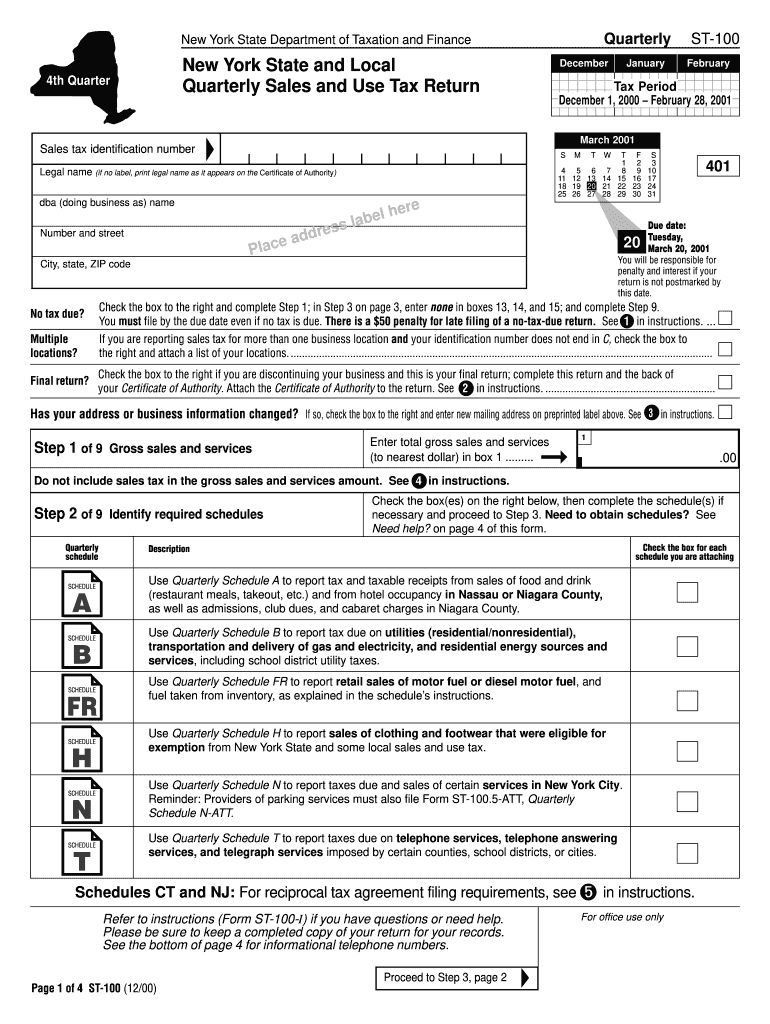

Nys Sales Tax Form St 100 Instructions

Nys Sales Tax Form St 100 Instructions - On your check or money order, write: Has your address or business information changed?. Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,. Make your check or money order payable in u.s. Make check or money order payable to new york state sales tax. Funds to new york state sales tax. Most filers fall under this requirement. Find quarterly sales tax filer forms and instructions.

Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,. Make your check or money order payable in u.s. Find quarterly sales tax filer forms and instructions. Most filers fall under this requirement. Has your address or business information changed?. Funds to new york state sales tax. Make check or money order payable to new york state sales tax. On your check or money order, write:

Make your check or money order payable in u.s. Funds to new york state sales tax. Most filers fall under this requirement. On your check or money order, write: Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,. Has your address or business information changed?. Find quarterly sales tax filer forms and instructions. Make check or money order payable to new york state sales tax.

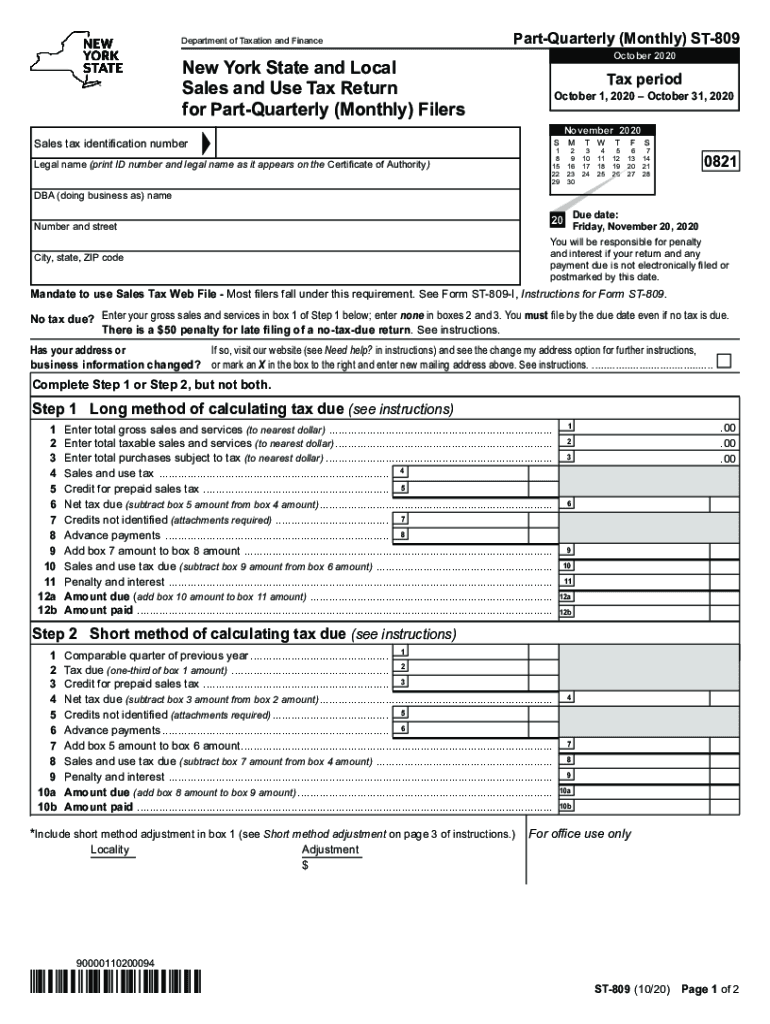

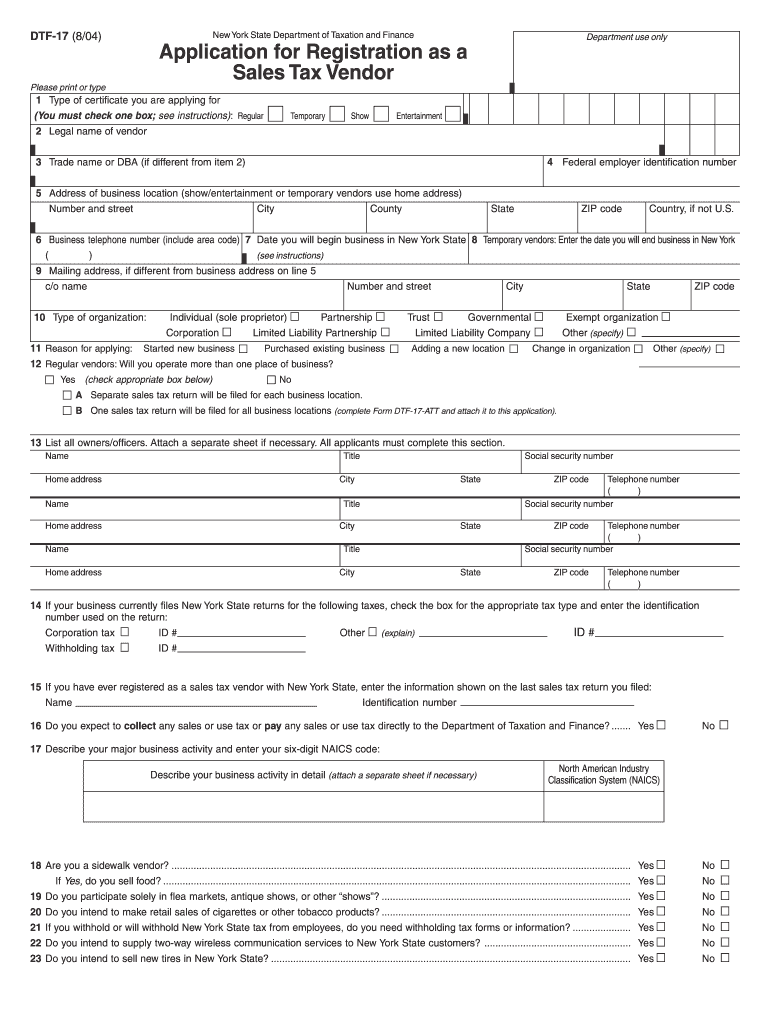

Sales Tax Form St8

Has your address or business information changed?. Make your check or money order payable in u.s. Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,. On your check or money order, write: Funds to new york state sales tax.

Tax Form St 100 ≡ Fill Out Printable PDF Forms Online

Has your address or business information changed?. Make check or money order payable to new york state sales tax. Funds to new york state sales tax. Make your check or money order payable in u.s. Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,.

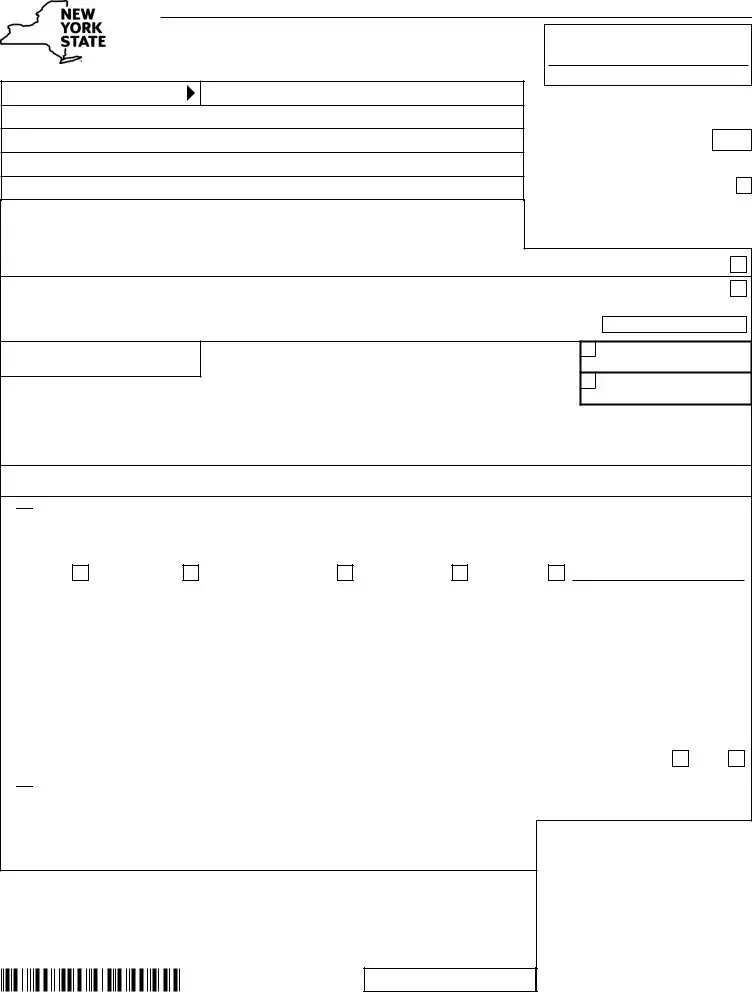

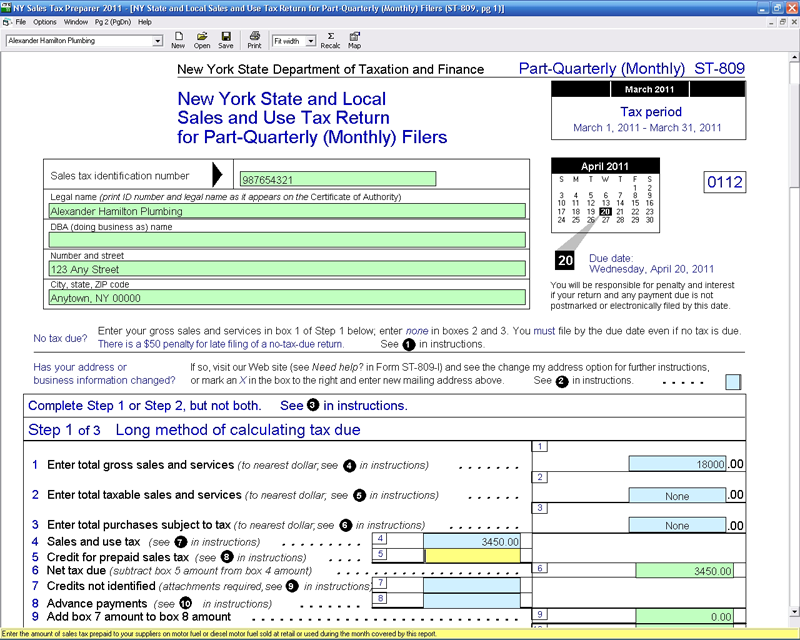

NY ST809 2020 Fill out Tax Template Online US Legal Forms

Has your address or business information changed?. Funds to new york state sales tax. Find quarterly sales tax filer forms and instructions. On your check or money order, write: Make check or money order payable to new york state sales tax.

What Is A Sales Tax Form at Lisa Carpino blog

Has your address or business information changed?. Make your check or money order payable in u.s. Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,. Find quarterly sales tax filer forms and instructions. Make check or money order payable to new york state sales tax.

Fillable Form St 100 Printable Forms Free Online

Find quarterly sales tax filer forms and instructions. Make your check or money order payable in u.s. Funds to new york state sales tax. Make check or money order payable to new york state sales tax. On your check or money order, write:

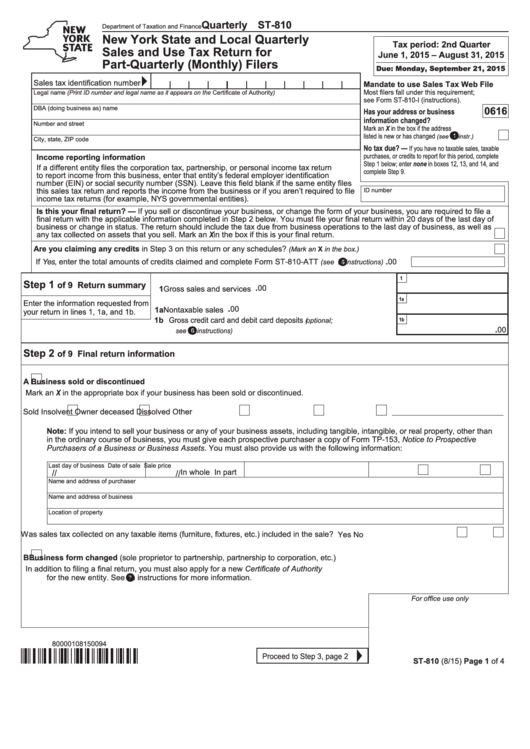

Printable New York State Tax Forms Printable Forms Free Online

Make check or money order payable to new york state sales tax. Find quarterly sales tax filer forms and instructions. Has your address or business information changed?. On your check or money order, write: Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,.

Printable Nys Sales Tax Form St100

Most filers fall under this requirement. On your check or money order, write: Make check or money order payable to new york state sales tax. Make your check or money order payable in u.s. Funds to new york state sales tax.

Printable Nys Sales Tax Form St100

Funds to new york state sales tax. Has your address or business information changed?. Find quarterly sales tax filer forms and instructions. Most filers fall under this requirement. Make check or money order payable to new york state sales tax.

NY Sales Tax Preparer CFS Tax Software, Inc. Software for Tax

Make check or money order payable to new york state sales tax. On your check or money order, write: Find quarterly sales tax filer forms and instructions. Make your check or money order payable in u.s. Has your address or business information changed?.

Printable Nys Sales Tax Form St100

Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,. On your check or money order, write: Funds to new york state sales tax. Has your address or business information changed?. Most filers fall under this requirement.

Has Your Address Or Business Information Changed?.

Make your check or money order payable in u.s. Most filers fall under this requirement. Make check or money order payable to new york state sales tax. On your check or money order, write:

Funds To New York State Sales Tax.

Find quarterly sales tax filer forms and instructions. Add sales and use tax column total (box 14) to total special taxes and fees (box 15c) and subtract total tax credits, advance payments,.