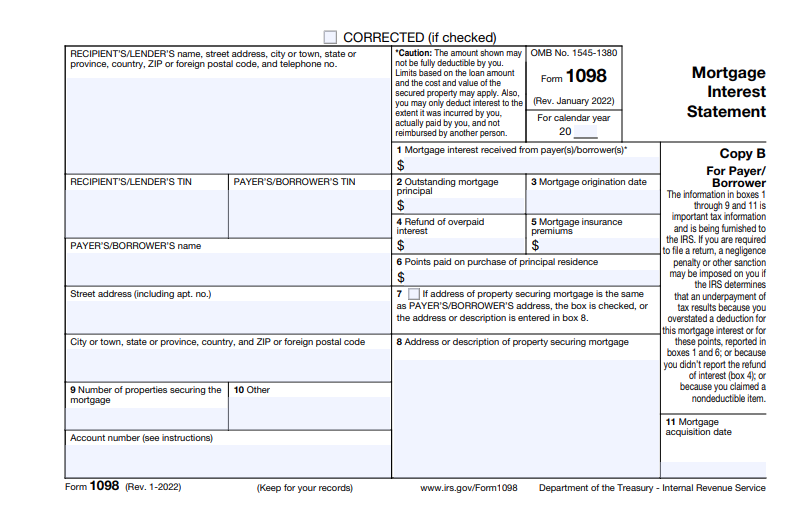

Loandepot 1098 Tax Form

Loandepot 1098 Tax Form - Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. If you receive a current tax bill for any tax item that. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. How come i didn't get a 1098 from both mortgage lenders i had this year? Make payments and access important information about your account. The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from.

Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. How come i didn't get a 1098 from both mortgage lenders i had this year? Make payments and access important information about your account. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. If you receive a current tax bill for any tax item that. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders.

The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Make payments and access important information about your account. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. If you receive a current tax bill for any tax item that. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. How come i didn't get a 1098 from both mortgage lenders i had this year?

What is IRS Form 1098?

Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. If you receive a current tax.

IRS Form 1098C Instructions Qualified Vehicle Contributions

If you receive a current tax bill for any tax item that. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. Use form 1098 (info copy only).

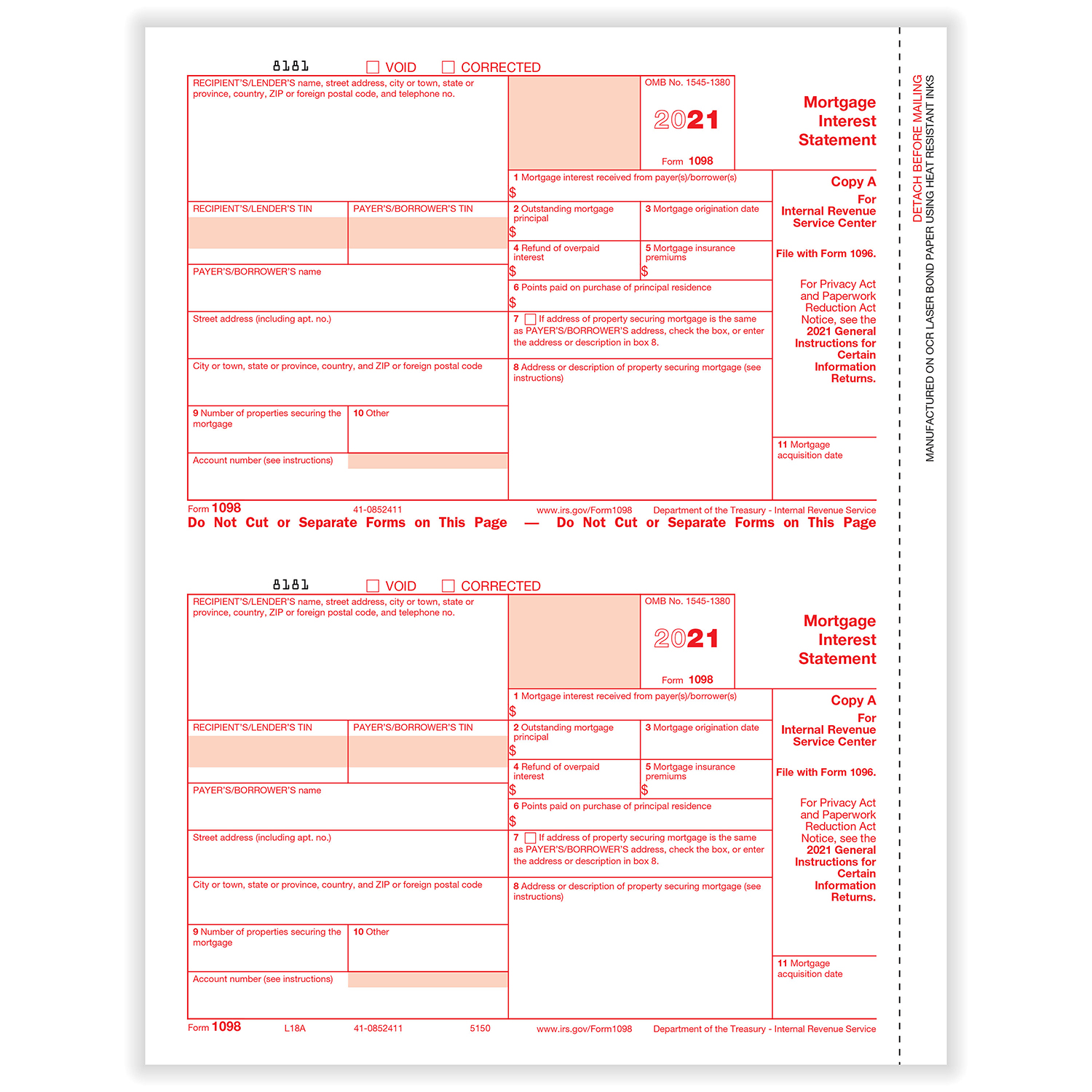

1098 Mortgage Interest Federal 1098 Tax Forms Formstax

How come i didn't get a 1098 from both mortgage lenders i had this year? Make payments and access important information about your account. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Form 1098 if you paid at least.

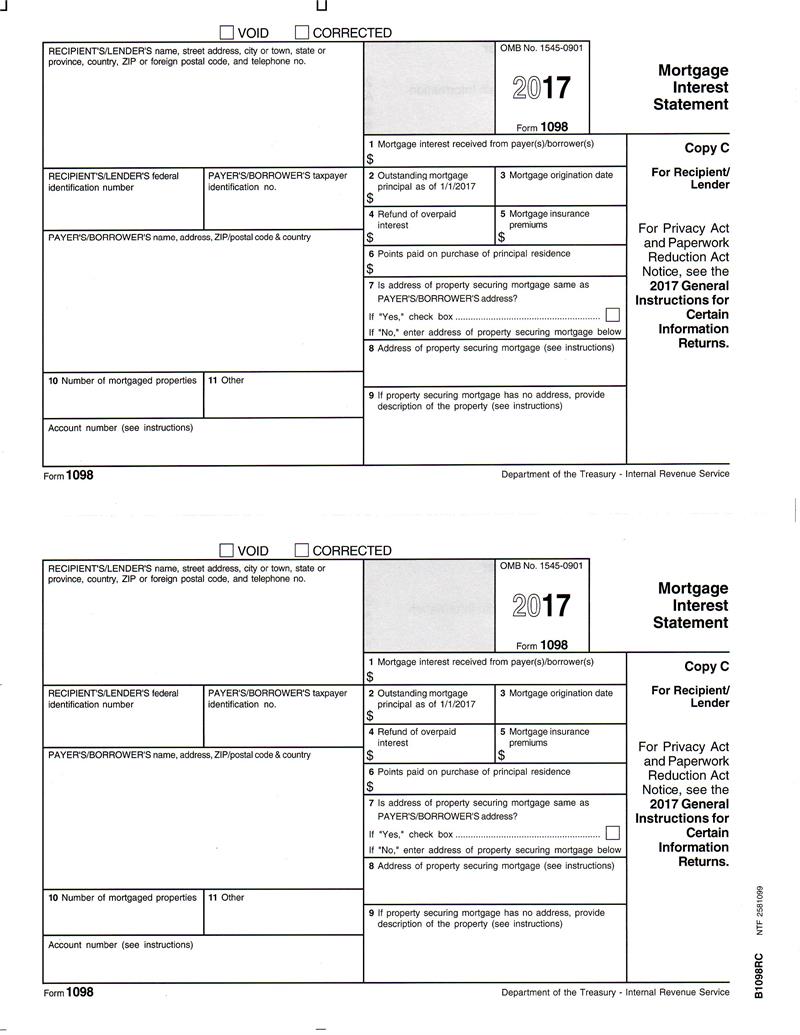

Form 1098, Mortgage Interest Statement, Recipient Copy C

Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. How come i didn't get a 1098.

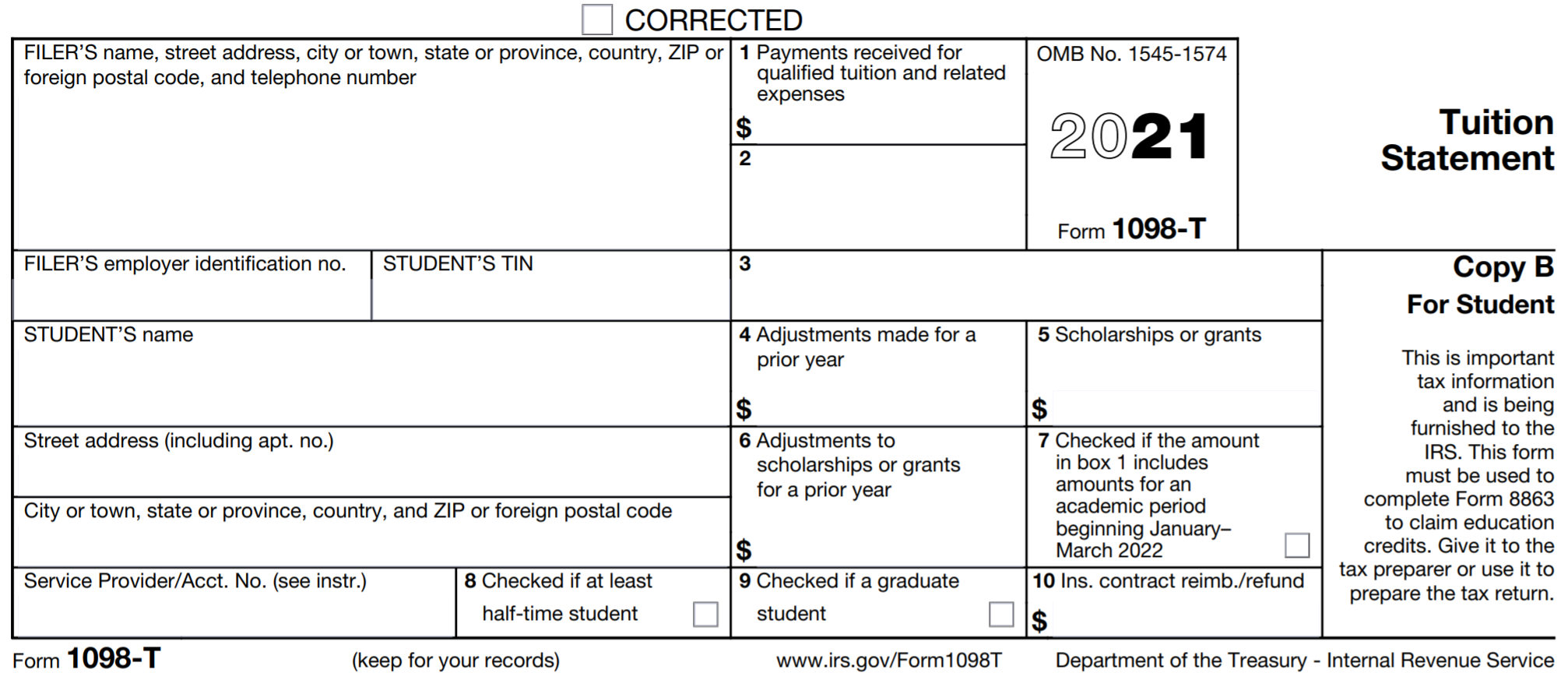

1098T Ventura County Community College District

How come i didn't get a 1098 from both mortgage lenders i had this year? Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Make payments and access important information about your account. The form 1098—also known as.

Form 1098E, Student Loan Interest Statement, Recipient Copy C

The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Use form 1098, mortgage interest statement,.

Where to Find the 1098T Form

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. How come i didn't get a 1098 from both mortgage lenders i had this year? Form 1098 if you paid at least $600 in interest in a year, your mortgage company.

Education Credits and Deductions (Form 1098T) Support

Make payments and access important information about your account. How come i didn't get a 1098 from both mortgage lenders i had this year? If you receive a current tax bill for any tax item that. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of.

1098T Federal Copy A (L18TA)

How come i didn't get a 1098 from both mortgage lenders i had this year? If you receive a current tax bill for any tax item that. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Use form.

1098 Tax Forms, Lender Copy C

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage..

Form 1098 If You Paid At Least $600 In Interest In A Year, Your Mortgage Company Is Required To Send You A Copy Of Form 1098 (Also Known As The Mortgage.

The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. Make payments and access important information about your account. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from.

How Come I Didn't Get A 1098 From Both Mortgage Lenders I Had This Year?

If you receive a current tax bill for any tax item that. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the.