Nj W4 Form

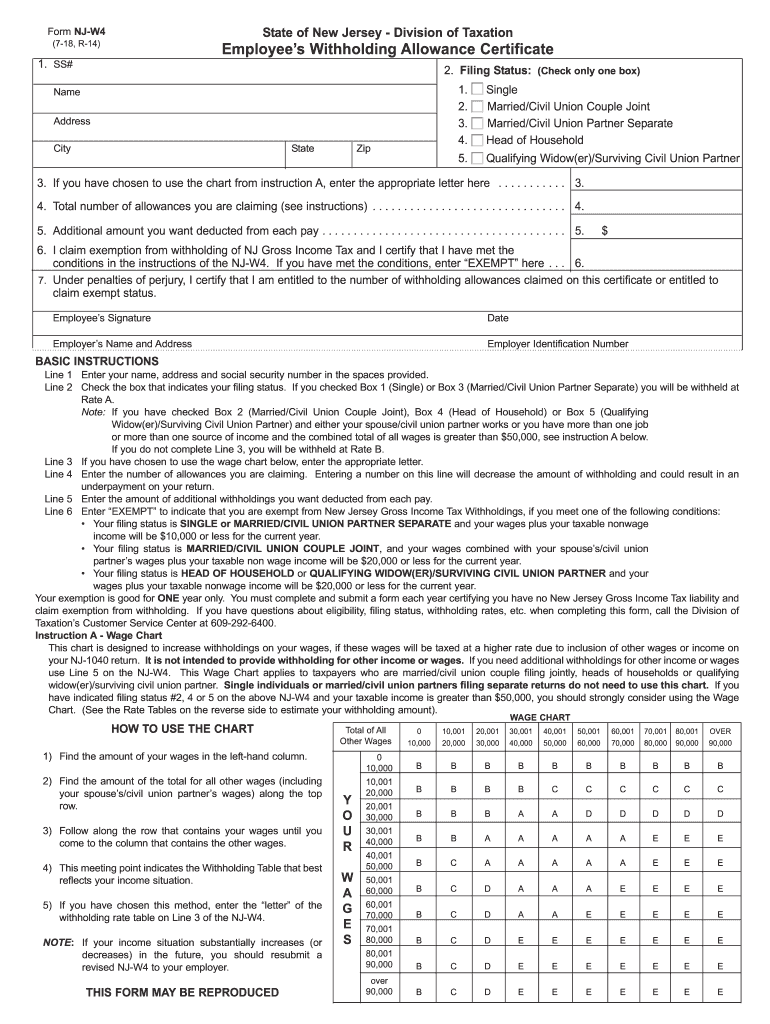

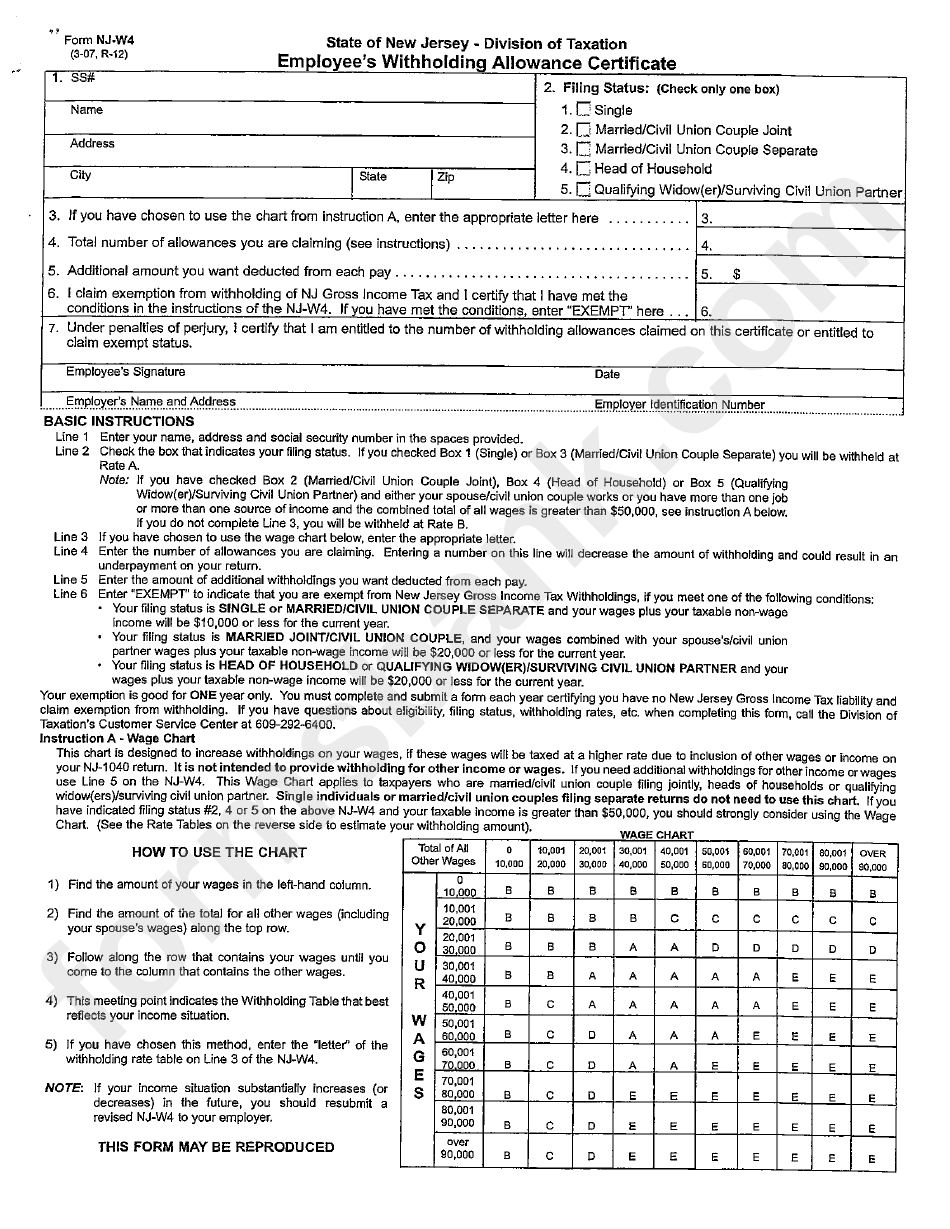

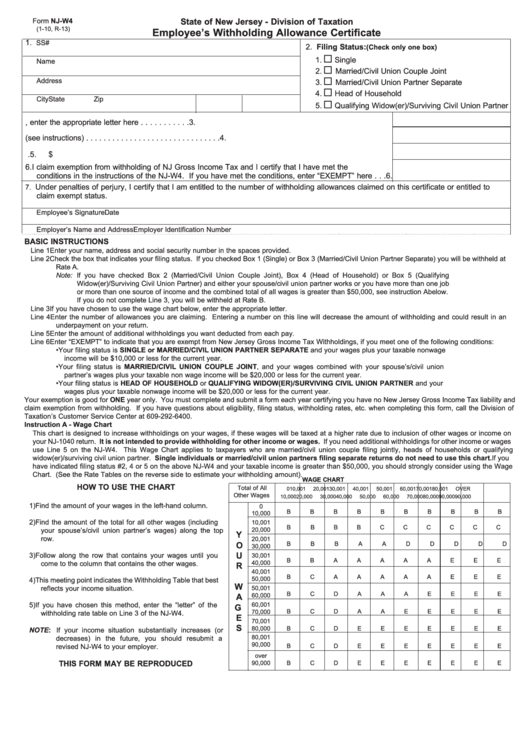

Nj W4 Form - (see the rate tables on the reverse side to estimate your withholding amount.) Single individuals or married individuals filing separate returns do. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. When an employee has more than one job, or if. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). If you have questions about. You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding.

You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding. If you have questions about. (see the rate tables on the reverse side to estimate your withholding amount.) When an employee has more than one job, or if. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Single individuals or married individuals filing separate returns do. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers).

(see the rate tables on the reverse side to estimate your withholding amount.) When an employee has more than one job, or if. If you have questions about. You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Single individuals or married individuals filing separate returns do.

Nj W4 2021 2022 W4 Form

(see the rate tables on the reverse side to estimate your withholding amount.) If you have questions about. Single individuals or married individuals filing separate returns do. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). W4 and your taxable income is greater than $50,000, you should strongly consider using the wage.

2024 Nj W4 Form Fara Oralla

If you have questions about. When an employee has more than one job, or if. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). (see the rate tables on the reverse side to estimate your withholding amount.) W4 and your taxable income is greater than $50,000, you should strongly consider using the.

Fillable Form NjW4 Employee'S Withholding Allowance Certificate

(see the rate tables on the reverse side to estimate your withholding amount.) W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. If you have questions about. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). You must complete and submit a form each.

Fillable Online jarga Nj W4 Form 2008 PDF

This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). Single individuals or married individuals filing separate returns do. (see the rate tables on the reverse side to estimate your withholding amount.) You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim.

TAX YEAR 2024 Form NJW4 What is it? How to fill it out. Surya Padhi,EA

You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding. Single individuals or married individuals filing separate returns do. When an employee has more than one job, or if. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart..

Fill Free fillable Form NJW4 State of New Jersey Division of PDF form

If you have questions about. Single individuals or married individuals filing separate returns do. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding. When an employee has more.

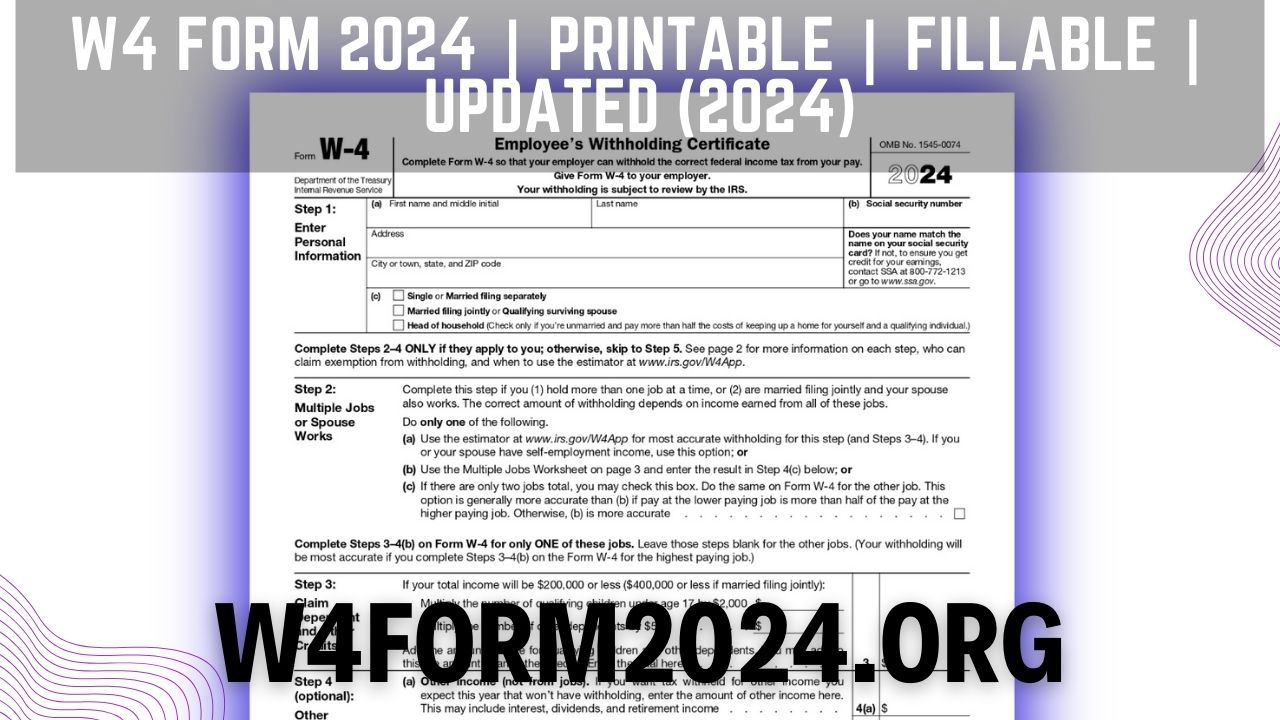

New W4 Form 2024 Bamby Carline

This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding. When an employee has more than one job, or if. Single individuals or married individuals filing separate returns do..

W4 Chart 2024 Shir Yvette

When an employee has more than one job, or if. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. If you have questions about. (see the rate tables on the reverse side to estimate your withholding amount.) Single individuals or married individuals filing separate returns do.

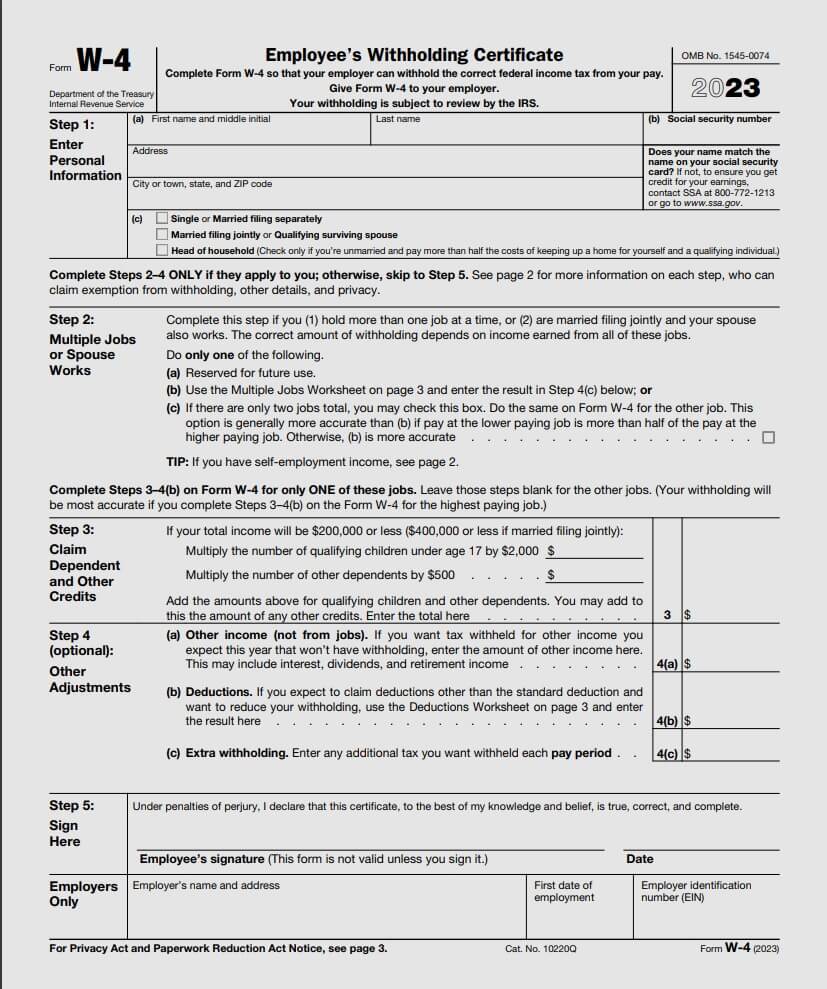

2023 W4 Form Printable Pdf

When an employee has more than one job, or if. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. If you have questions about. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers). Single individuals or married individuals filing separate returns do.

2024 Nj W4 Kira Serena

(see the rate tables on the reverse side to estimate your withholding amount.) If you have questions about. When an employee has more than one job, or if. Single individuals or married individuals filing separate returns do. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart.

Single Individuals Or Married Individuals Filing Separate Returns Do.

(see the rate tables on the reverse side to estimate your withholding amount.) You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding. W4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. This wage chart applies to taxpayers who are married filing jointly, heads of households or qualifying widows(ers).

If You Have Questions About.

When an employee has more than one job, or if.