Airbnb Schedule C Or E

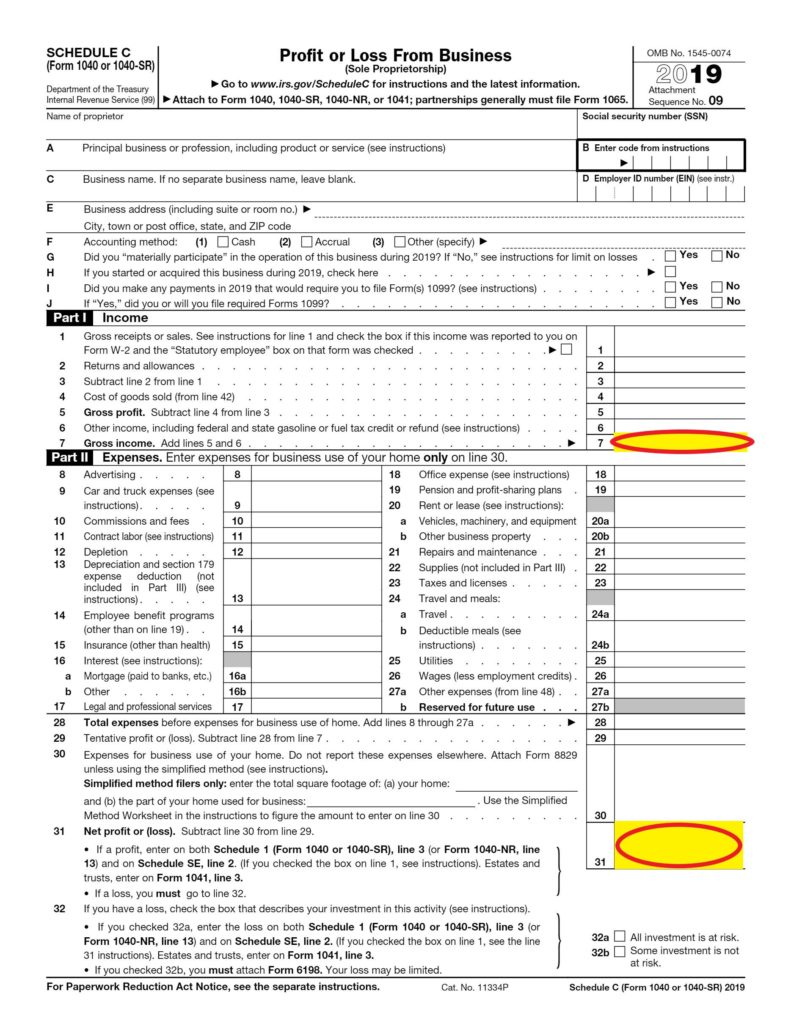

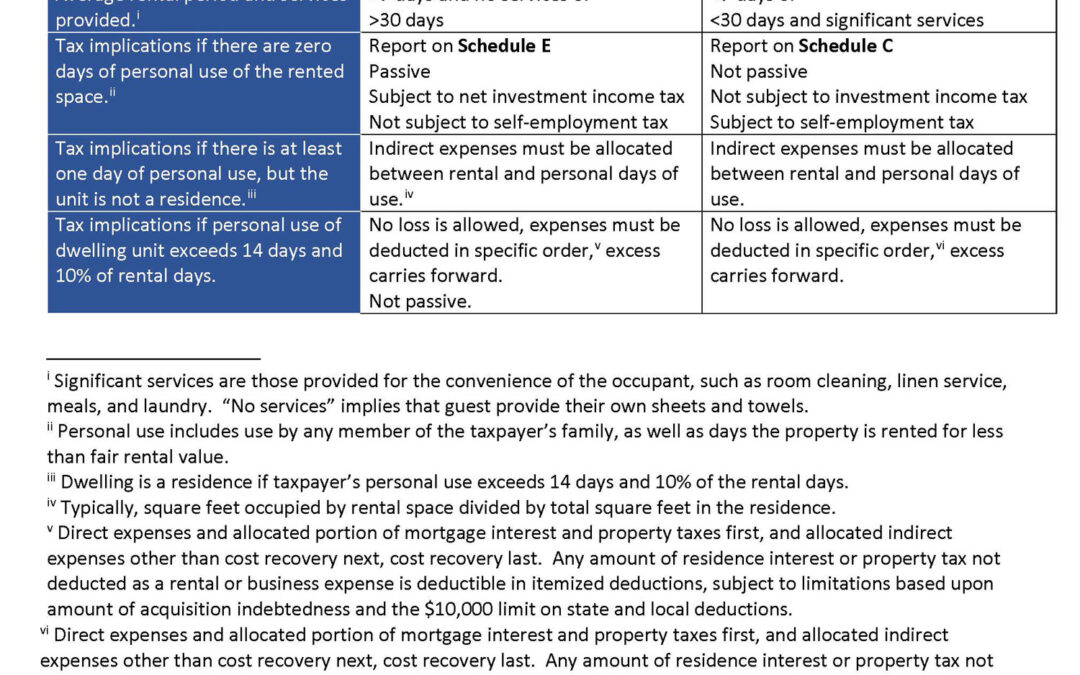

Airbnb Schedule C Or E - What’s the difference between schedule c and schedule e for airbnb rentals? Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,. The distinction comes down to whether your airbnb activity is.

What’s the difference between schedule c and schedule e for airbnb rentals? Both options have advantages and disadvantages,. Understanding whether to file your rental income through schedule c or schedule e is crucial. The distinction comes down to whether your airbnb activity is.

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,. What’s the difference between schedule c and schedule e for airbnb rentals? The distinction comes down to whether your airbnb activity is.

Airbnb Schedule C or E? David Weinstein MBA CPA CFE

The distinction comes down to whether your airbnb activity is. Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,. What’s the difference between schedule c and schedule e for airbnb rentals?

Synchronize Airbnb Calendar Printable And Enjoyable Learning

The distinction comes down to whether your airbnb activity is. What’s the difference between schedule c and schedule e for airbnb rentals? Both options have advantages and disadvantages,. Understanding whether to file your rental income through schedule c or schedule e is crucial.

PPP Guide for SelfEmployed (Schedule C/1099) COVID Chai+1

Understanding whether to file your rental income through schedule c or schedule e is crucial. The distinction comes down to whether your airbnb activity is. Both options have advantages and disadvantages,. What’s the difference between schedule c and schedule e for airbnb rentals?

Short Term Rental Archives David Weinstein MBA CPA CFE

Understanding whether to file your rental income through schedule c or schedule e is crucial. What’s the difference between schedule c and schedule e for airbnb rentals? The distinction comes down to whether your airbnb activity is. Both options have advantages and disadvantages,.

Airbnb EGift Card (1002000) Thank You Reward for Our Client

Both options have advantages and disadvantages,. The distinction comes down to whether your airbnb activity is. What’s the difference between schedule c and schedule e for airbnb rentals? Understanding whether to file your rental income through schedule c or schedule e is crucial.

How to update my calendar? Airbnb Community

Both options have advantages and disadvantages,. What’s the difference between schedule c and schedule e for airbnb rentals? Understanding whether to file your rental income through schedule c or schedule e is crucial. The distinction comes down to whether your airbnb activity is.

Airbnb Provider Checklist Template Google Sheets Excel Spreadsheet in

Understanding whether to file your rental income through schedule c or schedule e is crucial. What’s the difference between schedule c and schedule e for airbnb rentals? Both options have advantages and disadvantages,. The distinction comes down to whether your airbnb activity is.

Airbnb Taxes Schedule C Vs. Schedule E Passive Airbnb

The distinction comes down to whether your airbnb activity is. Both options have advantages and disadvantages,. Understanding whether to file your rental income through schedule c or schedule e is crucial. What’s the difference between schedule c and schedule e for airbnb rentals?

Airbnb Taxes Schedule C Vs. Schedule E Passive Airbnb

What’s the difference between schedule c and schedule e for airbnb rentals? Both options have advantages and disadvantages,. The distinction comes down to whether your airbnb activity is. Understanding whether to file your rental income through schedule c or schedule e is crucial.

Airbnb Schedule C or E How to report your Airbnb Taxes Taxed Right

Understanding whether to file your rental income through schedule c or schedule e is crucial. The distinction comes down to whether your airbnb activity is. Both options have advantages and disadvantages,. What’s the difference between schedule c and schedule e for airbnb rentals?

What’s The Difference Between Schedule C And Schedule E For Airbnb Rentals?

Understanding whether to file your rental income through schedule c or schedule e is crucial. Both options have advantages and disadvantages,. The distinction comes down to whether your airbnb activity is.