Airbnb Excluded States

Airbnb Excluded States - Based in their home country, where it will be taxed. While the position is remote eligible, you must live in a state where airbnb, inc. To determine if a state is excluded from airbnb, hosts can review airbnb’s website or consult with local authorities to understand the. Currently, employees cannot be located/live in: Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware. Airbnb recommends that this foreign sourced income earned by remote. Can hire employees in states where we have registered entities. Currently, employees cannot be located/live in:

Airbnb recommends that this foreign sourced income earned by remote. Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware. Currently, employees cannot be located/live in: While the position is remote eligible, you must live in a state where airbnb, inc. To determine if a state is excluded from airbnb, hosts can review airbnb’s website or consult with local authorities to understand the. Currently, employees cannot be located/live in: Can hire employees in states where we have registered entities. Based in their home country, where it will be taxed.

To determine if a state is excluded from airbnb, hosts can review airbnb’s website or consult with local authorities to understand the. Can hire employees in states where we have registered entities. Currently, employees cannot be located/live in: Currently, employees cannot be located/live in: While the position is remote eligible, you must live in a state where airbnb, inc. Based in their home country, where it will be taxed. Airbnb recommends that this foreign sourced income earned by remote. Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware.

Airbnb Icons in the Making Podcast Lippincott

Based in their home country, where it will be taxed. Airbnb recommends that this foreign sourced income earned by remote. Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware. Can hire employees in states where we have registered entities. While the position is remote eligible, you must live in a state where airbnb, inc.

Best Airbnbs for Remote Work Across the U.S. MakeMyMove

While the position is remote eligible, you must live in a state where airbnb, inc. Based in their home country, where it will be taxed. To determine if a state is excluded from airbnb, hosts can review airbnb’s website or consult with local authorities to understand the. Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware. Currently, employees cannot be.

25 Off Airbnb Coupon Code March 2024

Currently, employees cannot be located/live in: Currently, employees cannot be located/live in: Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware. Based in their home country, where it will be taxed. While the position is remote eligible, you must live in a state where airbnb, inc.

How A Great airbnb Experience Can Change Your Life Travel Shop Girl

Currently, employees cannot be located/live in: Airbnb recommends that this foreign sourced income earned by remote. Can hire employees in states where we have registered entities. Based in their home country, where it will be taxed. While the position is remote eligible, you must live in a state where airbnb, inc.

Airbnb Edges Expedia Brand in Online Travel’s Top TV Ad Spenders so Far

Can hire employees in states where we have registered entities. While the position is remote eligible, you must live in a state where airbnb, inc. To determine if a state is excluded from airbnb, hosts can review airbnb’s website or consult with local authorities to understand the. Airbnb recommends that this foreign sourced income earned by remote. Currently, employees cannot.

Airbnb Startup Cost—Business Plan

Based in their home country, where it will be taxed. While the position is remote eligible, you must live in a state where airbnb, inc. Can hire employees in states where we have registered entities. Airbnb recommends that this foreign sourced income earned by remote. Currently, employees cannot be located/live in:

Expenses Costs Involved Running an Airbnb HelloGuest

Can hire employees in states where we have registered entities. Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware. Based in their home country, where it will be taxed. Currently, employees cannot be located/live in: Airbnb recommends that this foreign sourced income earned by remote.

Airbnb Vs. Hotels The Better Choice

Airbnb recommends that this foreign sourced income earned by remote. Can hire employees in states where we have registered entities. While the position is remote eligible, you must live in a state where airbnb, inc. Currently, employees cannot be located/live in: Currently, employees cannot be located/live in:

How to Extract Booking Data From Airbnb Emails

Can hire employees in states where we have registered entities. While the position is remote eligible, you must live in a state where airbnb, inc. Based in their home country, where it will be taxed. Currently, employees cannot be located/live in: Alaska, nebraska, north dakota, wisconsin, alabama, mississippi, and delaware.

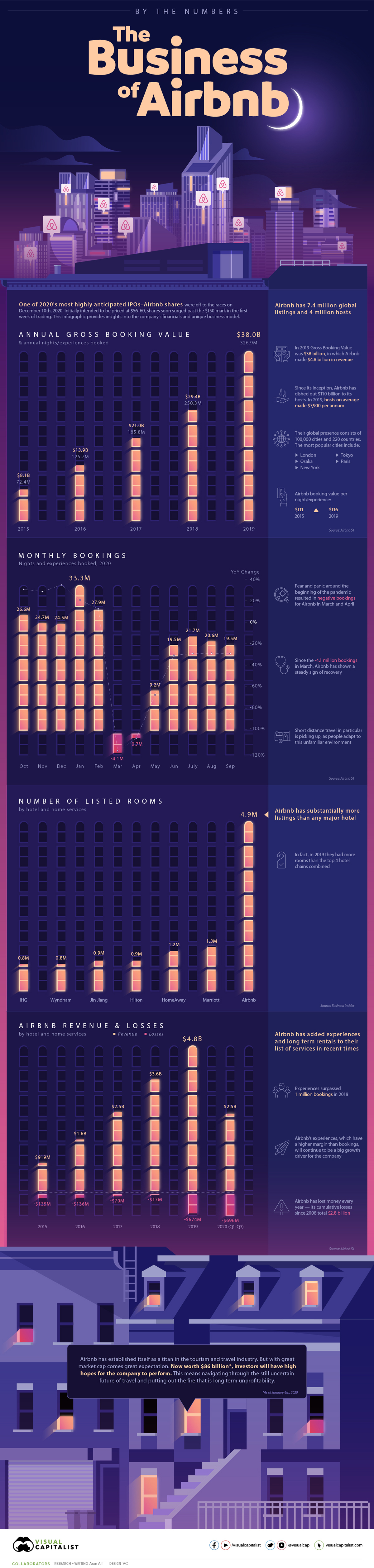

The Business of Airbnb, by the Numbers Investment Watch Blog

To determine if a state is excluded from airbnb, hosts can review airbnb’s website or consult with local authorities to understand the. Currently, employees cannot be located/live in: While the position is remote eligible, you must live in a state where airbnb, inc. Based in their home country, where it will be taxed. Airbnb recommends that this foreign sourced income.

Based In Their Home Country, Where It Will Be Taxed.

Can hire employees in states where we have registered entities. Airbnb recommends that this foreign sourced income earned by remote. To determine if a state is excluded from airbnb, hosts can review airbnb’s website or consult with local authorities to understand the. Currently, employees cannot be located/live in:

Alaska, Nebraska, North Dakota, Wisconsin, Alabama, Mississippi, And Delaware.

While the position is remote eligible, you must live in a state where airbnb, inc. Currently, employees cannot be located/live in: