Is Service Revenue On A Balance Sheet

Is Service Revenue On A Balance Sheet - Rather, it is reported on the. Here’s a breakdown of the typical flow: Service revenue goes to accounts receivable on the balance sheet. To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation: Where does service revenue go on a balance sheet? Service revenue doesn’t actually appear on the balance sheet. Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. Instead, it is reported on the income statement, also known. Therefore, service revenue is not typically directly recorded on the balance sheet. In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement.

Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. Rather, it is reported on the. Therefore, service revenue is not typically directly recorded on the balance sheet. Where does service revenue go on a balance sheet? Instead, it is reported on the income statement, also known. Service revenue doesn’t actually appear on the balance sheet. To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation: In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement. Here’s a breakdown of the typical flow: Service revenue goes to accounts receivable on the balance sheet.

Where does service revenue go on a balance sheet? Here’s a breakdown of the typical flow: Service revenue doesn’t actually appear on the balance sheet. Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. Instead, it is reported on the income statement, also known. In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement. To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation: Service revenue goes to accounts receivable on the balance sheet. Therefore, service revenue is not typically directly recorded on the balance sheet. Rather, it is reported on the.

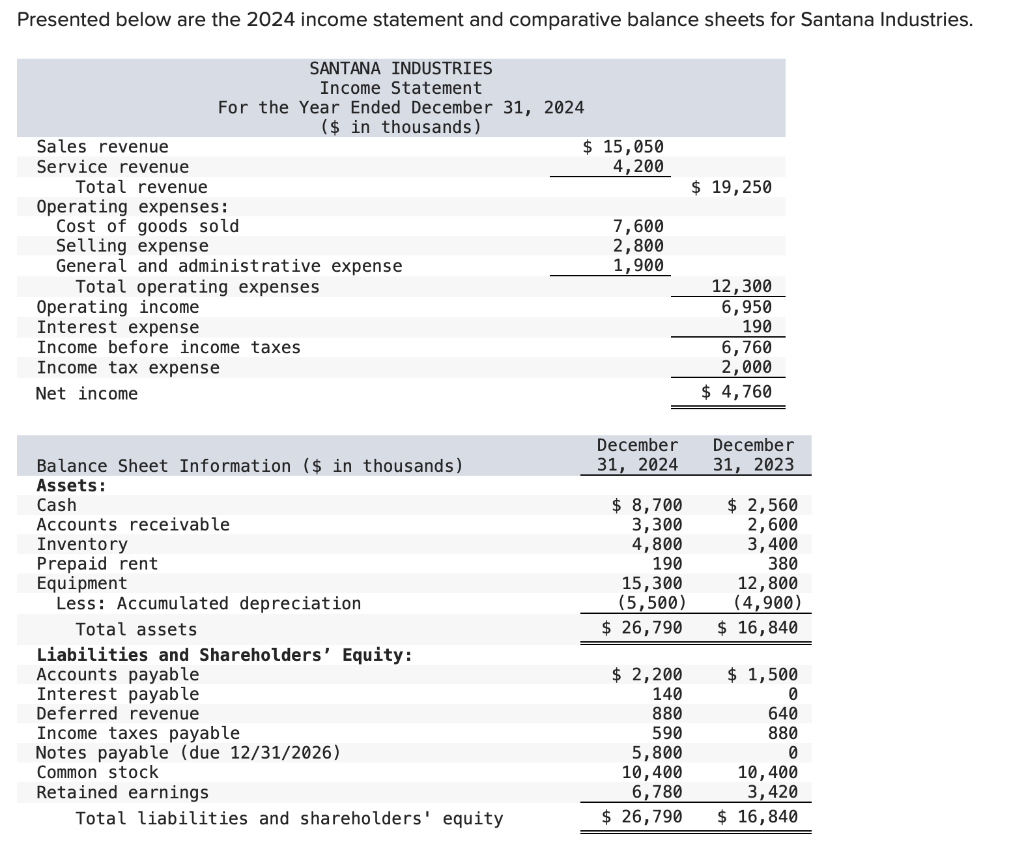

Solved Great Adventures Problem 111 The statement,

Instead, it is reported on the income statement, also known. Rather, it is reported on the. Service revenue doesn’t actually appear on the balance sheet. Therefore, service revenue is not typically directly recorded on the balance sheet. Where does service revenue go on a balance sheet?

Does Service Revenue Go On The Balance Sheet cloudshareinfo

Here’s a breakdown of the typical flow: Therefore, service revenue is not typically directly recorded on the balance sheet. Where does service revenue go on a balance sheet? To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation: In most cases, service revenue is reported on the income statement, which is also known.

What Is Service Revenue On A Balance Sheet LiveWell

Service revenue doesn’t actually appear on the balance sheet. Therefore, service revenue is not typically directly recorded on the balance sheet. Instead, it is reported on the income statement, also known. Where does service revenue go on a balance sheet? To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation:

GREAT ADVENTURES, INC. Statement For the Year

Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. Rather, it is reported on the. In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement. Instead, it is reported on the income statement, also known. Here’s a breakdown.

Unearned Revenue What It Is, How It Is Recorded and Reported

In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement. Rather, it is reported on the. Service revenue goes to accounts receivable on the balance sheet. Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. Service revenue doesn’t.

How to read and understand financial statements

Therefore, service revenue is not typically directly recorded on the balance sheet. To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation: Here’s a breakdown of the typical flow: Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. Instead, it is reported on.

What is Unearned Revenue? QuickBooks Canada Blog

Therefore, service revenue is not typically directly recorded on the balance sheet. To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation: Rather, it is reported on the. Service revenue goes to accounts receivable on the balance sheet. Where does service revenue go on a balance sheet?

Unearned Revenue Definition, How To Record, Example

Service revenue goes to accounts receivable on the balance sheet. In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement. Instead, it is reported on the income statement, also known. Rather, it is reported on the. Service revenue doesn’t actually appear on the balance sheet.

Does Service Revenue Go On The Balance Sheet cloudshareinfo

Here’s a breakdown of the typical flow: Rather, it is reported on the. Where does service revenue go on a balance sheet? Instead, it is reported on the income statement, also known. In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement.

Solved Presented below are the 2024 statement and

In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement. Therefore, service revenue is not typically directly recorded on the balance sheet. Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. Here’s a breakdown of the typical flow:.

Here’s A Breakdown Of The Typical Flow:

In most cases, service revenue is reported on the income statement, which is also known as the profit and loss (p&l) statement. Although service revenue isn't an asset in accrual accounting, accounts receivable or cash payments that come from services are. To understand why service revenue is not recorded on the balance sheet, let’s consider the accounting equation: Service revenue goes to accounts receivable on the balance sheet.

Instead, It Is Reported On The Income Statement, Also Known.

Where does service revenue go on a balance sheet? Rather, it is reported on the. Therefore, service revenue is not typically directly recorded on the balance sheet. Service revenue doesn’t actually appear on the balance sheet.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)