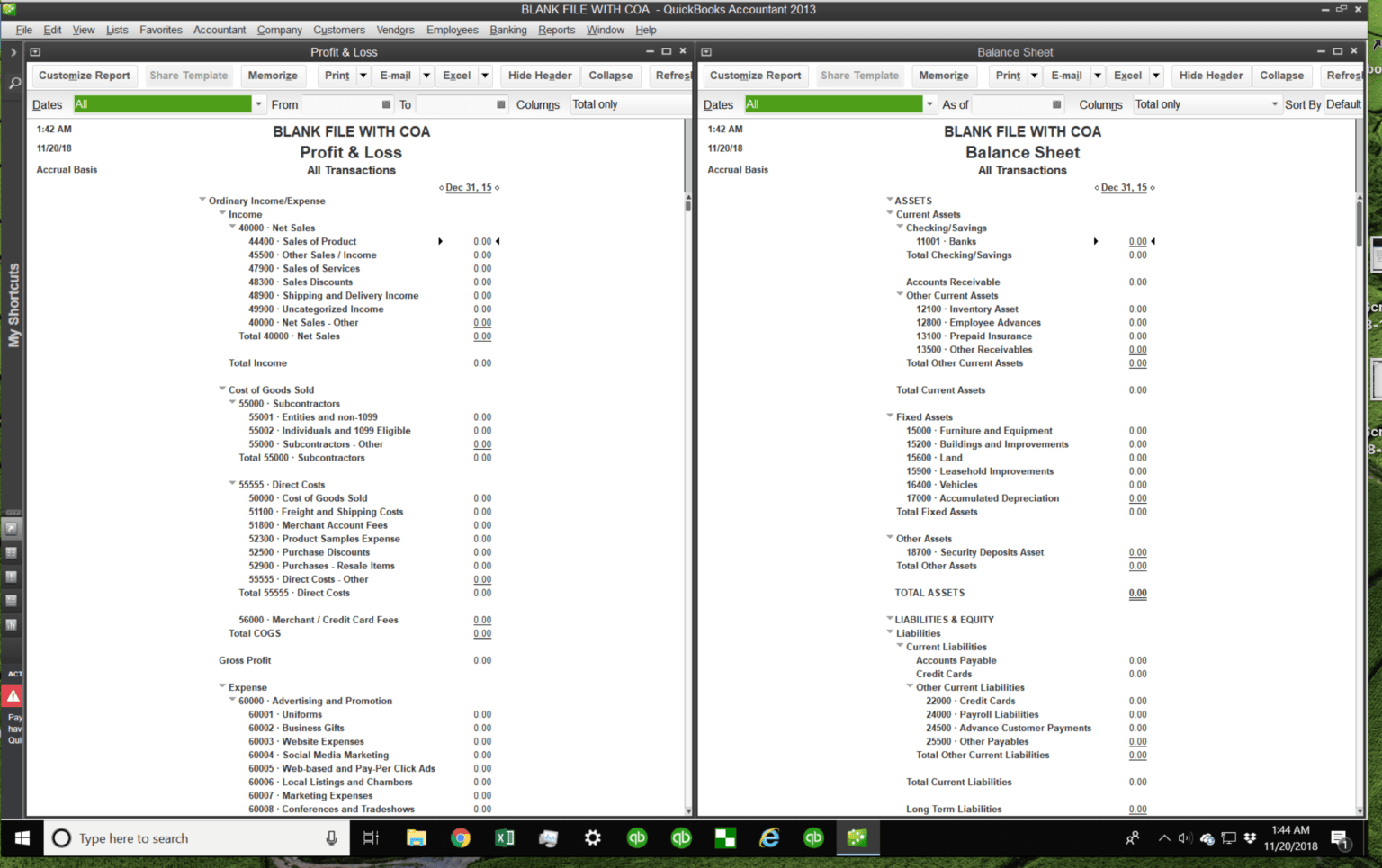

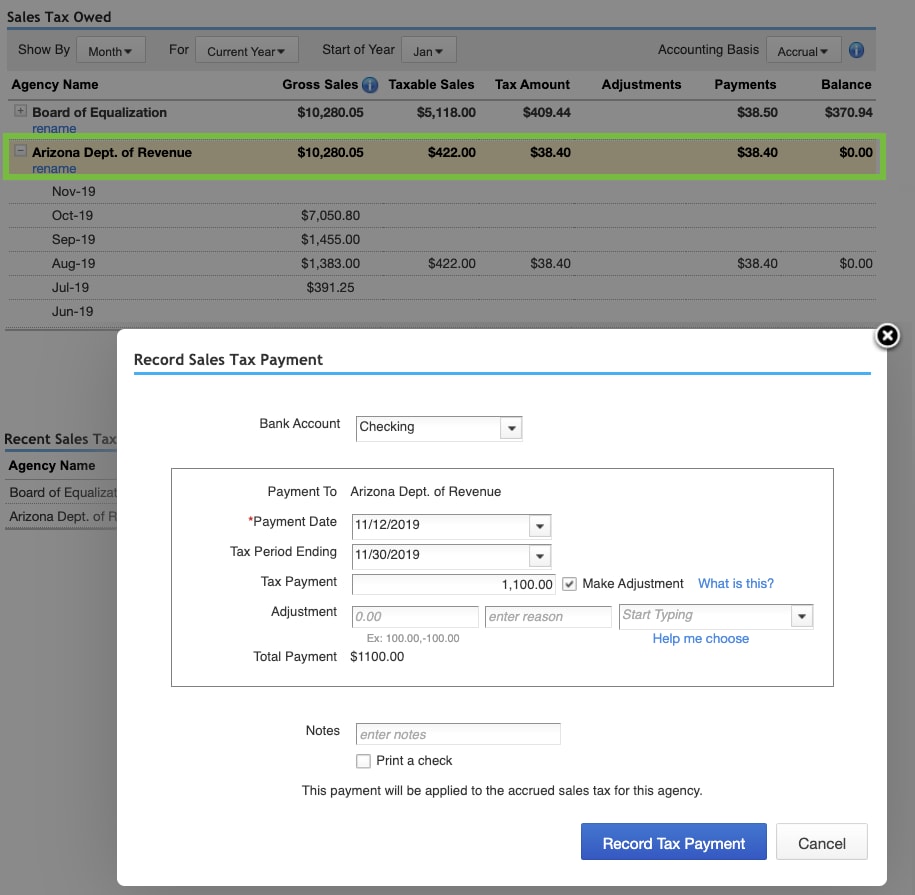

How To Categorize Property Tax Payable In Quickbooks Online

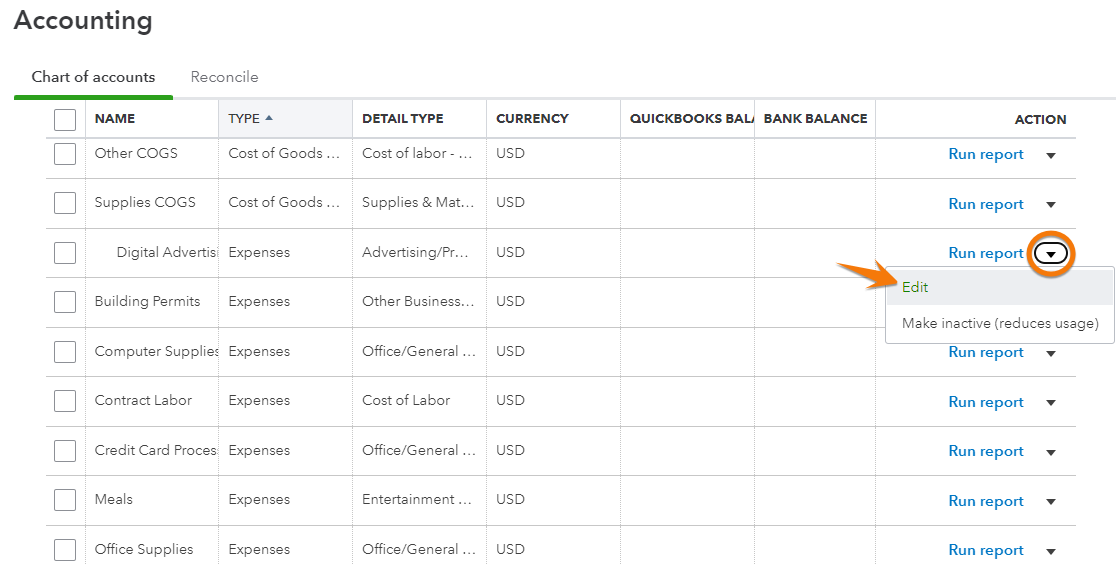

How To Categorize Property Tax Payable In Quickbooks Online - Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Categorizing property tax payable in quickbooks online is a straightforward process. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Set up a chart of accounts :. Navigate to the accounting tab, then chart of. With the following steps, you should be able to categorize your expected tax payments.

Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. With the following steps, you should be able to categorize your expected tax payments. Set up a chart of accounts :. Navigate to the accounting tab, then chart of. Categorizing property tax payable in quickbooks online is a straightforward process. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important.

Set up a chart of accounts :. With the following steps, you should be able to categorize your expected tax payments. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Categorizing property tax payable in quickbooks online is a straightforward process. Navigate to the accounting tab, then chart of.

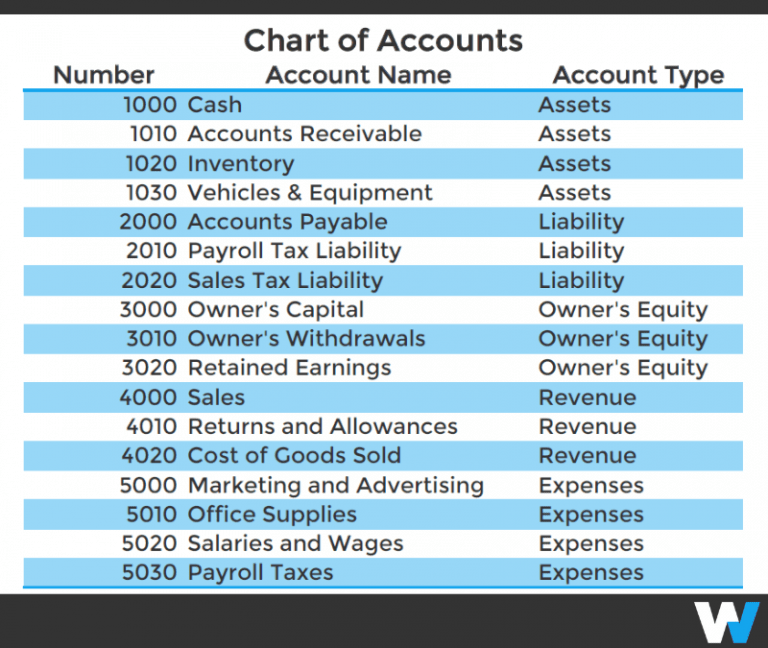

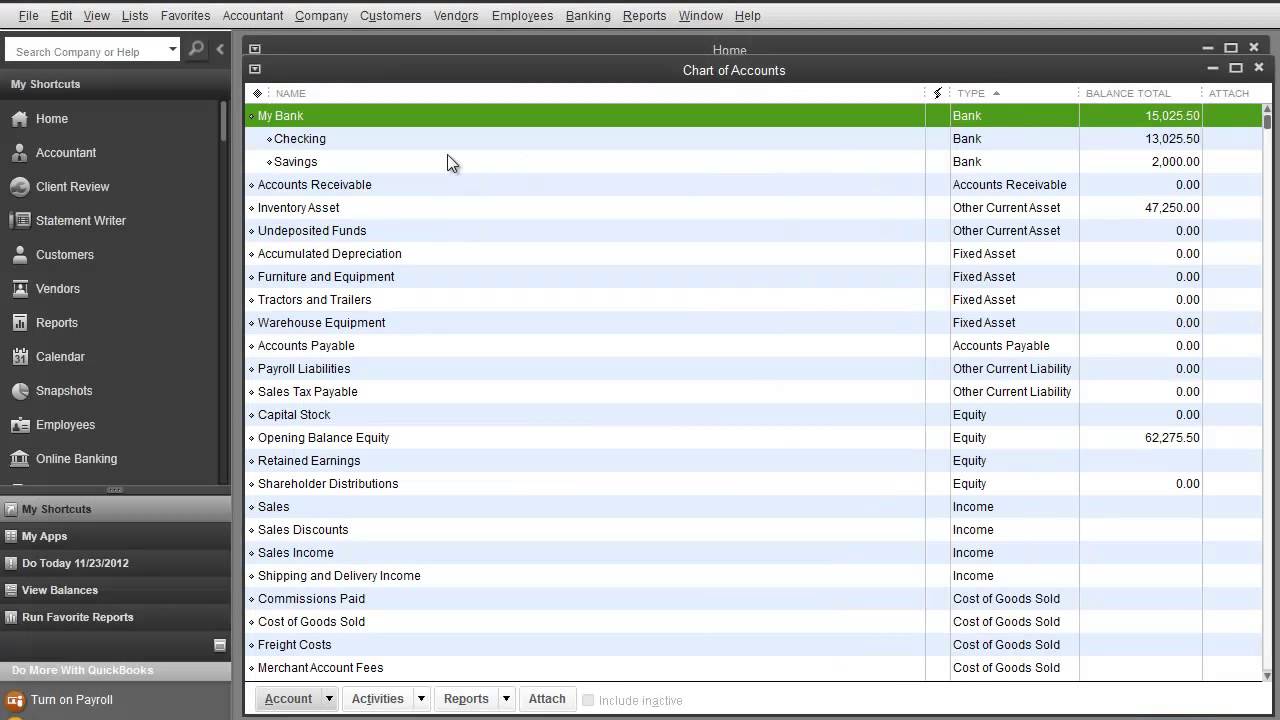

Real Estate Agent Chart Of Accounts

In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. With the following steps, you should be able to categorize your expected tax payments. Set up a chart of accounts :. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Navigate to the.

Quickbooks Chart Of Accounts Excel Template

Navigate to the accounting tab, then chart of. Set up a chart of accounts :. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Categorizing property tax payable in quickbooks online is a.

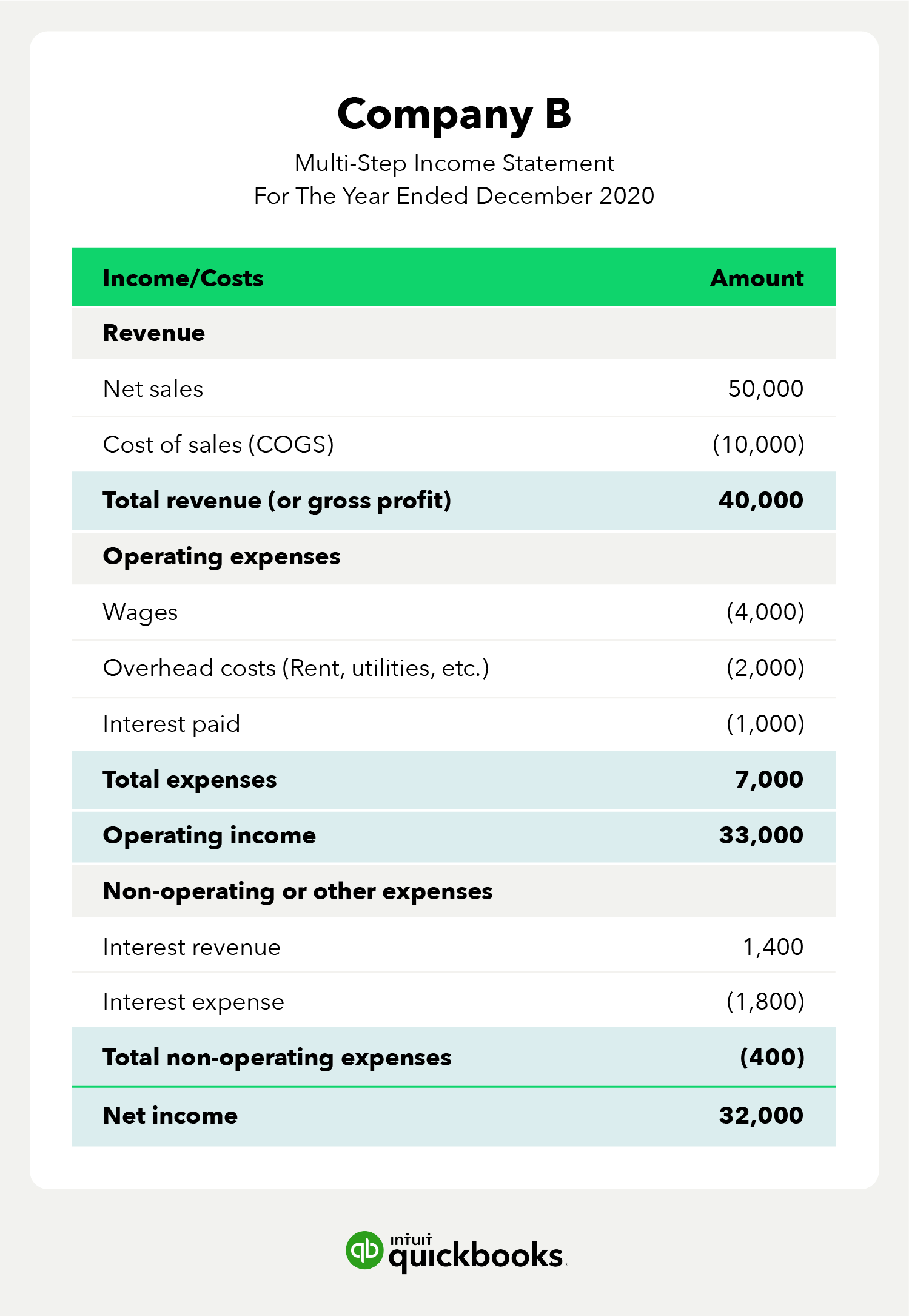

Is expense a Leia aqui What is an expense classified as

With the following steps, you should be able to categorize your expected tax payments. Navigate to the accounting tab, then chart of. Set up a chart of accounts :. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Categorizing property tax payable in quickbooks online is a straightforward process.

Quickbooks Chart Of Accounts Template Excel

With the following steps, you should be able to categorize your expected tax payments. Categorizing property tax payable in quickbooks online is a straightforward process. Navigate to the accounting tab, then chart of. Set up a chart of accounts :. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important.

How to Categorize Transactions in QuickBooks

Set up a chart of accounts :. Navigate to the accounting tab, then chart of. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. With the following steps, you should be able to categorize your expected tax payments. In this article, we’ll walk you through the process of categorizing tax payments in.

Chart Of Accounts For Travel Agency

In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Set up a chart of accounts :. Categorizing property tax payable in quickbooks online is a straightforward process. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Navigate to the accounting tab, then.

How to change payment method for quickbooks payroll service nvfad

Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Categorizing property tax payable in quickbooks online is a straightforward process. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. With the following steps, you should be able to categorize your expected tax.

How to set up a Chart of Accounts in QuickBooks Chart

Set up a chart of accounts :. Navigate to the accounting tab, then chart of. Categorizing property tax payable in quickbooks online is a straightforward process. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. With the following steps, you should be able to categorize your expected tax payments.

How To Categorize Non Business Expenses In Quickbooks at Armandina

Navigate to the accounting tab, then chart of. Set up a chart of accounts :. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,. Categorizing property tax payable in quickbooks online is a.

How To Categorize Non Business Expenses In Quickbooks at Armandina

Categorizing property tax payable in quickbooks online is a straightforward process. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. With the following steps, you should be able to categorize your expected tax payments. Set up a chart of accounts :. Categorizing estimated tax payments in quickbooks involves creating a.

Set Up A Chart Of Accounts :.

With the following steps, you should be able to categorize your expected tax payments. Navigate to the accounting tab, then chart of. Categorizing property tax payable in quickbooks online is a straightforward process. Categorizing estimated tax payments in quickbooks involves creating a systematic approach to record and track these payments,.