Does Instacart Report To Irs

Does Instacart Report To Irs - Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. If you earned $600 or more through instacart, the company will issue. Submitting accurate tax filings by the. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year.

If you earned $600 or more through instacart, the company will issue. Submitting accurate tax filings by the. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

Submitting accurate tax filings by the. If you earned $600 or more through instacart, the company will issue. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year.

Does Instacart Take Out Taxes? Ultimate Tax Filing Guide

If you earned $600 or more through instacart, the company will issue. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. Submitting accurate tax filings by the.

What Are Instacart Ads How You Can Advertise [Blog]

By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. If you earned $600 or more through instacart, the company will issue. Submitting accurate tax filings by the.

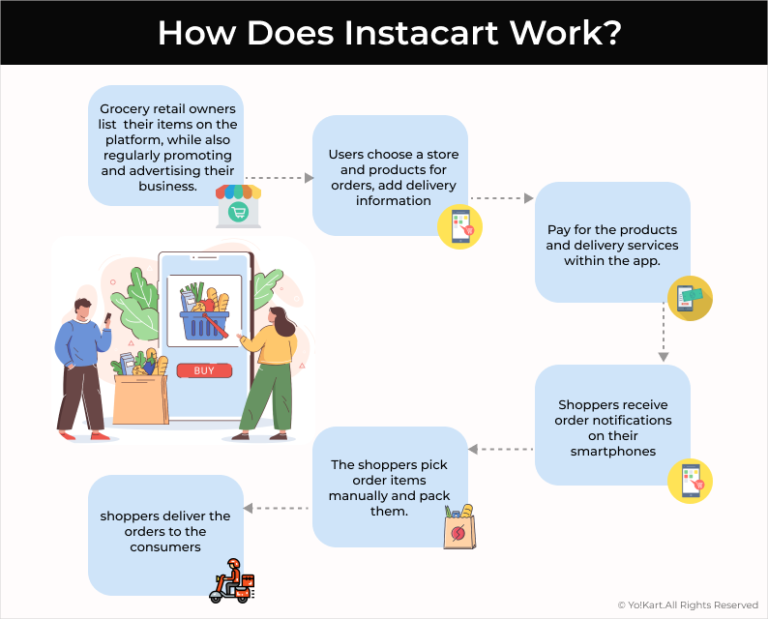

How Does Instacart Work?

Submitting accurate tax filings by the. If you earned $600 or more through instacart, the company will issue. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

Cost To Develop A Grocery Delivery App Like Instacart

By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. Submitting accurate tax filings by the. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. If you earned $600 or more through instacart, the company will issue.

How Does Instacart Work? And How Much Do the Fees Really Cost? The

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. If you earned $600 or more through instacart, the company will issue. Submitting accurate tax filings by the.

How Much Does Instacart Pay In 2024? [Data From 54 Cities]

If you earned $600 or more through instacart, the company will issue. Submitting accurate tax filings by the. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year.

How Does Instacart Pickup Work? (What you need to know!)

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. Submitting accurate tax filings by the. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. If you earned $600 or more through instacart, the company will issue.

How Does Instacart Work Business & Revenue Model Instacart

If you earned $600 or more through instacart, the company will issue. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. Submitting accurate tax filings by the.

How To Make Money As An Instacart Shopper My Undercover Experience

By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. If you earned $600 or more through instacart, the company will issue. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. Submitting accurate tax filings by the.

What is instacart app? Instacart review 2021

If you earned $600 or more through instacart, the company will issue. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year. Submitting accurate tax filings by the. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

Submitting Accurate Tax Filings By The.

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. If you earned $600 or more through instacart, the company will issue. By january 31st each year, instacart sends 1099 forms electronically to every shopper who earned at least $600 the previous tax year.

![How Much Does Instacart Pay In 2024? [Data From 54 Cities]](https://www.ridester.com/wp-content/uploads/2018/05/how_much_do_instacart_shoppers_make-header_2.jpg)