Quickbooks Online Sales Tax Settings

Quickbooks Online Sales Tax Settings - Click edit sales tax settings in the related tasks list to. Add multiple sales tax rates, including combined. To create a custom tax rate, start by establishing the rate in quickbooks online under taxes > sales tax > sales tax settings. Learn how to set up, edit, and deactivate your sales tax rate and settings. Learn how to set up and use the automated sales tax feature in quickbooks online. You can turn sales tax on or off by editing sales tax settings. In the sales tax center, you can add and edit tax. To edit sales tax settings: Quickbooks can automatically do the sales tax.

Click edit sales tax settings in the related tasks list to. Learn how to set up and use the automated sales tax feature in quickbooks online. In the sales tax center, you can add and edit tax. To create a custom tax rate, start by establishing the rate in quickbooks online under taxes > sales tax > sales tax settings. Learn how to set up, edit, and deactivate your sales tax rate and settings. Quickbooks can automatically do the sales tax. You can turn sales tax on or off by editing sales tax settings. Add multiple sales tax rates, including combined. To edit sales tax settings:

Learn how to set up and use the automated sales tax feature in quickbooks online. To edit sales tax settings: Learn how to set up, edit, and deactivate your sales tax rate and settings. Add multiple sales tax rates, including combined. Click edit sales tax settings in the related tasks list to. You can turn sales tax on or off by editing sales tax settings. To create a custom tax rate, start by establishing the rate in quickbooks online under taxes > sales tax > sales tax settings. Quickbooks can automatically do the sales tax. In the sales tax center, you can add and edit tax.

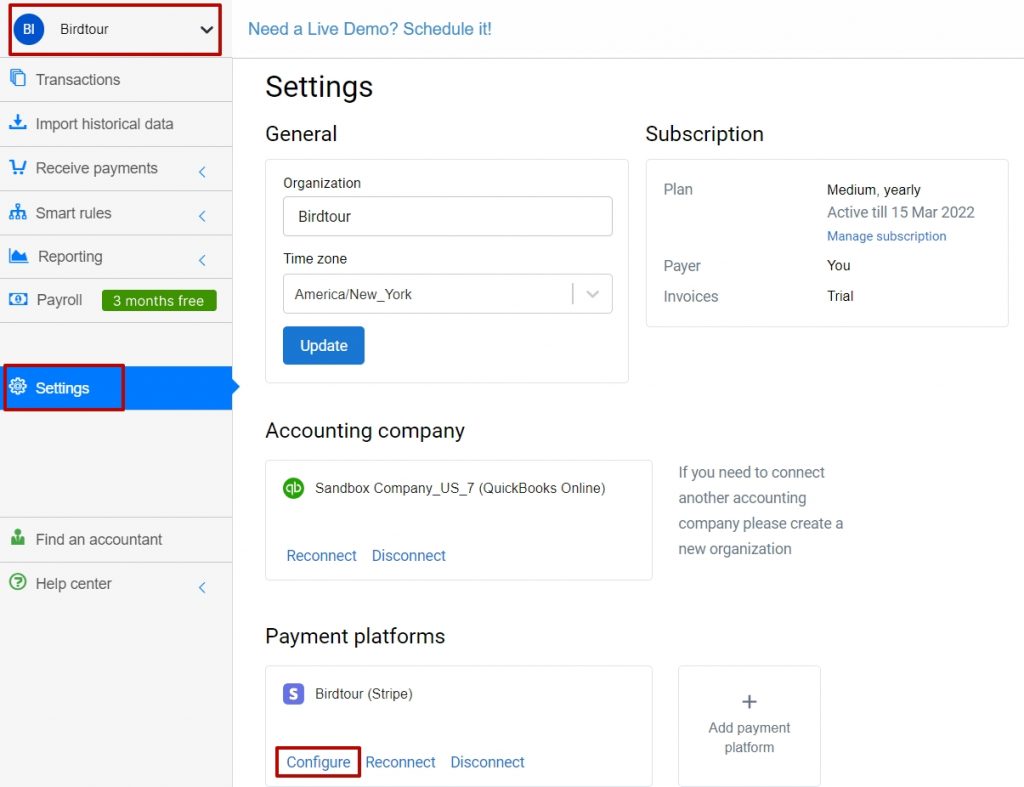

QuickBooks Online Sales Tax Compliance with TaxCloud

Learn how to set up, edit, and deactivate your sales tax rate and settings. To create a custom tax rate, start by establishing the rate in quickbooks online under taxes > sales tax > sales tax settings. Quickbooks can automatically do the sales tax. You can turn sales tax on or off by editing sales tax settings. Add multiple sales.

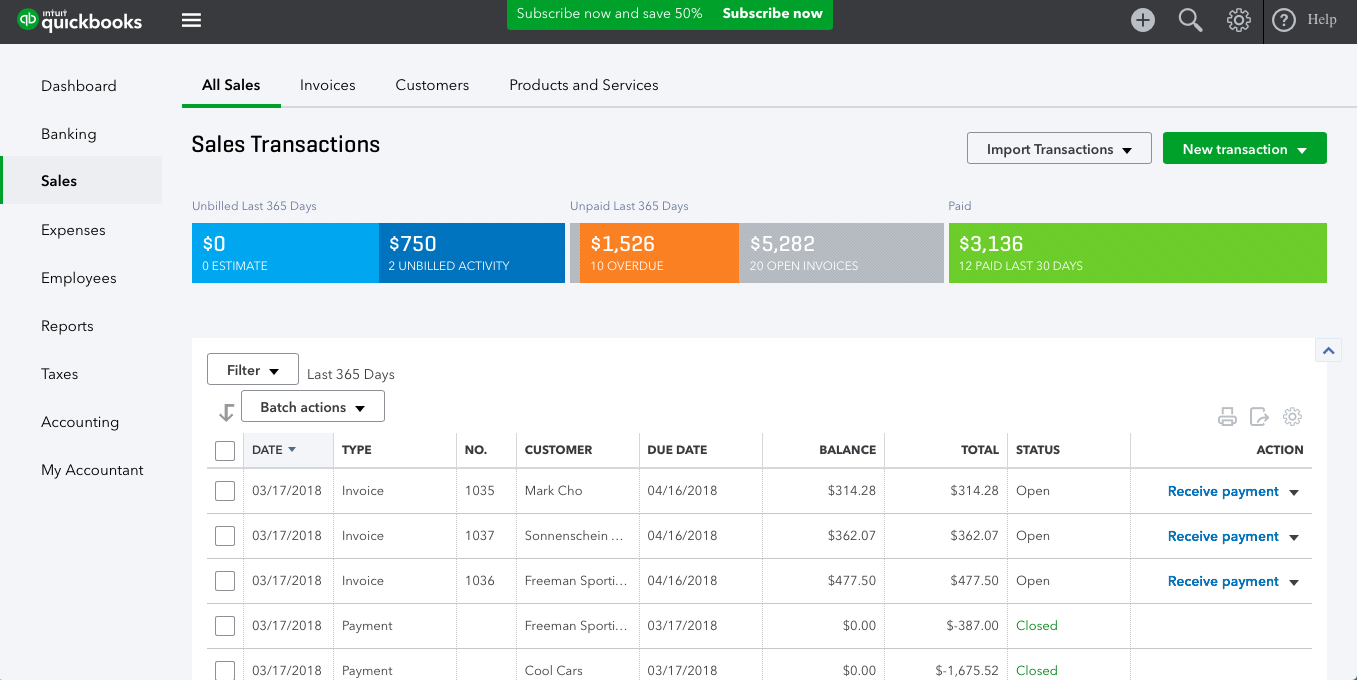

QuickBooks Online Sales Tax Set Up, Settings, Invoices with Sales Tax

To edit sales tax settings: In the sales tax center, you can add and edit tax. Click edit sales tax settings in the related tasks list to. Quickbooks can automatically do the sales tax. Learn how to set up, edit, and deactivate your sales tax rate and settings.

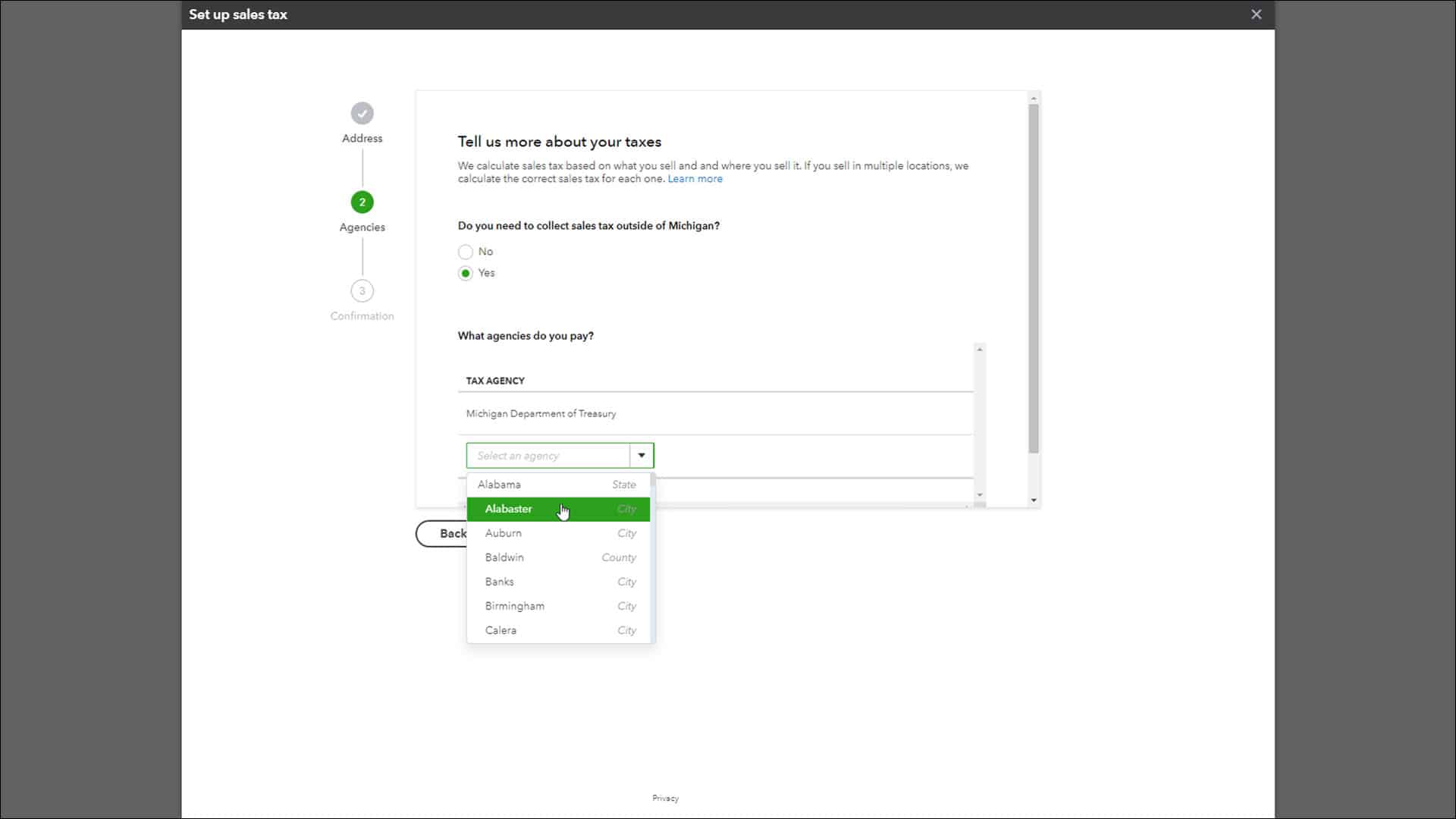

How to Set Up Sales Tax in QuickBooks Online or Xero. Sales Tax Guide

Learn how to set up and use the automated sales tax feature in quickbooks online. Learn how to set up, edit, and deactivate your sales tax rate and settings. Click edit sales tax settings in the related tasks list to. Quickbooks can automatically do the sales tax. You can turn sales tax on or off by editing sales tax settings.

Basic Chart of Accounts in QuickBooks Online Experts in QuickBooks

Learn how to set up, edit, and deactivate your sales tax rate and settings. To edit sales tax settings: Quickbooks can automatically do the sales tax. Click edit sales tax settings in the related tasks list to. Add multiple sales tax rates, including combined.

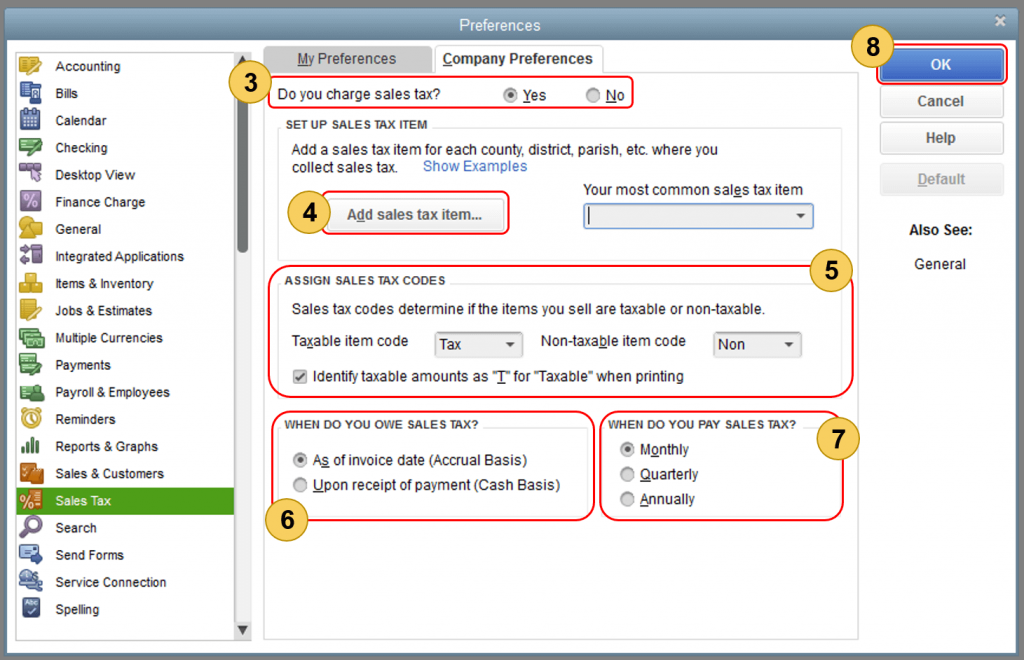

How to Set Up Sales Tax in QuickBooks Desktop?

You can turn sales tax on or off by editing sales tax settings. Learn how to set up and use the automated sales tax feature in quickbooks online. Quickbooks can automatically do the sales tax. To edit sales tax settings: Click edit sales tax settings in the related tasks list to.

How to Use QuickBooks Online StepByStep Guide Tips & Setup

To create a custom tax rate, start by establishing the rate in quickbooks online under taxes > sales tax > sales tax settings. Quickbooks can automatically do the sales tax. Click edit sales tax settings in the related tasks list to. You can turn sales tax on or off by editing sales tax settings. Learn how to set up, edit,.

Best ERP Software for the Pharmaceutical Industry

You can turn sales tax on or off by editing sales tax settings. Click edit sales tax settings in the related tasks list to. To edit sales tax settings: Learn how to set up, edit, and deactivate your sales tax rate and settings. Add multiple sales tax rates, including combined.

Tracking Sales Tax in QuickBooks Online YouTube

In the sales tax center, you can add and edit tax. Add multiple sales tax rates, including combined. You can turn sales tax on or off by editing sales tax settings. Quickbooks can automatically do the sales tax. To edit sales tax settings:

Set Up Sales Tax in QuickBooks Online Instructions

To edit sales tax settings: Click edit sales tax settings in the related tasks list to. Learn how to set up, edit, and deactivate your sales tax rate and settings. To create a custom tax rate, start by establishing the rate in quickbooks online under taxes > sales tax > sales tax settings. You can turn sales tax on or.

Top 10 Features for Accountants in QuickBooks Online

Add multiple sales tax rates, including combined. Click edit sales tax settings in the related tasks list to. You can turn sales tax on or off by editing sales tax settings. Quickbooks can automatically do the sales tax. To edit sales tax settings:

Learn How To Set Up And Use The Automated Sales Tax Feature In Quickbooks Online.

You can turn sales tax on or off by editing sales tax settings. Learn how to set up, edit, and deactivate your sales tax rate and settings. Click edit sales tax settings in the related tasks list to. To create a custom tax rate, start by establishing the rate in quickbooks online under taxes > sales tax > sales tax settings.

Add Multiple Sales Tax Rates, Including Combined.

To edit sales tax settings: In the sales tax center, you can add and edit tax. Quickbooks can automatically do the sales tax.