How To Enter Depreciation In Quickbooks

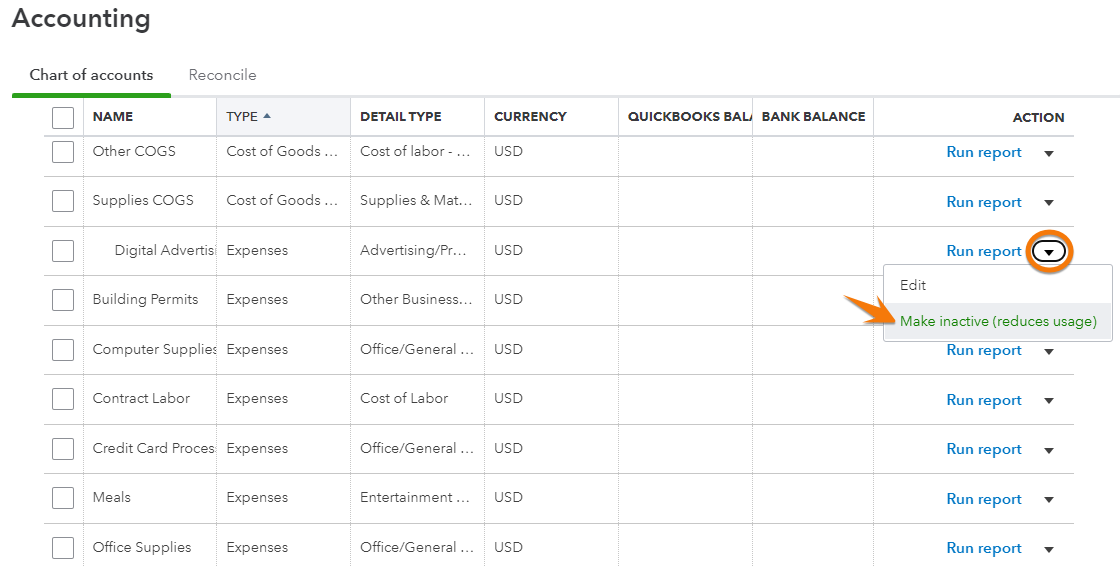

How To Enter Depreciation In Quickbooks - To enter a depreciation transaction: On the first line enter: In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Click create (+) > journal entry. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

To enter a depreciation transaction: In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. On the first line enter: Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Click create (+) > journal entry.

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Click create (+) > journal entry. To enter a depreciation transaction: Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. On the first line enter:

Depreciation Expense in QuickBooks YouTube

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. To enter a depreciation transaction: On the first line enter: Click create (+) > journal entry.

Adjusting Entry Depreciation 10380 QuickBooks Online 2023 YouTube

On the first line enter: To enter a depreciation transaction: In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Click create (+) > journal entry. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

What account do you credit for depreciation? Leia aqui What is journal

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. To enter a depreciation transaction: Click create (+) > journal entry. On the first line enter:

How to record Depreciation and Accumulated Depreciation in QuickBooks

To enter a depreciation transaction: On the first line enter: Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Click create (+) > journal entry. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records.

How to enter Depreciation into QuickBooks YouTube

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Click create (+) > journal entry. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. On the first line enter: To enter a depreciation transaction:

Depreciation Inside QuickBooks Desktop Candus Kampfer

Click create (+) > journal entry. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. To enter a depreciation transaction: Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. On the first line enter:

How do you handle depreciation on QB

To enter a depreciation transaction: In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. On the first line enter: Click create (+) > journal entry.

QuickBooks Online Tutorial Entering Depreciation Expenses Easily

On the first line enter: To enter a depreciation transaction: In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Click create (+) > journal entry.

Quickbooks Chart Of Accounts Excel Template

To enter a depreciation transaction: In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. Click create (+) > journal entry. On the first line enter: Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

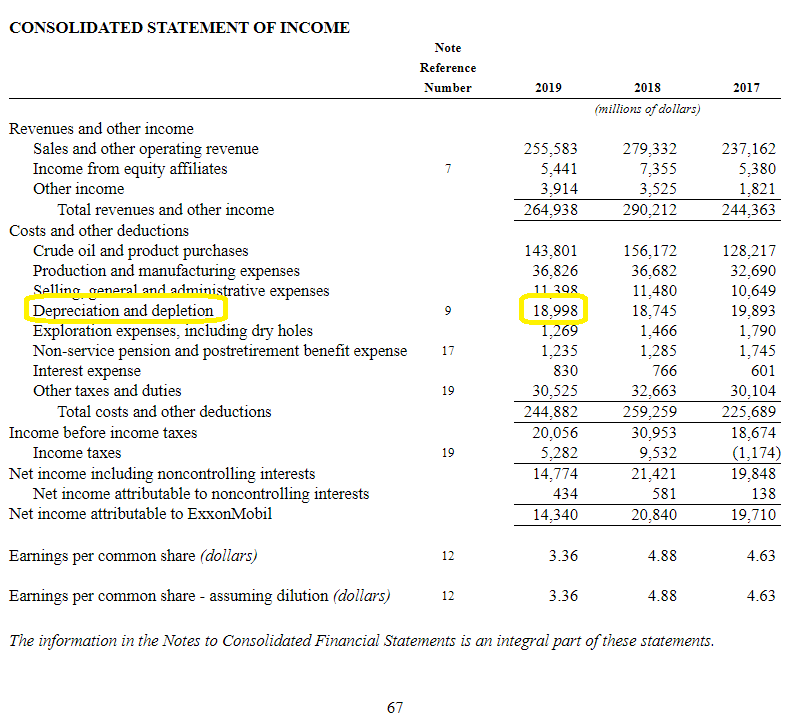

Statement Example Depreciation

To enter a depreciation transaction: On the first line enter: Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Click create (+) > journal entry. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records.

Click Create (+) > Journal Entry.

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. To enter a depreciation transaction: On the first line enter: In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records.