Accounts Receivable Turnover Ratio Meaning

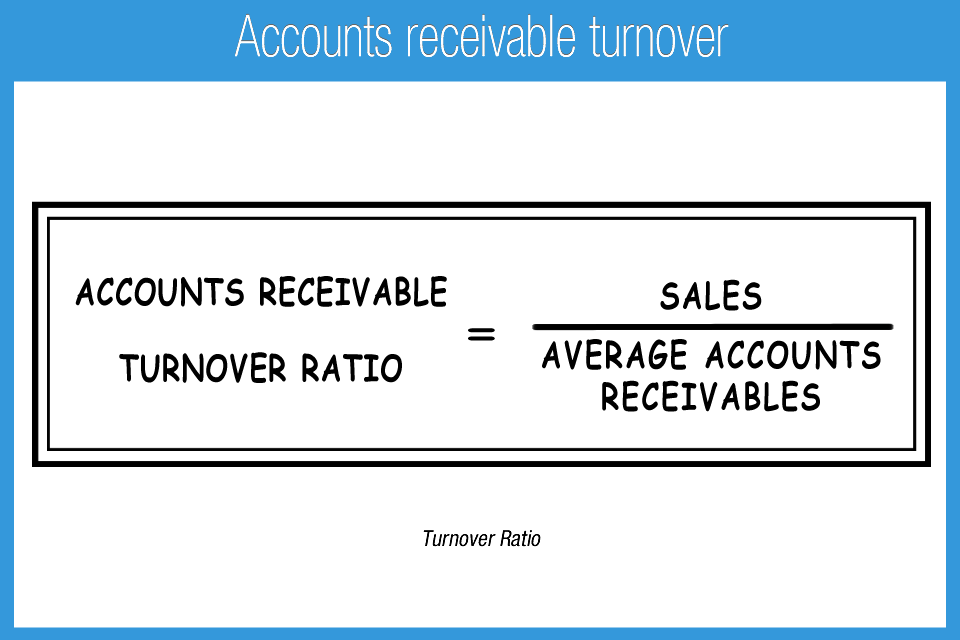

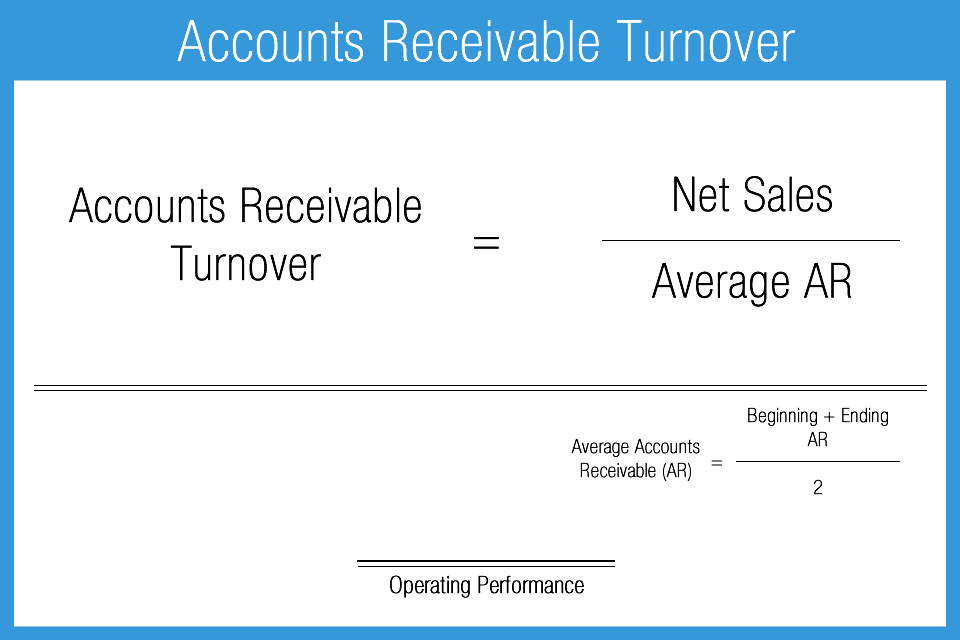

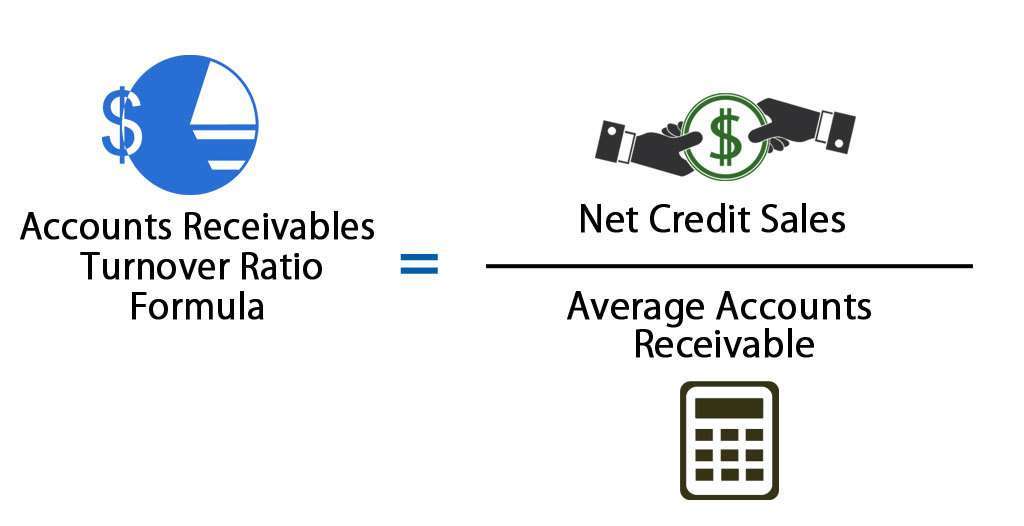

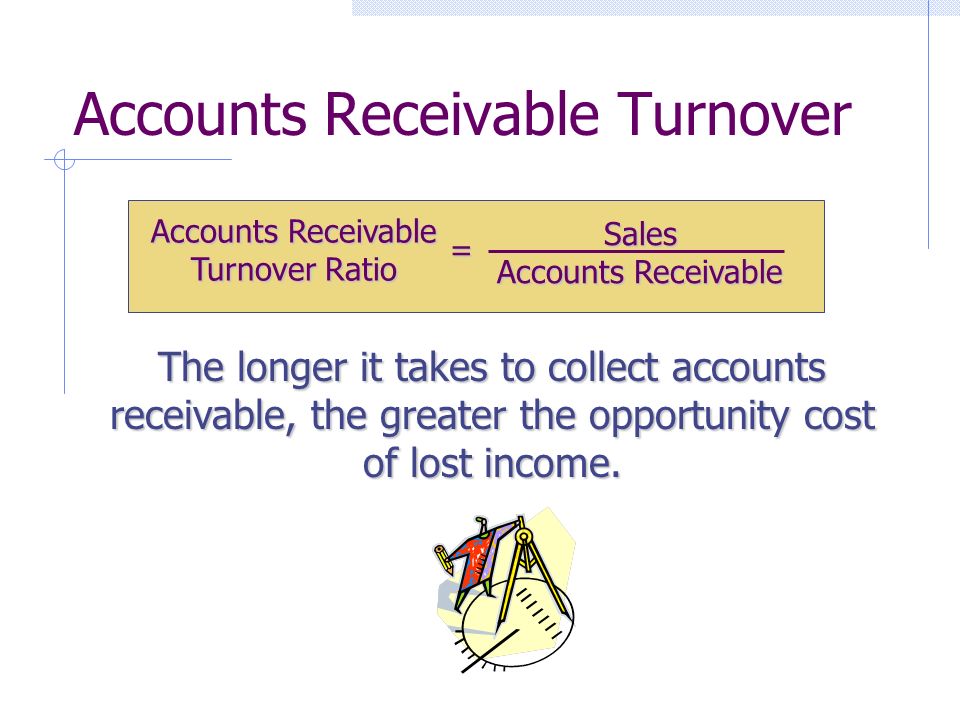

Accounts Receivable Turnover Ratio Meaning - The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. This value may also be referred to as. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. What is the accounts receivable turnover ratio? It is a quantification of a. What is accounts receivable turnover? Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash.

This value may also be referred to as. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. What is accounts receivable turnover? It is a quantification of a. Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. What is the accounts receivable turnover ratio? The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their.

What is the accounts receivable turnover ratio? Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. It is a quantification of a. What is accounts receivable turnover? The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. This value may also be referred to as. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their.

Accounts receivable turnover Accounting Play

Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. This value may also be referred to as. It is a quantification of a. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. What is accounts.

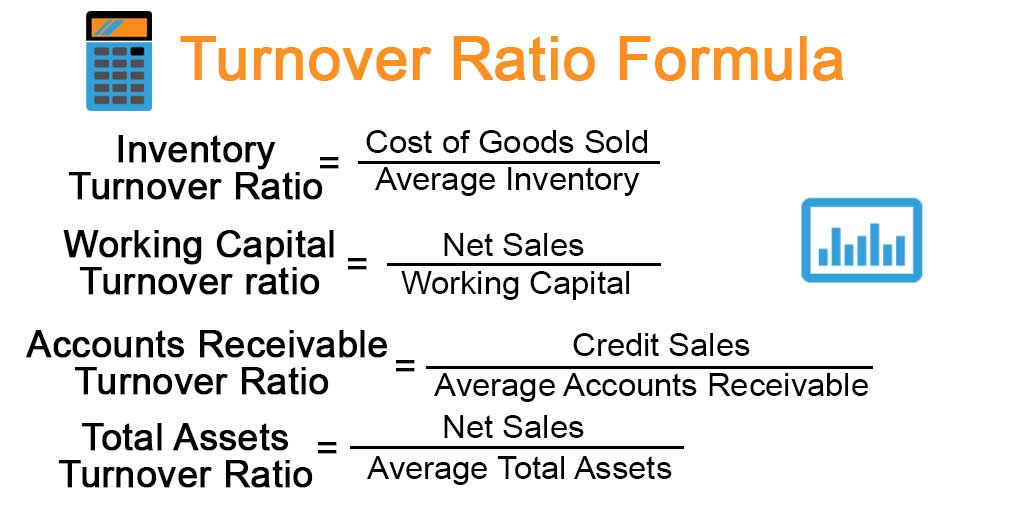

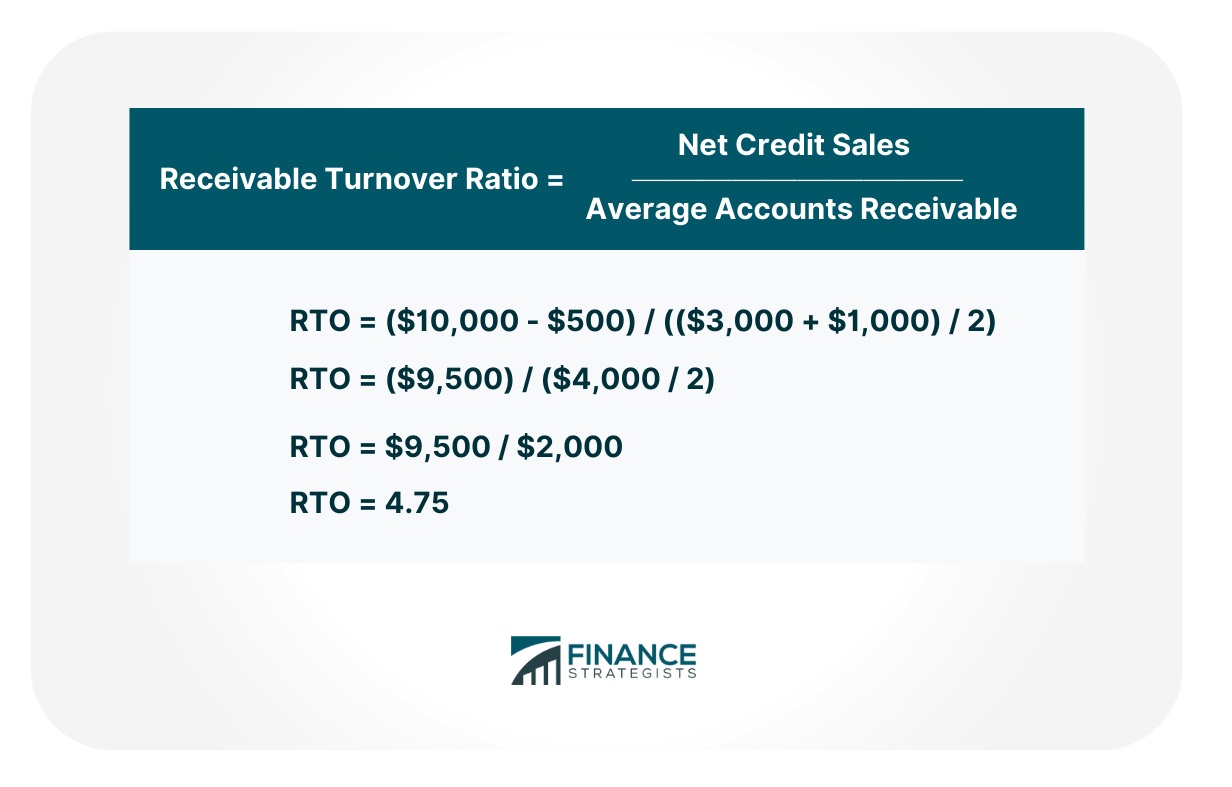

Turnover Ratio Formula Example with Excel Template

Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. What is the accounts receivable turnover ratio? This value may also be referred to.

Accounts Receivable Turnover Ratio Accounting Play

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. What is the accounts receivable turnover ratio? The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. This value may also be referred to as. Accounts receivable (ar) turnover.

Receivable Turnover Ratio Definition and Calculation BooksTime

What is the accounts receivable turnover ratio? It is a quantification of a. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, or.

Receivable Turnover Ratio Definition, and Formula Finance Strategists

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. The receivable turnover ratio, otherwise known as the debtor’s turnover.

Accounts Receivable Turnover Get the allImportant Details Here!

This value may also be referred to as. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. What is accounts receivable turnover? What is the accounts receivable turnover ratio? It is a quantification of a.

Receivable Turnover

The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. This value may also be referred to as. What is the accounts receivable turnover ratio? The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures.

Accounts receivable turnover ratio What you need to know Billtrust

The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. It is a quantification of a. This value may also be referred to as. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. Accounts receivable (ar) turnover.

Understanding Accounts Receivables Turnover Ratio

This value may also be referred to as. What is accounts receivable turnover? What is the accounts receivable turnover ratio? The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company.

change in working capital formula investopedia Provide A Good Blogger

What is the accounts receivable turnover ratio? Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The accounts receivables turnover ratio measures the number of times.

The Receivable Turnover Ratio, Otherwise Known As The Debtor’s Turnover Ratio, Is A Measure Of How Quickly A Company Collects Its Outstanding Accounts Receivables.

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. It is a quantification of a. This value may also be referred to as.

What Is The Accounts Receivable Turnover Ratio?

Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. What is accounts receivable turnover?

:max_bytes(150000):strip_icc()/receivableturnoverratio-final-803376348e8642b1a50c7b422dce27b5.png)