Notional Volume

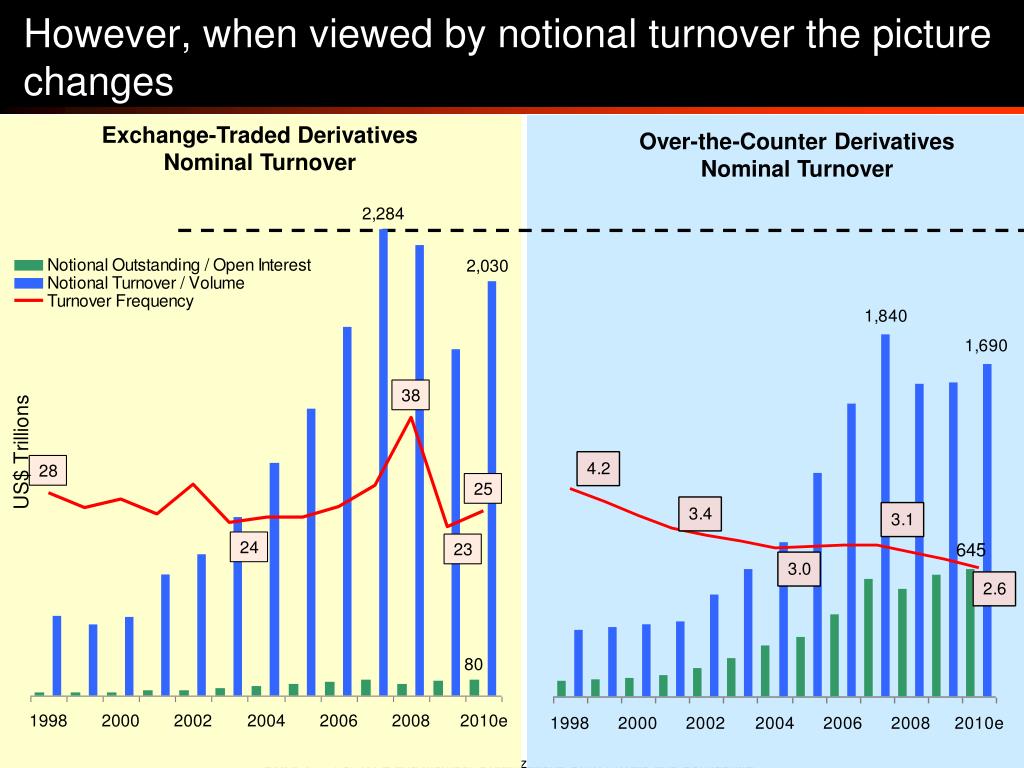

Notional Volume - Notional value is the total asset value of a hedged position. How does notional value work? Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade.

How does notional value work? Consider an interest rate swap,. Notional value is the total asset value of a hedged position. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade.

Consider an interest rate swap,. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional value is the total asset value of a hedged position. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. How does notional value work?

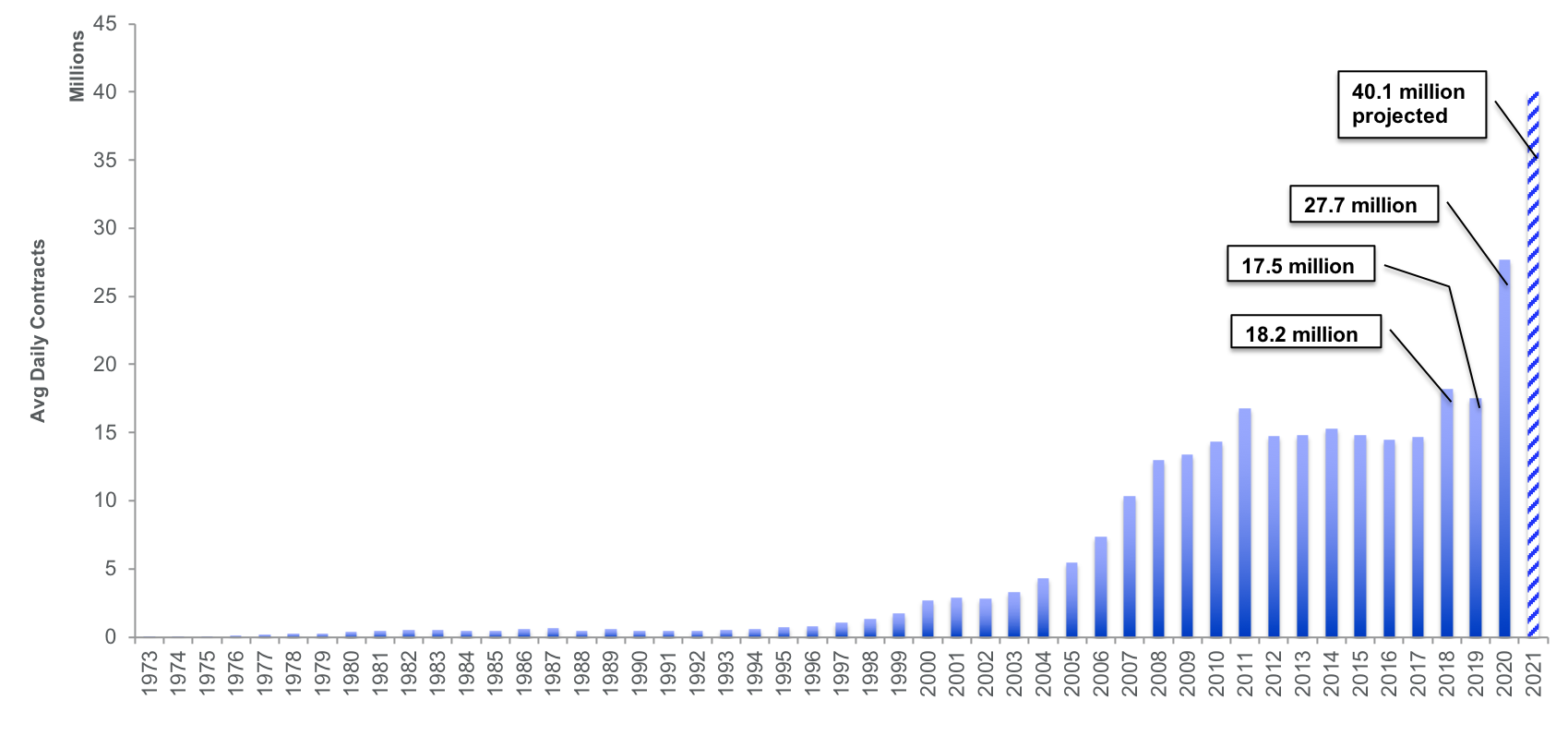

Data Insights 20210407 Q1 2021 Options Review

Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position. Consider an interest rate swap,. How does notional value work?

The Monthly Brief June 2023 Monthly Newsletter Paradigm

Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional value is the total asset value of a hedged position. How does notional value work? Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts.

100 Cash Rebates AlphaTick

How does notional value work? Notional value is the total asset value of a hedged position. Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade.

Notional Cartesian control volume over a surface patch. (a) Homogeneous

Notional value is the total asset value of a hedged position. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. How does notional value work? Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Consider an interest rate swap,.

Traded 1 Dollar Notional Volume Credential Galxe

Consider an interest rate swap,. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional value is the total asset value of a hedged position. How does notional value work? Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts.

What is Notional Value?

Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Consider an interest rate swap,. How does notional value work? Notional value is the total asset value of a hedged position.

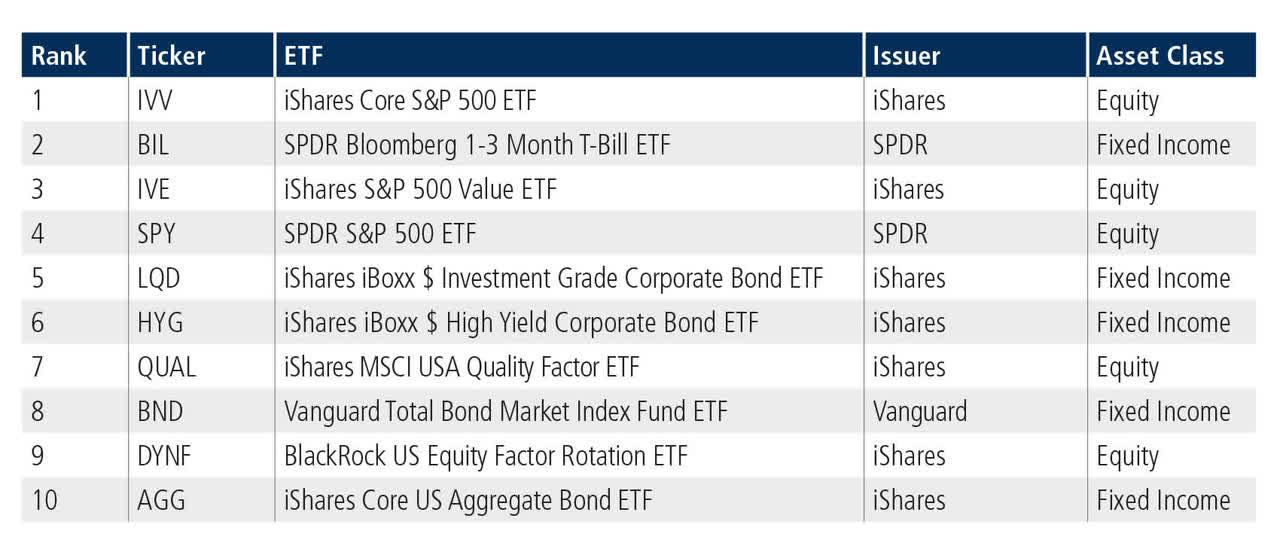

Tradeweb ExchangeTraded Funds Update January 2024 Seeking Alpha

Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. How does notional value work? Consider an interest rate swap,. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional value is the total asset value of a hedged position.

Introducing Notional V3

How does notional value work? Notional value is the total asset value of a hedged position. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Consider an interest rate swap,.

Notional Value Explained Options Trading Concepts YouTube

Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position. Consider an interest rate swap,. How does notional value work? Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade.

What is Notional Volume and Why Does It Matter Go Hack Trading

Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Consider an interest rate swap,. Notional value is the total asset value of a hedged position. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. How does notional value work?

How Does Notional Value Work?

Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Consider an interest rate swap,. Notional value is the total asset value of a hedged position.