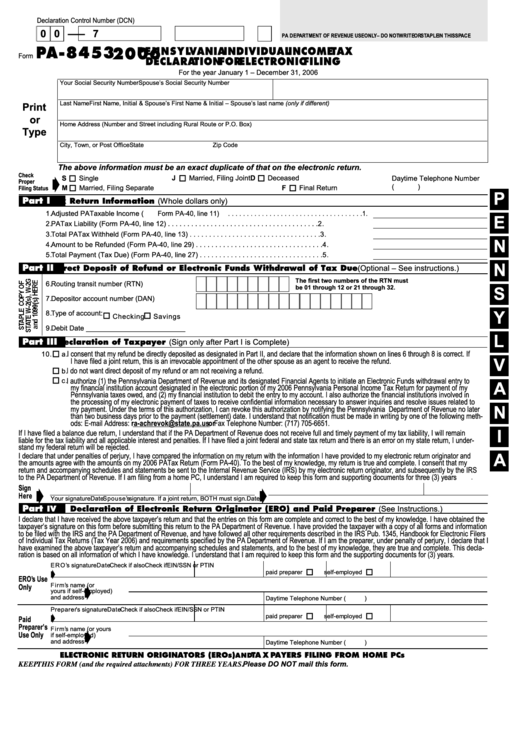

Pa Form 8453

Pa Form 8453 - Learn how to fill out, when and where. Yes, you can sign the form and just keep it with your tax records for three years. According to the instructions for that form: It does not need to be sent in to the pennsylvania. Commonwealth of pennsylvania government websites and email systems use. Local, state, and federal government websites often end in.gov. After your return has been accepted, the form should be in your pdf file of. You do not actually send the form to pa or anywhere. Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return.

After your return has been accepted, the form should be in your pdf file of. You do not actually send the form to pa or anywhere. Local, state, and federal government websites often end in.gov. Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return. Commonwealth of pennsylvania government websites and email systems use. It does not need to be sent in to the pennsylvania. Yes, you can sign the form and just keep it with your tax records for three years. Learn how to fill out, when and where. According to the instructions for that form:

Commonwealth of pennsylvania government websites and email systems use. Learn how to fill out, when and where. It does not need to be sent in to the pennsylvania. Yes, you can sign the form and just keep it with your tax records for three years. You do not actually send the form to pa or anywhere. Local, state, and federal government websites often end in.gov. After your return has been accepted, the form should be in your pdf file of. Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return. According to the instructions for that form:

IRS Form 8453 walkthrough ARCHIVED COPY READ COMMENTS ONLY YouTube

Yes, you can sign the form and just keep it with your tax records for three years. You do not actually send the form to pa or anywhere. It does not need to be sent in to the pennsylvania. Local, state, and federal government websites often end in.gov. According to the instructions for that form:

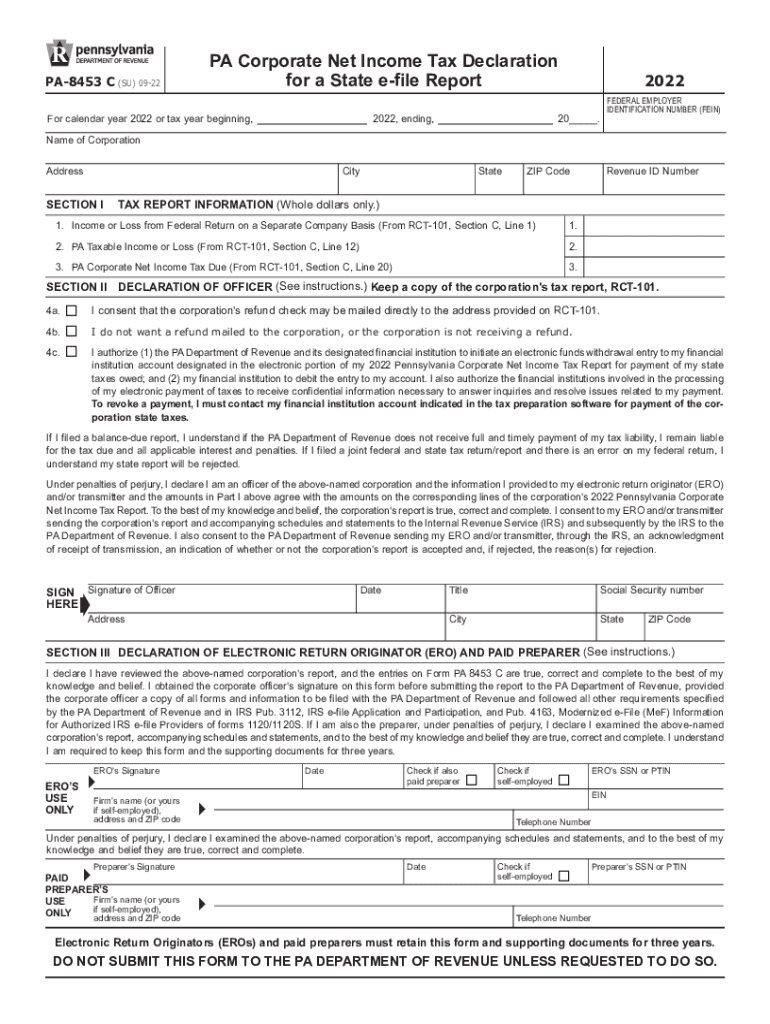

PA8453P 2012 PA S Corporation/Partnership Information Return Free

According to the instructions for that form: Yes, you can sign the form and just keep it with your tax records for three years. Commonwealth of pennsylvania government websites and email systems use. Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return. It does not need to be sent in to the.

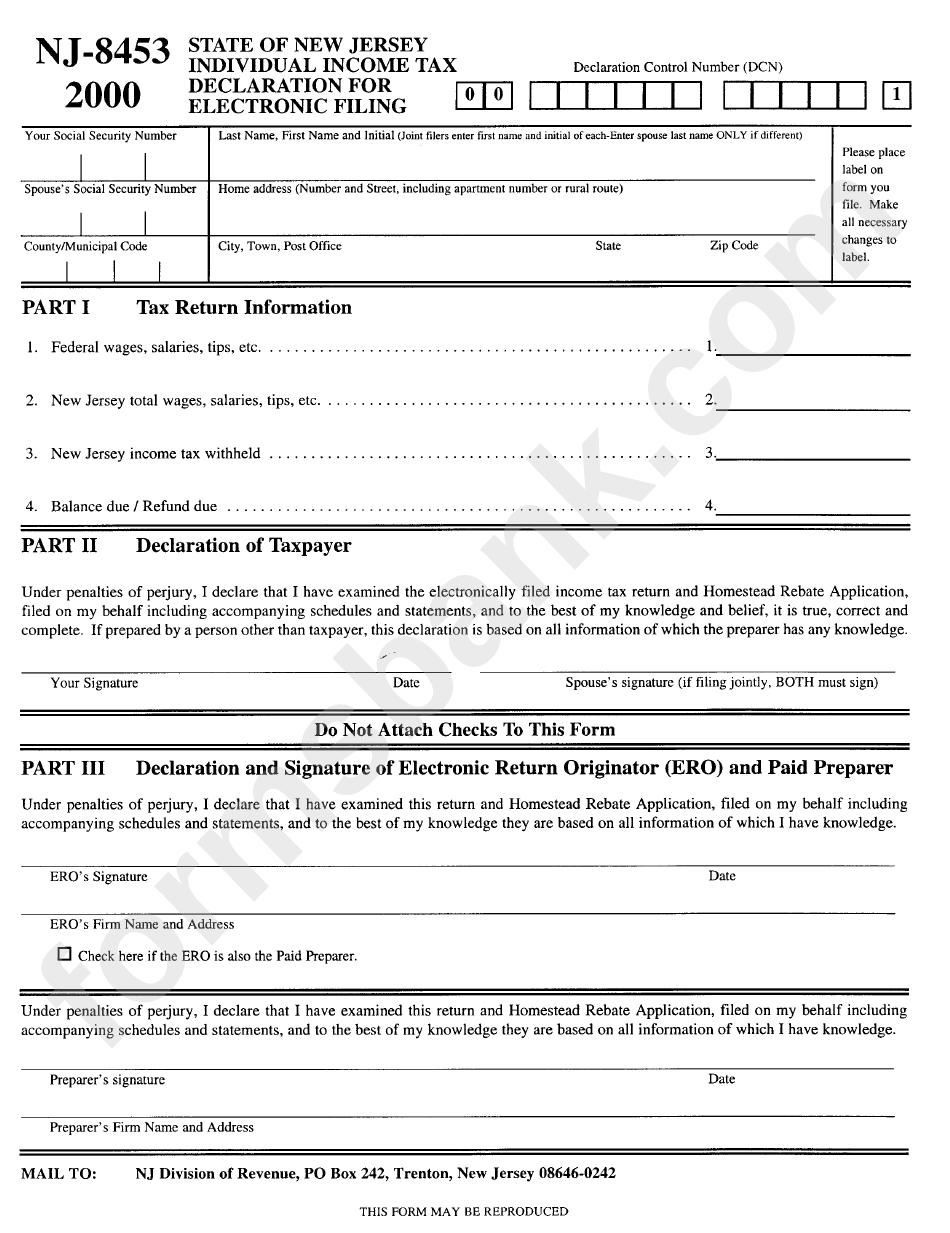

Form Nj8453 Individual Tax Declaration For Electronic Filing

After your return has been accepted, the form should be in your pdf file of. According to the instructions for that form: Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return. Learn how to fill out, when and where. Commonwealth of pennsylvania government websites and email systems use.

8453 Pe Fillable Form Printable Forms Free Online

After your return has been accepted, the form should be in your pdf file of. According to the instructions for that form: It does not need to be sent in to the pennsylvania. Yes, you can sign the form and just keep it with your tax records for three years. Learn how to fill out, when and where.

PA8453C 2015 PA Corporation Tax Declaration for a State EFile

It does not need to be sent in to the pennsylvania. Local, state, and federal government websites often end in.gov. After your return has been accepted, the form should be in your pdf file of. Commonwealth of pennsylvania government websites and email systems use. Learn how to fill out, when and where.

Pa 8453 Fill out & sign online DocHub

You do not actually send the form to pa or anywhere. According to the instructions for that form: It does not need to be sent in to the pennsylvania. Yes, you can sign the form and just keep it with your tax records for three years. Form 8453 is used to send paper forms or supporting documents with an electronically.

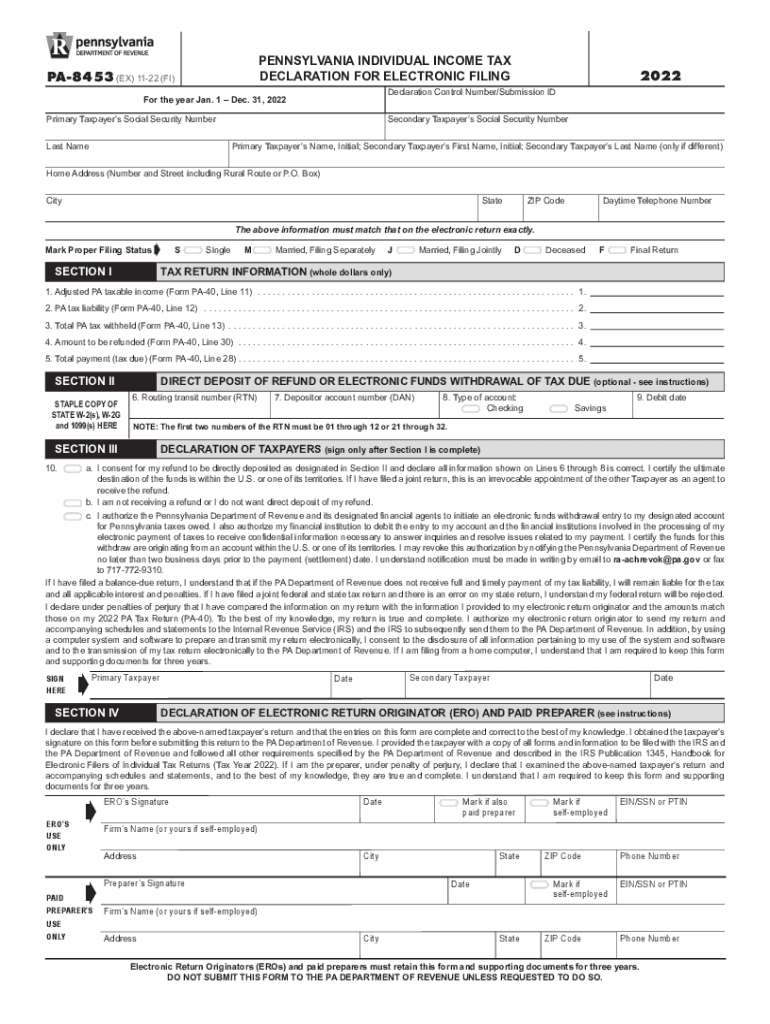

Form PA8453 Download Fillable PDF or Fill Online Pennsylvania

Yes, you can sign the form and just keep it with your tax records for three years. Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return. Learn how to fill out, when and where. After your return has been accepted, the form should be in your pdf file of. It does not.

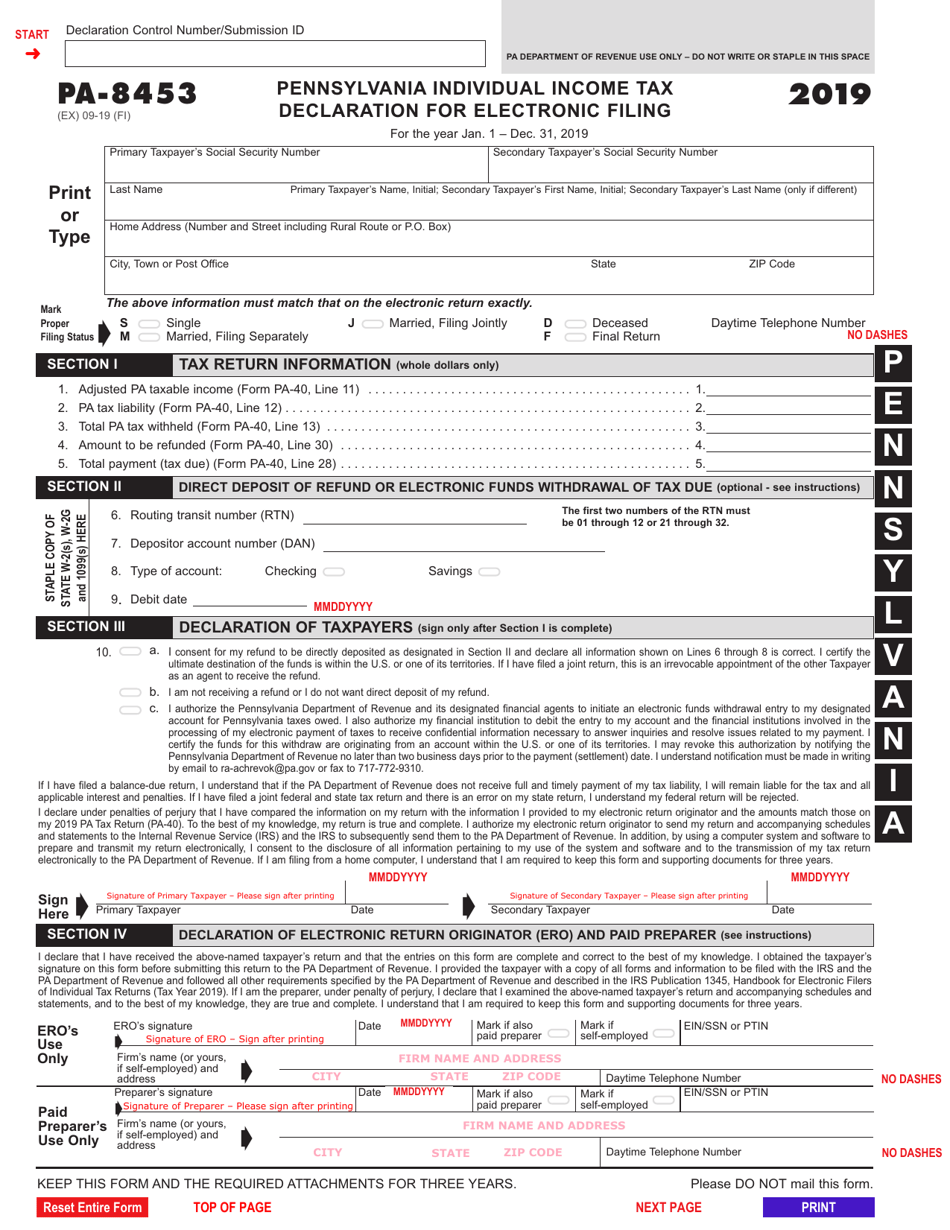

Form Pa 8453 Pennsylvania Individual Tax Declaration For

After your return has been accepted, the form should be in your pdf file of. Local, state, and federal government websites often end in.gov. According to the instructions for that form: It does not need to be sent in to the pennsylvania. Commonwealth of pennsylvania government websites and email systems use.

Pa State Tax Complete with ease airSlate SignNow

Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return. Local, state, and federal government websites often end in.gov. Learn how to fill out, when and where. It does not need to be sent in to the pennsylvania. You do not actually send the form to pa or anywhere.

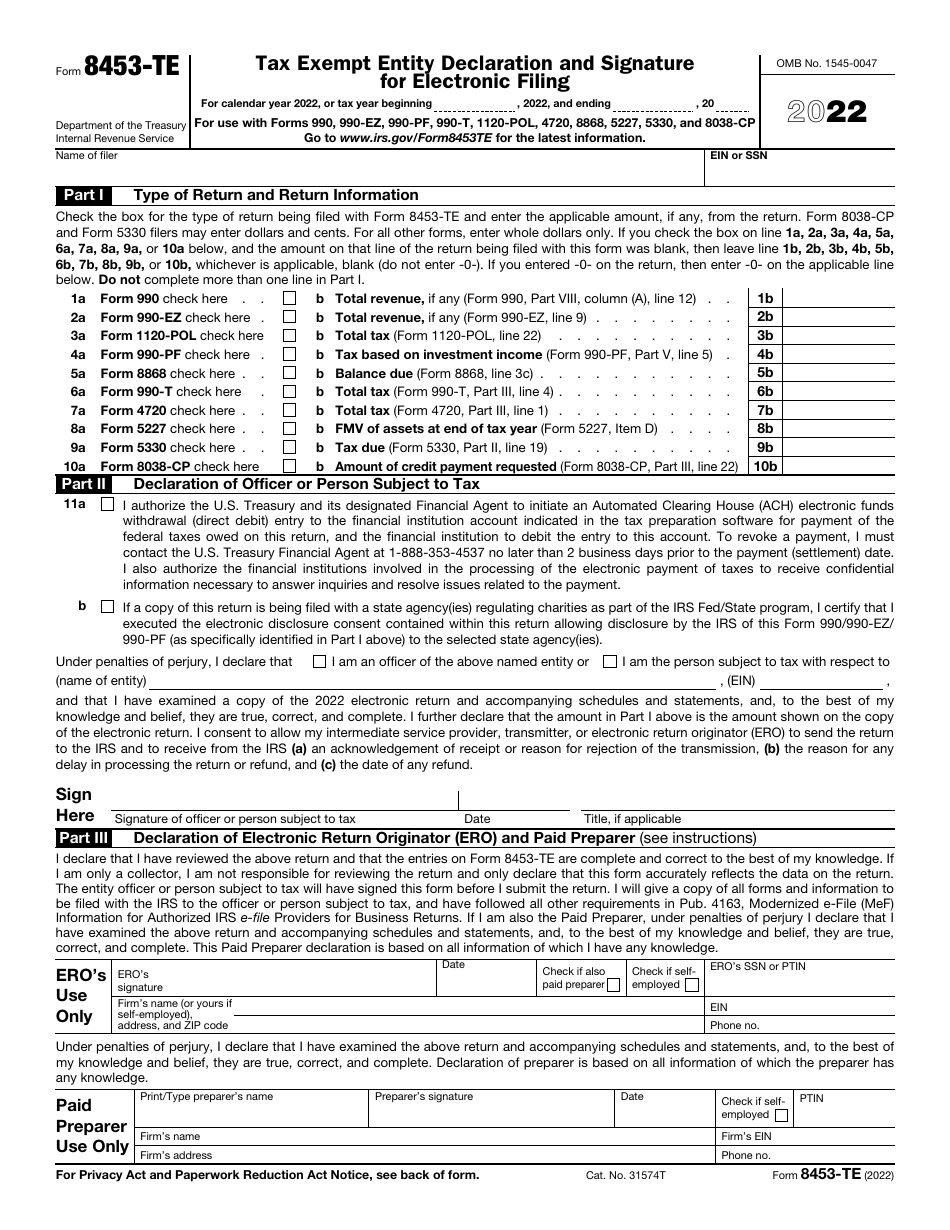

IRS Form 8453TE Download Fillable PDF or Fill Online Tax Exempt Entity

Learn how to fill out, when and where. Commonwealth of pennsylvania government websites and email systems use. You do not actually send the form to pa or anywhere. According to the instructions for that form: After your return has been accepted, the form should be in your pdf file of.

It Does Not Need To Be Sent In To The Pennsylvania.

After your return has been accepted, the form should be in your pdf file of. Yes, you can sign the form and just keep it with your tax records for three years. Commonwealth of pennsylvania government websites and email systems use. Form 8453 is used to send paper forms or supporting documents with an electronically filed tax return.

You Do Not Actually Send The Form To Pa Or Anywhere.

According to the instructions for that form: Learn how to fill out, when and where. Local, state, and federal government websites often end in.gov.