How To Categorize Sales Tax Paid In Quickbooks

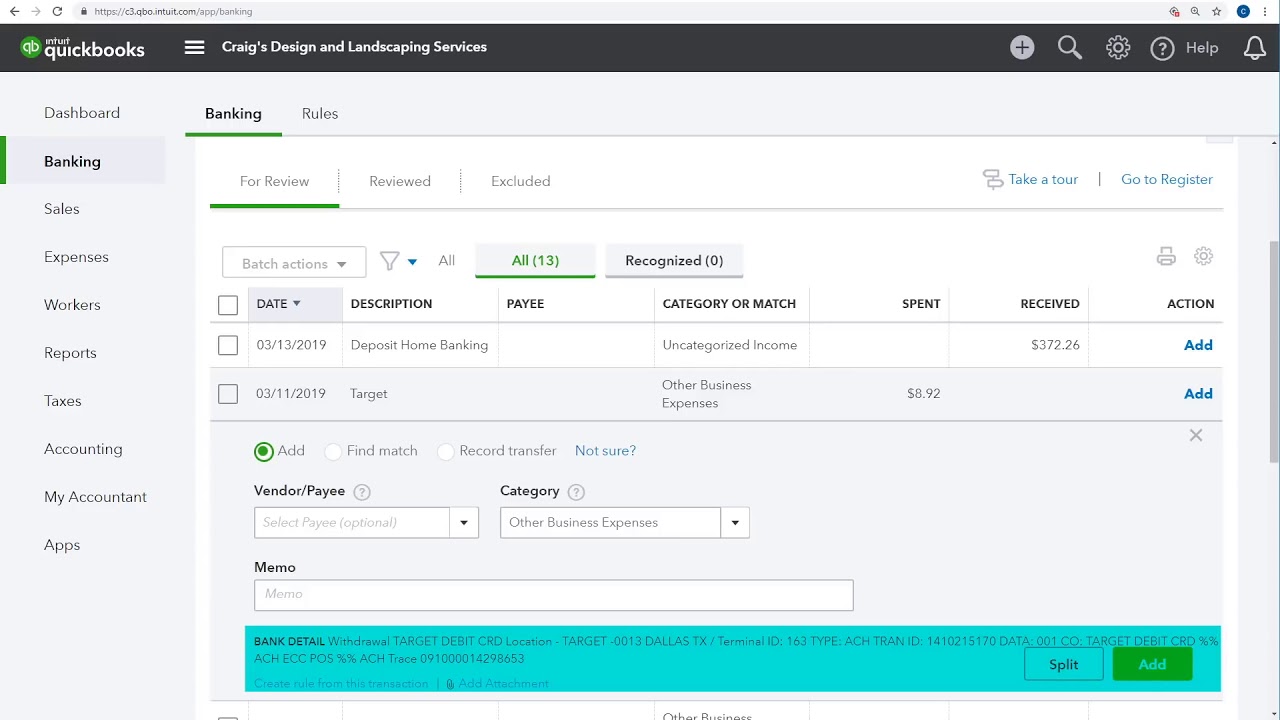

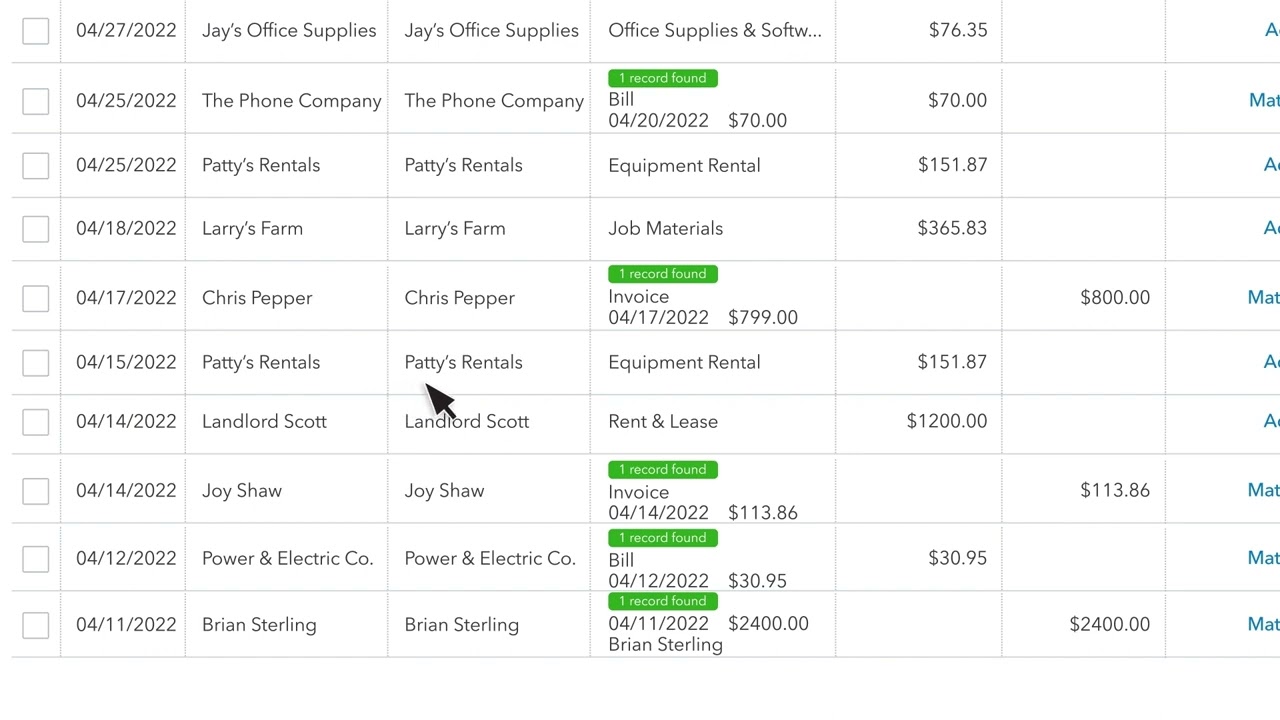

How To Categorize Sales Tax Paid In Quickbooks - To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. Set up sales tax rates : Go to company settings > sales tax. (left dashboard > taxes > sales tax. You will need to manually record sales tax payment through the sales tax center in qbo. Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. To categorize tax payments that come in through the bank feed in quickbooks desktop, you can follow these steps: To categorize sales tax paid in quickbooks, follow these steps: Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,.

Go to company settings > sales tax. To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. (left dashboard > taxes > sales tax. Set up sales tax rates : Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. You will need to manually record sales tax payment through the sales tax center in qbo. To categorize sales tax paid in quickbooks, follow these steps: To categorize tax payments that come in through the bank feed in quickbooks desktop, you can follow these steps: Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,.

(left dashboard > taxes > sales tax. Go to company settings > sales tax. Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. You will need to manually record sales tax payment through the sales tax center in qbo. To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. To categorize tax payments that come in through the bank feed in quickbooks desktop, you can follow these steps: Set up sales tax rates : Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. To categorize sales tax paid in quickbooks, follow these steps:

How To Categorize a Tax Refund In QuickBooks

Set up sales tax rates : (left dashboard > taxes > sales tax. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. To categorize tax payments that come in through the bank feed in quickbooks.

How To Categorize Cleaning Expenses In Quickbooks at Kelly Puckett blog

Go to company settings > sales tax. Set up sales tax rates : To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. Categorizing estimated tax payments in quickbooks involves creating a.

How To Categorize State Tax Payments In Quickbooks Daily Sales

To categorize tax payments that come in through the bank feed in quickbooks desktop, you can follow these steps: Go to company settings > sales tax. (left dashboard > taxes > sales tax. You will need to manually record sales tax payment through the sales tax center in qbo. Learn how to efficiently manage sales tax in quickbooks, from setup.

Categorize Personal Expense Paid with Business Card In QuickBooks

Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. (left dashboard > taxes > sales tax. To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. Set up sales tax rates : You will need to manually record sales tax payment.

How to Categorize Transactions in QuickBooks

Go to company settings > sales tax. You will need to manually record sales tax payment through the sales tax center in qbo. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. To categorize sales.

How to Setup Sales Tax in Quickbooks YouTube

To categorize tax payments that come in through the bank feed in quickbooks desktop, you can follow these steps: To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. Go to company settings > sales tax. Learn how to efficiently manage sales tax in quickbooks, from setup to recording.

How to Categorize Transactions in QuickBooks

To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. (left dashboard > taxes > sales tax. Set up sales tax rates : Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. To categorize tax payments that come in through the.

销售税类型和目标销售税的例子 金博宝官网网址

Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Go to company settings > sales tax. To categorize sales tax paid in quickbooks, follow these steps: Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. To record sales tax payments in quickbooks online, follow.

How to Categorise Transactions in QuickBooks Online Introduction to

To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. To categorize sales tax paid in quickbooks, follow these steps: Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. To categorize tax payments that come in through the bank feed in.

How To Categorize Expenses in QuickBooks (FAQs Guide) LiveFlow

Go to company settings > sales tax. Set up sales tax rates : To categorize sales tax paid in quickbooks, follow these steps: (left dashboard > taxes > sales tax. To categorize tax payments that come in through the bank feed in quickbooks desktop, you can follow these steps:

Go To Company Settings > Sales Tax.

Learn how to efficiently manage sales tax in quickbooks, from setup to recording transactions, ensuring compliance and. (left dashboard > taxes > sales tax. You will need to manually record sales tax payment through the sales tax center in qbo. To categorize tax payments that come in through the bank feed in quickbooks desktop, you can follow these steps:

Set Up Sales Tax Rates :

To categorize sales tax paid in quickbooks, follow these steps: To record sales tax payments in quickbooks online, follow a structured process that involves setting up sales tax, recording the payments. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,.