How To Complete Form 8958

How To Complete Form 8958 - How do i complete irs form 8958? Let’s start with the taxpayer information at the. Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. You'll need to sign in or create an account to connect with an expert. Your community property income will be your normal. This form will explain to the irs. See irs publication 555 community property for information on what allocations need to be done to the tax return. Once you have completed the steps above, please complete the married filing separately allocations form 8958.

Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. Once you have completed the steps above, please complete the married filing separately allocations form 8958. You'll need to sign in or create an account to connect with an expert. How do i complete irs form 8958? See irs publication 555 community property for information on what allocations need to be done to the tax return. Let’s start with the taxpayer information at the. This form will explain to the irs. Your community property income will be your normal.

This form will explain to the irs. Let’s start with the taxpayer information at the. How do i complete irs form 8958? See irs publication 555 community property for information on what allocations need to be done to the tax return. You'll need to sign in or create an account to connect with an expert. Your community property income will be your normal. Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. Once you have completed the steps above, please complete the married filing separately allocations form 8958.

Fill Free fillable Form 8958 Allocation of Tax Amounts Between

See irs publication 555 community property for information on what allocations need to be done to the tax return. Once you have completed the steps above, please complete the married filing separately allocations form 8958. Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. Let’s start with the taxpayer information.

Ub 04 Form Pdf Fillable Free Printable Forms Free Online

Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. See irs publication 555 community property for information on what allocations need to be done to the tax return. Your community property income will be your normal. How do i complete irs form 8958? This form will explain to the irs.

Free Fillable Form 8958 Printable Forms Free Online

Your community property income will be your normal. How do i complete irs form 8958? Let’s start with the taxpayer information at the. See irs publication 555 community property for information on what allocations need to be done to the tax return. Once you have completed the steps above, please complete the married filing separately allocations form 8958.

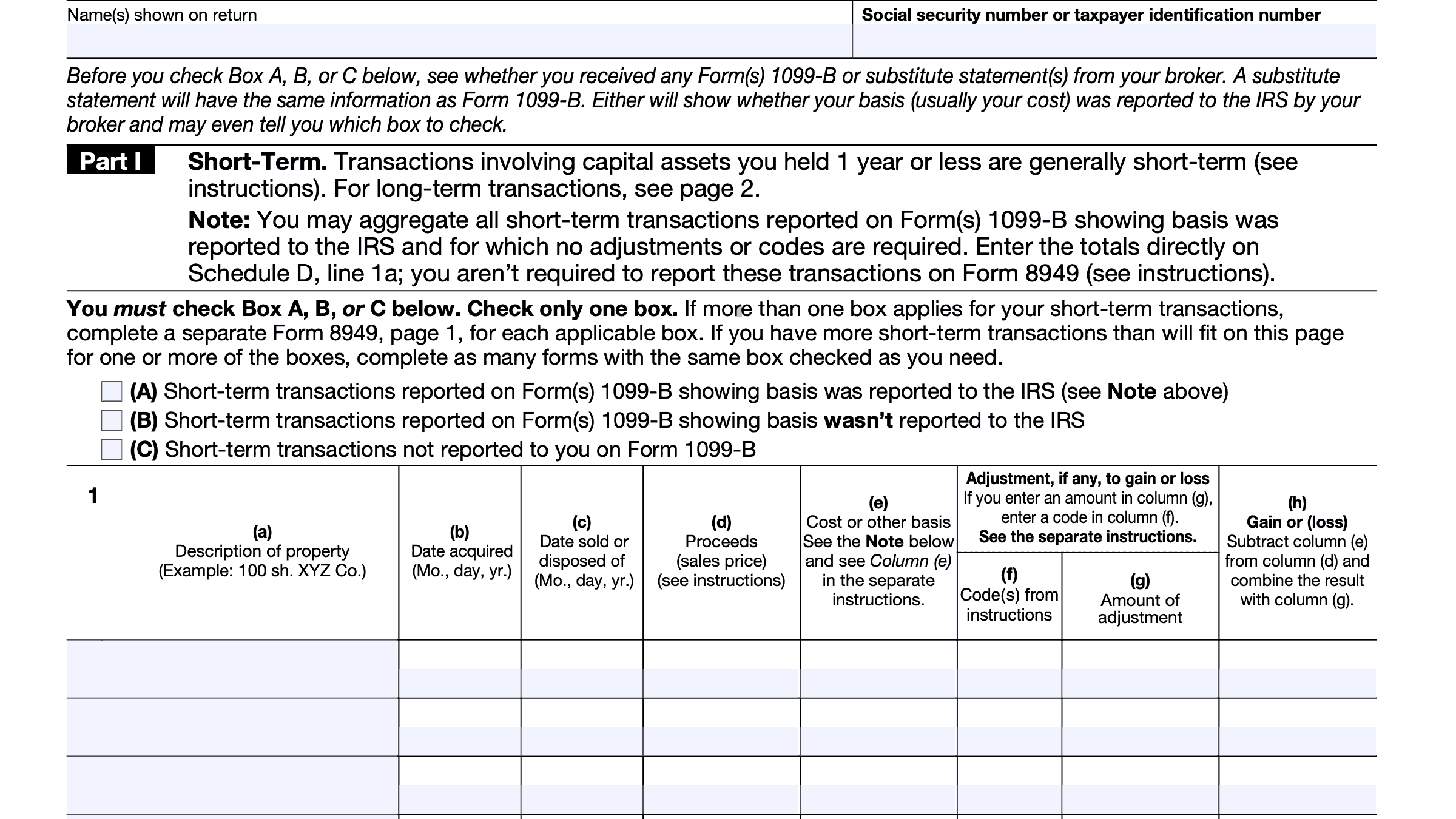

Form 8949 Instructions 2023 Printable Forms Free Online

Once you have completed the steps above, please complete the married filing separately allocations form 8958. You'll need to sign in or create an account to connect with an expert. Your community property income will be your normal. How do i complete irs form 8958? Learn how to use form 8958 to divide tax obligations between married filing separate spouses.

Sample Irs Form 4810 Fill Out And Sign Printable Pdf Template Signnow

You'll need to sign in or create an account to connect with an expert. Your community property income will be your normal. See irs publication 555 community property for information on what allocations need to be done to the tax return. Once you have completed the steps above, please complete the married filing separately allocations form 8958. This form will.

Screenshot1 The Official Blog of TaxSlayer

See irs publication 555 community property for information on what allocations need to be done to the tax return. Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. Once you have completed the steps above, please complete the married filing separately allocations form 8958. This form will explain to the.

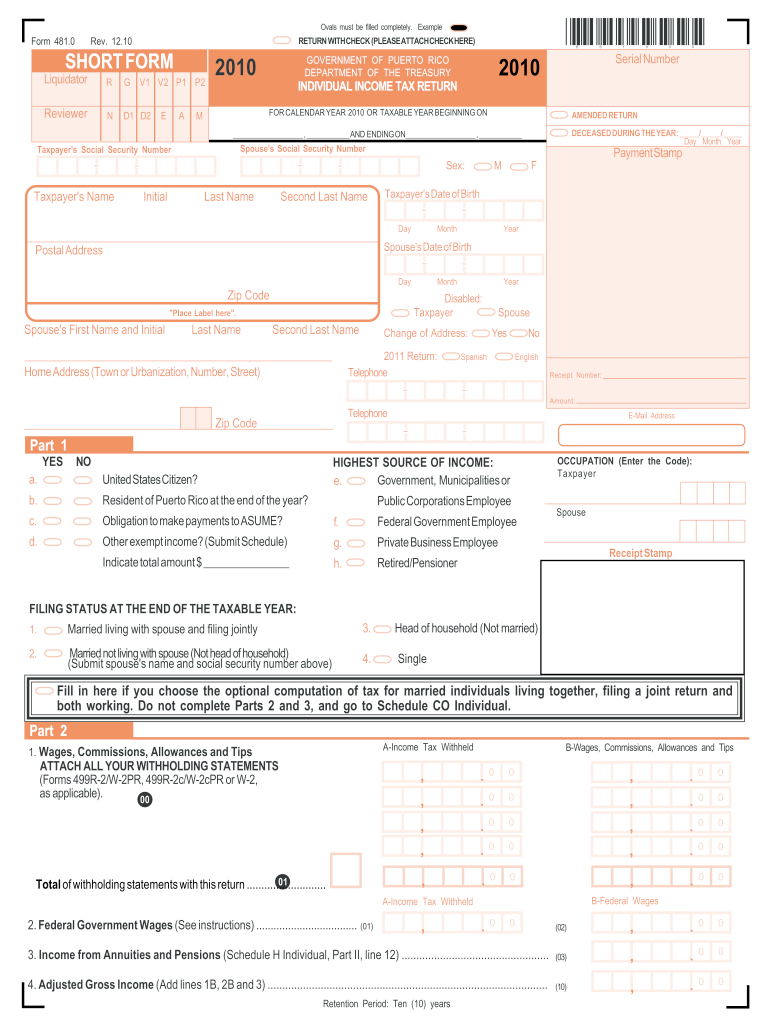

Tax Subject CA1 Filing a California Tax Return

This form will explain to the irs. Let’s start with the taxpayer information at the. See irs publication 555 community property for information on what allocations need to be done to the tax return. Your community property income will be your normal. You'll need to sign in or create an account to connect with an expert.

Americans forprosperity2007

See irs publication 555 community property for information on what allocations need to be done to the tax return. Once you have completed the steps above, please complete the married filing separately allocations form 8958. Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. Your community property income will be.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain Free

Your community property income will be your normal. This form will explain to the irs. See irs publication 555 community property for information on what allocations need to be done to the tax return. Once you have completed the steps above, please complete the married filing separately allocations form 8958. Learn how to use form 8958 to divide tax obligations.

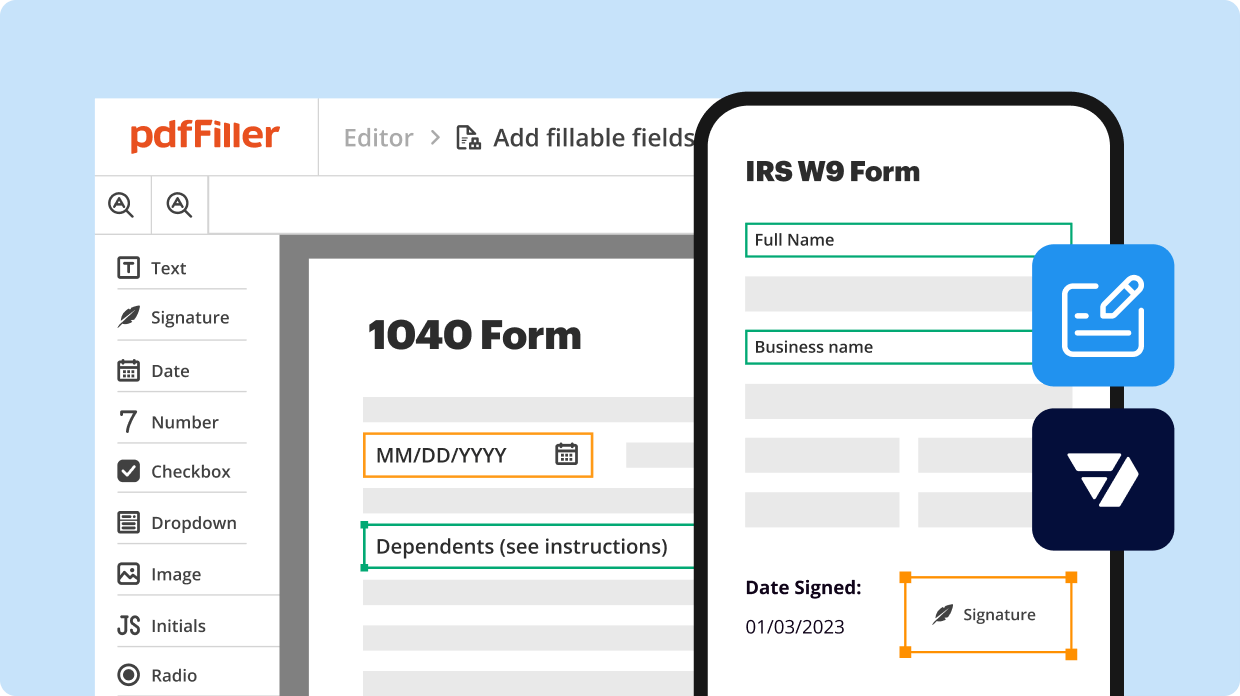

Complete Form 8958 on Windows OS pdfFiller

Let’s start with the taxpayer information at the. Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. How do i complete irs form 8958? Once you have completed the steps above, please complete the married filing separately allocations form 8958. You'll need to sign in or create an account to.

You'll Need To Sign In Or Create An Account To Connect With An Expert.

See irs publication 555 community property for information on what allocations need to be done to the tax return. Your community property income will be your normal. Learn how to use form 8958 to divide tax obligations between married filing separate spouses or rdps with community. Let’s start with the taxpayer information at the.

Once You Have Completed The Steps Above, Please Complete The Married Filing Separately Allocations Form 8958.

How do i complete irs form 8958? This form will explain to the irs.