Quickbooks Depreciation

Quickbooks Depreciation - Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,.

Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,.

What account do you credit for depreciation? Leia aqui What is journal

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,.

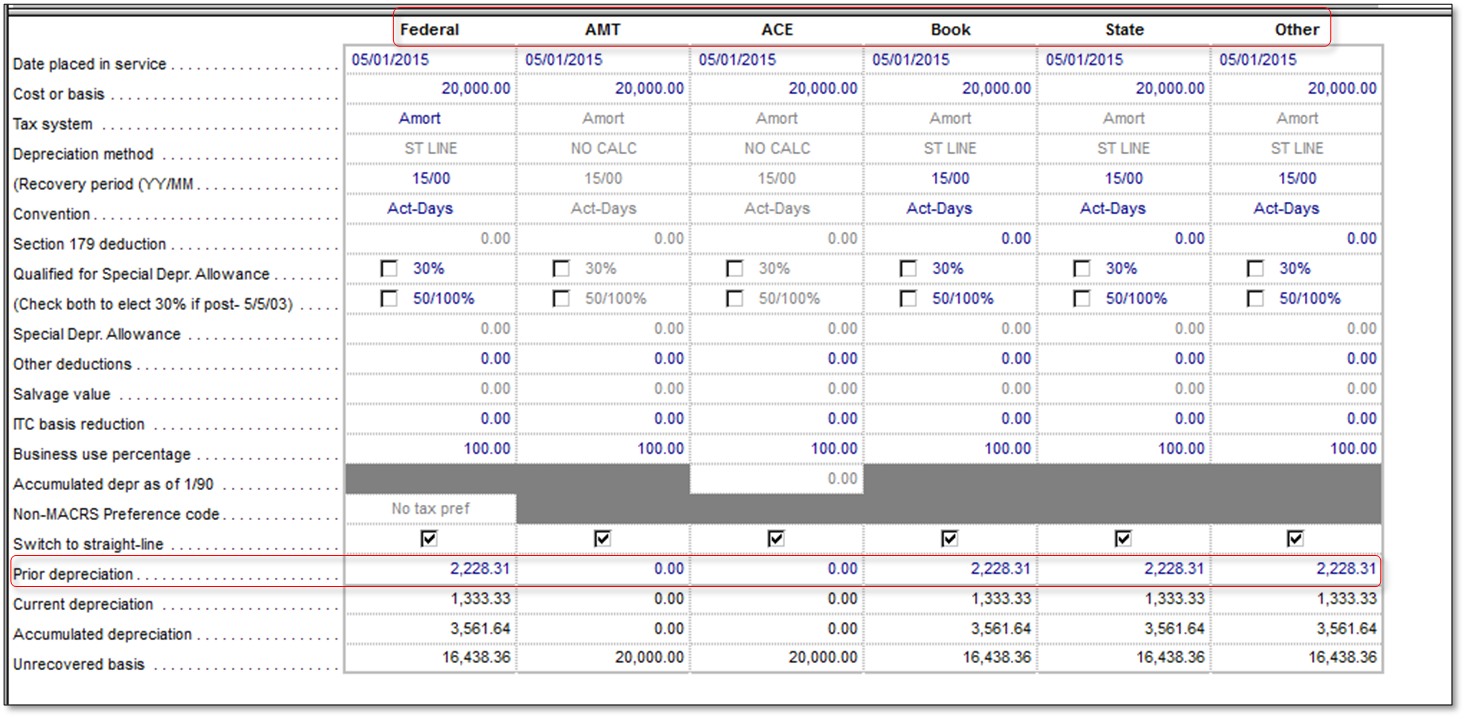

Fixed Asset Depreciation Schedule Excel Excel Templates

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,.

Depreciation Expense in QuickBooks YouTube

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,.

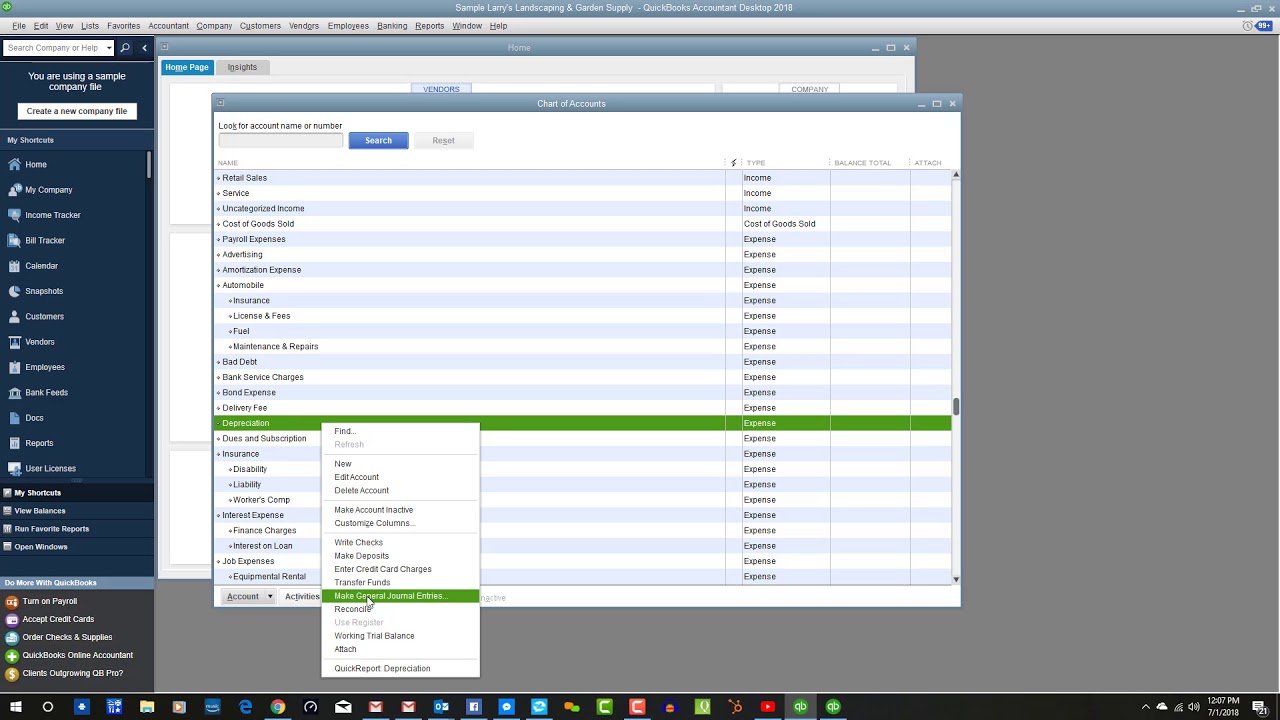

Depreciation Inside QuickBooks Desktop Candus Kampfer

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,.

Fixed Assets and Depreciation Basics for QuickBooks Users YouTube

Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

How to record Depreciation and Accumulated Depreciation in QuickBooks

Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

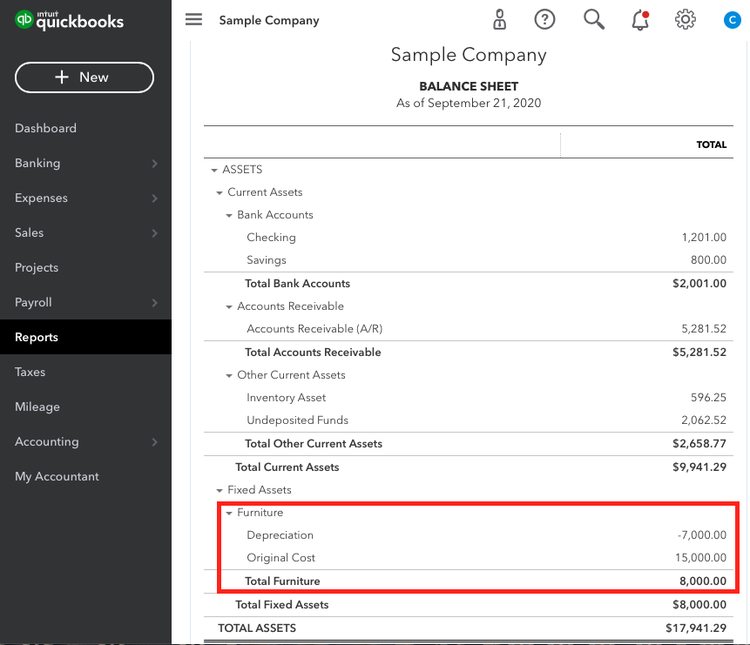

How to Calculate Depreciation on Fixed Assets in QuickBooks

Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

Accumulated Depreciation in QuickBooks Desktop YouTube

Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

How to Use QuickBooks to Calculate Depreciation?

Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

A Beginner's Guide to Accumulated Depreciation

Ensuring accurate depreciation recording in quickbooks involves maintaining detailed asset records, staying updated on regulatory changes,. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

Ensuring Accurate Depreciation Recording In Quickbooks Involves Maintaining Detailed Asset Records, Staying Updated On Regulatory Changes,.

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.