Form For Vat Return

Form For Vat Return - Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

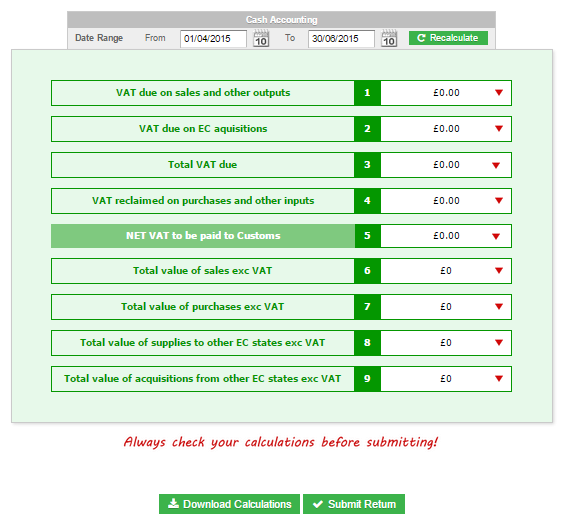

VAT Returns Guide VAT QuickFile

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

VAT Return Form VAT 3 (Kenya)

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

Product Update 417 VAT return correction form for year 2018 available

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

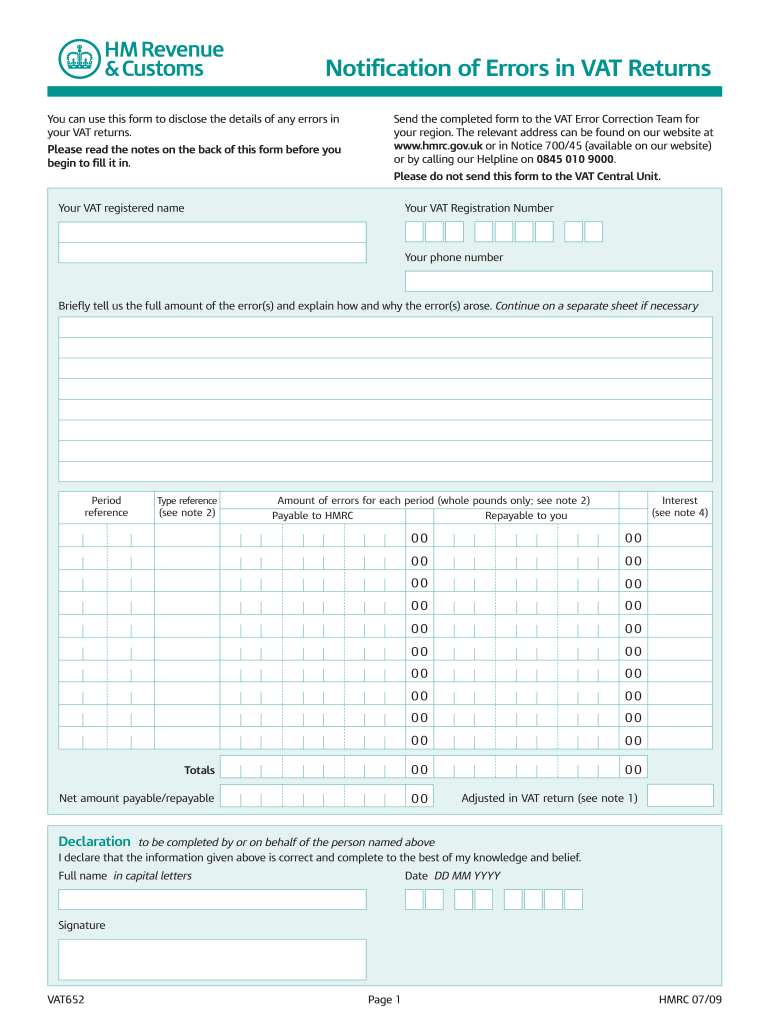

Vat652 Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

What is a VAT return? FreeAgent

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

VAT return template EasyBooks Small Business Bookkeeping App Try

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

What is a VAT return? FreeAgent

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

Checking, editing and locking a VAT return FreeAgent Support

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

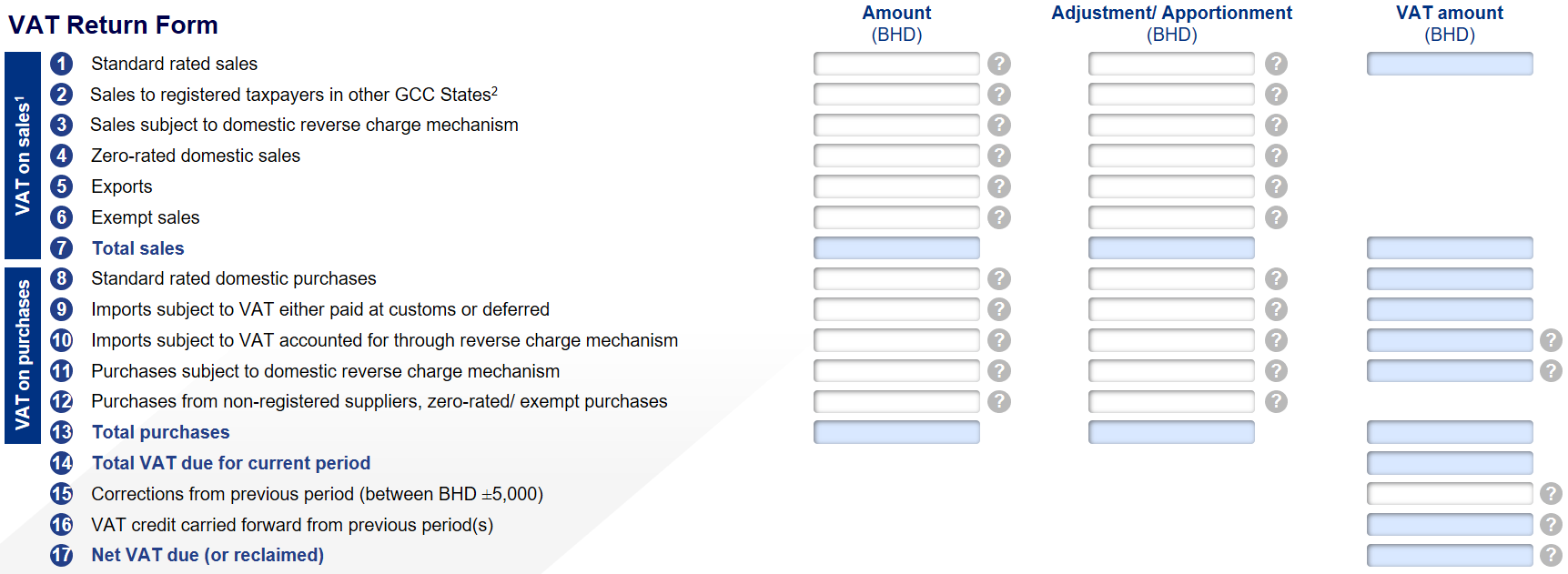

VAT Return Format in Bahrain Tally Solutions

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

A Vat Return Is A Form You Fill In To Tell Hm Revenue And Customs (Hmrc) How Much Vat You’ve Charged And How Much You’ve Paid To.

Forms for claiming a vat refund if your business is registered in a country outside the uk