Categorize Tax Penalties In Quickbooks

Categorize Tax Penalties In Quickbooks - They settled and paid $20k in owed taxes and $10k. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Sui employer for unemployment tax. Categorize the tax payments under the appropriate liability account, such as payroll liabilities: To categorize irs payments in quickbooks, the first step is to set up irs payments as a vendor within the software, utilizing appropriate tax. We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. I do the bookkeeping for a company that had a sales tax audit by ny in 2021.

I do the bookkeeping for a company that had a sales tax audit by ny in 2021. We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. They settled and paid $20k in owed taxes and $10k. Categorize the tax payments under the appropriate liability account, such as payroll liabilities: In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Sui employer for unemployment tax. To categorize irs payments in quickbooks, the first step is to set up irs payments as a vendor within the software, utilizing appropriate tax.

We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. To categorize irs payments in quickbooks, the first step is to set up irs payments as a vendor within the software, utilizing appropriate tax. They settled and paid $20k in owed taxes and $10k. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Sui employer for unemployment tax. Categorize the tax payments under the appropriate liability account, such as payroll liabilities: I do the bookkeeping for a company that had a sales tax audit by ny in 2021.

How to Categorize Credit Card Payments in QuickBooks? MWJ Consultancy

In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. To categorize irs payments in quickbooks, the first step is to set up irs payments as a vendor within the software, utilizing appropriate tax. In quickbooks online, the correct way to record tax penalties and interest is by making a journal.

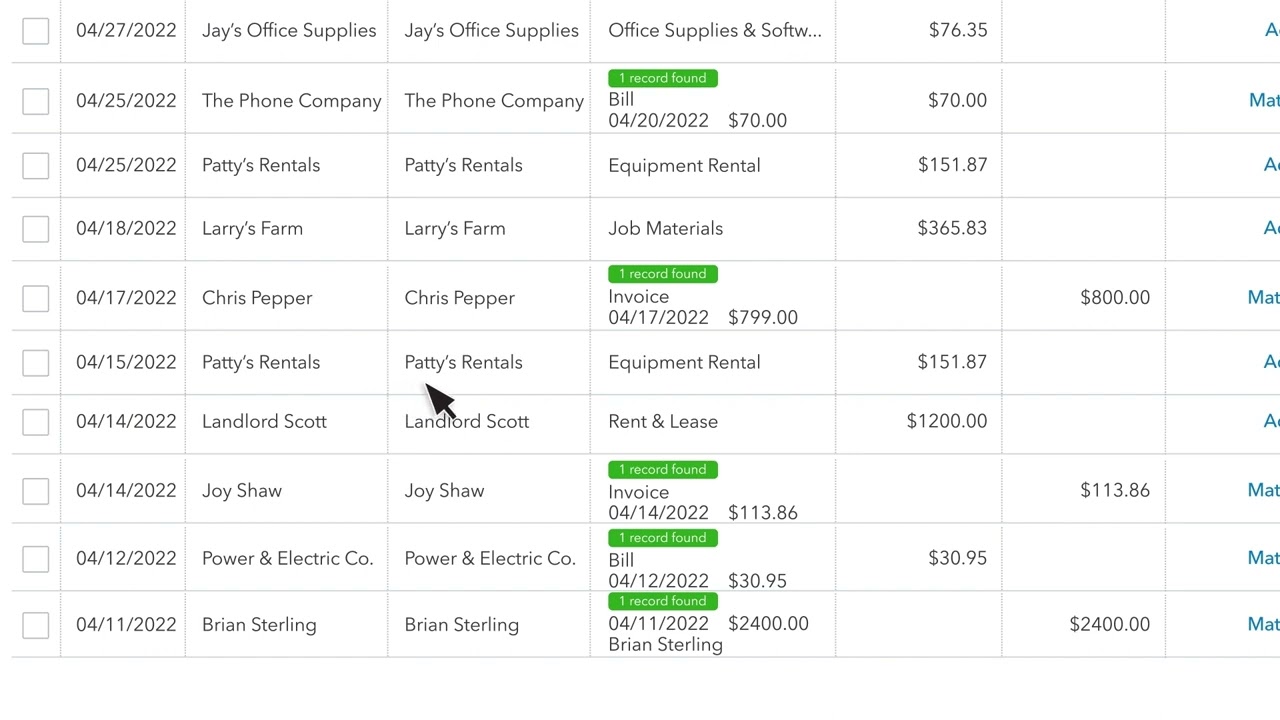

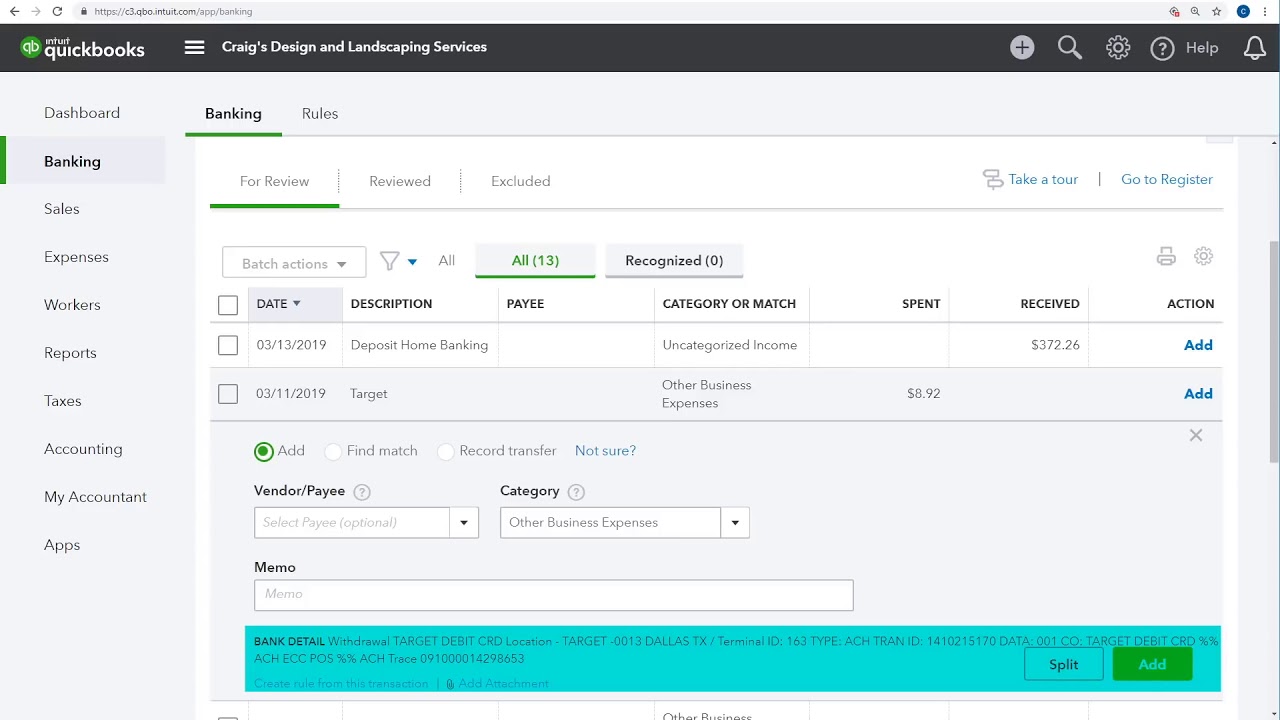

How to Categorise Transactions in QuickBooks Online Introduction to

In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. They settled and paid $20k in owed taxes and $10k. Sui employer for unemployment tax. In quickbooks online, the correct way.

How to categorize transactions in QuickBooks Online Booke AI

Categorize the tax payments under the appropriate liability account, such as payroll liabilities: To categorize irs payments in quickbooks, the first step is to set up irs payments as a vendor within the software, utilizing appropriate tax. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change.

How to Categorize a Credit Card Payment in QuickBooks

Categorize the tax payments under the appropriate liability account, such as payroll liabilities: We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. To categorize irs payments in quickbooks, the first.

How To Categorize a Tax Refund In QuickBooks

Sui employer for unemployment tax. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. I do the bookkeeping for a company that had a sales tax audit by ny in 2021. They settled and paid $20k in owed taxes and $10k. In quickbooks online, the correct way to record tax.

How to Categorize Transactions in QuickBooks

To categorize irs payments in quickbooks, the first step is to set up irs payments as a vendor within the software, utilizing appropriate tax. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Categorize the tax payments under the appropriate liability account, such as payroll.

How To Categorize a Tax Refund In QuickBooks

They settled and paid $20k in owed taxes and $10k. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. Sui employer for unemployment tax. We've been.

How To Categorize a Tax Refund In QuickBooks

To categorize irs payments in quickbooks, the first step is to set up irs payments as a vendor within the software, utilizing appropriate tax. Sui employer for unemployment tax. We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. In this article, we’ll walk you through the process of categorizing.

How to Categorize Transactions From Your Bank & Credit Card QuickBooks

They settled and paid $20k in owed taxes and $10k. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. Sui employer for unemployment tax. Categorize the tax payments under the.

QUICKBOOKS (QBO) HOW TO Categorize transactions in Bank Feeds YouTube

In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. Sui employer for unemployment tax. In this article, we’ll walk you through the process of categorizing tax payments in quickbooks online, highlighting the important. I do the bookkeeping for a company that had a sales tax.

In This Article, We’ll Walk You Through The Process Of Categorizing Tax Payments In Quickbooks Online, Highlighting The Important.

We've been classifying expenses we make to relieve speeding and parking citations incurred by our employees as penalties & settlements.. In quickbooks online, the correct way to record tax penalties and interest is by making a journal entry to account for the change in. They settled and paid $20k in owed taxes and $10k. Sui employer for unemployment tax.

To Categorize Irs Payments In Quickbooks, The First Step Is To Set Up Irs Payments As A Vendor Within The Software, Utilizing Appropriate Tax.

I do the bookkeeping for a company that had a sales tax audit by ny in 2021. Categorize the tax payments under the appropriate liability account, such as payroll liabilities: