Does Shopify Report To Irs

Does Shopify Report To Irs - Yes, shopify is required to report certain financial information to the irs as a payment processor. Tax commitment contains all sales. Does shopify report to the irs? Shopify sellers have a responsibility to report their income to the irs properly. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form.

Does shopify report to the irs? Shopify sellers have a responsibility to report their income to the irs properly. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Yes, shopify is required to report certain financial information to the irs as a payment processor. Tax commitment contains all sales.

Does shopify report to the irs? Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Yes, shopify is required to report certain financial information to the irs as a payment processor. Shopify sellers have a responsibility to report their income to the irs properly. Tax commitment contains all sales.

Does Shopify Collect Sales Tax (Guide & How to Collect)

Yes, shopify is required to report certain financial information to the irs as a payment processor. Does shopify report to the irs? Shopify sellers have a responsibility to report their income to the irs properly. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Tax commitment contains all.

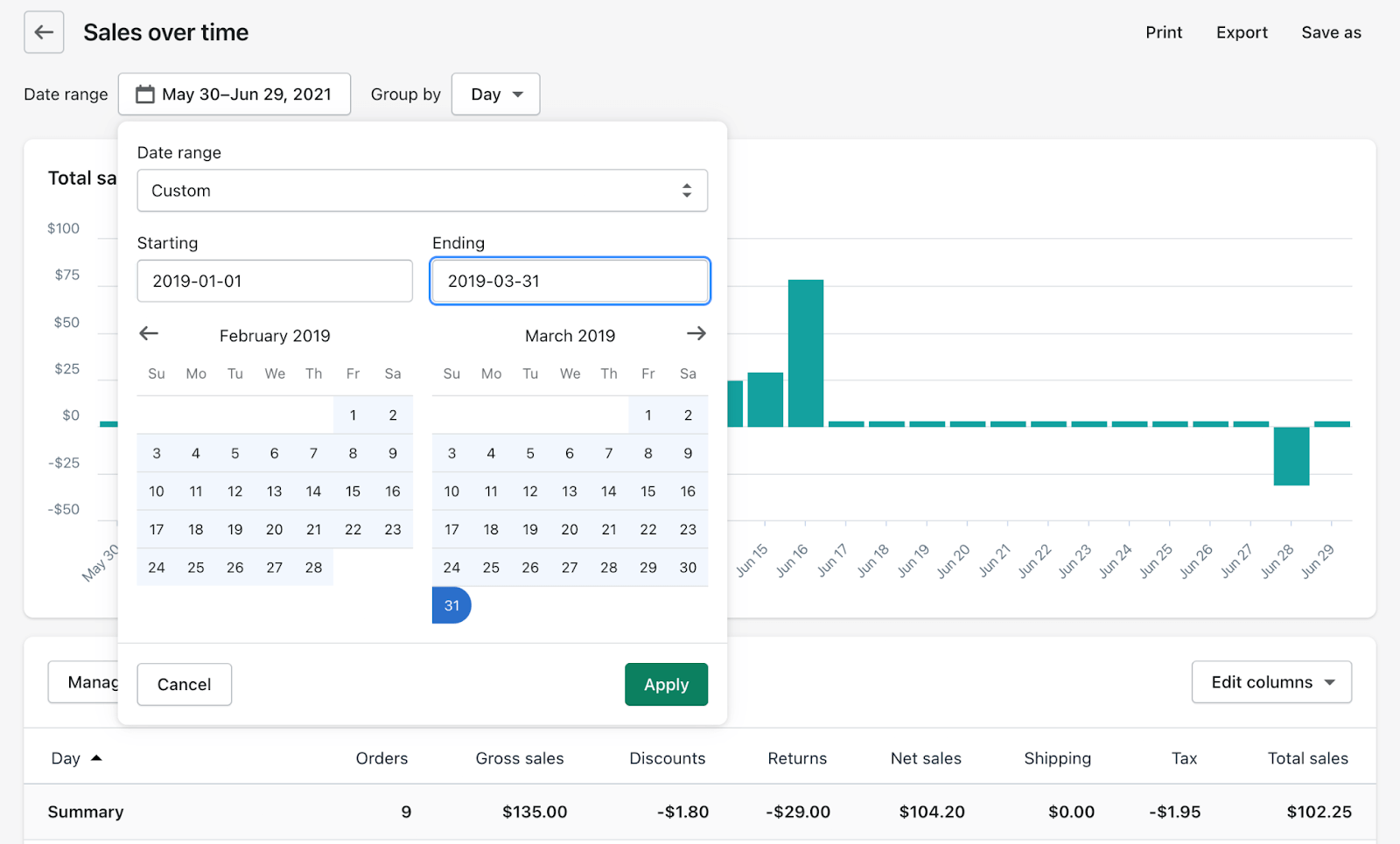

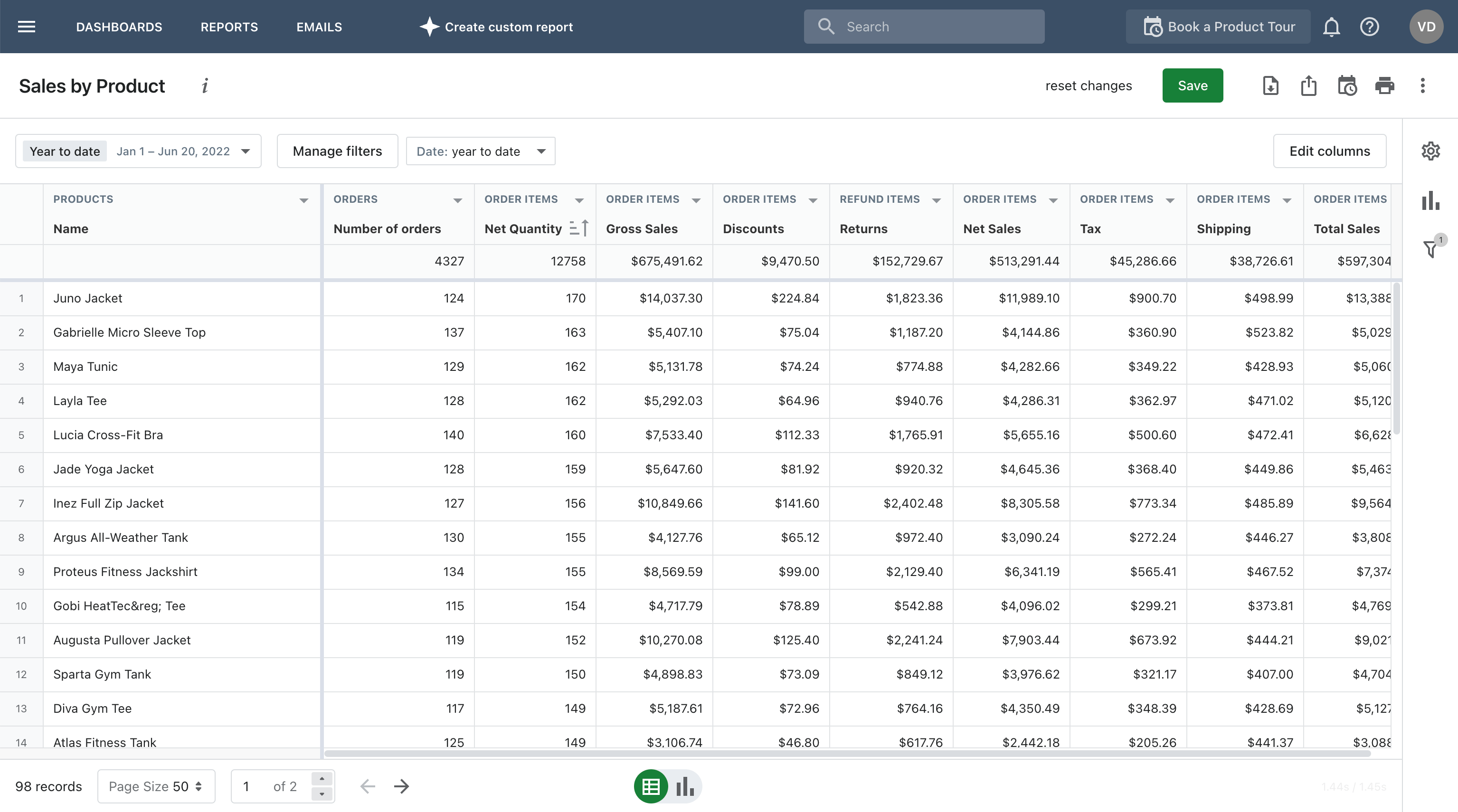

The Ultimate Guide to Shopify Reports Coupler.io Blog

Tax commitment contains all sales. Shopify sellers have a responsibility to report their income to the irs properly. Yes, shopify is required to report certain financial information to the irs as a payment processor. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Does shopify report to the.

Does Shopify Collect Sales Tax? What You Need To Know

Does shopify report to the irs? Yes, shopify is required to report certain financial information to the irs as a payment processor. Tax commitment contains all sales. Shopify sellers have a responsibility to report their income to the irs properly. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a.

Does Etsy Report Sales To The IRS? Thrive on Etsy

Yes, shopify is required to report certain financial information to the irs as a payment processor. Does shopify report to the irs? Shopify sellers have a responsibility to report their income to the irs properly. Tax commitment contains all sales. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a.

Does Shopify Report To The IRS? Multiorders

Shopify sellers have a responsibility to report their income to the irs properly. Yes, shopify is required to report certain financial information to the irs as a payment processor. Tax commitment contains all sales. Does shopify report to the irs? Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a.

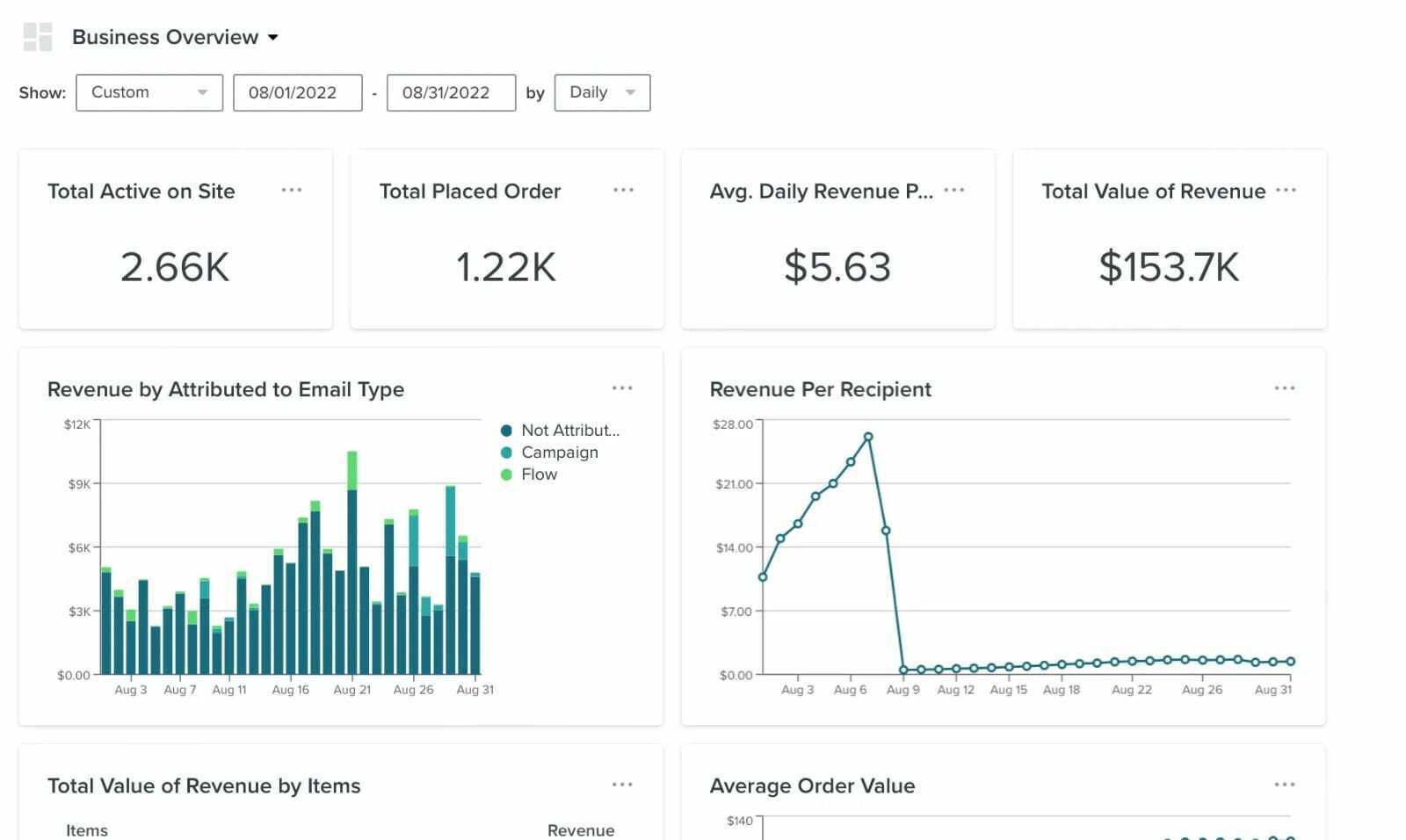

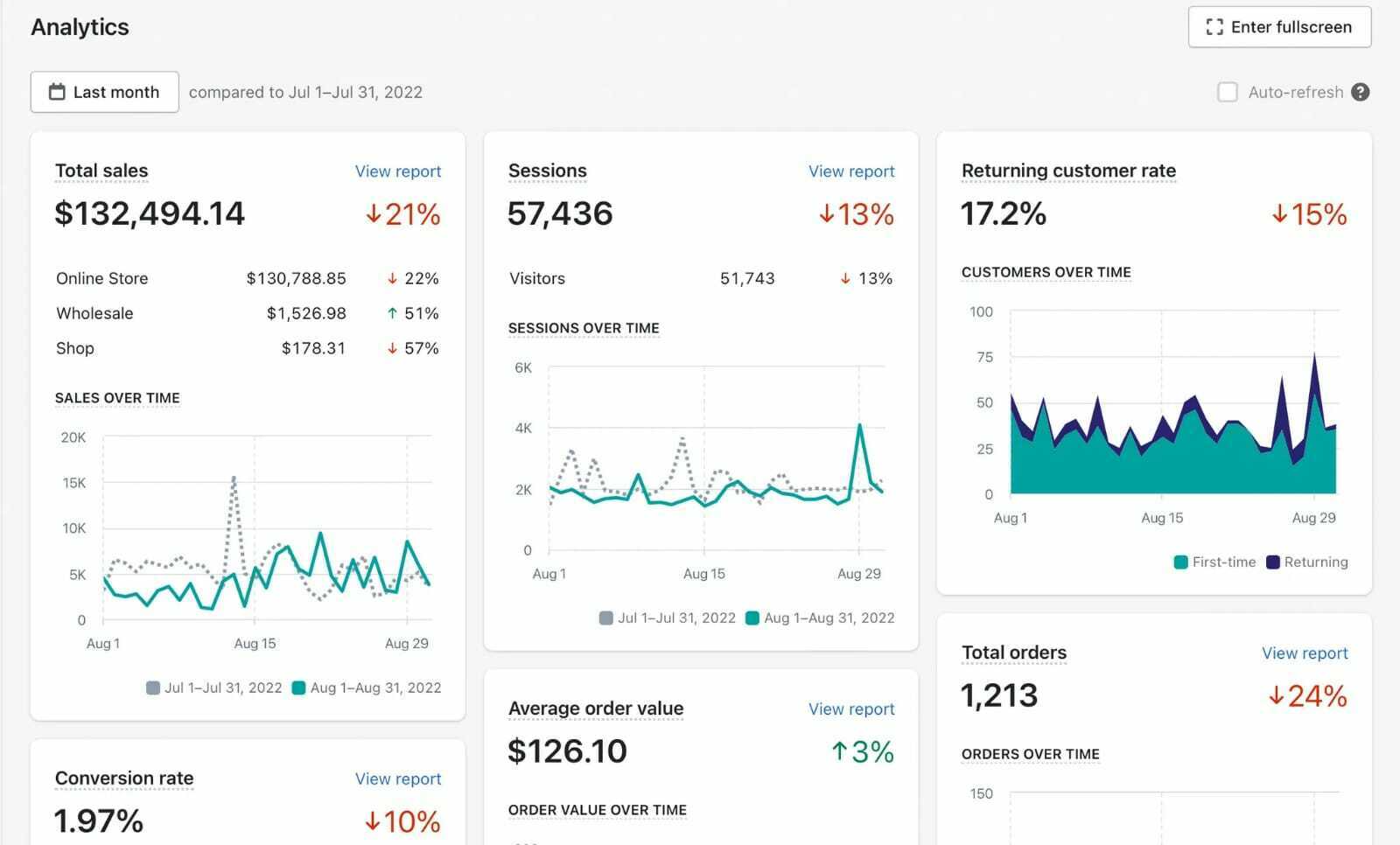

Why does Shopify report less sales than Klaviyo? Klaviyo Community

Shopify sellers have a responsibility to report their income to the irs properly. Does shopify report to the irs? Tax commitment contains all sales. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Yes, shopify is required to report certain financial information to the irs as a payment.

Why does Shopify report less sales than Klaviyo? Klaviyo Community

Shopify sellers have a responsibility to report their income to the irs properly. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Yes, shopify is required to report certain financial information to the irs as a payment processor. Does shopify report to the irs? Tax commitment contains all.

Analytics and Reporting for Shopify and Magento Mipler Reports

Does shopify report to the irs? Shopify sellers have a responsibility to report their income to the irs properly. Tax commitment contains all sales. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Yes, shopify is required to report certain financial information to the irs as a payment.

Does Shopify Collect Sales Tax (Guide & How to Collect)

Does shopify report to the irs? Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Tax commitment contains all sales. Yes, shopify is required to report certain financial information to the irs as a payment processor. Shopify sellers have a responsibility to report their income to the irs.

Shopify 1099 Taxes For Freelancers and Business Owners a Guide FlyFin

Shopify sellers have a responsibility to report their income to the irs properly. Does shopify report to the irs?yes, shopify reports most account owners' business transactions to the irs every year, in a form. Tax commitment contains all sales. Does shopify report to the irs? Yes, shopify is required to report certain financial information to the irs as a payment.

Does Shopify Report To The Irs?Yes, Shopify Reports Most Account Owners' Business Transactions To The Irs Every Year, In A Form.

Yes, shopify is required to report certain financial information to the irs as a payment processor. Shopify sellers have a responsibility to report their income to the irs properly. Tax commitment contains all sales. Does shopify report to the irs?