Form 941 Due Dates

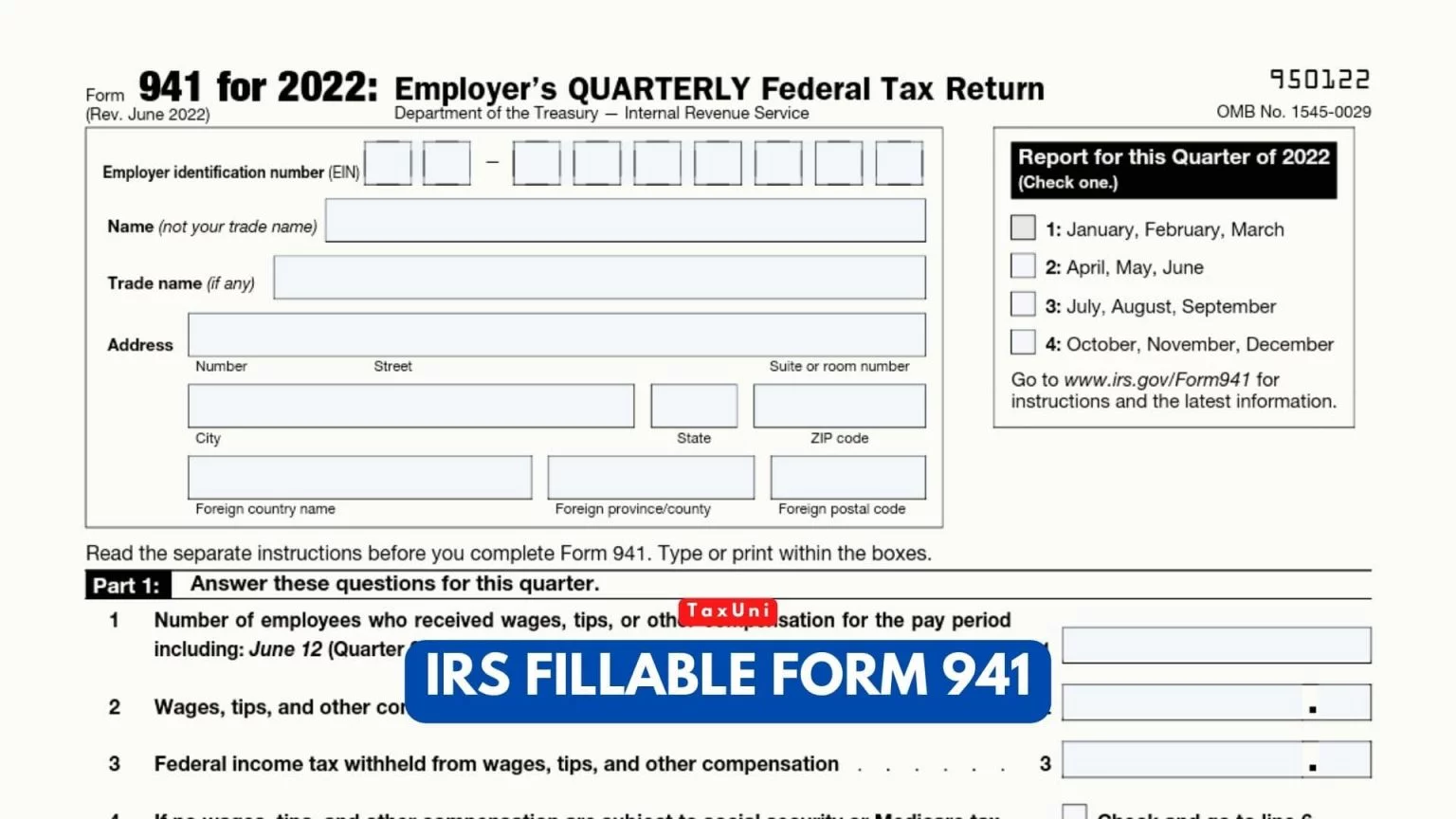

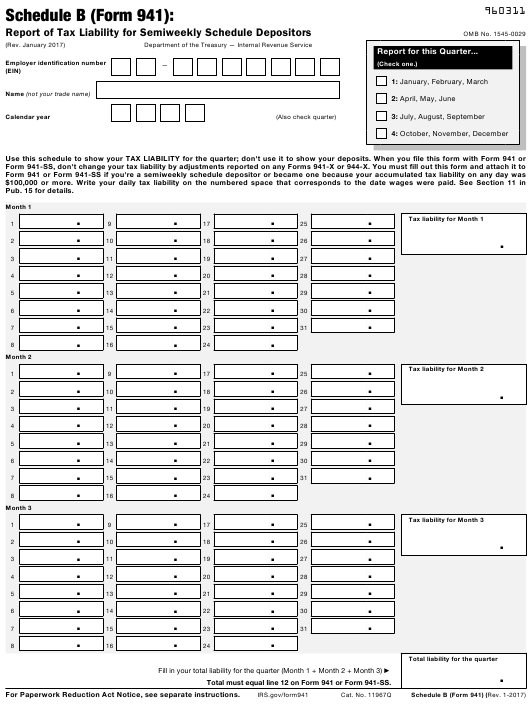

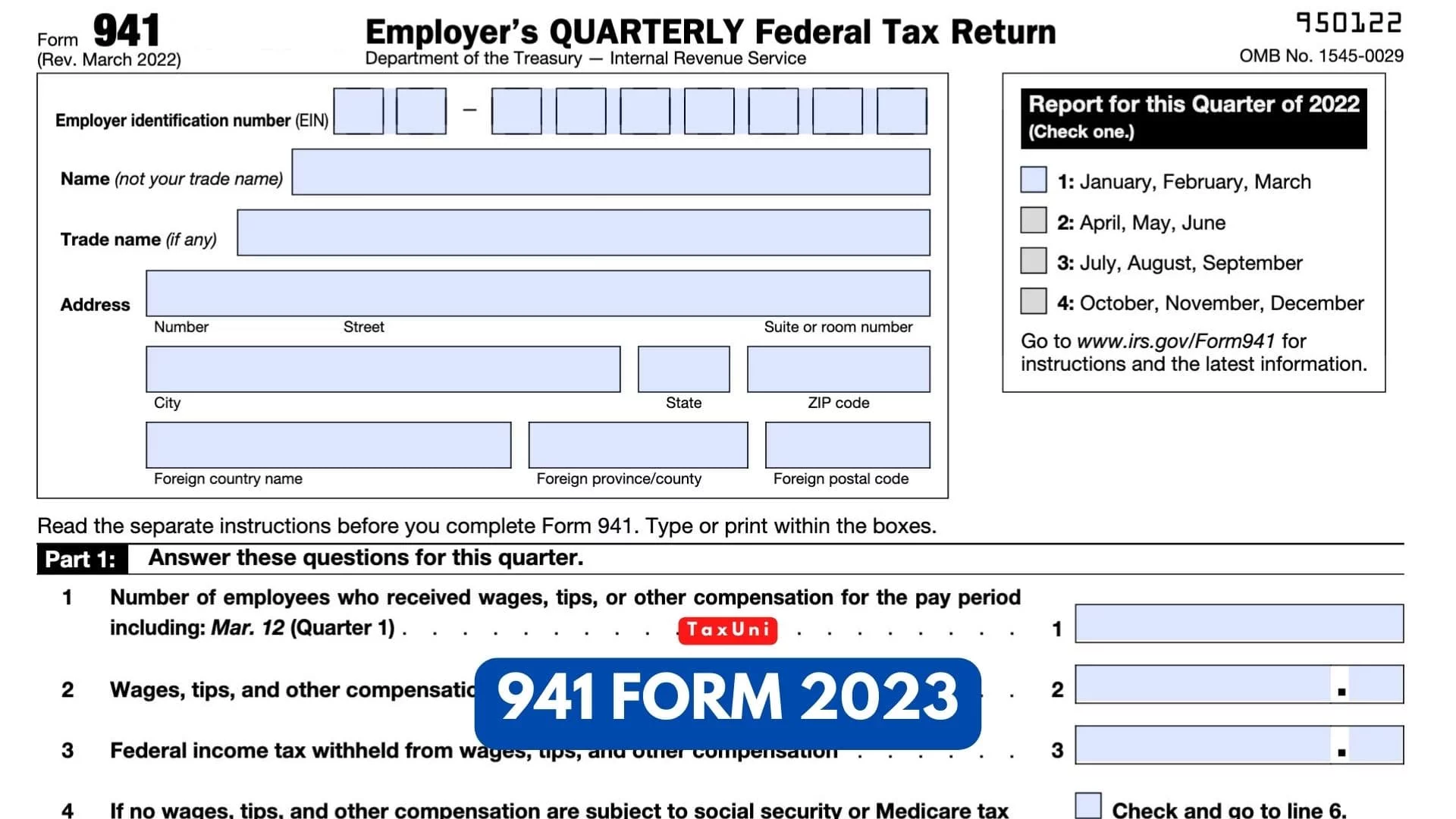

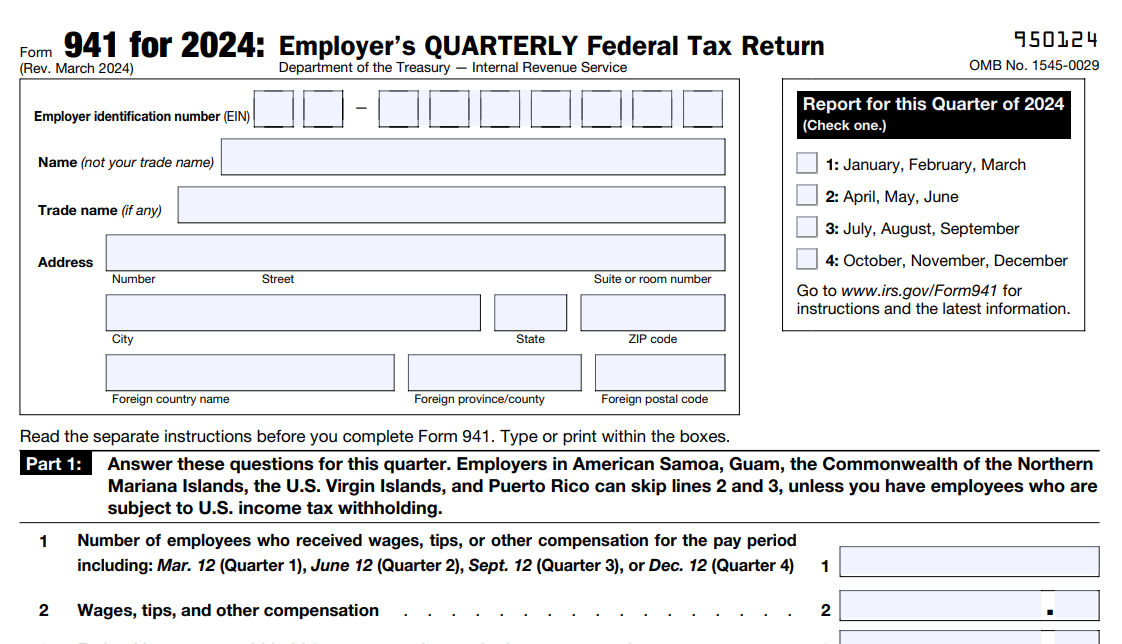

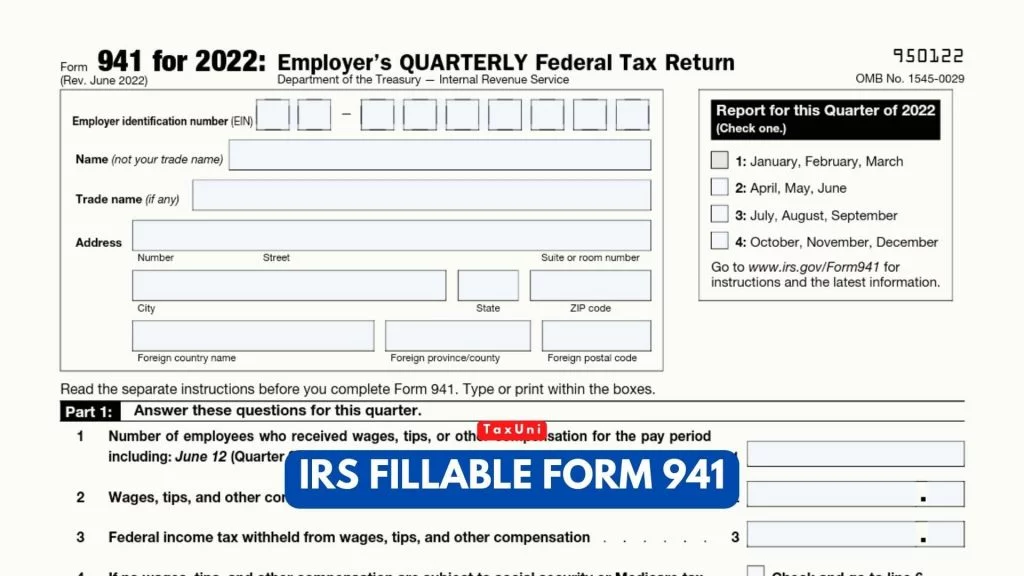

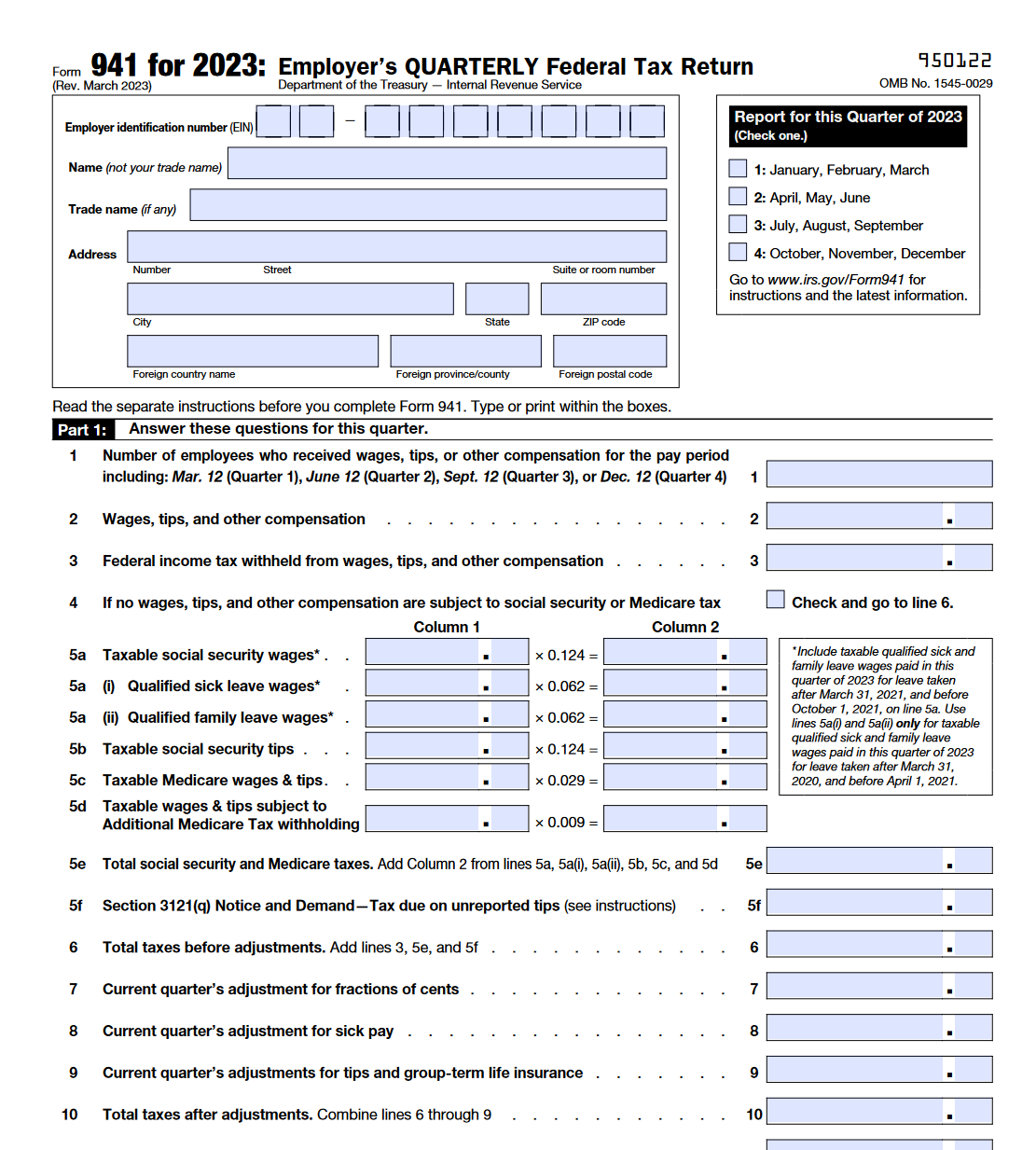

Form 941 Due Dates - For more information on depositing and filing these. Most businesses are required to submit form 941 on the last day of the month following each quarter. See the employment tax due dates page for filing and depositing due dates. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. When is form 941 due?

Most businesses are required to submit form 941 on the last day of the month following each quarter. When is form 941 due? See the employment tax due dates page for filing and depositing due dates. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. For more information on depositing and filing these.

When is form 941 due? Most businesses are required to submit form 941 on the last day of the month following each quarter. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. For more information on depositing and filing these. See the employment tax due dates page for filing and depositing due dates.

Irs Form 941 Due Dates 2024 Deana Estella

For more information on depositing and filing these. Most businesses are required to submit form 941 on the last day of the month following each quarter. When is form 941 due? Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. If you haven't received your.

When Are 941 Forms Due 2024 Ivory Arluene

Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. For more information on depositing and filing these. See the employment tax due dates page for filing and depositing due dates. When is form 941 due? If you haven't received your ein by the due date.

Quarterly 941 Due Dates 2024 Dulce Glenine

See the employment tax due dates page for filing and depositing due dates. Most businesses are required to submit form 941 on the last day of the month following each quarter. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry..

Form 941 Due Dates 2024 Dara Felecia

If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. When is form 941 due? See the employment tax due dates page for filing and depositing due dates. Irs form 941, the employer’s quarterly federal tax return, is how you tell.

When Are 941 Forms Due 2024 Cayla Nellie

See the employment tax due dates page for filing and depositing due dates. When is form 941 due? Most businesses are required to submit form 941 on the last day of the month following each quarter. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your..

Quarterly 941 Due Dates 2024 Dulce Glenine

See the employment tax due dates page for filing and depositing due dates. Most businesses are required to submit form 941 on the last day of the month following each quarter. When is form 941 due? If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date.

2024 Payroll Tax & Form 941 Due Dates Paylocity Paylocity

Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. See the employment tax due dates page for filing and depositing due dates. When is form 941 due? Most businesses are required to submit form 941 on the last day of the month following each quarter..

What Are The Form 941 Quarterly Due Dates 2024 Cati Mattie

If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. For more information on depositing and filing these. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from.

Irs Form 941 Due Dates 2024 Moina Terrijo

See the employment tax due dates page for filing and depositing due dates. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. Most businesses are required to submit form 941 on the last day of the month following each quarter..

2023 Form 941 Due Dates Printable Forms Free Online

When is form 941 due? For more information on depositing and filing these. Most businesses are required to submit form 941 on the last day of the month following each quarter. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry..

If You Haven't Received Your Ein By The Due Date Of Form 941, File A Paper Return And Write “Applied For” And The Date You Applied In This Entry.

See the employment tax due dates page for filing and depositing due dates. When is form 941 due? For more information on depositing and filing these. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your.