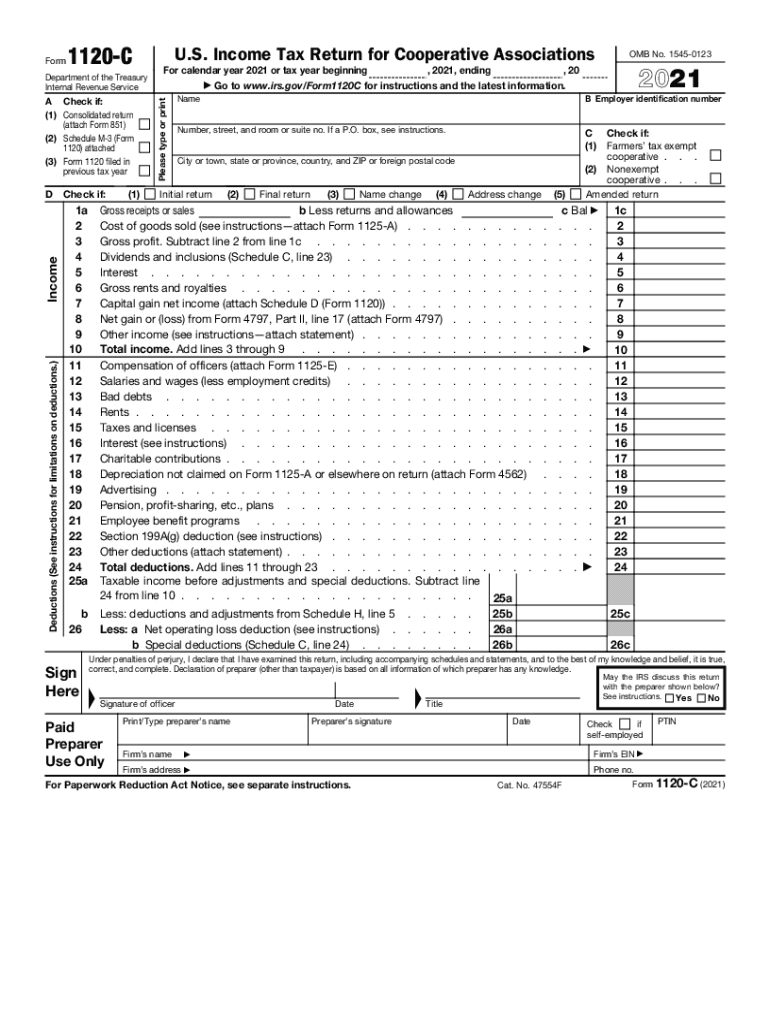

C Corporation Tax Form

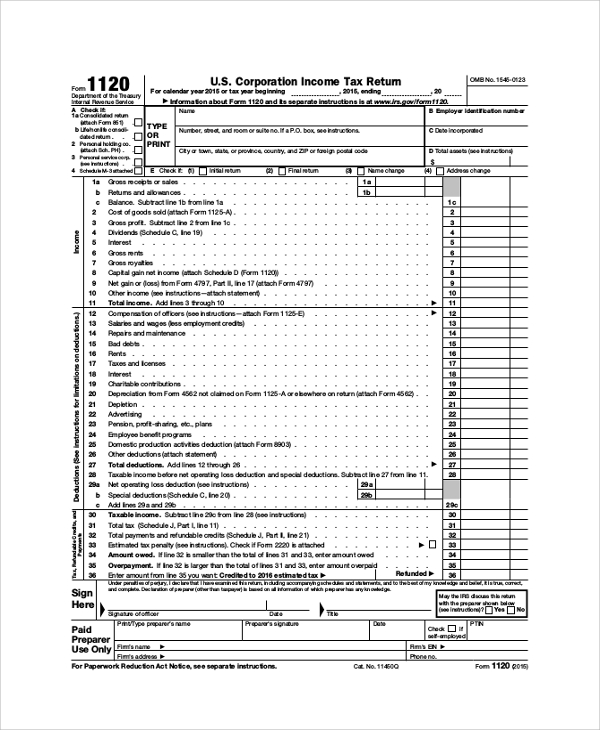

C Corporation Tax Form - 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

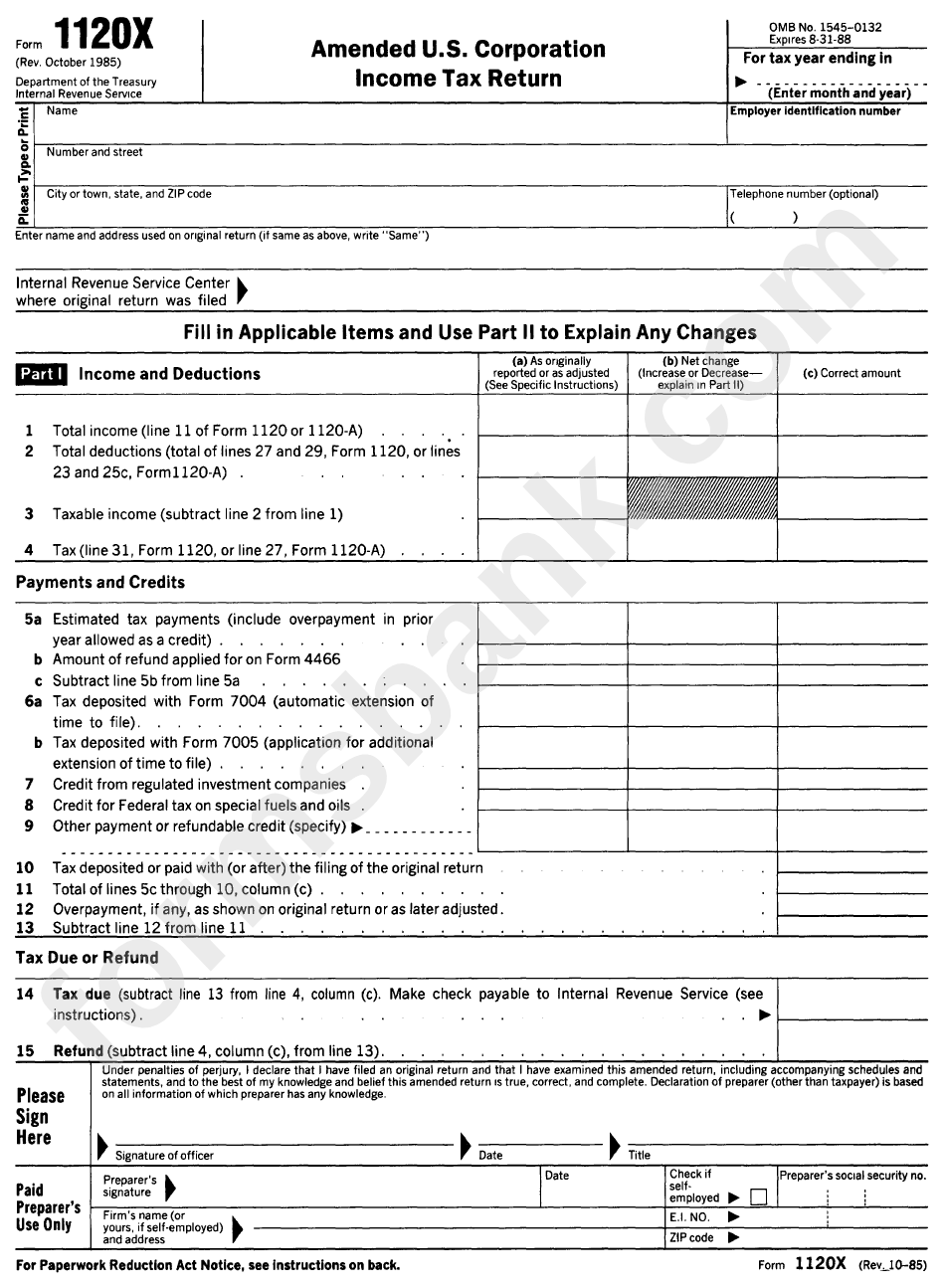

Form 1120x Amended U.s. Corporation Tax Return printable pdf

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

Download C Corporation Tax (Form 1120) SoftArchive

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

What Is IRS Form 1120 Tax Return Form For Corporation

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

What's Best, Corporation or LLC? S Corporation C Corporation Tax

43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

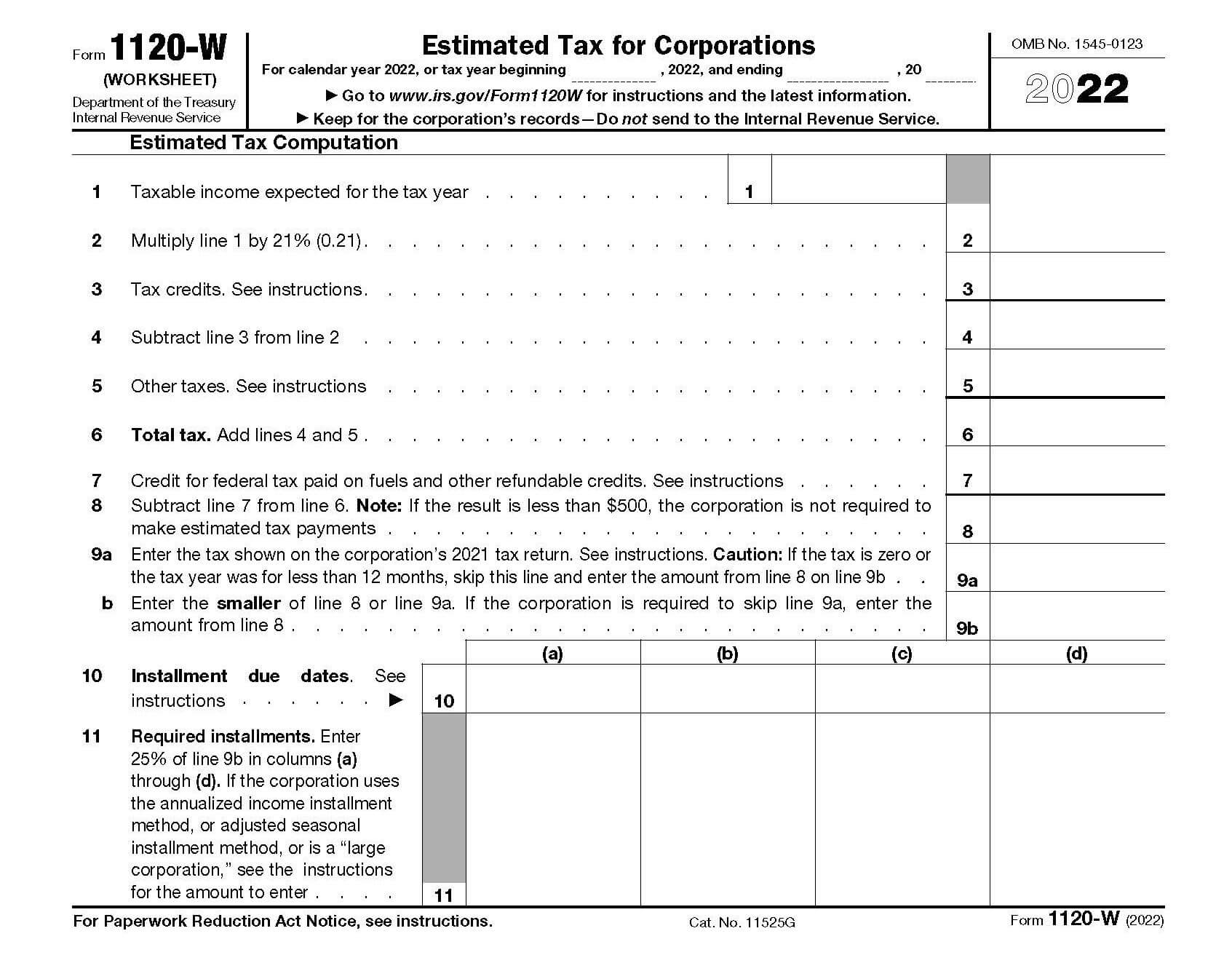

C Corporation Tax Rates 20212024 Form Fill Out and Sign Printable

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

2023 Form 1120 W Printable Forms Free Online

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

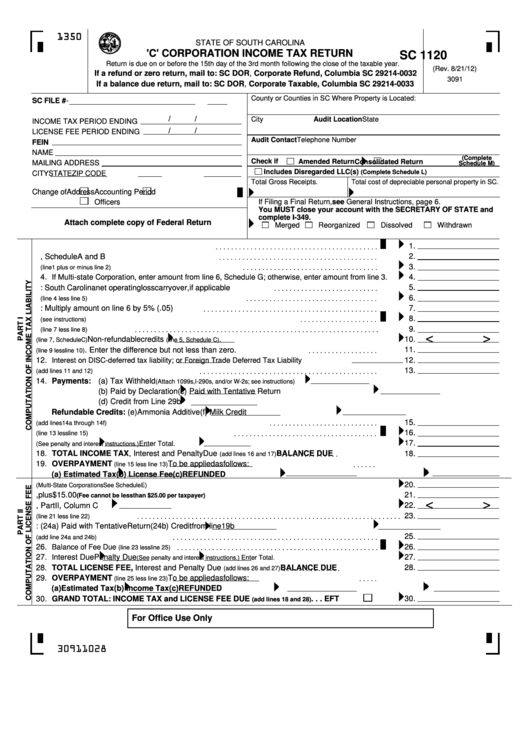

Cd 405 instructions 2021 Fill out & sign online DocHub

43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

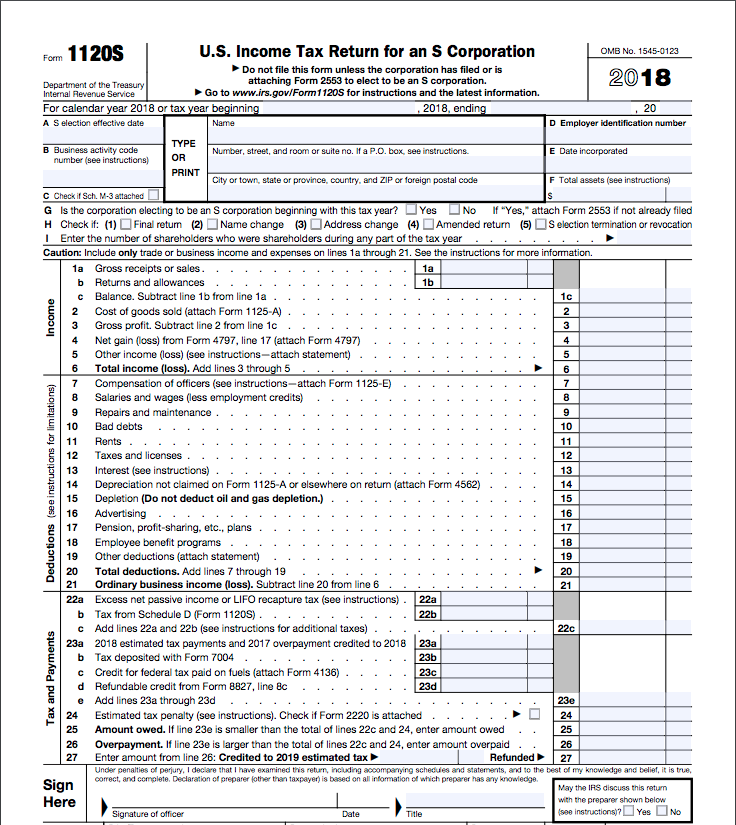

How To Complete Form 1120s S Corporation Tax Return Heading

43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Free Fillable Form 1120 H Printable Forms Free Online

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. 43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

Use This Form To Report The Income, Gains, Losses, Deductions, Credits, And To Figure The Income Tax Liability Of A Corporation.

43 rows report wages, tips, and other compensation, and withheld income, social security, and medicare taxes for employees.

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)