Notional Exposure

Notional Exposure - Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Learn how notional value works and. Notional value is the total asset value of a hedged position, such as an interest rate swap.

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is the total asset value of a hedged position, such as an interest rate swap. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Learn how notional value works and.

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Learn how notional value works and. Notional value is the total asset value of a hedged position, such as an interest rate swap.

Notional Imgflip

Learn how notional value works and. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Notional value is the total asset value of a hedged position, such as an interest rate swap.

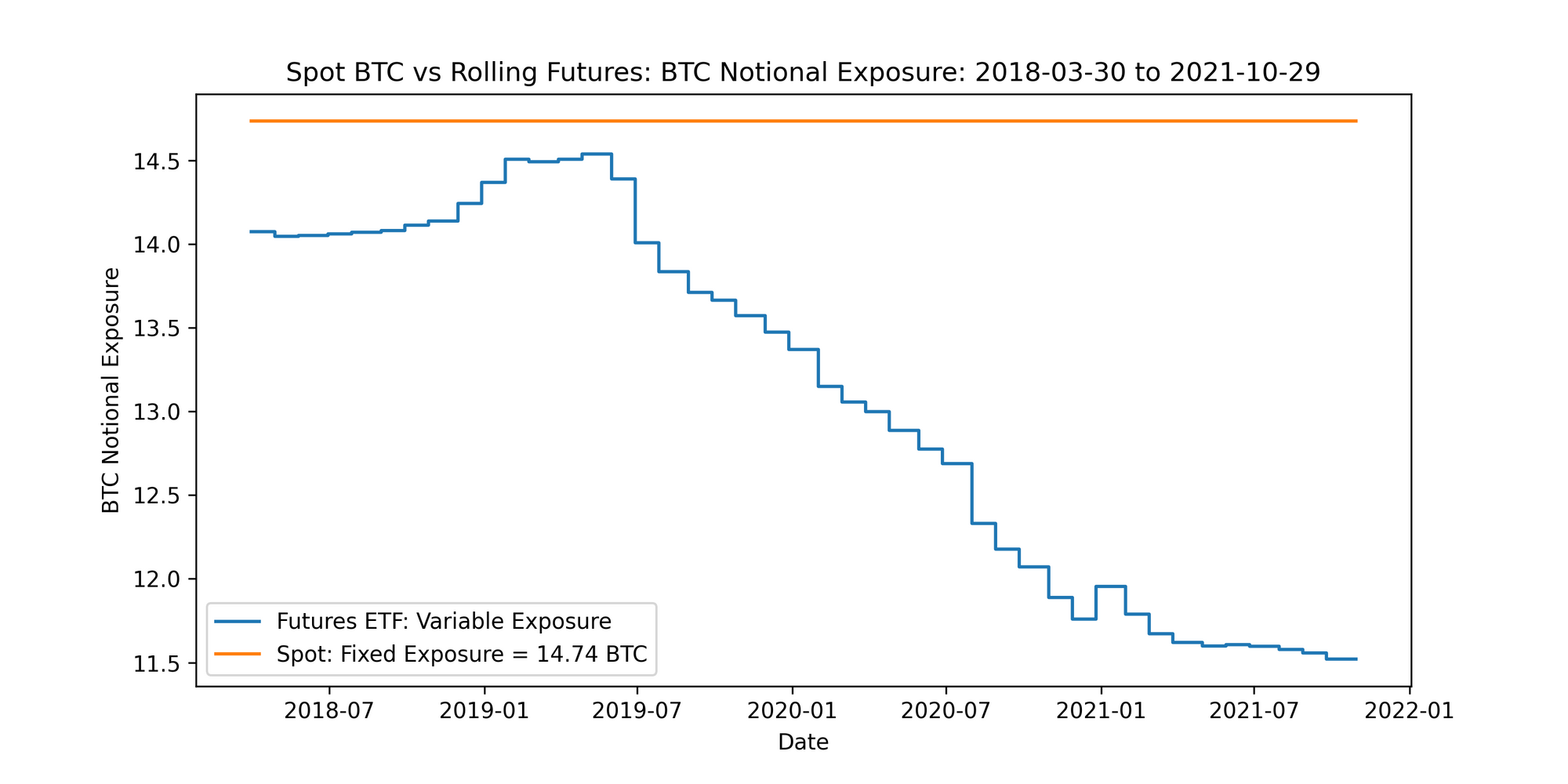

A Quantitative Analysis Of The BTC Futures ETF

Notional value is the total asset value of a hedged position, such as an interest rate swap. Learn how notional value works and. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure.

industry notional outstanding and gross credit exposure billions

Learn how notional value works and. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is the total asset value of a hedged position, such as an interest rate swap. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure.

Notional Exposure versus Buying Power YouTube

Learn how notional value works and. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Notional value is the total asset value of a hedged position, such as an interest rate swap.

Net notional exposure on EA sovereign bonds. (a) Country level. (b

Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Learn how notional value works and. Notional value is the total asset value of a hedged position, such as an interest rate swap. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

Intro to Gamma Exposure Charts and how to create your own gamma levels

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Learn how notional value works and. Notional value is the total asset value of a hedged position, such as an interest rate swap. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure.

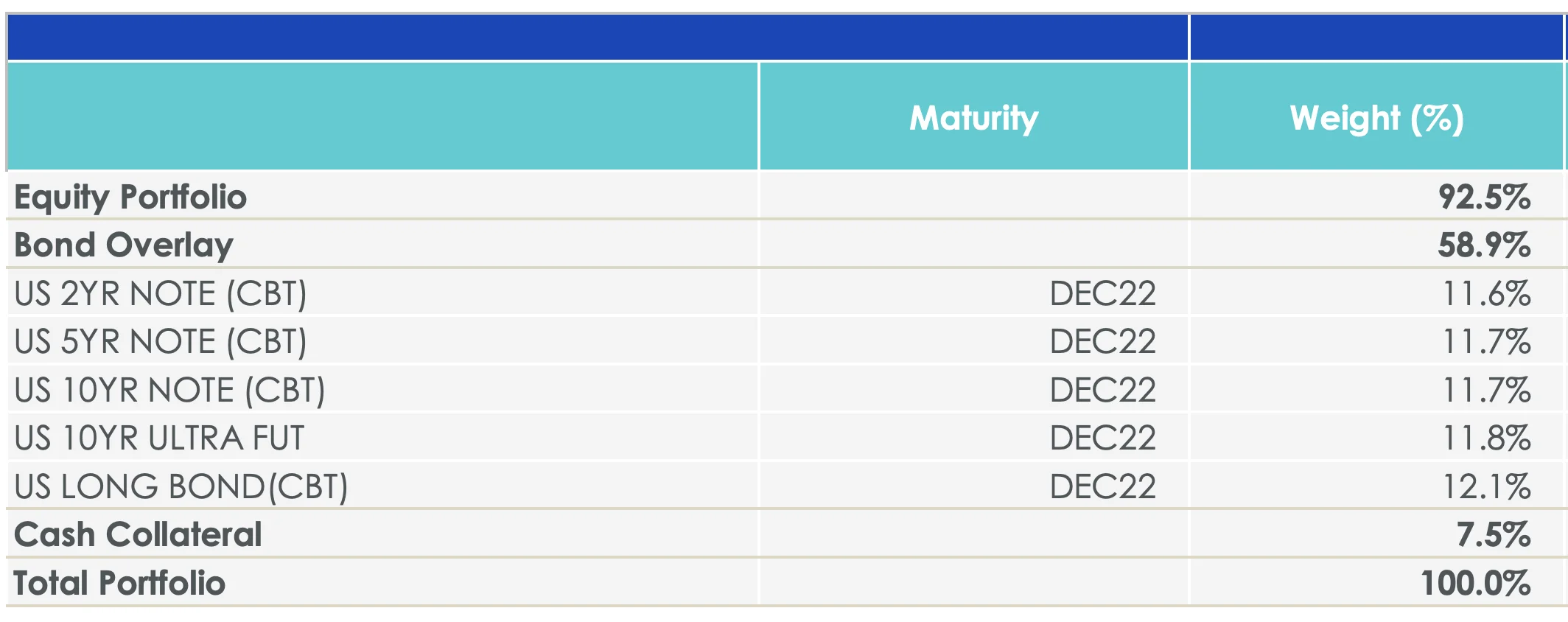

WisdomTree U.S. Efficient Core Fund Review NTSX ETF Review

Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Learn how notional value works and. Notional value is the total asset value of a hedged position, such as an interest rate swap. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure.

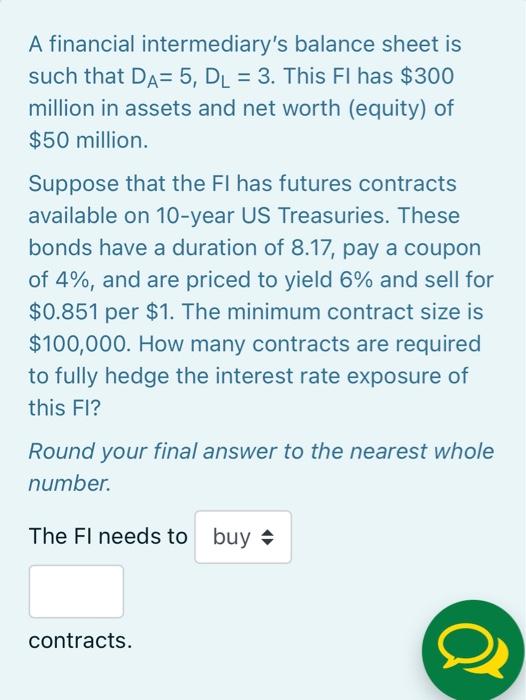

Solved A financial intermediary's balance sheet is such that

Notional value is the total asset value of a hedged position, such as an interest rate swap. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Learn how notional value works and. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure.

An update to the OCC's Quarterly Report on Bank Trading and Derivatives

Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Notional value is the total asset value of a hedged position, such as an interest rate swap. Learn how notional value works and. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.

Derivatives Exposure Adjusting Notional Amounts Asset Management

Notional value is the total asset value of a hedged position, such as an interest rate swap. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential. Learn how notional value works and.

Learn How Notional Value Works And.

Notional value is the total asset value of a hedged position, such as an interest rate swap. Notional value is the total value of a leveraged position's assets, providing a basis for understanding potential exposure. Understanding notional amounts is essential for anyone dealing with derivatives, swaps, and options, as it helps gauge potential.