Airbnb Schedule E Or C

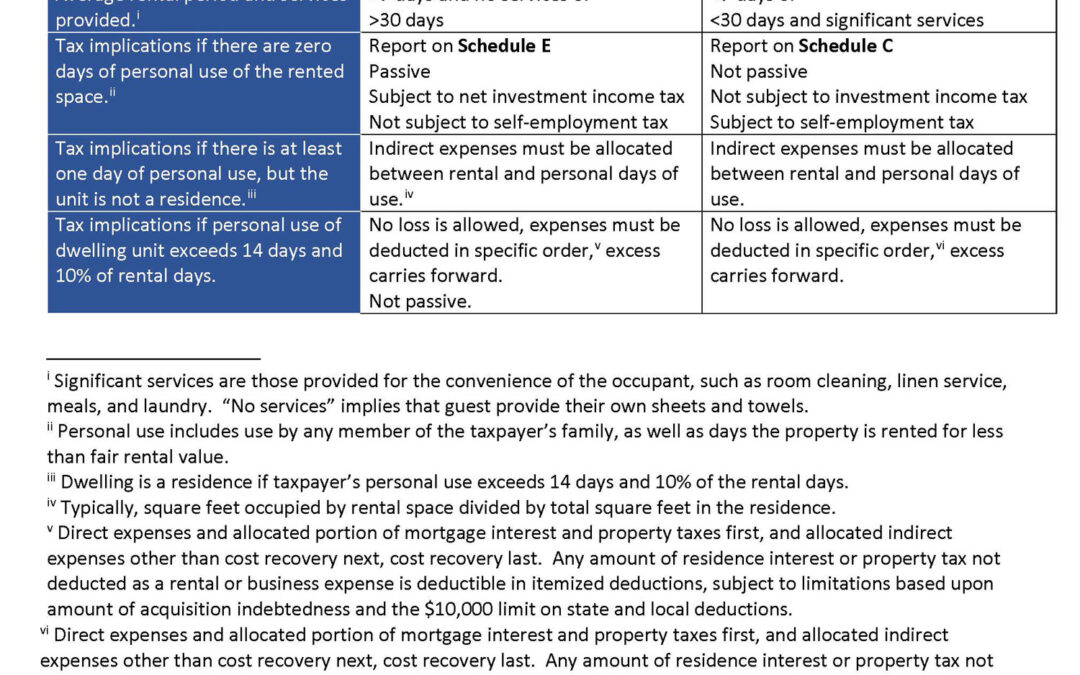

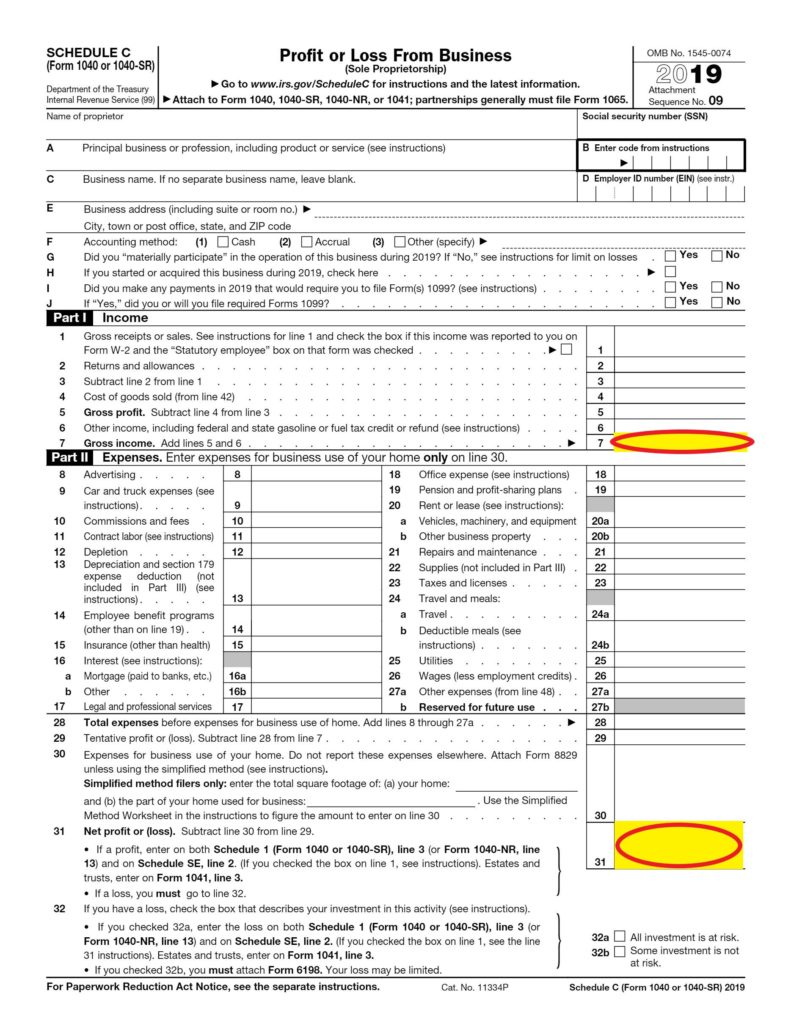

Airbnb Schedule E Or C - Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

Both options have advantages and disadvantages,. Understanding whether to file your rental income through schedule c or schedule e is crucial.

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

Airbnb Schedule C or E How to report your Airbnb Taxes Taxed Right

Both options have advantages and disadvantages,. Understanding whether to file your rental income through schedule c or schedule e is crucial.

Airbnb Taxes Schedule C Vs. Schedule E Passive Airbnb

Both options have advantages and disadvantages,. Understanding whether to file your rental income through schedule c or schedule e is crucial.

Short Term Rental Archives David Weinstein MBA CPA CFE

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

Airbnb EGift Card (1002000) Thank You Reward for Our Client

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

Synchronize Airbnb Calendar Printable And Enjoyable Learning

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

Schedule C or Schedule E for rental property owners? Airbnb Taxes

Both options have advantages and disadvantages,. Understanding whether to file your rental income through schedule c or schedule e is crucial.

Airbnb Taxes Schedule C Vs. Schedule E Passive Airbnb

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

Airbnb Provider Checklist Template Google Sheets Excel Spreadsheet in

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

How to update my calendar? Airbnb Community

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,.

Both Options Have Advantages And Disadvantages,.

Understanding whether to file your rental income through schedule c or schedule e is crucial.