How To Categorize Client Gifts In Quickbooks

How To Categorize Client Gifts In Quickbooks - Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. Let me guide you on how to record gift certificates in quickbooks online, rq. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. So, which detail type should be used for client gifts when setting this up in the chart of accounts? Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Once you accept gift certificate payments, you agree.

Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. So, which detail type should be used for client gifts when setting this up in the chart of accounts? In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Once you accept gift certificate payments, you agree. Let me guide you on how to record gift certificates in quickbooks online, rq. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and.

Once you accept gift certificate payments, you agree. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. So, which detail type should be used for client gifts when setting this up in the chart of accounts? Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Let me guide you on how to record gift certificates in quickbooks online, rq.

How to Categorize Gifts in QuickBooks

In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Let me guide you on how to record gift certificates in quickbooks online, rq..

How To Categorize Transactions In Quickbooks

In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Proper categorization.

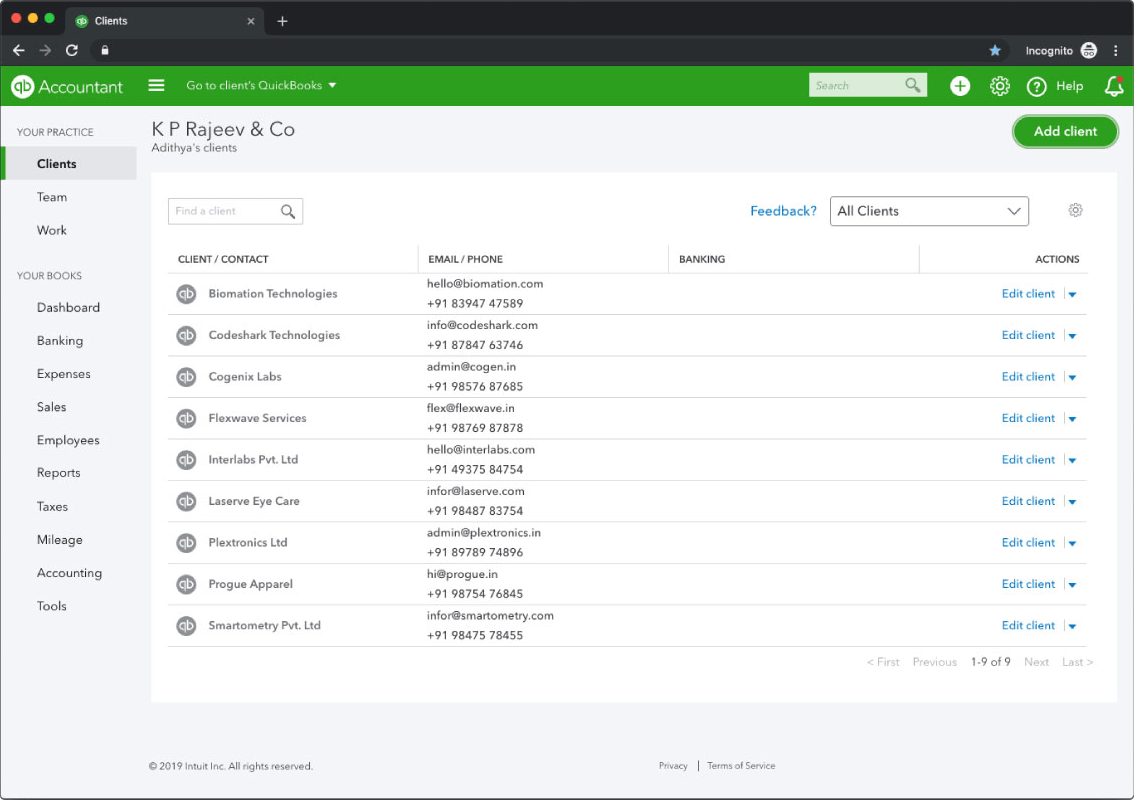

QuickBooks Online Accountant (QBOA) Manage Your Client's Account Easily

Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Let.

How To Categorize Expenses in QuickBooks (FAQs Guide) LiveFlow

In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Once you accept gift certificate payments, you agree. Properly categorizing client gifts in quickbooks is essential for.

QUICKBOOKS (QBO) HOW TO Categorize transactions in Bank Feeds YouTube

So, which detail type should be used for client gifts when setting this up in the chart of accounts? In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company..

How to Categorize Transactions in QuickBooks

So, which detail type should be used for client gifts when setting this up in the chart of accounts? Let me guide you on how to record gift certificates in quickbooks online, rq. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Once you accept gift certificate payments, you agree. In this comprehensive.

How to categorize transactions in QuickBooks Online Booke AI

I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Once you accept gift certificate payments, you agree. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. Proper categorization of gifts in quickbooks requires a systematic approach to.

How to Categorize Gifts in QuickBooks

Let me guide you on how to record gift certificates in quickbooks online, rq. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Once you accept gift certificate payments, you agree. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. In this comprehensive.

How to Categorize Credit Card Payments in QuickBooks? MWJ Consultancy

Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. Once you accept gift certificate payments, you agree..

How To Categorize Employee Gifts In Quickbooks

Once you accept gift certificate payments, you agree. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. So, which detail type should be used for client gifts when setting this up in the chart of accounts? I simply create an expense category in the chart of accounts for client gifts, much like.

I Simply Create An Expense Category In The Chart Of Accounts For Client Gifts, Much Like You Would For Meals And Entertainment (Or Business.

Once you accept gift certificate payments, you agree. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and.

Let Me Guide You On How To Record Gift Certificates In Quickbooks Online, Rq.

In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. So, which detail type should be used for client gifts when setting this up in the chart of accounts?