Prepaid Expenses On Balance Sheet

Prepaid Expenses On Balance Sheet - Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses are recorded on the balance sheet as an asset, most. Learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Record the initial payment on the balance sheet. Prepaid expenses make the organization liable to receive. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. In other words, prepaid expenses are expenditures paid in one. The journal entry reflects both a cash payment. In business accounting, a prepaid expense is any good or service that has been paid for but not yet incurred. You’ll usually input prepaid expenses on the balance sheet as current assets.

Prepaid expenses are recorded on the balance sheet as an asset, most. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. You’ll usually input prepaid expenses on the balance sheet as current assets. In other words, prepaid expenses are expenditures paid in one. The journal entry reflects both a cash payment. Learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Prepaid expenses make the organization liable to receive. In business accounting, a prepaid expense is any good or service that has been paid for but not yet incurred. Record the initial payment on the balance sheet.

Prepaid expenses make the organization liable to receive. Record the initial payment on the balance sheet. The journal entry reflects both a cash payment. In business accounting, a prepaid expense is any good or service that has been paid for but not yet incurred. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Prepaid expenses are recorded on the balance sheet as an asset, most. In other words, prepaid expenses are expenditures paid in one. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. You’ll usually input prepaid expenses on the balance sheet as current assets.

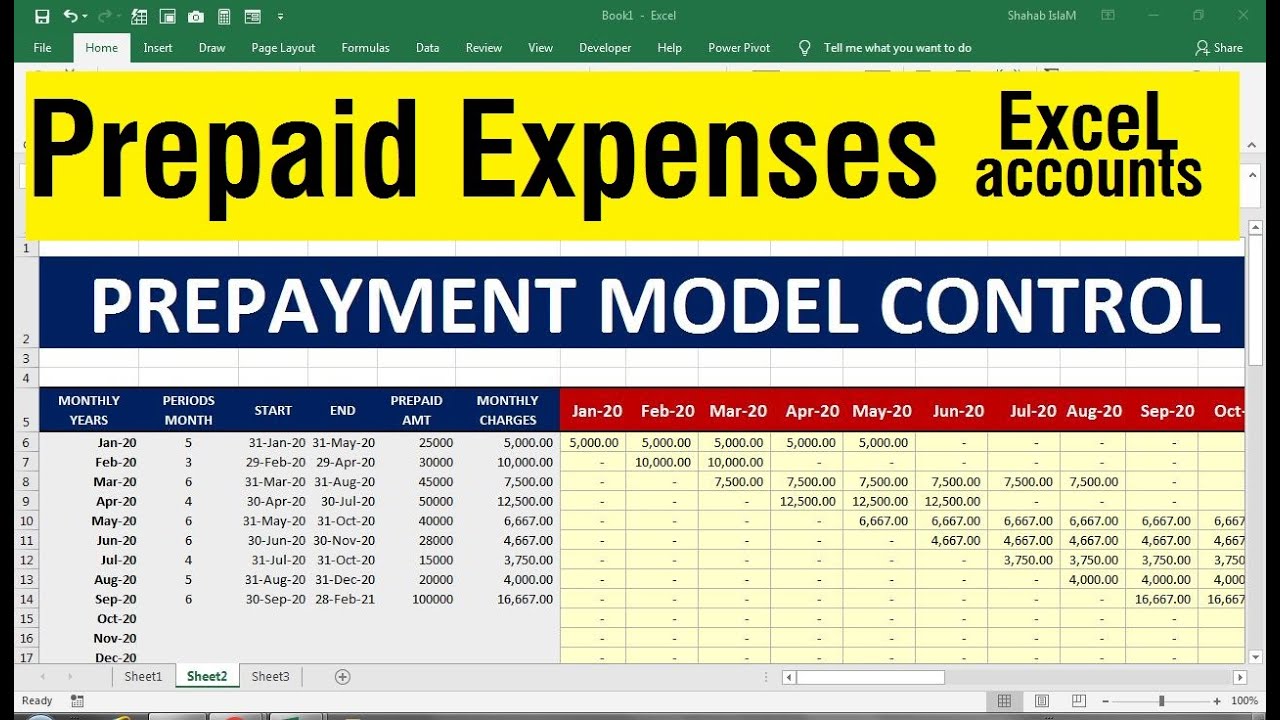

Prepaid Expenses and Balance Sheet YouTube

Prepaid expenses are recorded on the balance sheet as an asset, most. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Record the initial payment on the balance sheet. Learn what prepaid expenses are, how to classify them as an asset or expense on your financial.

Where are prepaid expenses on balance sheet? Leia aqui Are prepaid

Learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. The journal entry reflects both a cash payment. Prepaid expenses are recorded on the balance sheet as an asset, most. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the.

Solved A comparative balance sheet and statement is

The journal entry reflects both a cash payment. You’ll usually input prepaid expenses on the balance sheet as current assets. Prepaid expenses are recorded on the balance sheet as an asset, most. In other words, prepaid expenses are expenditures paid in one. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

You’ll usually input prepaid expenses on the balance sheet as current assets. Prepaid expenses are recorded on the balance sheet as an asset, most. Prepaid expenses make the organization liable to receive. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. The journal entry reflects both.

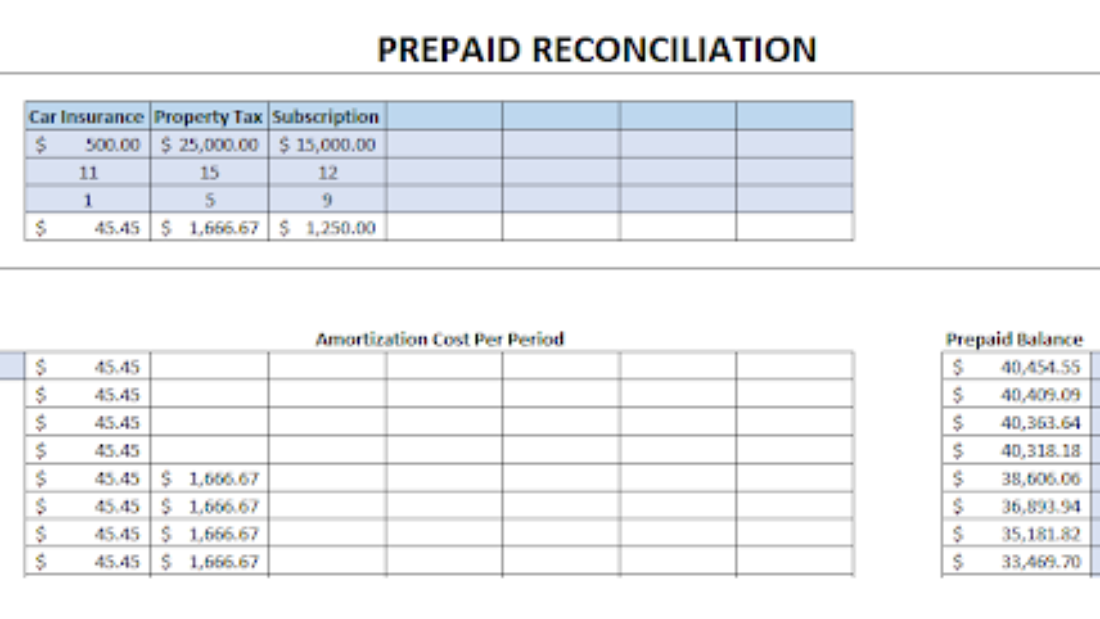

Browse Our Sample of Prepaid Amortization Schedule Template Excel

Learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. In business accounting, a prepaid expense is any good or service that has been.

Prepaid Expenses What Are Prepaid Expenses On A Balance Sheet

Learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. In other words, prepaid expenses are expenditures paid in one. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. You’ll usually input prepaid.

Prepaid expenses balance sheet bezywave

Record the initial payment on the balance sheet. In other words, prepaid expenses are expenditures paid in one. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. The journal entry reflects both a cash payment. In business accounting, a prepaid expense is any good or service.

Prepaid Expense Definition and Example

Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. In other words, prepaid expenses are expenditures paid in one. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. Prepaid expenses are recorded on the balance sheet.

prepaid expenses worksheet in excel prepayments and accruals schedule

In business accounting, a prepaid expense is any good or service that has been paid for but not yet incurred. You’ll usually input prepaid expenses on the balance sheet as current assets. The journal entry reflects both a cash payment. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid.

Expenses Template Master Template

The journal entry reflects both a cash payment. You’ll usually input prepaid expenses on the balance sheet as current assets. In other words, prepaid expenses are expenditures paid in one. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. In business accounting, a prepaid expense is any good or service.

Prepaid Expenses Represent Expenditures That Have Not Yet Been Recorded By A Company As An Expense, But Have Been Paid For In Advance.

Prepaid expenses make the organization liable to receive. Record the initial payment on the balance sheet. Learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Prepaid expenses are recorded on the balance sheet as an asset, most.

The Journal Entry Reflects Both A Cash Payment.

In business accounting, a prepaid expense is any good or service that has been paid for but not yet incurred. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. In other words, prepaid expenses are expenditures paid in one. You’ll usually input prepaid expenses on the balance sheet as current assets.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)