Ohio Tax Withholding Form

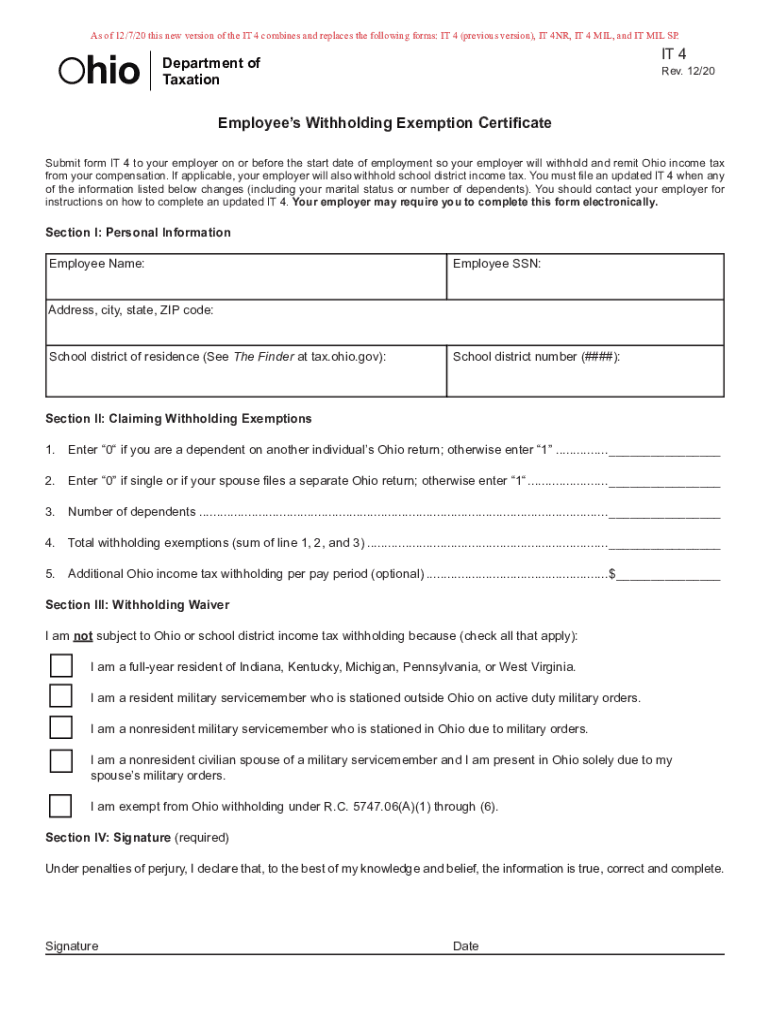

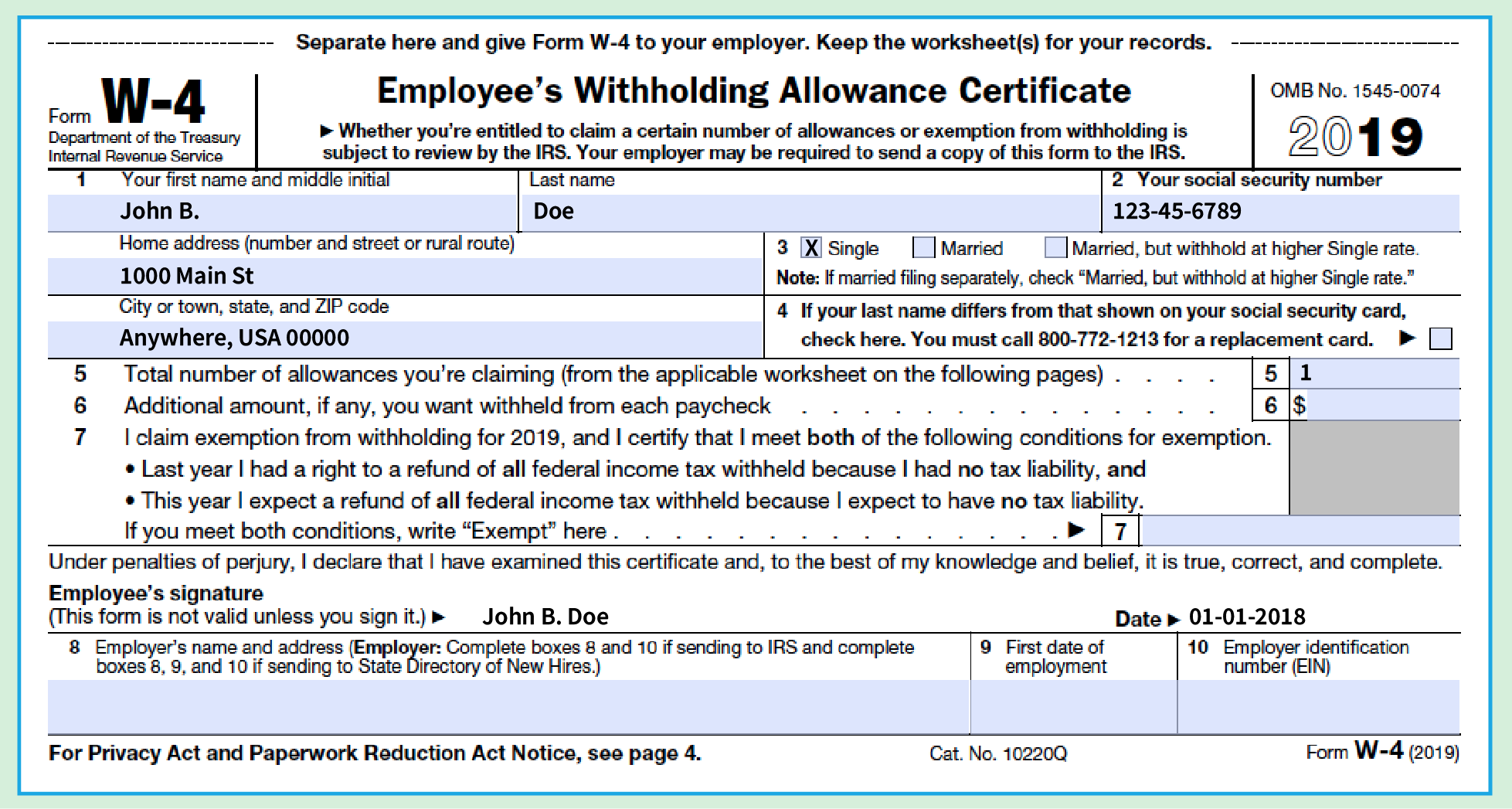

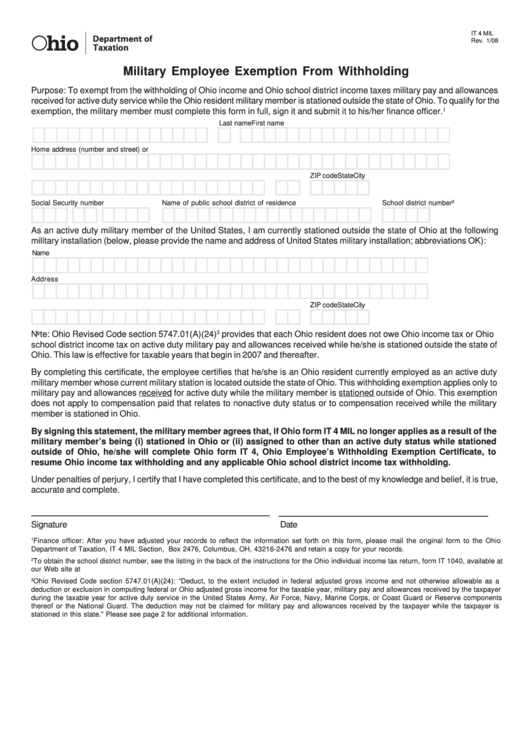

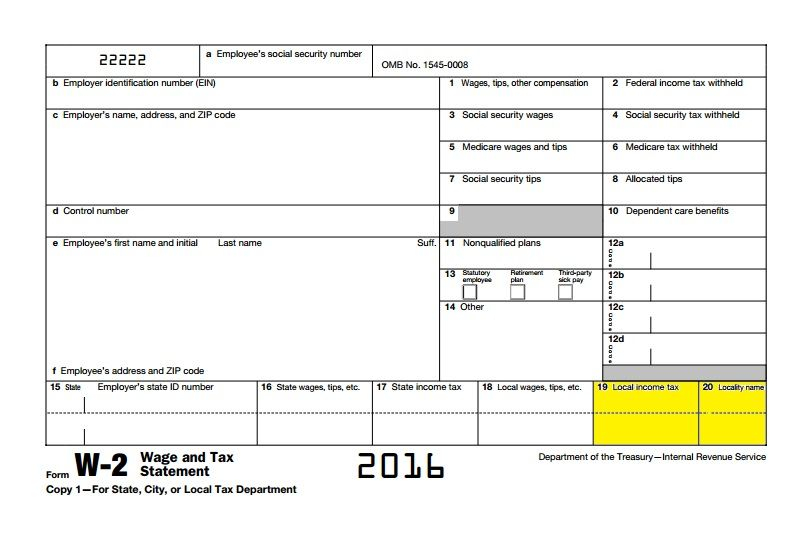

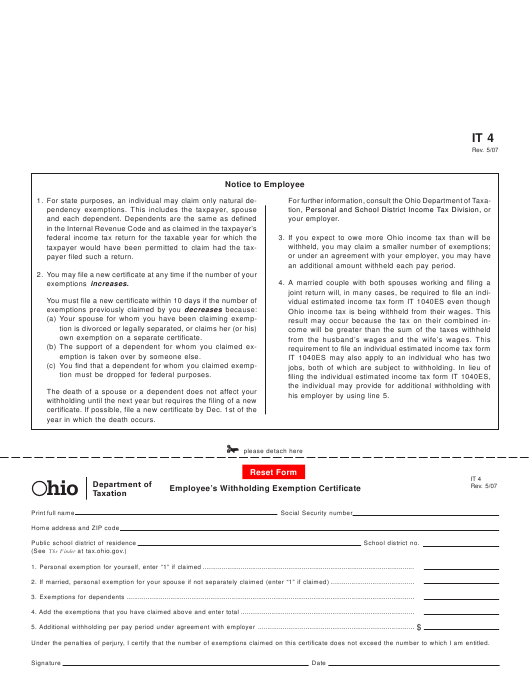

Ohio Tax Withholding Form - Paper employer withholding and school district withholding forms are no longer available. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. This result may occur because the tax. Estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. The ohio department of taxation provides a searchable. Electronic filing has been mandatory since. With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees'. Need paper individual or school district income tax forms mailed to you? The department of taxation recently revised form it 4, employee’s withholding exemption certificate. This updated form, or an electronic.

The ohio department of taxation provides a searchable. Need paper individual or school district income tax forms mailed to you? Electronic filing has been mandatory since. Access the forms you need to file taxes or do business in ohio. Paper employer withholding and school district withholding forms are no longer available. Estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees'. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. This updated form, or an electronic.

Paper employer withholding and school district withholding forms are no longer available. The ohio department of taxation provides a searchable. With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees'. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. This result may occur because the tax. Access the forms you need to file taxes or do business in ohio. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Electronic filing has been mandatory since. Need paper individual or school district income tax forms mailed to you? Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation.

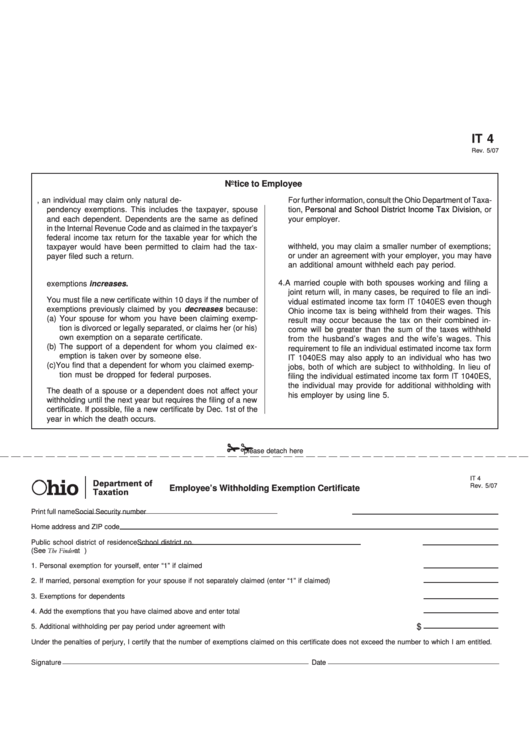

Ohio Department Of Taxation Employee Withholding Form

The ohio department of taxation provides a searchable. Paper employer withholding and school district withholding forms are no longer available. With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees'. Access the forms you need to file taxes or do business in ohio. The department of taxation recently revised form.

Ohio Estimated Tax Payments 2024 Due Dates And Times Elsie

Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. This result may occur because the tax. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. With rare exception, employers that do business.

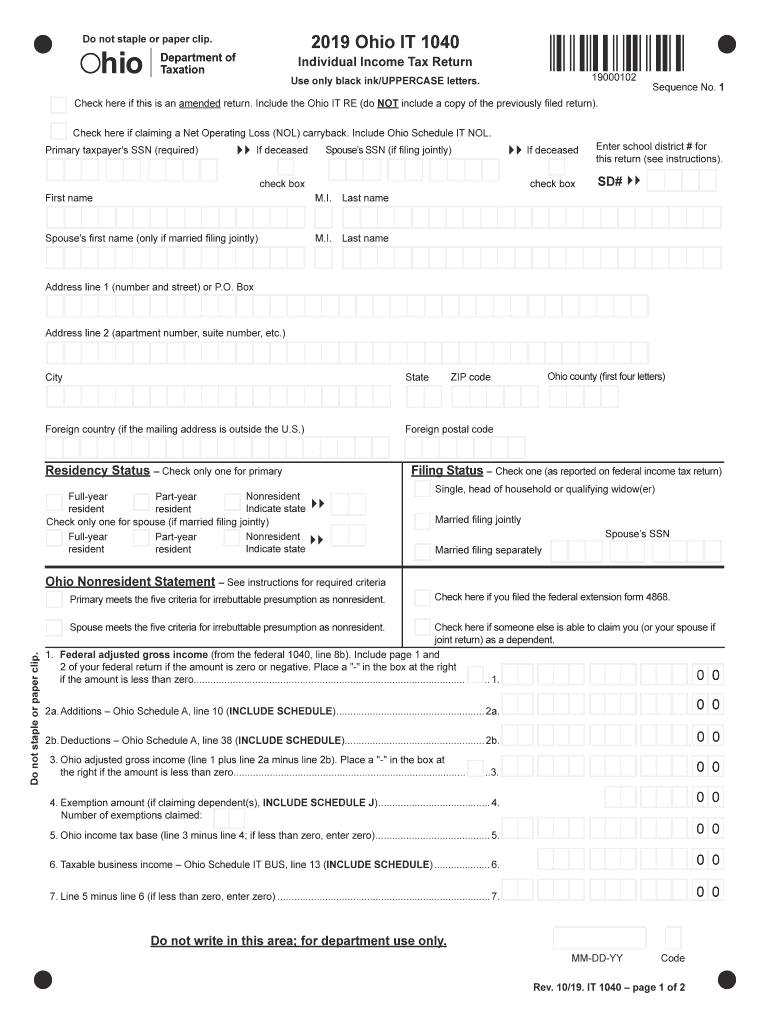

Ohio State Tax Withholding Form 2022

Paper employer withholding and school district withholding forms are no longer available. This result may occur because the tax. Electronic filing has been mandatory since. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Submit form it 4 to your employer on or before the start date of employment so.

Employee Ohio Withholding Form

Paper employer withholding and school district withholding forms are no longer available. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Access the forms you need to file taxes or do business in ohio. This result may occur because the tax. The.

Wisconsin Withholding Form 2023 Printable Forms Free Online

With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees'. Estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. This result may occur because the tax. Paper employer withholding and school district withholding forms are no longer available. Ohio form it 4,.

Ohio Tax Forms Printable Printable Forms Free Online

Need paper individual or school district income tax forms mailed to you? This result may occur because the tax. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Ohio.

Ohio Employee'S Withholding Exemption Certificate printable pdf download

Need paper individual or school district income tax forms mailed to you? Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Paper employer withholding and school district withholding forms are no longer available. This updated form, or an electronic. Estimated income tax form it 1040es even though ohio income tax.

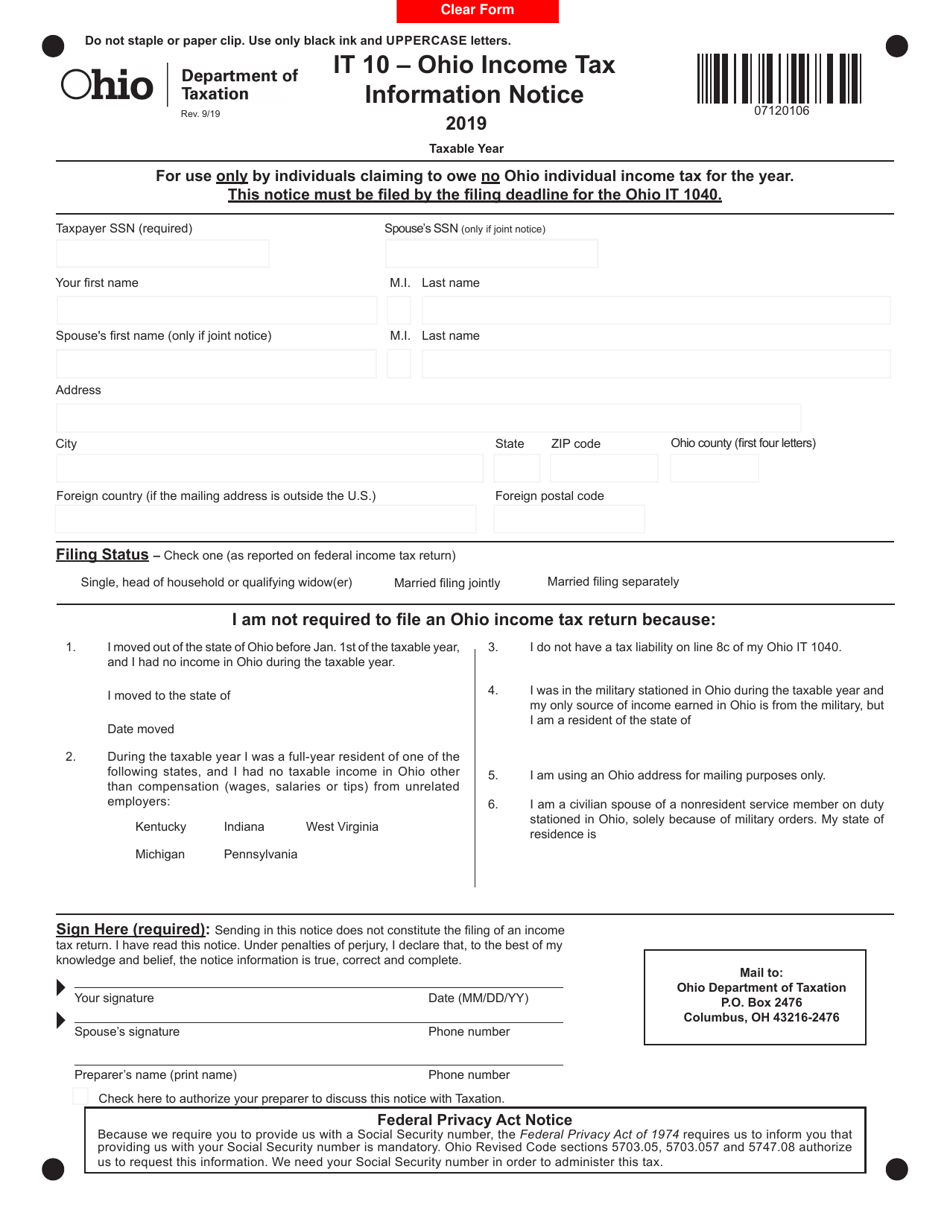

Form IT10 2019 Fill Out, Sign Online and Download Fillable PDF

This result may occur because the tax. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Electronic filing has been mandatory since. Paper employer withholding and school district withholding forms are no longer available. Need paper individual or school district income tax.

Ohio Tax Withholding Form 2023 Printable Forms Free Online

Electronic filing has been mandatory since. This result may occur because the tax. Paper employer withholding and school district withholding forms are no longer available. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The department of taxation recently revised form it.

Ashtabula Ohio Tax Withholding Forms

The ohio department of taxation provides a searchable. Need paper individual or school district income tax forms mailed to you? Estimated income tax form it 1040es even though ohio income tax is being withheld from their wages. Access the forms you need to file taxes or do business in ohio. Ohio form it 4, employee’s withholding exemption certificate, is a.

Submit Form It 4 To Your Employer On Or Before The Start Date Of Employment So Your Employer Will Withhold And Remit Ohio Income Tax From Your.

The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Electronic filing has been mandatory since. With rare exception, employers that do business in ohio are responsible for withholding ohio individual income tax from their employees'. This result may occur because the tax.

Access The Forms You Need To File Taxes Or Do Business In Ohio.

The ohio department of taxation provides a searchable. This updated form, or an electronic. Paper employer withholding and school district withholding forms are no longer available. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation.

Estimated Income Tax Form It 1040Es Even Though Ohio Income Tax Is Being Withheld From Their Wages.

Need paper individual or school district income tax forms mailed to you?

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)