Additional Medicare Tax

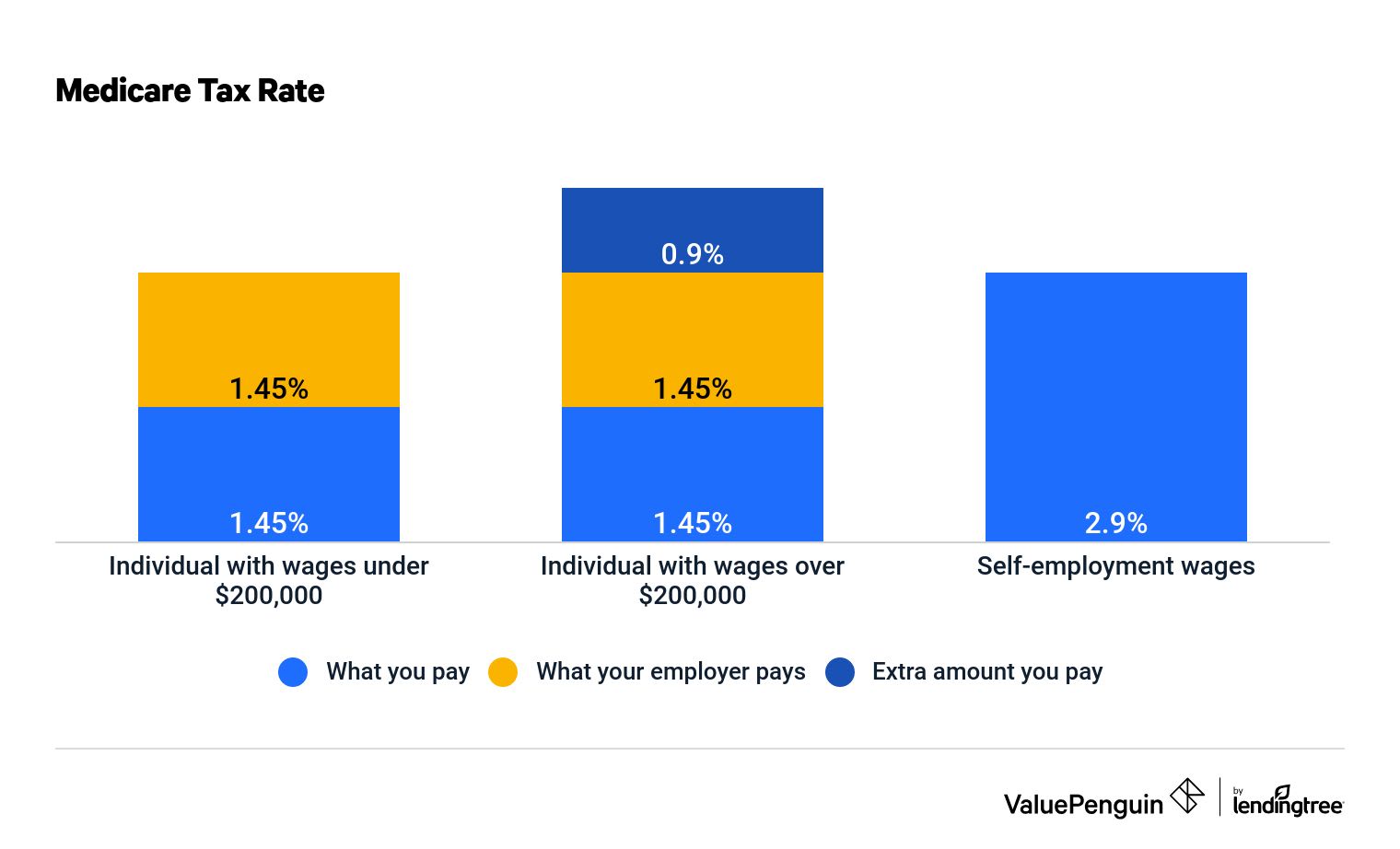

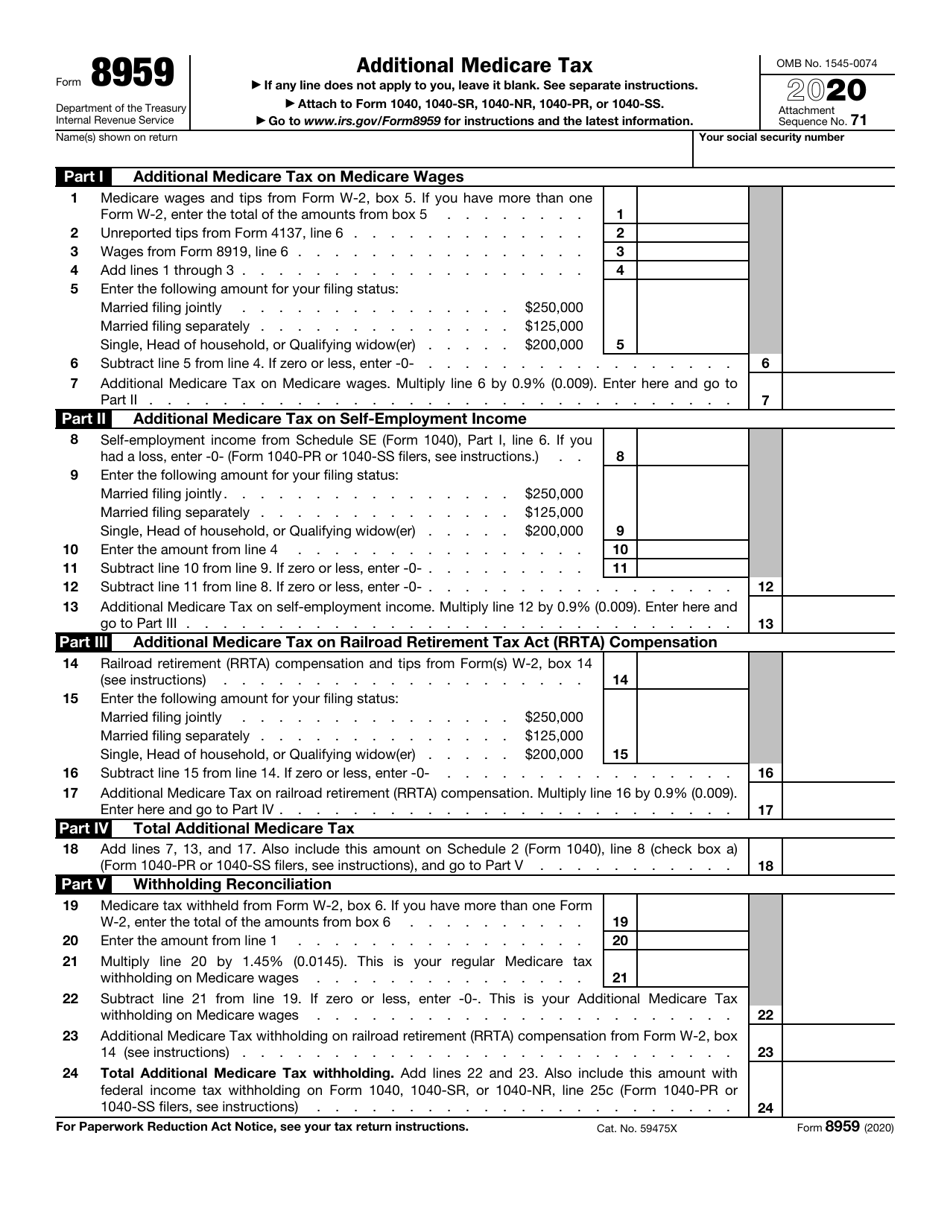

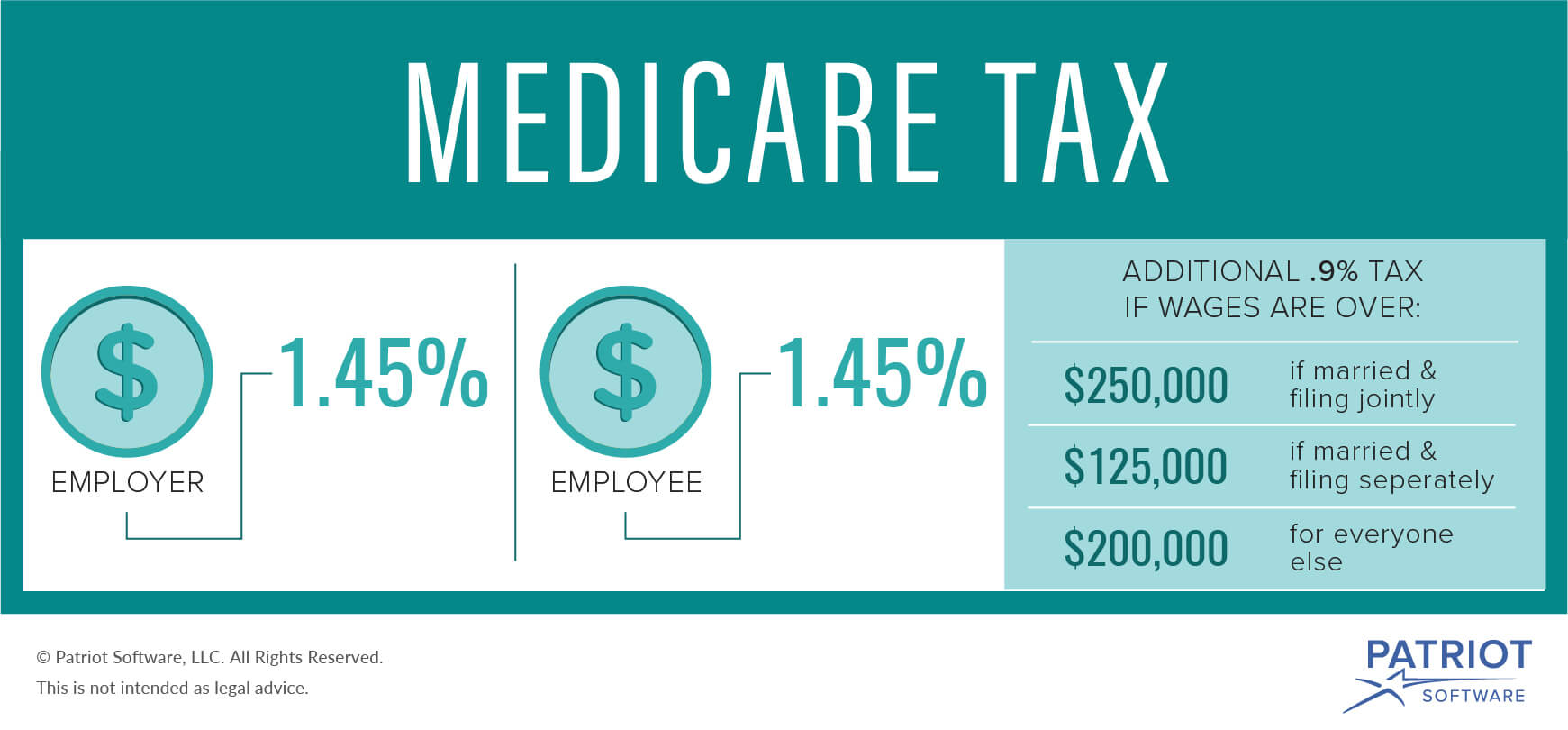

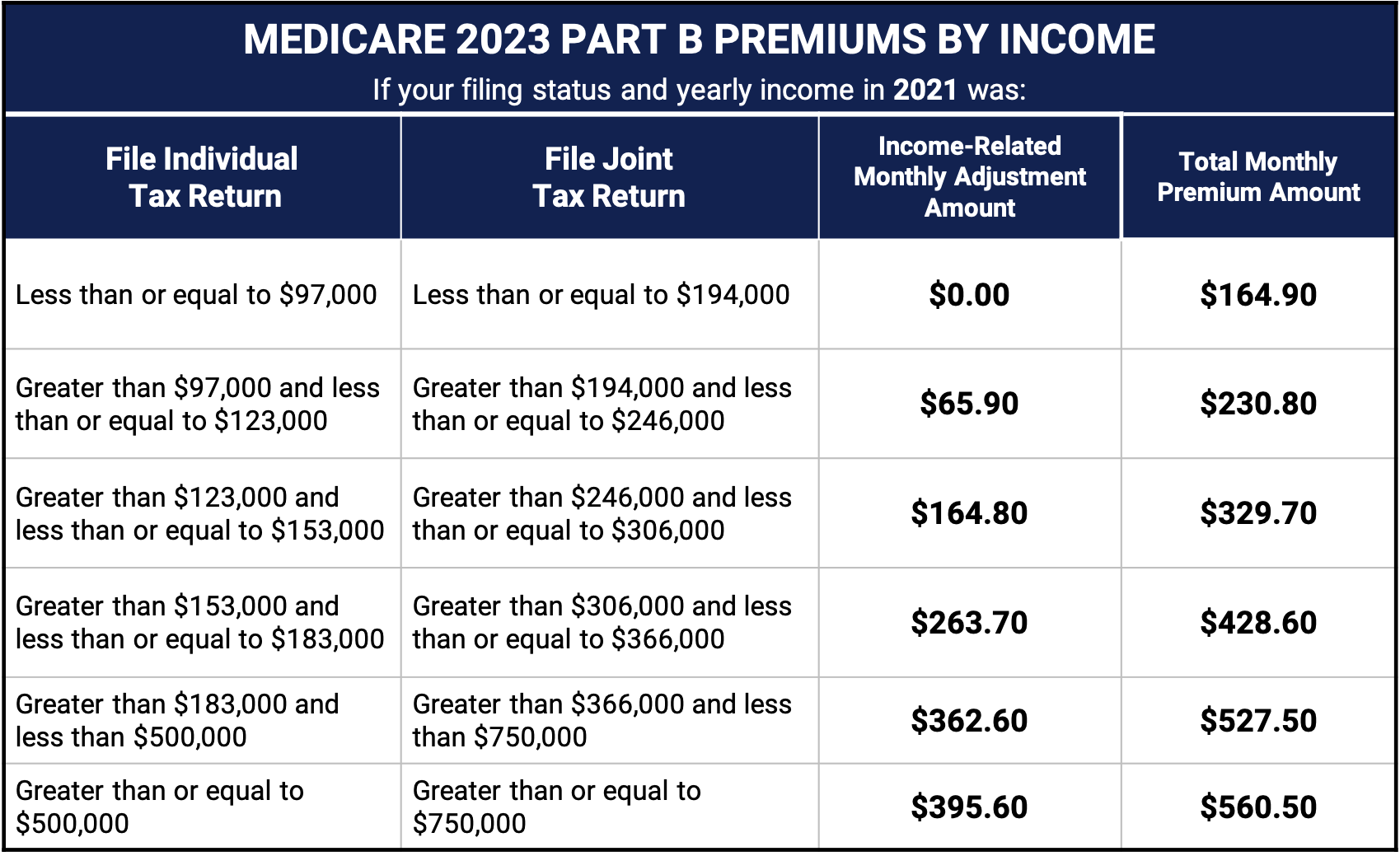

Additional Medicare Tax - This article explains the medicare standard tax and the medicare additional tax. It applies to taxpayers who earn over a set income threshold. You’ll only have to pay the additional tax if your income surpasses a specific. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. Find information on the additional medicare tax. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does.

You’ll only have to pay the additional tax if your income surpasses a specific. This article explains the medicare standard tax and the medicare additional tax. Find information on the additional medicare tax. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. It applies to taxpayers who earn over a set income threshold.

You’ll only have to pay the additional tax if your income surpasses a specific. Find information on the additional medicare tax. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. This article explains the medicare standard tax and the medicare additional tax. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It applies to taxpayers who earn over a set income threshold.

What is Medicare Tax Purpose, Rate, Additional Medicare, and More

This article explains the medicare standard tax and the medicare additional tax. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. You’ll only have to pay the additional tax if your income surpasses a specific. It applies to taxpayers who earn over a set income threshold. The additional medicare.

Additional Medicare Tax 2024 Form 2024 Application Tobe Adriena

It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. It applies to taxpayers who earn over a set income threshold. This article explains the medicare standard tax and the medicare additional tax. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does..

Understanding Medicare Additional Tax

You’ll only have to pay the additional tax if your income surpasses a specific. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. This article explains the medicare standard tax and.

Form 8959 Additional Medicare Tax (2014) Free Download

It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. You’ll only have to pay the additional tax if your income surpasses a specific. Find information on the additional medicare tax. The.

What Is Additional Medicare Tax? A Comprehensive Guide The

This article explains the medicare standard tax and the medicare additional tax. Find information on the additional medicare tax. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It applies to taxpayers who earn over a set income threshold. The additional medicare tax is an extra 0.9% tax on top of the.

What Is Additional Medicare Tax? A Comprehensive Guide The

The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. You’ll only have to pay the additional tax if your income surpasses a specific. It applies to taxpayers who earn over a set income threshold. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare..

Additional Medicare Tax Information for Employers

It applies to taxpayers who earn over a set income threshold. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. Find information on the additional medicare tax. You’ll only have to pay the additional tax if your income surpasses a specific. The additional medicare tax is 0.9%, but it.

What Is Medicare Tax? Definitions, Rates and Calculations ValuePenguin

It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. This article explains the medicare standard tax and the medicare additional tax. It applies to taxpayers who earn over a set income threshold. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does..

Additional Medicare Tax Limit 2024 Leta Brittani

Find information on the additional medicare tax. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It applies to taxpayers who earn over a set income threshold. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. It also looks at who pays the.

Understanding the Additional Medicare Tax For High Earners

The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It applies to taxpayers who earn over a set income threshold. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. This article explains the medicare standard tax and the medicare additional tax. It also.

It Applies To Taxpayers Who Earn Over A Set Income Threshold.

This article explains the medicare standard tax and the medicare additional tax. Find information on the additional medicare tax. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the.

The Additional Medicare Tax Is 0.9%, But It Doesn’t Apply To Everyone Like Standard Medicare Tax Does.

You’ll only have to pay the additional tax if your income surpasses a specific.

:max_bytes(150000):strip_icc()/GettyImages-151333466-5661ad343df78cedb0b6a924.jpg)