Accrual Accounting In Quickbooks And Created A Customer Invoice

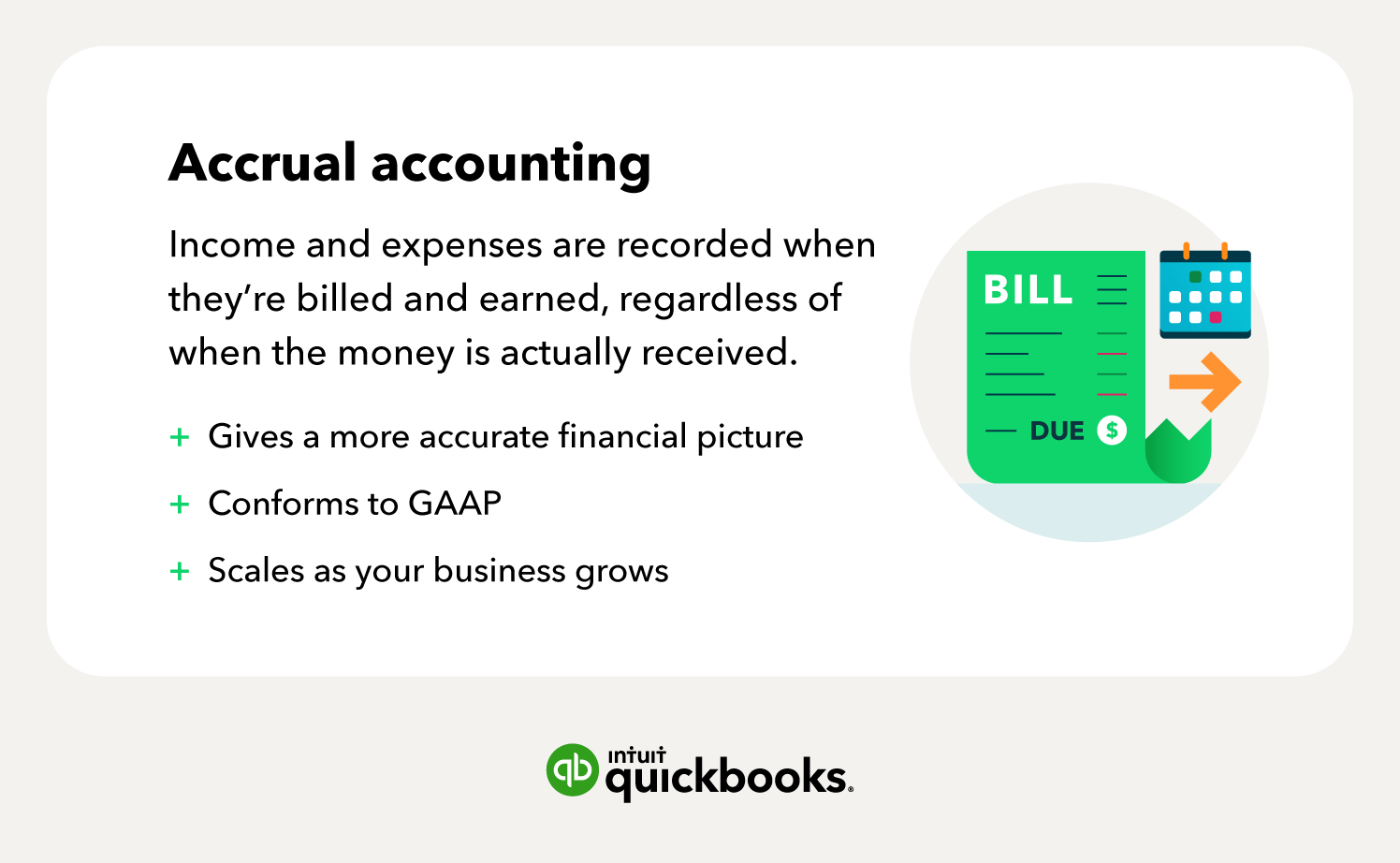

Accrual Accounting In Quickbooks And Created A Customer Invoice - Explore examples, journal entries, and how quickbooks tools can. Discover how to record accrued revenue accurately. Which account is debited when the invoice is. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Tasia is using accrual accounting in quickbooks and created a customer invoice.

Tasia is using accrual accounting in quickbooks and created a customer invoice. Which account is debited when the invoice is. Discover how to record accrued revenue accurately. Explore examples, journal entries, and how quickbooks tools can. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable.

When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Tasia is using accrual accounting in quickbooks and created a customer invoice. Explore examples, journal entries, and how quickbooks tools can. Which account is debited when the invoice is. Discover how to record accrued revenue accurately.

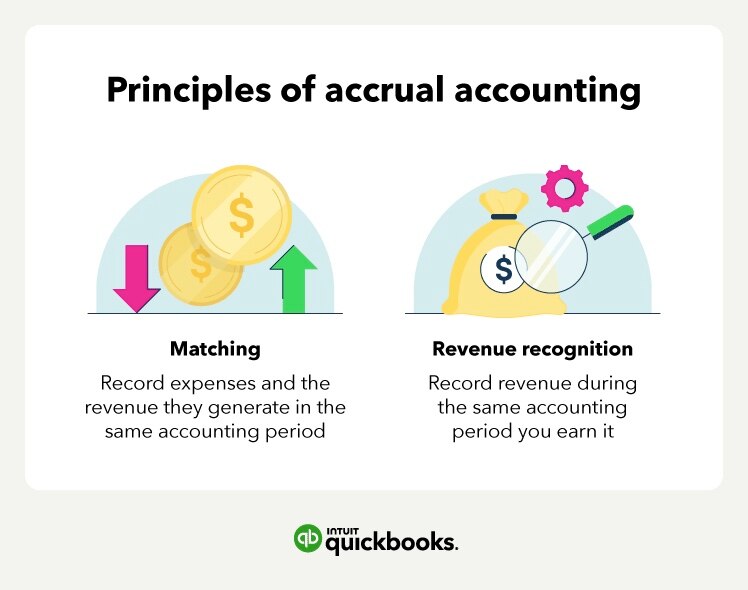

What is accrual accounting? All you need to know

Discover how to record accrued revenue accurately. Explore examples, journal entries, and how quickbooks tools can. Tasia is using accrual accounting in quickbooks and created a customer invoice. Which account is debited when the invoice is. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable.

Beginner's Ultimate Guide Accounting Methods Explained

When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Explore examples, journal entries, and how quickbooks tools can. Tasia is using accrual accounting in quickbooks and created a customer invoice. Which account is debited when the invoice is. Discover how to record accrued revenue accurately.

Accrual accounting How it works, advantages, and disadvantages Article

Discover how to record accrued revenue accurately. Which account is debited when the invoice is. Explore examples, journal entries, and how quickbooks tools can. Tasia is using accrual accounting in quickbooks and created a customer invoice. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable.

How to do Accrual Accounting in QuickBooks

Tasia is using accrual accounting in quickbooks and created a customer invoice. Discover how to record accrued revenue accurately. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Which account is debited when the invoice is. Explore examples, journal entries, and how quickbooks tools can.

What are accrued expenses? A breakdown of accrual accounting QuickBooks

Discover how to record accrued revenue accurately. Explore examples, journal entries, and how quickbooks tools can. Tasia is using accrual accounting in quickbooks and created a customer invoice. Which account is debited when the invoice is. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable.

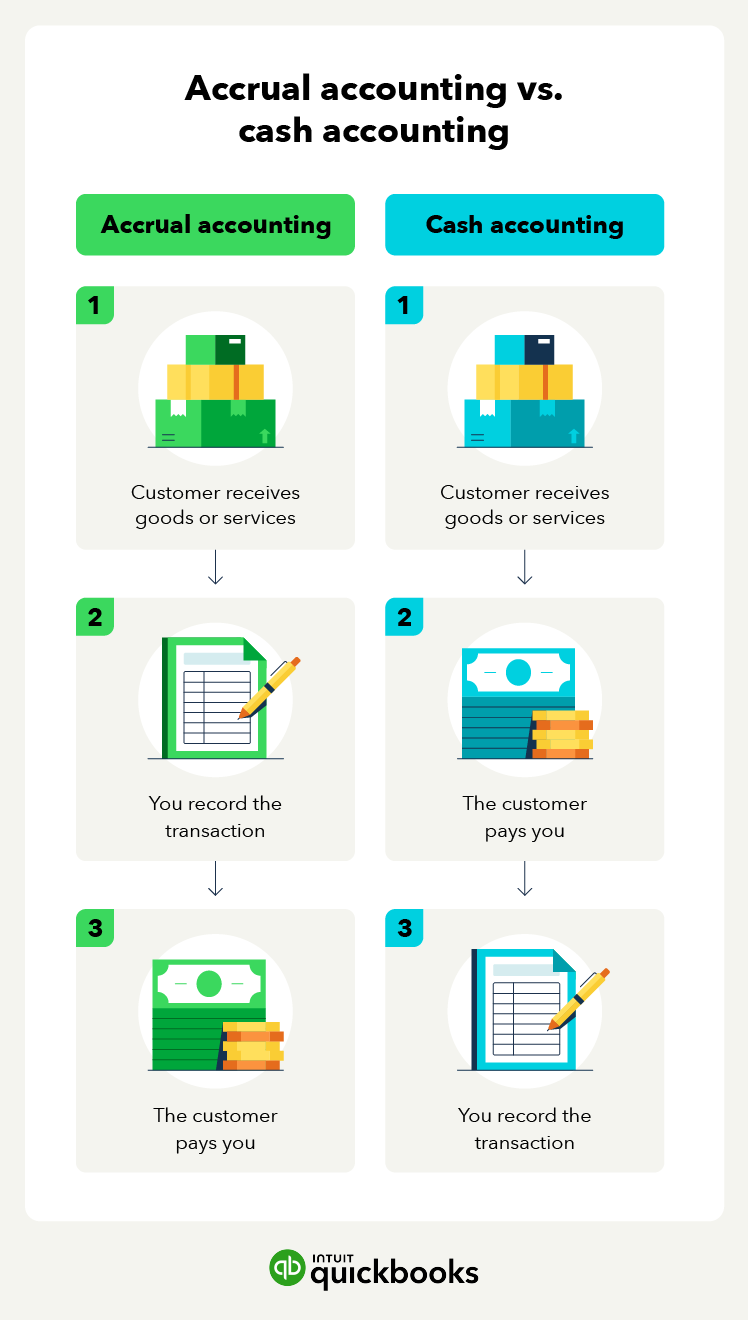

Cash accounting vs accrual accounting

Tasia is using accrual accounting in quickbooks and created a customer invoice. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Explore examples, journal entries, and how quickbooks tools can. Which account is debited when the invoice is. Discover how to record accrued revenue accurately.

What is Modified Accrual Accounting?

Which account is debited when the invoice is. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Tasia is using accrual accounting in quickbooks and created a customer invoice. Discover how to record accrued revenue accurately. Explore examples, journal entries, and how quickbooks tools can.

Accrued revenue how to record it in 2023 QuickBooks

When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Explore examples, journal entries, and how quickbooks tools can. Discover how to record accrued revenue accurately. Tasia is using accrual accounting in quickbooks and created a customer invoice. Which account is debited when the invoice is.

Tasia is using accrual accounting in QuickBooks and created a customer

Which account is debited when the invoice is. Discover how to record accrued revenue accurately. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable. Explore examples, journal entries, and how quickbooks tools can. Tasia is using accrual accounting in quickbooks and created a customer invoice.

Cash vs. Accrual Accounting Which is Best? QuickBooks

Which account is debited when the invoice is. Discover how to record accrued revenue accurately. Tasia is using accrual accounting in quickbooks and created a customer invoice. Explore examples, journal entries, and how quickbooks tools can. When a customer invoice is created in accrual accounting using quickbooks, the account that is debited is accounts receivable.

When A Customer Invoice Is Created In Accrual Accounting Using Quickbooks, The Account That Is Debited Is Accounts Receivable.

Which account is debited when the invoice is. Explore examples, journal entries, and how quickbooks tools can. Discover how to record accrued revenue accurately. Tasia is using accrual accounting in quickbooks and created a customer invoice.