Journal Entry For Payroll In Quickbooks

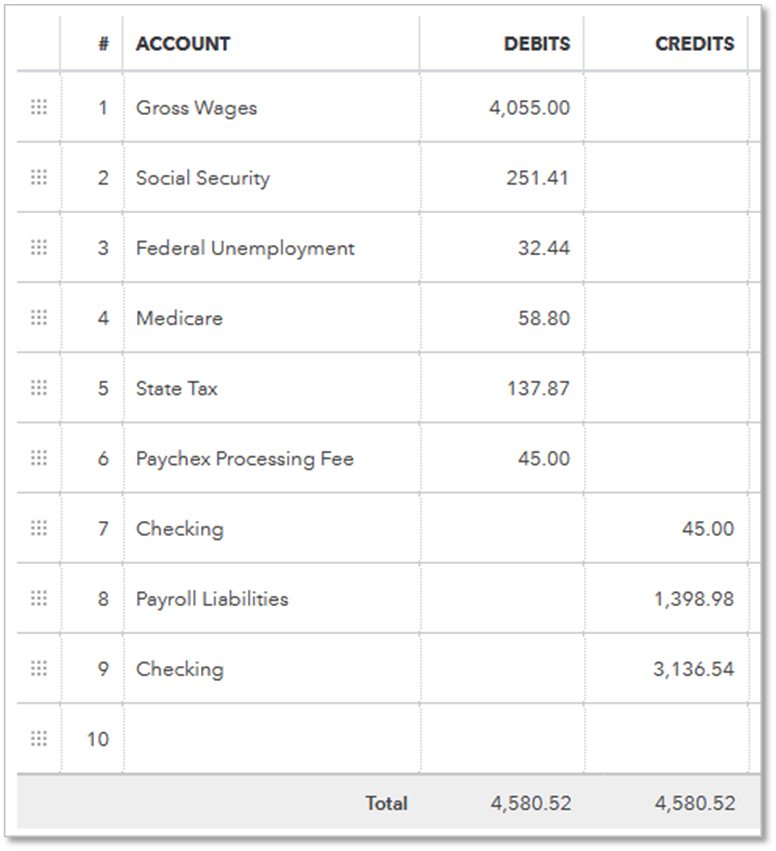

Journal Entry For Payroll In Quickbooks - Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. After you pay your employees outside of quickbooks, create a journal entry. Fill out the fields to create your journal entry. Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll. Get your employees' payroll pay stubs or a payroll report. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Go to the company menu and select make general journal entries. In this article, we’ll explore how to.

Get your employees' payroll pay stubs or a payroll report. Go to the company menu and select make general journal entries. After you pay your employees outside of quickbooks, create a journal entry. Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. In this article, we’ll explore how to. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Fill out the fields to create your journal entry.

Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. After you pay your employees outside of quickbooks, create a journal entry. Go to the company menu and select make general journal entries. Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll. In this article, we’ll explore how to. Fill out the fields to create your journal entry. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Get your employees' payroll pay stubs or a payroll report.

Payroll Journal Entry Template Excel

Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording.

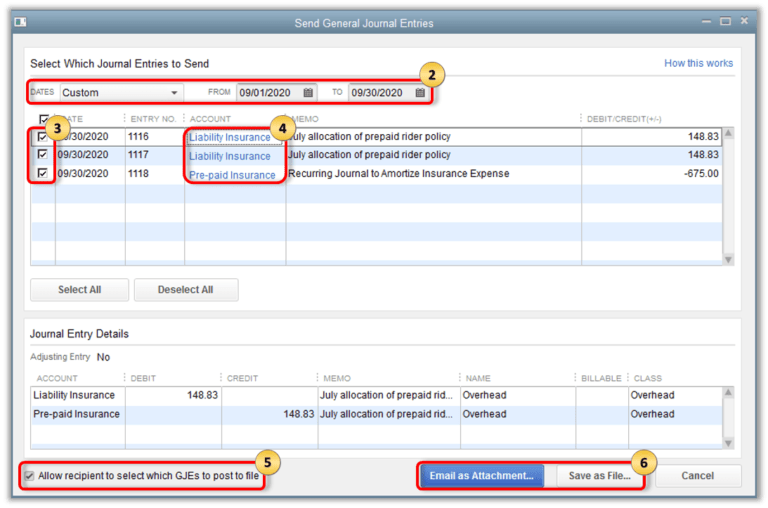

Record payroll transactions manually QuickBooks Community

Get your employees' payroll pay stubs or a payroll report. After you pay your employees outside of quickbooks, create a journal entry. Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll. Fill out the fields to create your journal entry. In this article, we’ll explore how to.

Quickbooks Journal Entry Template

Get your employees' payroll pay stubs or a payroll report. After you pay your employees outside of quickbooks, create a journal entry. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries. In this article, we’ll explore how to.

How should I enter the previous ADP Payroll into Quickbooks?

After you pay your employees outside of quickbooks, create a journal entry. Get your employees' payroll pay stubs or a payroll report. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. In this article, we’ll explore how to. Record your gross wages, taxes, and employee taxes by creating a journal.

How to Make a Journal Entry in QuickBooks Online? QAsolved

Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Go to the company menu and select make general journal entries. Get your employees' payroll pay stubs or a payroll report. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Fill out the fields to create.

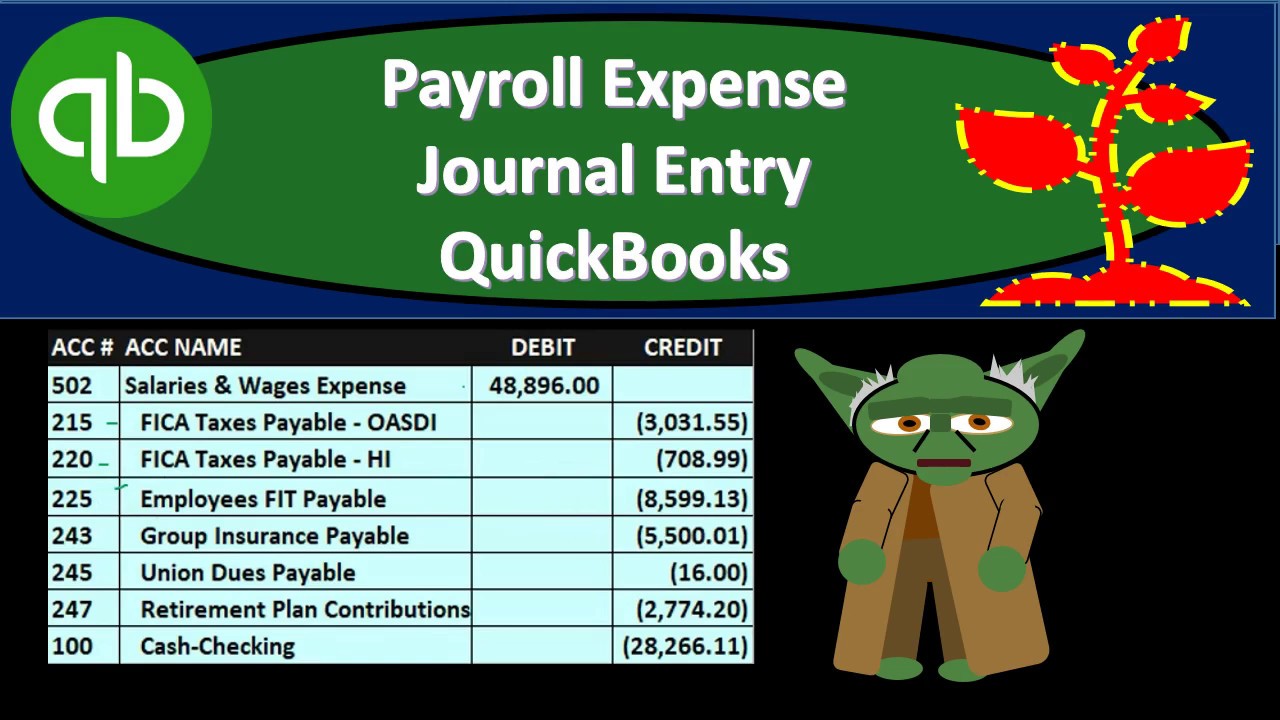

Payroll Expense Journal Entry QuickBooks Desktop 2019 YouTube

Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. After you pay your employees outside of quickbooks, create a journal entry. Fill out the fields to create your journal entry. Get your employees' payroll pay stubs or a payroll report. Record your gross wages, taxes, and employee taxes by creating.

A payroll journal entry is a method of accrual accounting, in which a

Fill out the fields to create your journal entry. After you pay your employees outside of quickbooks, create a journal entry. Go to the company menu and select make general journal entries. In this article, we’ll explore how to. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise.

How To Enter Journal Entry In Quickbooks Online

Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll. Fill out the fields to create your journal entry. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Get your employees' payroll pay stubs or a payroll report. In.

Sample Payroll Journal Entry

Get your employees' payroll pay stubs or a payroll report. After you pay your employees outside of quickbooks, create a journal entry. In this article, we’ll explore how to. Go to the company menu and select make general journal entries. Fill out the fields to create your journal entry.

How to Record a Journal Entry in QuickBooks Online?

Get your employees' payroll pay stubs or a payroll report. Fill out the fields to create your journal entry. Go to the company menu and select make general journal entries. In this article, we’ll explore how to. Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll.

Get Your Employees' Payroll Pay Stubs Or A Payroll Report.

Record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. After you pay your employees outside of quickbooks, create a journal entry. In this article, we’ll explore how to.

Fill Out The Fields To Create Your Journal Entry.

Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries.