Form 8833 Turbotax

Form 8833 Turbotax - As you stated, turbotax does not support irs form 8833. Tax return and form 8833 if claiming the following treaty benefits: The payee must file a u.s. This form can be crucial for reducing. If you need to include this form with your tax return and the return has. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. A reduction or modification in the taxation of gain.

This form can be crucial for reducing. If you need to include this form with your tax return and the return has. A reduction or modification in the taxation of gain. The payee must file a u.s. As you stated, turbotax does not support irs form 8833. Tax return and form 8833 if claiming the following treaty benefits: If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns.

The payee must file a u.s. A reduction or modification in the taxation of gain. Tax return and form 8833 if claiming the following treaty benefits: This form can be crucial for reducing. As you stated, turbotax does not support irs form 8833. If you need to include this form with your tax return and the return has. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns.

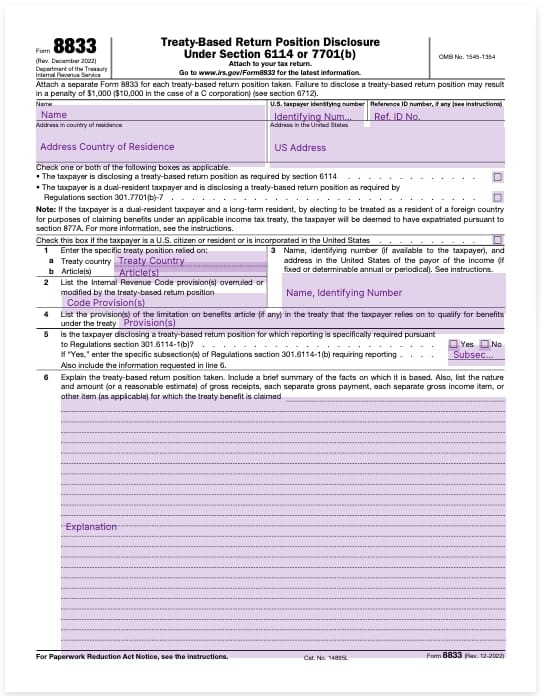

Form 8833 TreatyBased Return Position Disclosure — Bambridge

If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. If you need to include this form with your tax return and the return has. A reduction or modification in the taxation of gain. As you stated, turbotax does not support irs form 8833. The payee must file a u.s.

A Beginner’s Guide to IRS Tax Treaty Benefits, Form 8833

As you stated, turbotax does not support irs form 8833. A reduction or modification in the taxation of gain. If you need to include this form with your tax return and the return has. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. Tax return and form 8833 if.

Irs Form 8833 Fillable Printable Forms Free Online

As you stated, turbotax does not support irs form 8833. A reduction or modification in the taxation of gain. Tax return and form 8833 if claiming the following treaty benefits: If you need to include this form with your tax return and the return has. If you're an expat in a treaty nation, you might need to file irs form.

Form 8833, TreatyBased Return Position Disclosure Under Section 6114

A reduction or modification in the taxation of gain. Tax return and form 8833 if claiming the following treaty benefits: As you stated, turbotax does not support irs form 8833. The payee must file a u.s. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns.

Tax Treaty Benefits & Form 8833 What You Need to Know

Tax return and form 8833 if claiming the following treaty benefits: As you stated, turbotax does not support irs form 8833. If you need to include this form with your tax return and the return has. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. The payee must file.

Form 8833 & Tax Treaties Understanding Your US Tax Return

As you stated, turbotax does not support irs form 8833. The payee must file a u.s. If you need to include this form with your tax return and the return has. A reduction or modification in the taxation of gain. Tax return and form 8833 if claiming the following treaty benefits:

Calaméo IRS FORM 8833 [TREATY BASED RETURN POSITION DISCLOSURE]

This form can be crucial for reducing. The payee must file a u.s. Tax return and form 8833 if claiming the following treaty benefits: If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. If you need to include this form with your tax return and the return has.

Video Form 8833 Tax Treaty Disclosure

This form can be crucial for reducing. A reduction or modification in the taxation of gain. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. Tax return and form 8833 if claiming the following treaty benefits: If you need to include this form with your tax return and the.

IRS Form 8833 Instructions TreatyBased Return Disclosures

If you need to include this form with your tax return and the return has. As you stated, turbotax does not support irs form 8833. The payee must file a u.s. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. A reduction or modification in the taxation of gain.

Form 8833 & Tax Treaties Understanding Your US Tax Return

As you stated, turbotax does not support irs form 8833. A reduction or modification in the taxation of gain. If you need to include this form with your tax return and the return has. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. The payee must file a u.s.

If You Need To Include This Form With Your Tax Return And The Return Has.

This form can be crucial for reducing. A reduction or modification in the taxation of gain. Tax return and form 8833 if claiming the following treaty benefits: As you stated, turbotax does not support irs form 8833.

The Payee Must File A U.s.

If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns.

![Calaméo IRS FORM 8833 [TREATY BASED RETURN POSITION DISCLOSURE]](https://p.calameoassets.com/200703182719-55c45f599c90efa5d4892cae327a07bd/p1.jpg)