Instacart Ein Number

Instacart Ein Number - Your business name would be your name. Instacart changed their 1099 filing & delivery process for 2023. Set up each business separately (avon, instacart, uber). The irs requires your taxpayer identification number (tin) on your 1099 tax form. If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin). When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your 12 digit number is by registering the business on. Your business address would be.

Your business address would be. The irs requires your taxpayer identification number (tin) on your 1099 tax form. If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin). Your business name would be your name. Set up each business separately (avon, instacart, uber). Instacart changed their 1099 filing & delivery process for 2023. When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your 12 digit number is by registering the business on.

Set up each business separately (avon, instacart, uber). If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin). Your business address would be. When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your 12 digit number is by registering the business on. Your business name would be your name. The irs requires your taxpayer identification number (tin) on your 1099 tax form. Instacart changed their 1099 filing & delivery process for 2023.

Instacart delivers a lower valuation

When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your 12 digit number is by registering the business on. The irs requires your taxpayer identification number (tin) on your 1099 tax form. If you are an individual, your social security number (ssn) or.

How To Contact Instacart Support In 2022 YouTube

The irs requires your taxpayer identification number (tin) on your 1099 tax form. Set up each business separately (avon, instacart, uber). Instacart changed their 1099 filing & delivery process for 2023. Your business name would be your name. When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.).

Instacart Acquires Eversight MarTech Cube

Your business address would be. Your business name would be your name. Instacart changed their 1099 filing & delivery process for 2023. If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin). When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.).

Report Instacart Customer Data Is Being Sold on the Dark Web

When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your 12 digit number is by registering the business on. Set up each business separately (avon, instacart, uber). If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin)..

Sprouts Launches New Retail Media Network Powered by Instacart's Carrot

The irs requires your taxpayer identification number (tin) on your 1099 tax form. If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin). Set up each business separately (avon, instacart, uber). Instacart changed their 1099 filing & delivery process for 2023. When you create your llc you still receive a 9 digit ein (even.

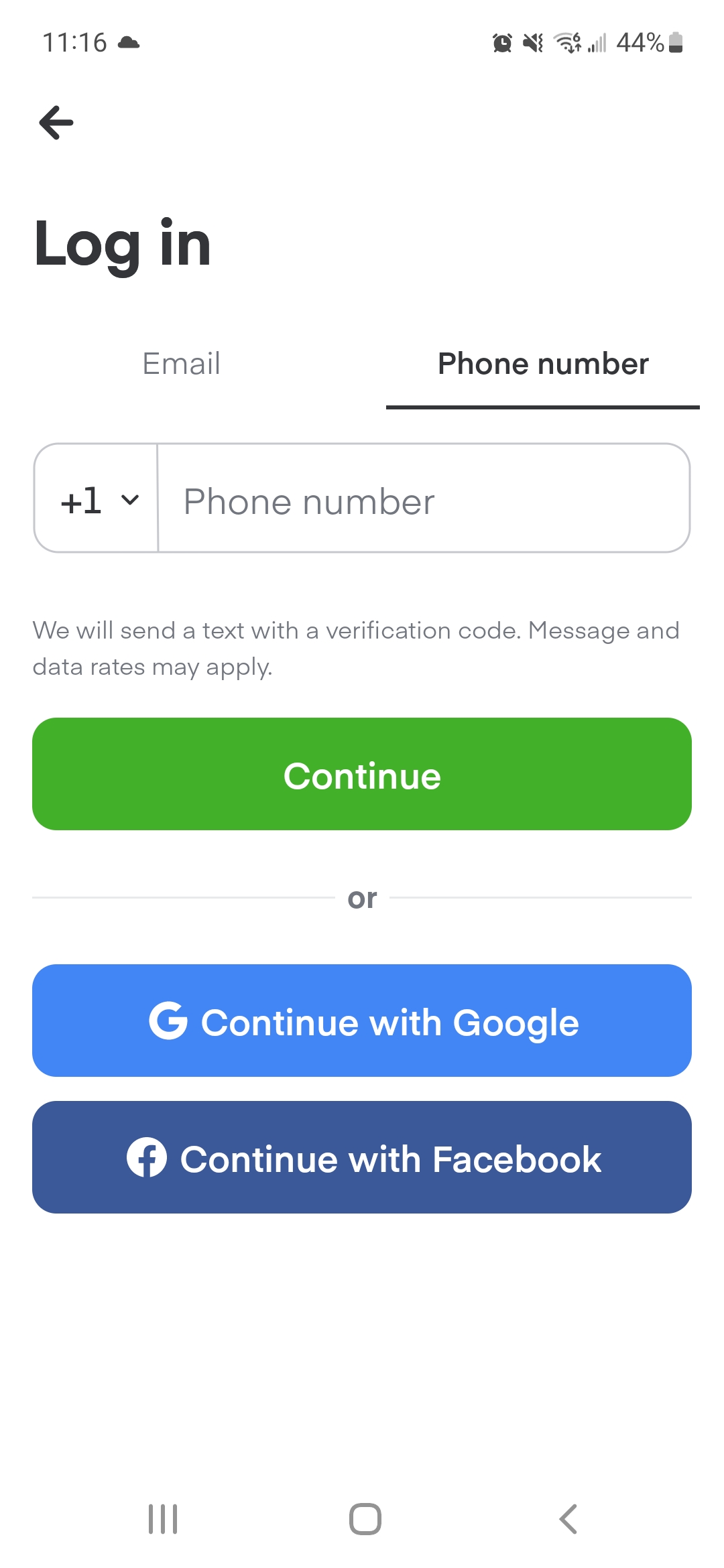

Get SMS Verification from Instacart Using a Virtual Phone Number Next

The irs requires your taxpayer identification number (tin) on your 1099 tax form. Your business address would be. Set up each business separately (avon, instacart, uber). Your business name would be your name. When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your.

Instacart Führt Die ChatGPTFunktion „Ask Instacart“ Ein Futuriq.de

The irs requires your taxpayer identification number (tin) on your 1099 tax form. Instacart changed their 1099 filing & delivery process for 2023. Your business name would be your name. If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin). Your business address would be.

Tips for Managing Instacart RSUs at IPO — EquityFTW

Set up each business separately (avon, instacart, uber). If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin). Instacart changed their 1099 filing & delivery process for 2023. The irs requires your taxpayer identification number (tin) on your 1099 tax form. When you create your llc you still receive a 9 digit ein (even.

Memo Instacart’s Omnichannel OS 2PM

When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your 12 digit number is by registering the business on. Your business address would be. Your business name would be your name. Instacart changed their 1099 filing & delivery process for 2023. If you.

Passo a passo de como criar Conta Instacart usando seu EIN Number

Set up each business separately (avon, instacart, uber). The irs requires your taxpayer identification number (tin) on your 1099 tax form. Your business address would be. Your business name would be your name. If you are an individual, your social security number (ssn) or individual taxpayer identification number (itin).

Your Business Name Would Be Your Name.

When you create your llc you still receive a 9 digit ein (even now in 2024, 7 years after the rule change.) the way to get your 12 digit number is by registering the business on. Your business address would be. Set up each business separately (avon, instacart, uber). Instacart changed their 1099 filing & delivery process for 2023.

If You Are An Individual, Your Social Security Number (Ssn) Or Individual Taxpayer Identification Number (Itin).

The irs requires your taxpayer identification number (tin) on your 1099 tax form.