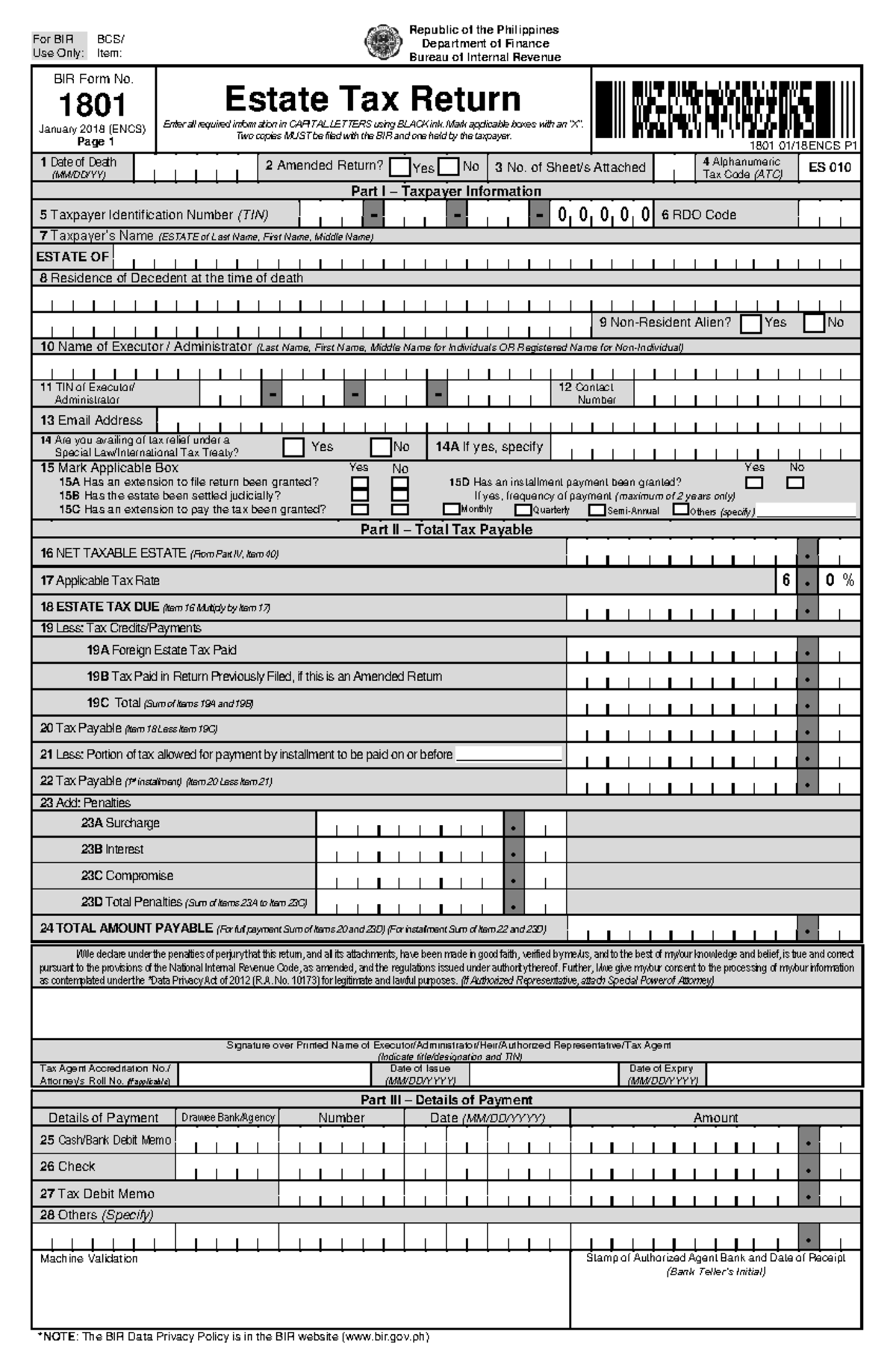

Estate Tax Form Bir

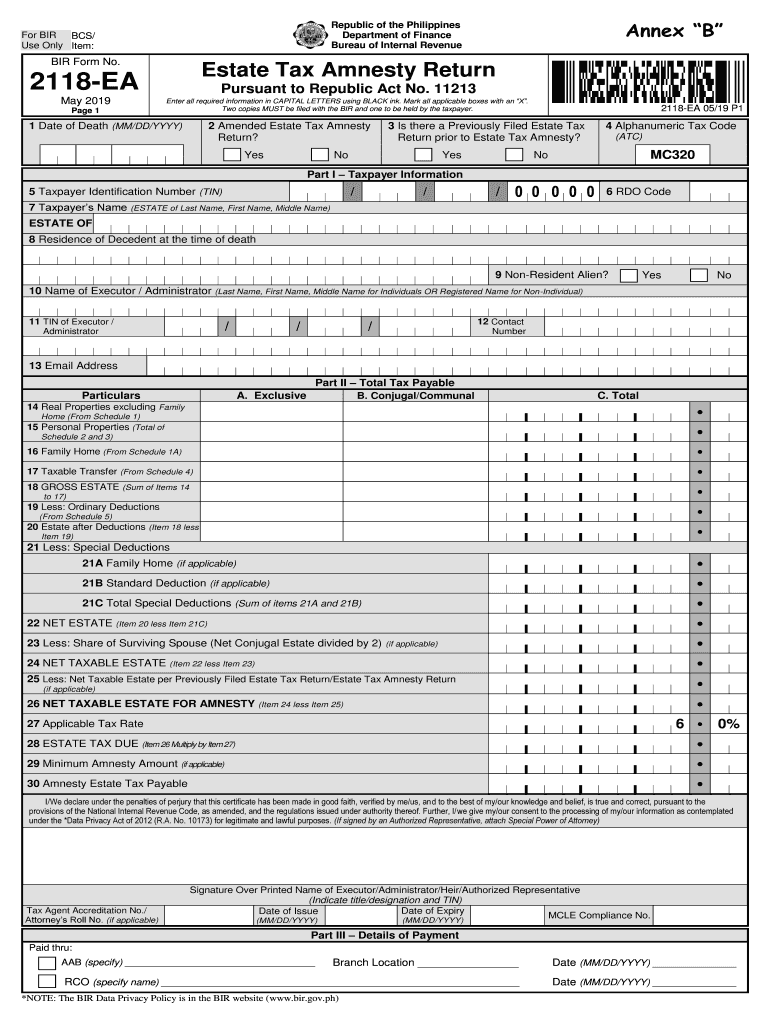

Estate Tax Form Bir - File the estate tax return using bir form 1801 within one year of the deceased's death. Include necessary documents such as death. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. The estate tax amnesty return (etar) (bir form no. 0 % 18 estate tax due (item 16 multiply by item. 17 applicable tax rate 6. Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and.

In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. The estate tax amnesty return (etar) (bir form no. Include necessary documents such as death. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. 17 applicable tax rate 6. Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and. 0 % 18 estate tax due (item 16 multiply by item. File the estate tax return using bir form 1801 within one year of the deceased's death.

0 % 18 estate tax due (item 16 multiply by item. Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and. File the estate tax return using bir form 1801 within one year of the deceased's death. In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. 17 applicable tax rate 6. The estate tax amnesty return (etar) (bir form no. Include necessary documents such as death.

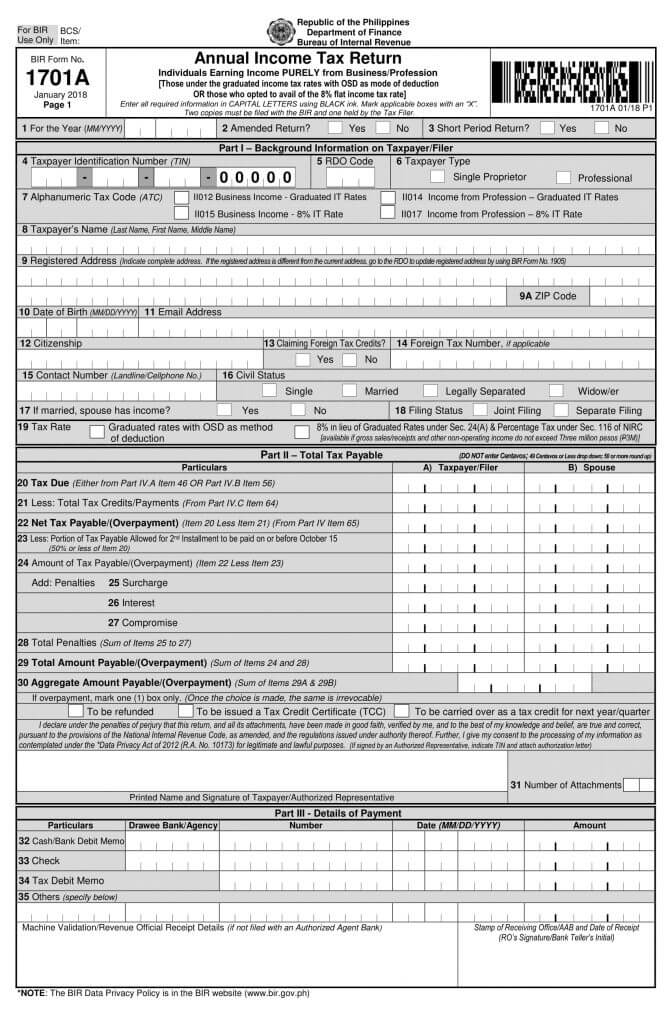

What are the Taxes a Small Business Needs To Pay? Info Plus Forms And

In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and. The estate tax amnesty return (etar) (bir form no. It.

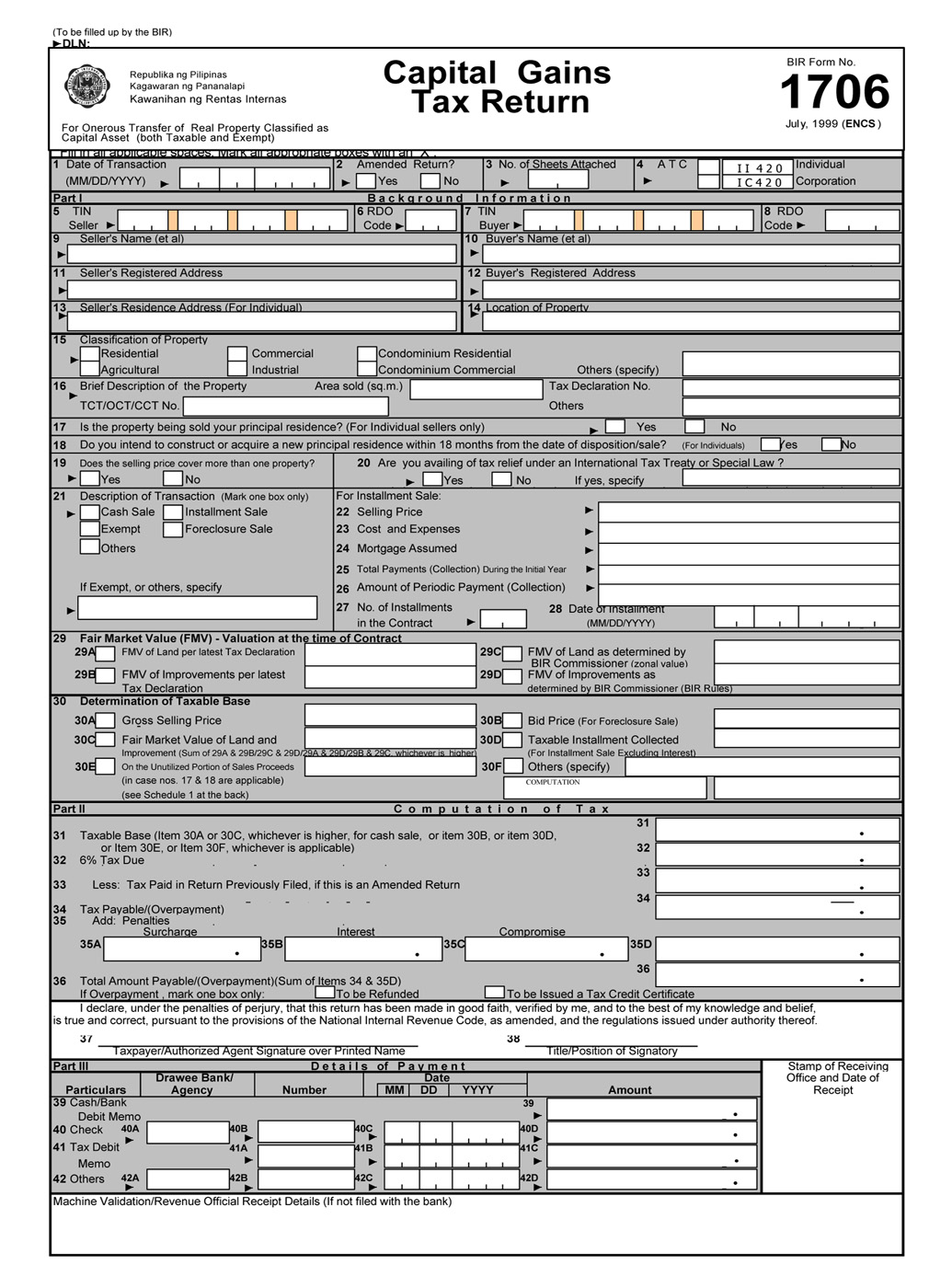

Form 1706

File the estate tax return using bir form 1801 within one year of the deceased's death. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. 0 % 18 estate tax due (item 16 multiply by item. The estate tax amnesty return (etar) (bir form no. Gross estate for citizens.

How to Compute and File The 2nd Quarter Tax Return (TRAIN

File the estate tax return using bir form 1801 within one year of the deceased's death. 17 applicable tax rate 6. In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. The estate tax amnesty return (etar) (bir form no. 0 % 18 estate tax.

How to Compute File and Pay Estate Tax YouTube

17 applicable tax rate 6. In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. File the estate tax return using bir form 1801 within one year of the deceased's death. Include necessary documents such as death. It also contains copy of the tax code,.

BIR Form 1904 A Comprehesive Guide TAXGURO

File the estate tax return using bir form 1801 within one year of the deceased's death. 0 % 18 estate tax due (item 16 multiply by item. In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. 17 applicable tax rate 6. Gross estate for.

Estate Tax Amnesty Return Fill and Sign Printable Template Online

Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and. In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. File the estate tax return using bir form 1801 within.

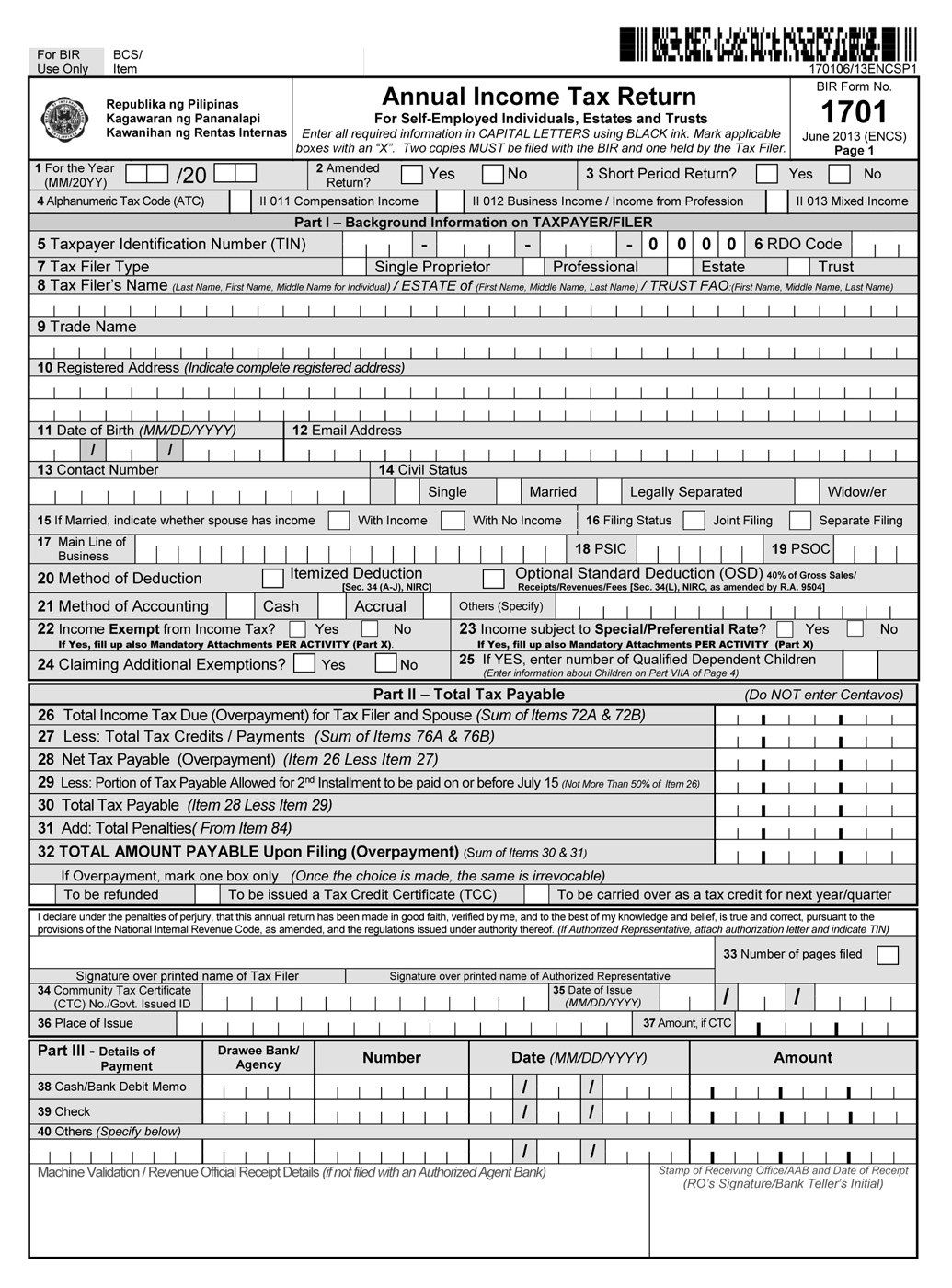

How to File and Pay your Annual Tax using BIR Form 1701 for

Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. 17 applicable tax rate 6. 0 % 18 estate tax due (item 16 multiply by.

CAPITAL GAINS TAX How to fillup BIR form 1706? YouTube

In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. The estate tax amnesty return (etar) (bir form no. Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and. 0.

What You Need to Know About The New BIR Forms Taxumo Blog

Gross estate for citizens shall include all properties of the decedent at the time of death, real or personal (except bank deposits already withdrawn and. 0 % 18 estate tax due (item 16 multiply by item. Include necessary documents such as death. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax.

BIR Form No. 1801 BIR form Law PUP Studocu

The estate tax amnesty return (etar) (bir form no. File the estate tax return using bir form 1801 within one year of the deceased's death. It also contains copy of the tax code, bir forms, zonal values of real properties, and other tax information materials. Include necessary documents such as death. In places where there are no aabs, payment shall.

It Also Contains Copy Of The Tax Code, Bir Forms, Zonal Values Of Real Properties, And Other Tax Information Materials.

0 % 18 estate tax due (item 16 multiply by item. In places where there are no aabs, payment shall be made directly to the revenue collection officer or duly authorized city or municipal treasurer who. Include necessary documents such as death. 17 applicable tax rate 6.

Gross Estate For Citizens Shall Include All Properties Of The Decedent At The Time Of Death, Real Or Personal (Except Bank Deposits Already Withdrawn And.

The estate tax amnesty return (etar) (bir form no. File the estate tax return using bir form 1801 within one year of the deceased's death.