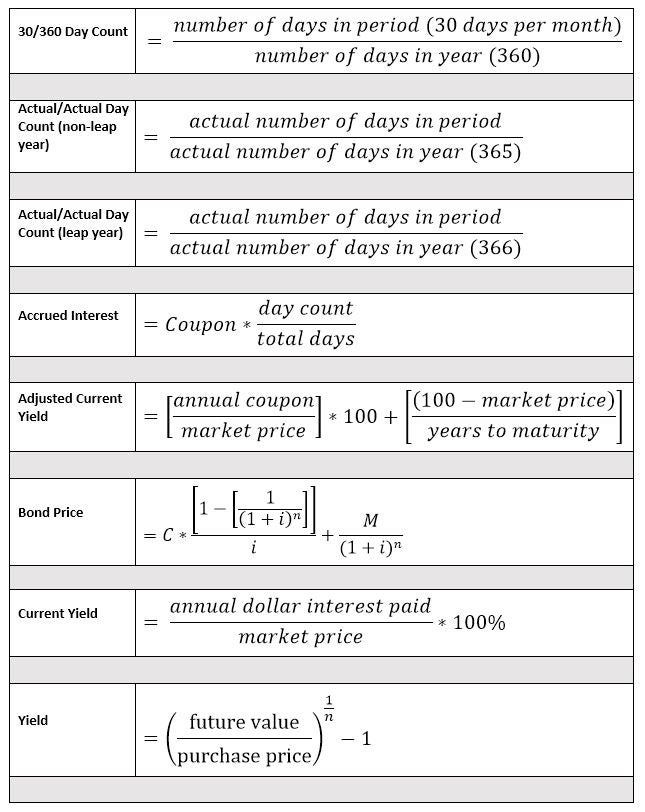

Finance Formulas Cheat Sheet

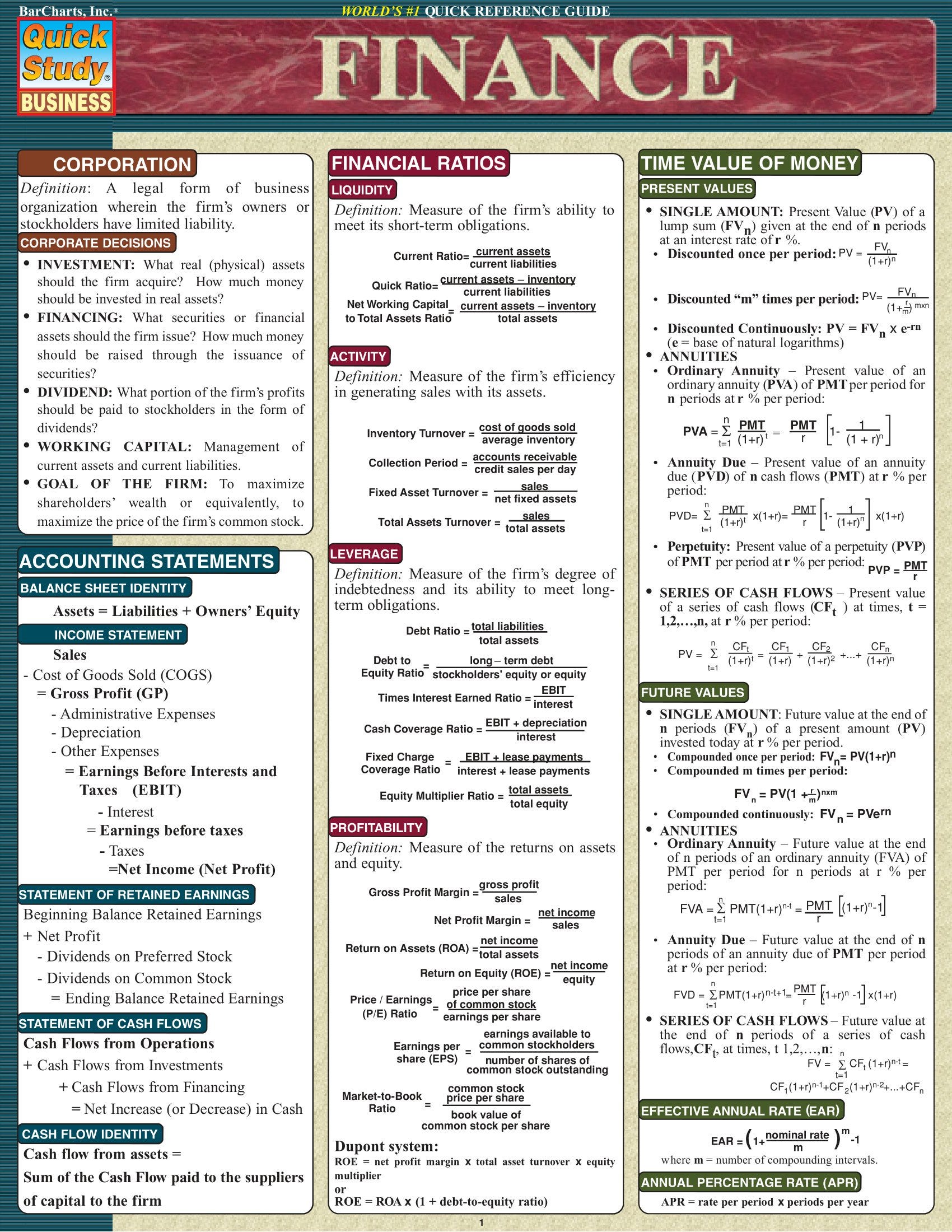

Finance Formulas Cheat Sheet - It is equal to the principal plus the interest earned. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. Mastering financial ratios is crucial for evaluating a company’s financial health. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Financial ratios at a glance cheat sheets. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. S is the future value (or maturity value).

Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. S is the future value (or maturity value). Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. Mastering financial ratios is crucial for evaluating a company’s financial health. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Financial ratios at a glance cheat sheets. It is equal to the principal plus the interest earned. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual.

From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Mastering financial ratios is crucial for evaluating a company’s financial health. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Financial ratios at a glance cheat sheets. S is the future value (or maturity value). It is equal to the principal plus the interest earned. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components.

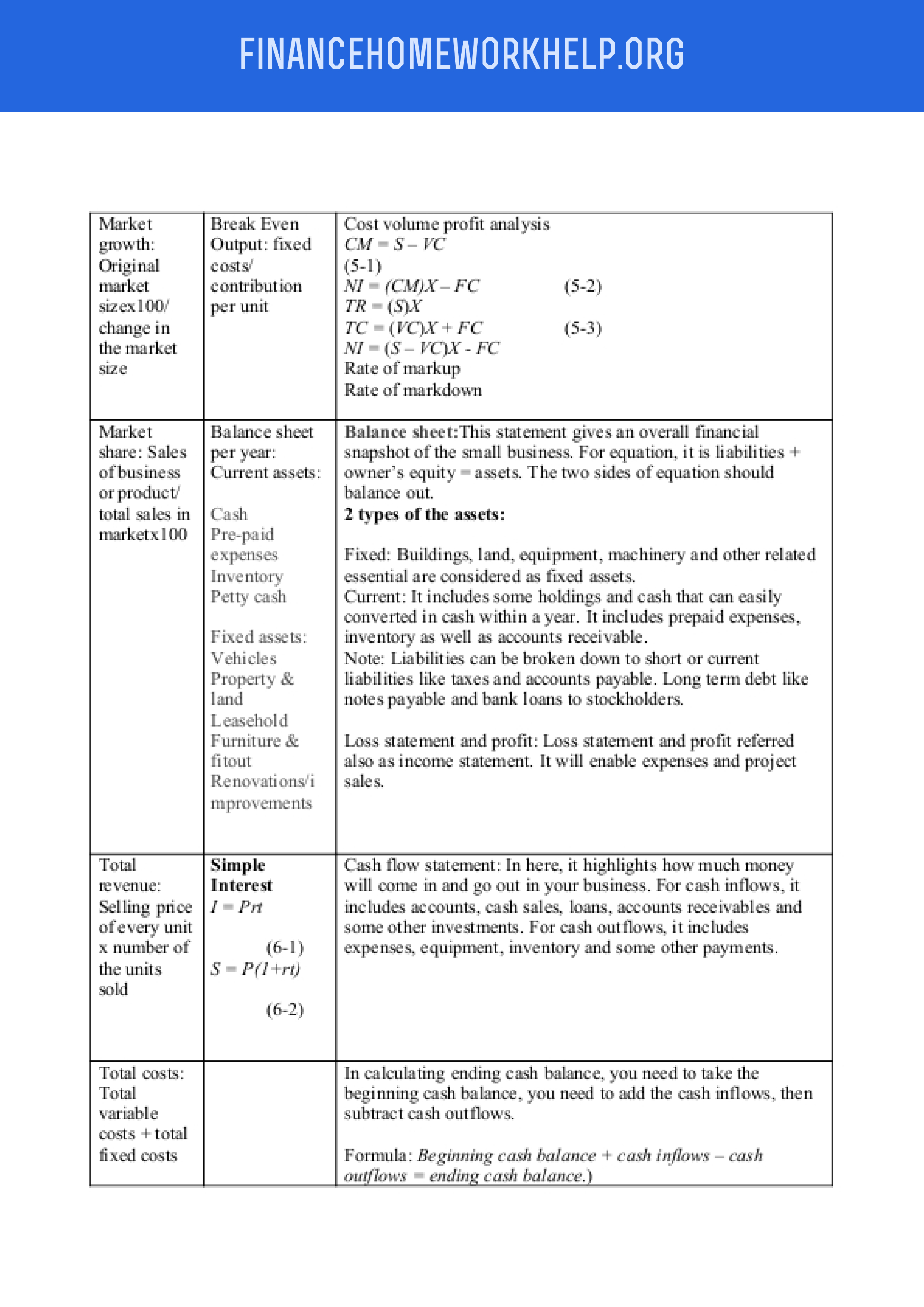

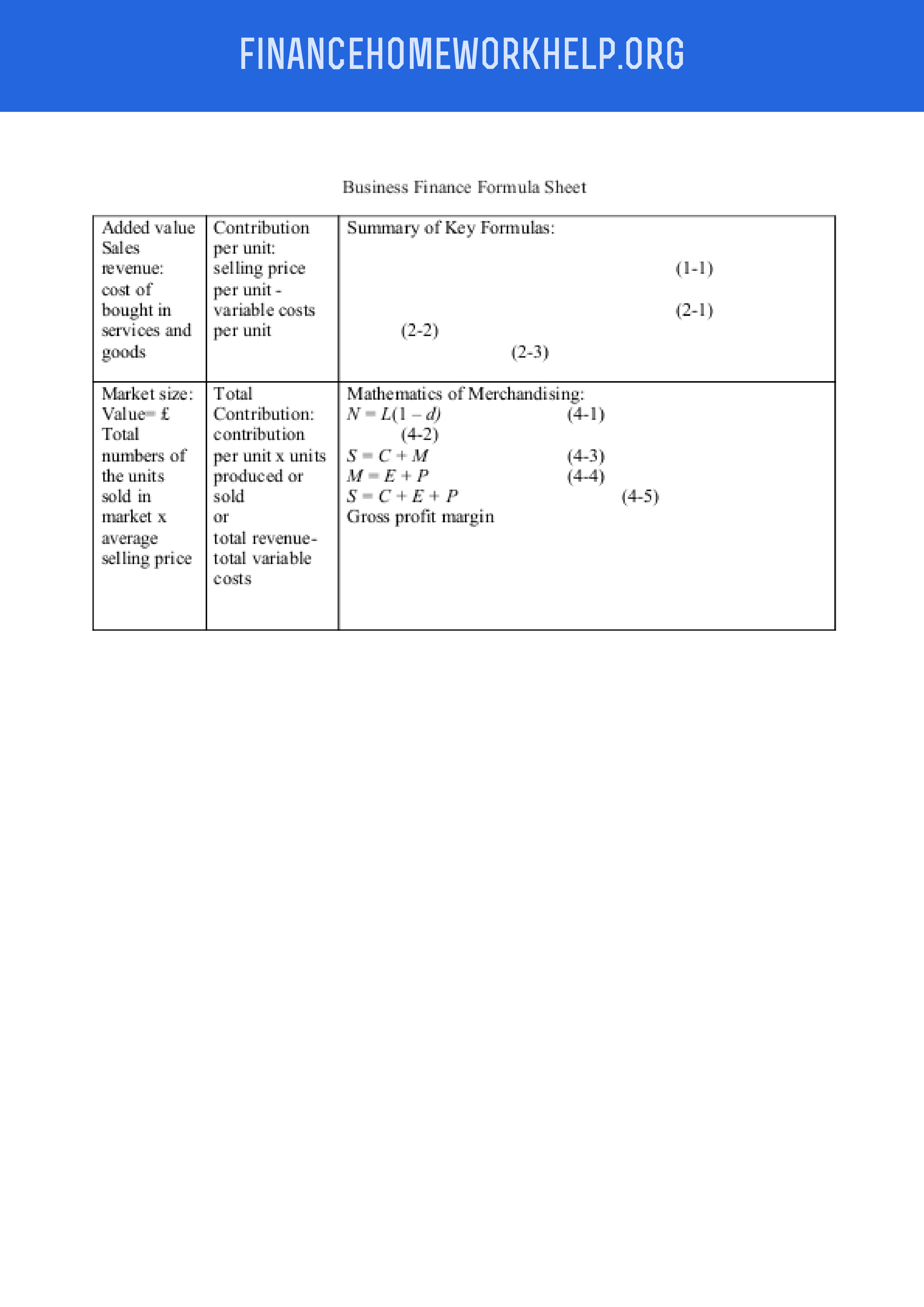

Our Handy Finance Formula Sheet Finance Homework Help

Mastering financial ratios is crucial for evaluating a company’s financial health. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its.

seretnow.me

It is equal to the principal plus the interest earned. S is the future value (or maturity value). Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Mastering financial ratios is crucial for evaluating a company’s financial health. Receivables turnover = annual sales average receivables the efficiency.

Finance Formulas Cheat Sheet

Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. From determining the future value of an investment using the fv function to analyze the net.

102 Useful Excel Formulas Cheat Sheet PDF (Free Download Sheet) in 2022

Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. S is the future value (or maturity value). Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Financial ratios at a.

Finance Formulas Cheat Sheet

S is the future value (or maturity value). From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Mastering financial ratios is crucial for evaluating a company’s financial health. Cfi's excel formulas cheat sheet will give.

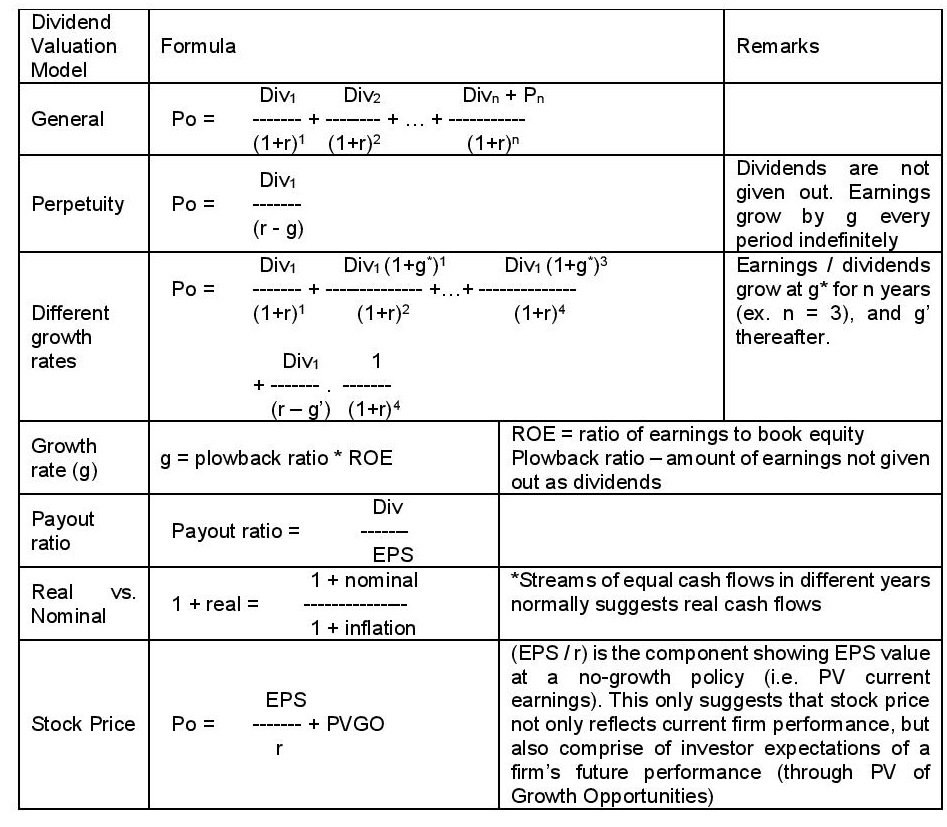

Perfect Pmp formula Cheat Sheet Financial ratio, Accounting classes

Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Cfi's excel formulas cheat sheet will give you.

🏰 Finance cheat sheet Compounding Quality

It is equal to the principal plus the interest earned. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Mastering financial ratios is crucial for evaluating a company’s financial health. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables.

Finance Formulas Cheat Sheet One Stop Accounting Formulas Cheat Sheet

Mastering financial ratios is crucial for evaluating a company’s financial health. Financial ratios at a glance cheat sheets. It is equal to the principal plus the interest earned. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Cfi's excel formulas cheat sheet will.

Finance Formulas Sheet

Mastering financial ratios is crucial for evaluating a company’s financial health. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. It is equal to the principal plus the interest.

Accounting Equation Cheat Sheet Tessshebaylo

It is equal to the principal plus the interest earned. Mastering financial ratios is crucial for evaluating a company’s financial health. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Financial ratios at a glance cheat sheets. Our finance cheat sheet provides essential.

Cfi's Excel Formulas Cheat Sheet Will Give You All The Most Important Formulas To Perform Financial Analysis And Modeling In Excel Spreadsheets.

Financial ratios at a glance cheat sheets. It is equal to the principal plus the interest earned. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. S is the future value (or maturity value).

From Determining The Future Value Of An Investment Using The Fv Function To Analyze The Net Present Value With The Npv Function, These Excel Formulas For Finance Help Financial Professionals, Analysts, And Even Individual.

Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. Mastering financial ratios is crucial for evaluating a company’s financial health.