Goat Tax Form

Goat Tax Form - However, you cannot claim a goat who was born on your place though. If you didn't find what you need, you can send an inquiry through our contact form. What values counts towards the $600 threshold for taxes when selling on goat? Is it the initial selling price or the final cash out value (when. This includes relevant tax forms. Fuel expenses or mileage to go get supplies. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find revenue in each of those tax forms is a little different. Goat.tax provides several items in its final deliverable for every study completed on the platform.

However, you cannot claim a goat who was born on your place though. What values counts towards the $600 threshold for taxes when selling on goat? Fuel expenses or mileage to go get supplies. This includes relevant tax forms. Is it the initial selling price or the final cash out value (when. Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find revenue in each of those tax forms is a little different. If you didn't find what you need, you can send an inquiry through our contact form. Goat.tax provides several items in its final deliverable for every study completed on the platform. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as.

However, you cannot claim a goat who was born on your place though. If you didn't find what you need, you can send an inquiry through our contact form. Fuel expenses or mileage to go get supplies. Goat.tax provides several items in its final deliverable for every study completed on the platform. Is it the initial selling price or the final cash out value (when. This includes relevant tax forms. What values counts towards the $600 threshold for taxes when selling on goat? Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find revenue in each of those tax forms is a little different.

GOAT.tax Partner's with CPAs

Is it the initial selling price or the final cash out value (when. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. Fuel expenses or mileage to go get supplies. This includes relevant tax forms. What values counts towards the $600 threshold for taxes when selling on.

FileDomestic Goat Portrait (aka).jpg Wikimedia Commons

However, you cannot claim a goat who was born on your place though. If you didn't find what you need, you can send an inquiry through our contact form. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. This includes relevant tax forms. What values counts towards.

Account Info GOAT.tax

Is it the initial selling price or the final cash out value (when. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. Fuel expenses or mileage to go get supplies. Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find.

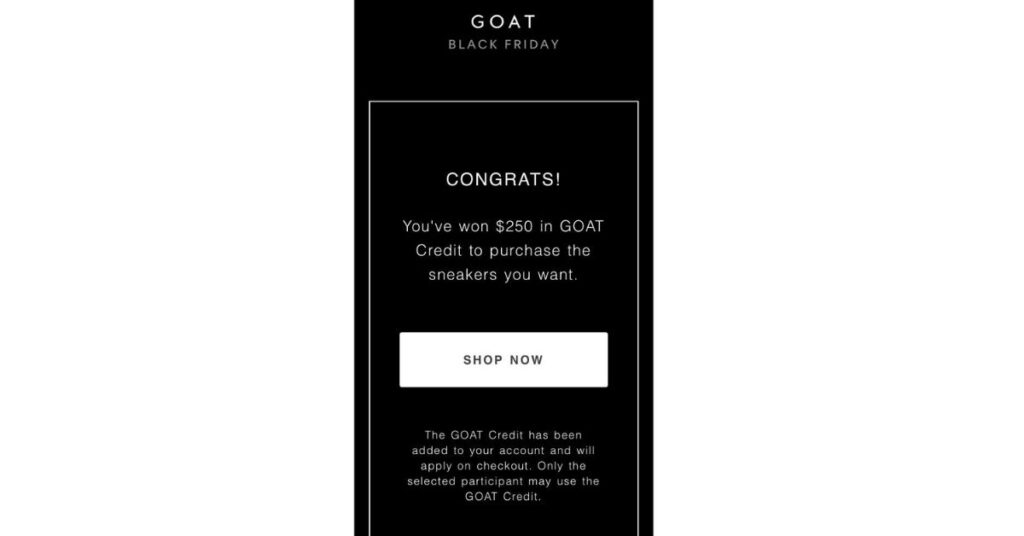

9 Does Goat Credit Expire? Full Guide

This includes relevant tax forms. However, you cannot claim a goat who was born on your place though. Is it the initial selling price or the final cash out value (when. Goat.tax provides several items in its final deliverable for every study completed on the platform. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer.

The Tax Goat Tax Goat is a Tax Software Provider

Goat.tax provides several items in its final deliverable for every study completed on the platform. What values counts towards the $600 threshold for taxes when selling on goat? This includes relevant tax forms. Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find revenue in each of those tax forms is a little.

Basic Goat coloring page Download, Print or Color Online for Free

Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find revenue in each of those tax forms is a little different. However, you cannot claim a goat who was born on your place though. What values counts towards the $600 threshold for taxes when selling on goat? Is it the initial selling price.

The Tax Goat Facebook Linktree

Fuel expenses or mileage to go get supplies. Is it the initial selling price or the final cash out value (when. What values counts towards the $600 threshold for taxes when selling on goat? Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find revenue in each of those tax forms is a.

GOAT.tax

Like each type of entity (partnership, scorp, ccorp, etc.) has its own tax forms, where we find revenue in each of those tax forms is a little different. Fuel expenses or mileage to go get supplies. This includes relevant tax forms. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you.

Wild Goat Free Stock Photo Public Domain Pictures

What values counts towards the $600 threshold for taxes when selling on goat? Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. However, you cannot claim a goat who was born on your place though. If you didn't find what you need, you can send an inquiry.

3dRose Goat Ate My Tax Return Cartoon Garden Flag, 12 by 18inch

Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. Is it the initial selling price or the final cash out value (when. This includes relevant tax forms. Fuel expenses or mileage to go get supplies. Like each type of entity (partnership, scorp, ccorp, etc.) has its own.

Like Each Type Of Entity (Partnership, Scorp, Ccorp, Etc.) Has Its Own Tax Forms, Where We Find Revenue In Each Of Those Tax Forms Is A Little Different.

What values counts towards the $600 threshold for taxes when selling on goat? However, you cannot claim a goat who was born on your place though. Tax identification numbers (tin) include a social security number (ssn) or an individual taxpayer identification number (itin) if you are selling as. This includes relevant tax forms.

Fuel Expenses Or Mileage To Go Get Supplies.

If you didn't find what you need, you can send an inquiry through our contact form. Goat.tax provides several items in its final deliverable for every study completed on the platform. Is it the initial selling price or the final cash out value (when.

.jpg)