How To Record Erc Refund In Quickbooks

How To Record Erc Refund In Quickbooks - If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. It is possible to make a deposit to record your particular erc credit. You can create a deposit to record your erc credit. First off, we'll have to create a new account to hold and house this credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Here are the steps to record employee retention credit in.

You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): First off, we'll have to create a new account to hold and house this credit. It is possible to make a deposit to record your particular erc credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. Here are the steps to record employee retention credit in.

First off, we'll have to create a new account to hold and house this credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc credit.

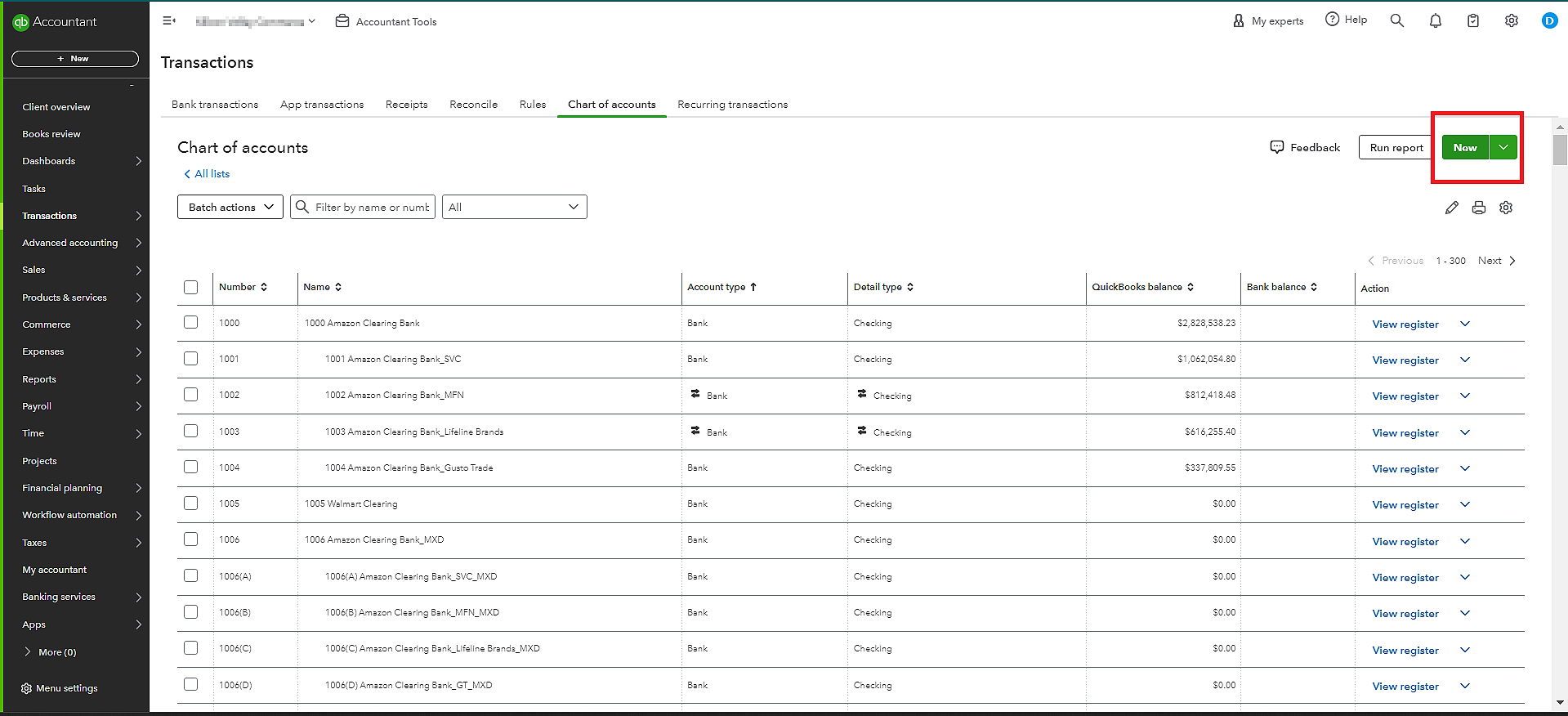

How to Record ERC in QuickBooks?

Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): First off, we'll have to create a new account to hold and house this credit..

How to Record ERC in QuickBooks?

Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc credit. You can create a deposit to record your erc credit. First off, we'll have to create a new account to hold and house this credit. If you received a refund check for the employee retention credit (erc),.

Record a Refund from a Vendor in QuickBooks Online Accounting Guide

You can create a deposit to record your erc credit. Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc credit. First off, we'll have to create a new account to hold and house this credit. To record a deposit for the refund of liabilities (which are, as.

How To Record Employee Retention Credit In Quickbooks Desktop LiveWell

You can create a deposit to record your erc credit. Here are the steps to record employee retention credit in. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. It is possible to make a deposit to record your particular erc credit. First off, we'll have.

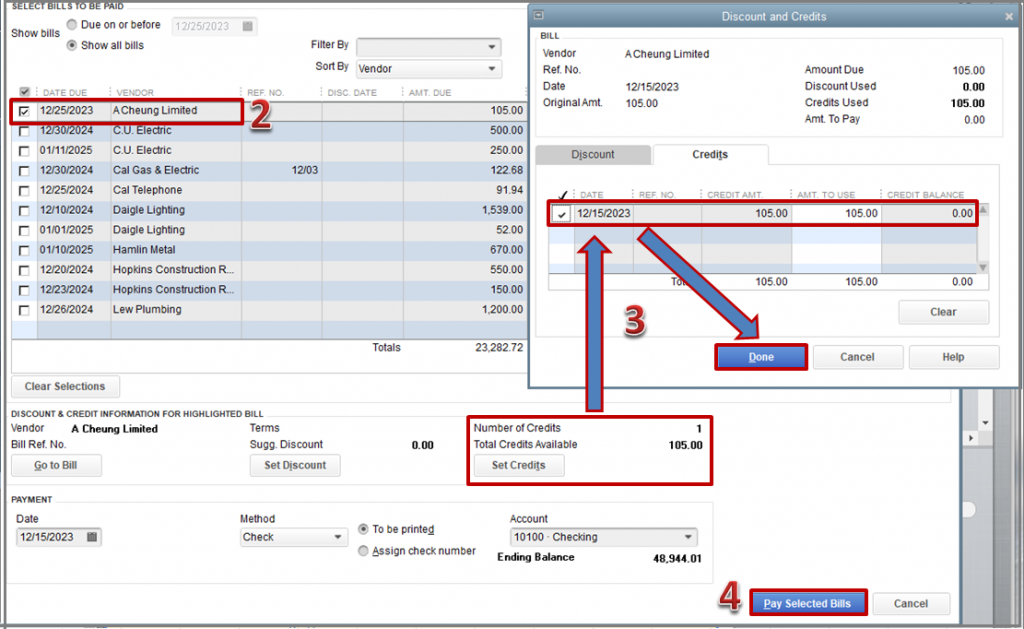

How To Record A Refund In Quickbooks

Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): It is possible to make a deposit to record your particular erc credit. First off, we'll have to.

Record QuickBooks Vendor Refund Complete StepbyStep Guide

First off, we'll have to create a new account to hold and house this credit. Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for.

Record Quickbooks Vendor Refund 1 Select the Received fr… Flickr

First off, we'll have to create a new account to hold and house this credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc.

How To Record A Refund In Quickbooks

To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. It is possible to make a deposit to record your particular erc credit. First off, we'll have to.

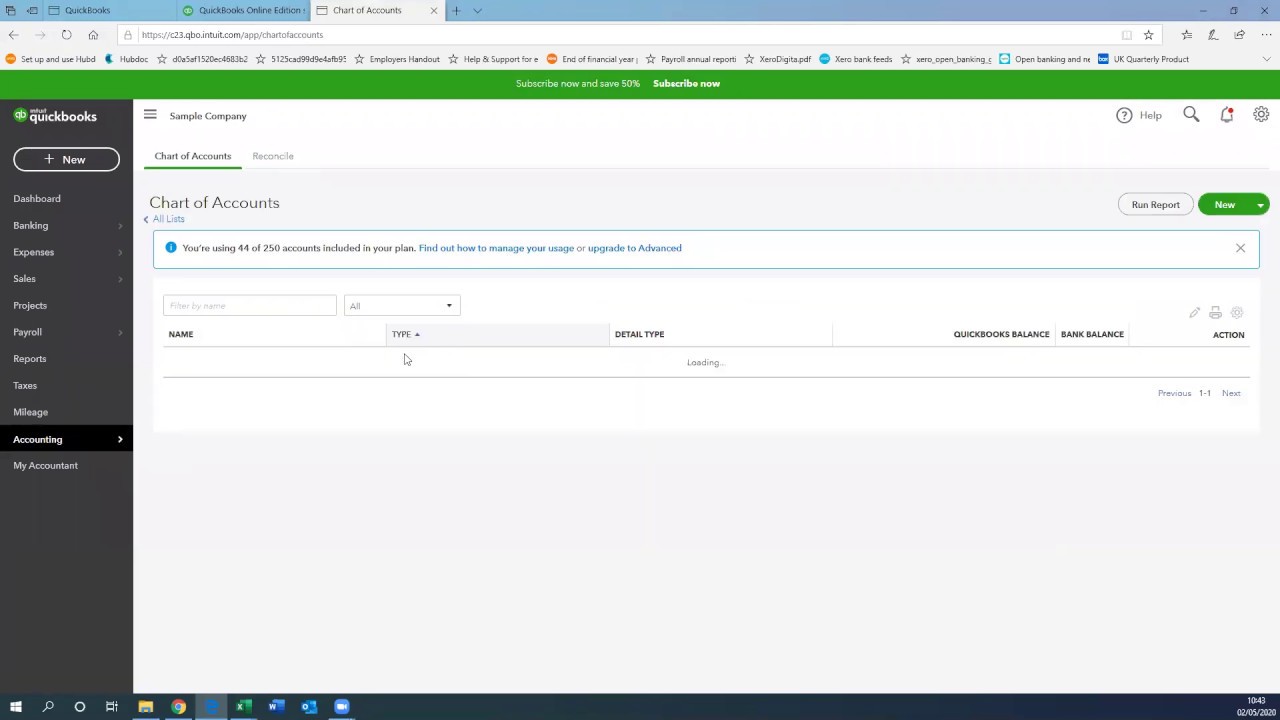

How To Record ERC Refund In Quickbooks

First off, we'll have to create a new account to hold and house this credit. You can create a deposit to record your erc credit. It is possible to make a deposit to record your particular erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment):.

How To Record A Refund In Quickbooks

It is possible to make a deposit to record your particular erc credit. Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): If you received a refund.

To Record A Deposit For The Refund Of Liabilities (Which Are, As You Say, Sitting On Your Balance Sheet As An Overpayment):

Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. It is possible to make a deposit to record your particular erc credit. First off, we'll have to create a new account to hold and house this credit.