Mn Renters Rebate Form

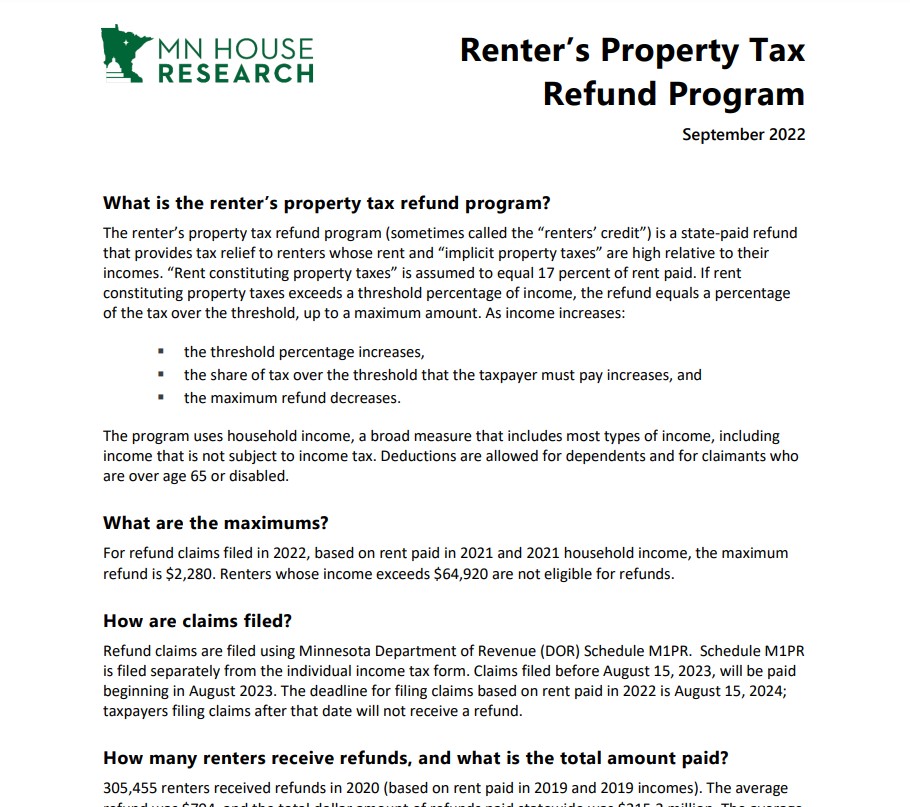

Mn Renters Rebate Form - How do i get my refund? Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. What do i need to claim. I authorize the minnesota department of revenue to discuss this tax return with the preparer. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. Minnesota property tax refund, mail station. What is the renter’s property tax refund program?

The renter’s property tax refund program (sometimes called the “renters’ credit”) is a. You may qualify for a tax refund if your household income is less than $73,270. Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. Claim a refund for paying your rent! If you own, use your property. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. What is the renter’s property tax refund program? To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. I authorize the minnesota department of revenue to discuss this tax return with the preparer. What do i need to claim.

Claim a refund for paying your rent! What is the renter’s property tax refund program? To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Instead, the credit will be added. Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. You may qualify for a tax refund if your household income is less than $73,270. Minnesota property tax refund, mail station. If you own, use your property. How do i get my refund? The renter’s property tax refund program (sometimes called the “renters’ credit”) is a.

Track My Renters Rebate Mn

To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). The renter’s property.

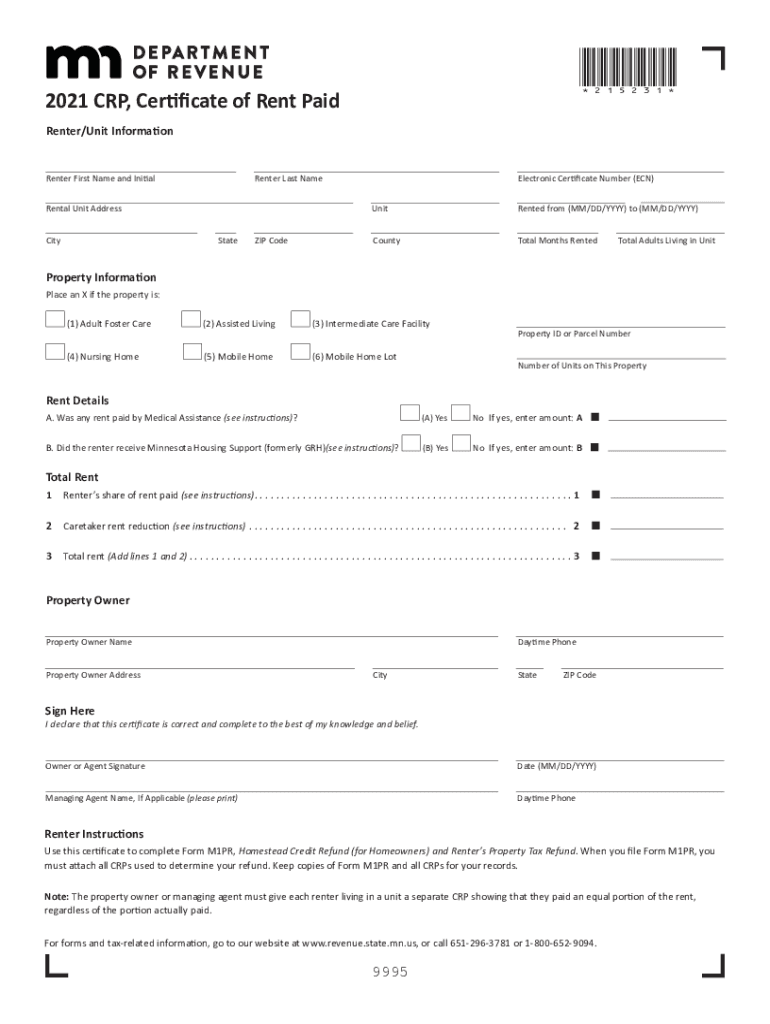

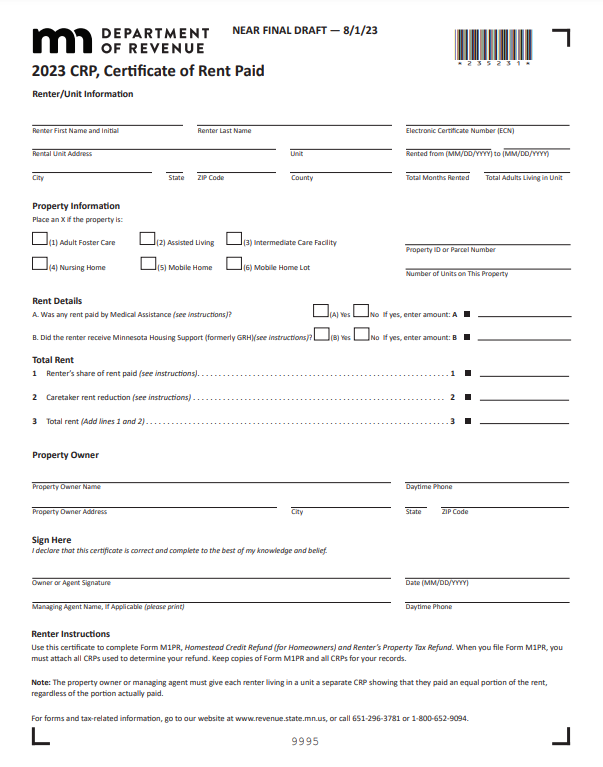

Renters Rebate Mn 20212024 Form Fill Out and Sign Printable PDF

Minnesota property tax refund, mail station. You may qualify for a tax refund if your household income is less than $73,270. Claim a refund for paying your rent! If you own, use your property. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024.

Efile Express 2022 Mn Renters Rebate

Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. What do i need to claim. What is the renter’s property tax refund program? You may qualify for a tax refund if your household income is less than $73,270. I authorize the minnesota department of revenue to.

Renters Printable Rebate Form

Claim a refund for paying your rent! You may qualify for a tax refund if your household income is less than $73,270. Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). What is the renter’s property tax refund program? What do i need to claim.

Fillable Form Crp Certificate Of Rent Paid Minnesota Department Of

Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. What do i need to claim. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Beginning with refunds paid in 2025 (tax year 2024),.

Mn Renter's Rebate Form 2023 Rent Rebates

Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). I authorize the minnesota department of revenue to discuss this tax return with the preparer. Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form..

Wisconsin Rent Rebate 2023 Rent Rebates

What is the renter’s property tax refund program? Minnesota property tax refund, mail station. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. Instead, the credit will be added. Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income.

Minnesota Renters Rebate 2023 Printable Rebate Form

• if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. You may qualify for a tax refund if your household income is less than $73,270. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. What do i need to claim. Beginning.

Renters Rebate Form MN 2024 Printable Rebate Form

Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr). Minnesota property tax refund, mail station. Claim a refund for paying your rent! How do i get my refund? Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual.

Can i file mn renters rebate online for free Fill out & sign online

Minnesota property tax refund, mail station. What do i need to claim. • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2024. If you own, use your property. Claim a refund for paying your rent!

Minnesota Property Tax Refund, Mail Station.

You may qualify for a tax refund if your household income is less than $73,270. Beginning with refunds paid in 2025 (tax year 2024), taxpayers will file and claim the credit as part of their income tax returns. What do i need to claim. Beginning with tax year 2024, r enters will no longer file a renter's property tax refund return (form m1pr).

• If You Rent, Your Landlord Must Give You A Certificate Of Rent Paid (Crp) By January 31, 2024.

To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. What is the renter’s property tax refund program? How do i get my refund? I authorize the minnesota department of revenue to discuss this tax return with the preparer.

The Renter’s Property Tax Refund Program (Sometimes Called The “Renters’ Credit”) Is A.

Starting with your 2024 taxes, if you are a renter, you can claim the renter's credit as part of your minnesota individual income tax return (form. Instead, the credit will be added. Claim a refund for paying your rent! If you own, use your property.