How To Apply A Credit From A Vendor In Quickbooks

How To Apply A Credit From A Vendor In Quickbooks - When you were given the credit. Enter vendor credits to record: Apply the vendor credit to a bill. How to record and how to apply vendor credits to quickbooks bills. That you should reconcile your vendor statements, use quickbooks’ online. Applying for vendor credits in quickbooks online can simplify your expense management and improve the accuracy of your financial records. I'll be delighted to guide you in applying a vendor credit toward any open or future bill. Click create (+) > vendor credit. In case you haven't created the vendor. Learn how to record a refund or credit from a vendor in quickbooks online.

Applying for vendor credits in quickbooks online can simplify your expense management and improve the accuracy of your financial records. In case you haven't created the vendor. Once you’ve entered all the details, click save and close to record the vendor credit. Choose the vendor who is giving you the credit. Just got a refund for a business expense? Learn how to record a refund or credit from a vendor in quickbooks online. Apply the vendor credit to a bill. When you were given the credit. Enter vendor credits to record: That you should reconcile your vendor statements, use quickbooks’ online.

How to record and how to apply vendor credits to quickbooks bills. Enter vendor credits to record: Once you’ve entered all the details, click save and close to record the vendor credit. Learn how to record a refund or credit from a vendor in quickbooks online. Just got a refund for a business expense? That you should reconcile your vendor statements, use quickbooks’ online. I'll be delighted to guide you in applying a vendor credit toward any open or future bill. In case you haven't created the vendor. Applying for vendor credits in quickbooks online can simplify your expense management and improve the accuracy of your financial records. When you were given the credit.

How to Apply for Vendor Credit in QuickBooks Online? MWJ Consultancy

Enter vendor credits to record: In case you haven't created the vendor. Choose the vendor who is giving you the credit. That you should reconcile your vendor statements, use quickbooks’ online. Once you’ve entered all the details, click save and close to record the vendor credit.

Company Settings Automatically Apply Credits Experts in QuickBooks

In case you haven't created the vendor. Click create (+) > vendor credit. How to record and how to apply vendor credits to quickbooks bills. That you should reconcile your vendor statements, use quickbooks’ online. Learn how to record a refund or credit from a vendor in quickbooks online.

How to Apply Vendor Credit in QuickBooks Online

Just got a refund for a business expense? Click create (+) > vendor credit. Choose the vendor who is giving you the credit. Learn how to record a refund or credit from a vendor in quickbooks online. In case you haven't created the vendor.

Quickbooks A follow along guide on how to use it TechStory

Choose the vendor who is giving you the credit. In case you haven't created the vendor. Just got a refund for a business expense? Apply the vendor credit to a bill. I'll be delighted to guide you in applying a vendor credit toward any open or future bill.

Apply credit memo to invoice in quickbooks for mac poobluesky

Enter vendor credits to record: Choose the vendor who is giving you the credit. Apply the vendor credit to a bill. When you were given the credit. How to record and how to apply vendor credits to quickbooks bills.

Solved How do I apply a vendor credit to the amount owed to vendor?

Applying for vendor credits in quickbooks online can simplify your expense management and improve the accuracy of your financial records. Choose the vendor who is giving you the credit. Learn how to record a refund or credit from a vendor in quickbooks online. Once you’ve entered all the details, click save and close to record the vendor credit. Just got.

How To Apply A Vendor Credit In Quickbooks

When you were given the credit. In case you haven't created the vendor. Apply the vendor credit to a bill. Just got a refund for a business expense? Learn how to record a refund or credit from a vendor in quickbooks online.

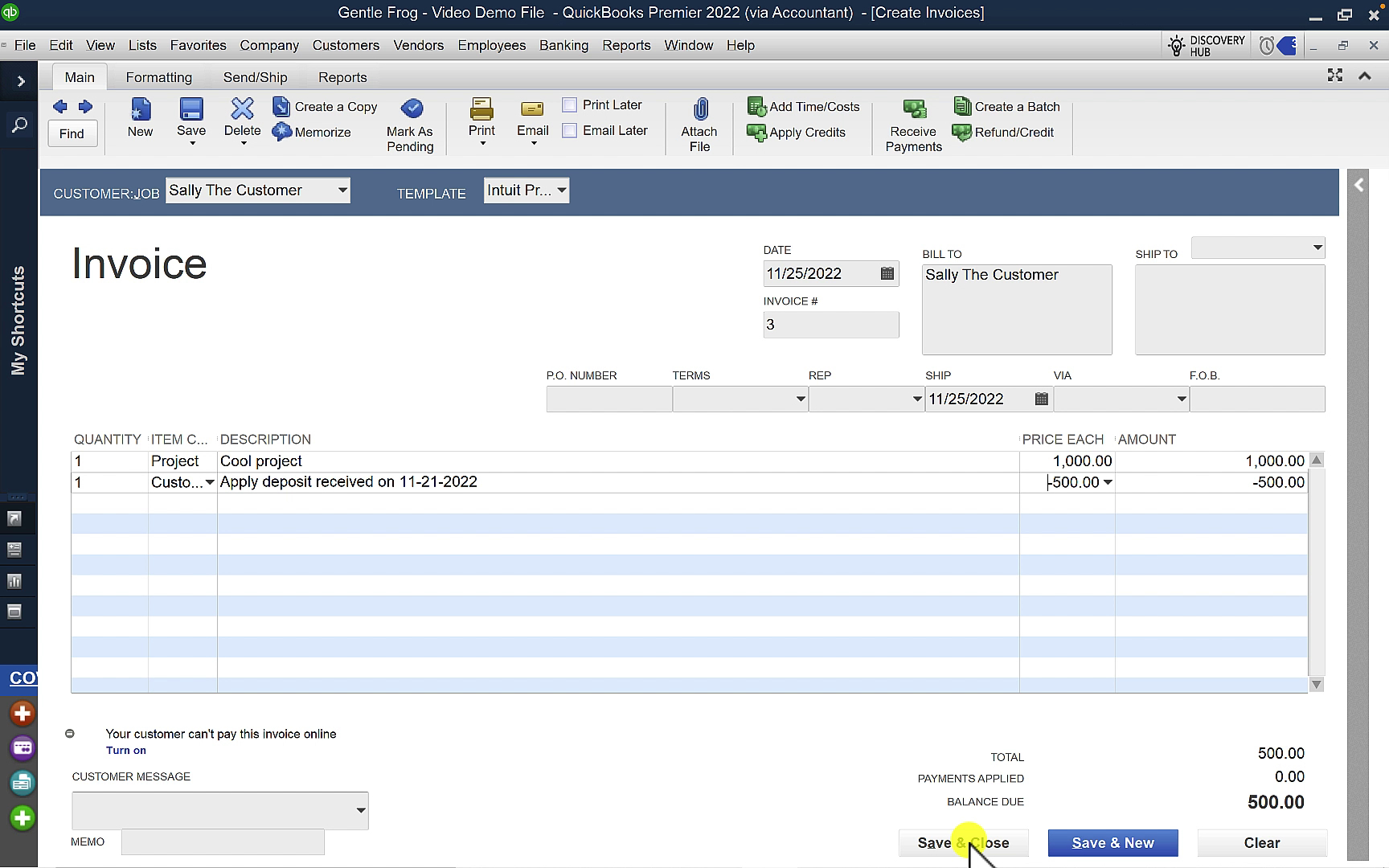

How to Collect Prepayments/Deposits in QuickBooks Desktop with a

Once you’ve entered all the details, click save and close to record the vendor credit. How to record and how to apply vendor credits to quickbooks bills. In case you haven't created the vendor. Apply the vendor credit to a bill. That you should reconcile your vendor statements, use quickbooks’ online.

Apply Credit to Set of Invoices

Learn how to record a refund or credit from a vendor in quickbooks online. When you were given the credit. I'll be delighted to guide you in applying a vendor credit toward any open or future bill. How to record and how to apply vendor credits to quickbooks bills. Applying for vendor credits in quickbooks online can simplify your expense.

Apply & Record Vendor Credit in QuickBooks Online YouTube

How to record and how to apply vendor credits to quickbooks bills. In case you haven't created the vendor. Just got a refund for a business expense? Apply the vendor credit to a bill. I'll be delighted to guide you in applying a vendor credit toward any open or future bill.

Learn How To Record A Refund Or Credit From A Vendor In Quickbooks Online.

How to record and how to apply vendor credits to quickbooks bills. Click create (+) > vendor credit. Apply the vendor credit to a bill. I'll be delighted to guide you in applying a vendor credit toward any open or future bill.

Once You’ve Entered All The Details, Click Save And Close To Record The Vendor Credit.

Choose the vendor who is giving you the credit. That you should reconcile your vendor statements, use quickbooks’ online. In case you haven't created the vendor. Enter vendor credits to record:

Just Got A Refund For A Business Expense?

When you were given the credit. Applying for vendor credits in quickbooks online can simplify your expense management and improve the accuracy of your financial records.