiple sales.

Automated Sales Tax in QuickBooks Online K2 Enterprises

This report provides a summary of sales by tax. Add multiple sales tax rates, including combined. To access the report, go to reports > vendors & payables > sales tax liability. Learn how to set up, edit, and deactivate your sales tax rate and settings. For all your taxable transactions, the sales tax center tool on quickbooks helps you in.

Sales Tax Liability Report

Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings. To access the report, go to reports > vendors & payables > sales tax liability. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. This report.

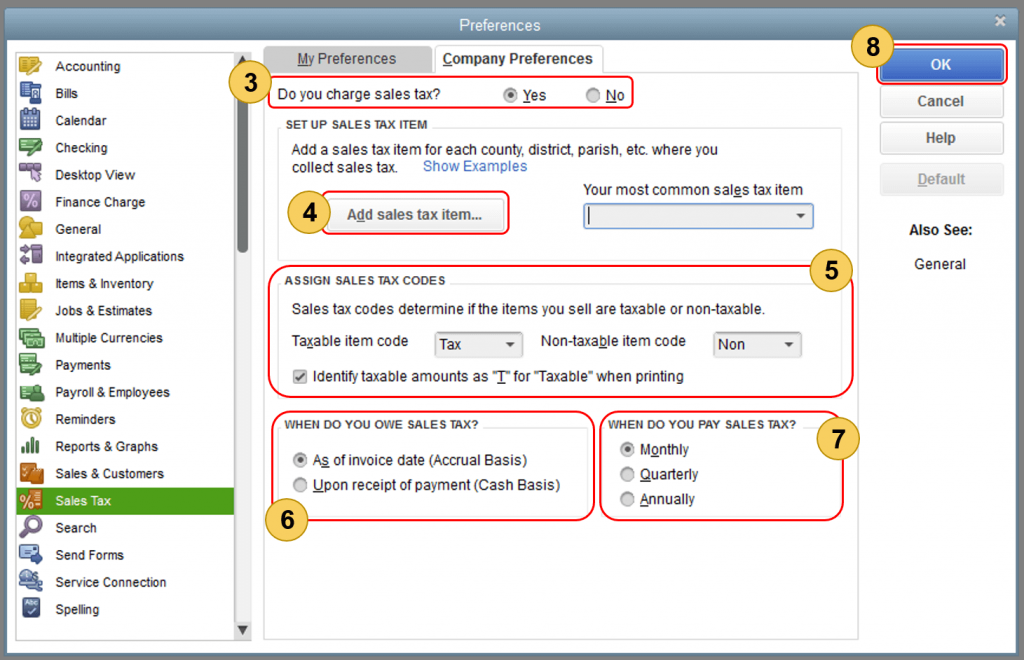

How to Set Up Sales Tax in QuickBooks Desktop?

To access the report, go to reports > vendors & payables > sales tax liability. In the sales tax center, you can add and edit tax. This report provides a summary of sales by tax. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. Add multiple sales.

Tracking Sales Tax in QuickBooks Introduction to QuickBooks Online

To access the report, go to reports > vendors & payables > sales tax liability. Add multiple sales tax rates, including combined. For all your taxable transactions, the sales tax center tool on quickbooks helps you in recording each and every sales tax payment. Learn how to set up, edit, and deactivate your sales tax rate and settings. This report.

Sales Tax Calculator Online Sales Tax Rates & Software QuickBooks

To access the report, go to reports > vendors & payables > sales tax liability. This report provides a summary of sales by tax. Learn how to set up, edit, and deactivate your sales tax rate and settings. Add multiple sales tax rates, including combined. In the sales tax center, you can add and edit tax.

For All Your Taxable Transactions, The Sales Tax Center Tool On Quickbooks Helps You In Recording Each And Every Sales Tax Payment.

In the sales tax center, you can add and edit tax. To access the report, go to reports > vendors & payables > sales tax liability. Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings.

![What QuickBooks Reports Do I Need for Taxes List]](https://www.acecloudhosting.com/wp-content/uploads/2023/09/Blog-image-3.jpg)