Do You Get A W2 From Instacart

Do You Get A W2 From Instacart - If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no. Does instacart provide w2 forms? No, instacart does not issue w2 forms to its independent contractors. The short answer is yes, but not to all shoppers. As an independent contractor, you are considered self. It shows your annual wages and taxes withheld from the company. Keep reading to learn everything you need to.

Does instacart provide w2 forms? Keep reading to learn everything you need to. It shows your annual wages and taxes withheld from the company. No, instacart does not issue w2 forms to its independent contractors. If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no. The short answer is yes, but not to all shoppers. As an independent contractor, you are considered self.

Does instacart provide w2 forms? The short answer is yes, but not to all shoppers. As an independent contractor, you are considered self. If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no. Keep reading to learn everything you need to. No, instacart does not issue w2 forms to its independent contractors. It shows your annual wages and taxes withheld from the company.

How do you get 2? r/kingofthievesgame

Does instacart provide w2 forms? As an independent contractor, you are considered self. No, instacart does not issue w2 forms to its independent contractors. The short answer is yes, but not to all shoppers. Keep reading to learn everything you need to.

Does Instacart Give You A W2? YouTube

Keep reading to learn everything you need to. If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no. No, instacart does not issue w2 forms to its independent contractors. It shows your annual wages and taxes withheld from the company. As an independent contractor, you are considered.

How To Make the Most Money with Instacart 8 Tips to Maximize Earnings

Does instacart provide w2 forms? No, instacart does not issue w2 forms to its independent contractors. As an independent contractor, you are considered self. Keep reading to learn everything you need to. It shows your annual wages and taxes withheld from the company.

How Much Money Can You Make with Instacart? Addify

No, instacart does not issue w2 forms to its independent contractors. Does instacart provide w2 forms? The short answer is yes, but not to all shoppers. It shows your annual wages and taxes withheld from the company. As an independent contractor, you are considered self.

Why an Instacart Shopper Can be the Perfect Side Hustle

Does instacart provide w2 forms? If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no. It shows your annual wages and taxes withheld from the company. As an independent contractor, you are considered self. The short answer is yes, but not to all shoppers.

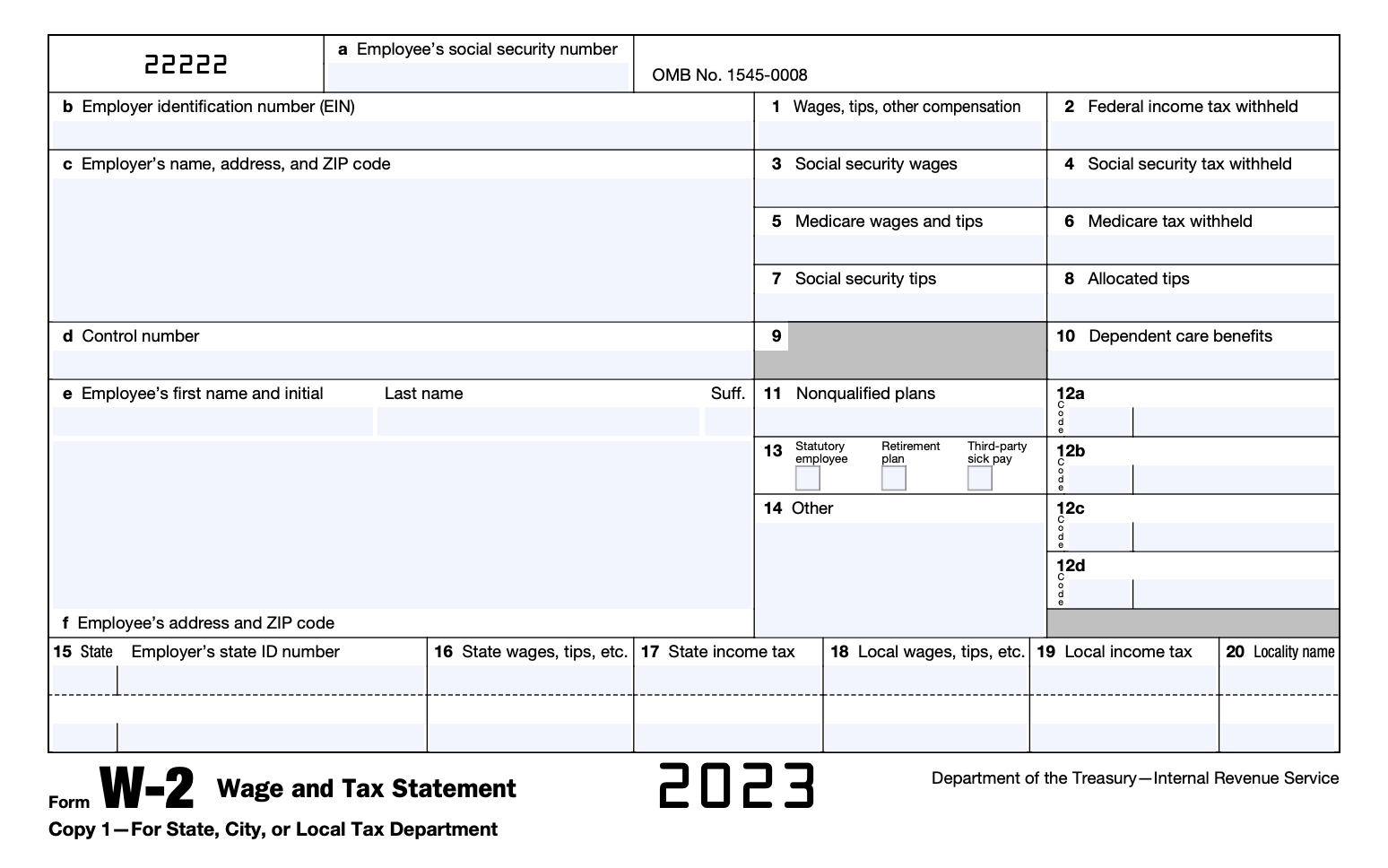

What Is W2 Form And How To Get W2 Wage And Tax Statement

The short answer is yes, but not to all shoppers. Keep reading to learn everything you need to. As an independent contractor, you are considered self. No, instacart does not issue w2 forms to its independent contractors. If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no.

When Do You Get W2 2024 Blake Christan

As an independent contractor, you are considered self. Does instacart provide w2 forms? The short answer is yes, but not to all shoppers. It shows your annual wages and taxes withheld from the company. No, instacart does not issue w2 forms to its independent contractors.

How Much Can You Make With Instacart (Earnings Report 2023)

No, instacart does not issue w2 forms to its independent contractors. Keep reading to learn everything you need to. Does instacart provide w2 forms? If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no. As an independent contractor, you are considered self.

How To Read Your Form W2 At Tax Time

Does instacart provide w2 forms? As an independent contractor, you are considered self. Keep reading to learn everything you need to. The short answer is yes, but not to all shoppers. No, instacart does not issue w2 forms to its independent contractors.

How Much Can You Make With Instacart?

The short answer is yes, but not to all shoppers. As an independent contractor, you are considered self. No, instacart does not issue w2 forms to its independent contractors. It shows your annual wages and taxes withheld from the company. Keep reading to learn everything you need to.

Does Instacart Provide W2 Forms?

As an independent contractor, you are considered self. No, instacart does not issue w2 forms to its independent contractors. It shows your annual wages and taxes withheld from the company. If you’re a full service shopper, like in the case of the independent contractor, then you are an independent contractor, and there’s no.

Keep Reading To Learn Everything You Need To.

The short answer is yes, but not to all shoppers.